The first DA layer on Bitcoin, a brief analysis of Nubit architecture and highlights

DA (Data Availability) simply means that the block producer publishes all transaction data of the block to the network so that validators can download it. We say the data is available if the block producer publishes the complete data and makes it available for download by validators. The DA layer is a layer abstracted along with the expansion needs of each blockchain and the higher requirements for DA. We have seen a large number of projects emerge in the market, such as Celestia, EigenLayer, NearDA, Avail, etc. These projects often establish their own schools, pull the banner, and vow to make their own reputation.

After the Bitcoin ecosystem is gradually injected with funds, various technical routes related to Bitcoin are also booming. L2, staking, introducing BTC to Ethereum or Solana’s DeFi projects have all appeared on the stage, and BTC’s Native DA projects have also begun to receive market attention.

Just recently, NubitNubit completed a $3 million Pre-Seed round of financing, with dao5, OKX Ventures, Primitive Ventures and others participating in the investment. The team said it is preparing for the launch of the mainnet.

What is Nubit?

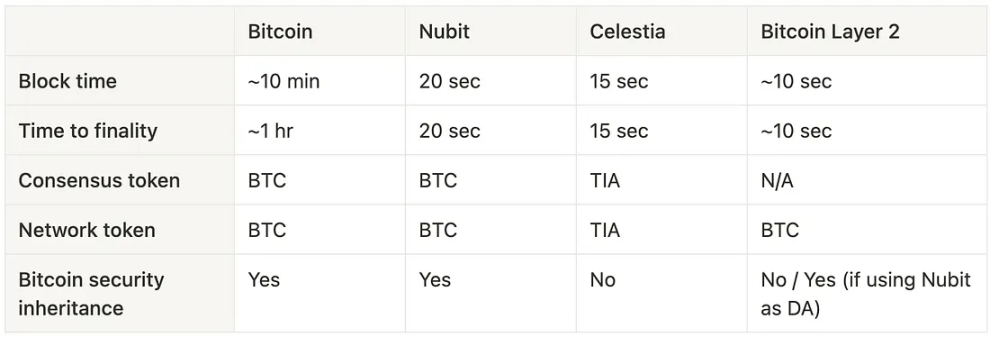

Nubit is a scalable Bitcoin-native DA layer, security protected by Bitcoin. Nubit can effectively expand the data capacity of Bitcoin and provide support for applications such as Ordinals, L2, oracles, thereby expanding the scope and efficiency of the Bitcoin ecosystem. It aims to fully inherit the security of Bitcoin, including economic security, resistance to tampering, resistance to censorship, etc.

When the cryptocurrency market is hot, the fees for Bitcoin transfers or transactions are often quite high, and there may even be a lot of congestion. Last year's surge in silver market demand caused Bitcoin to store more than 14GB of data, incurring extremely high costs. Data from its official website shows that Nubit can reduce transaction fees by more than 95% and increase the amount of data noise by more than 100 times.

Nubit Architecture

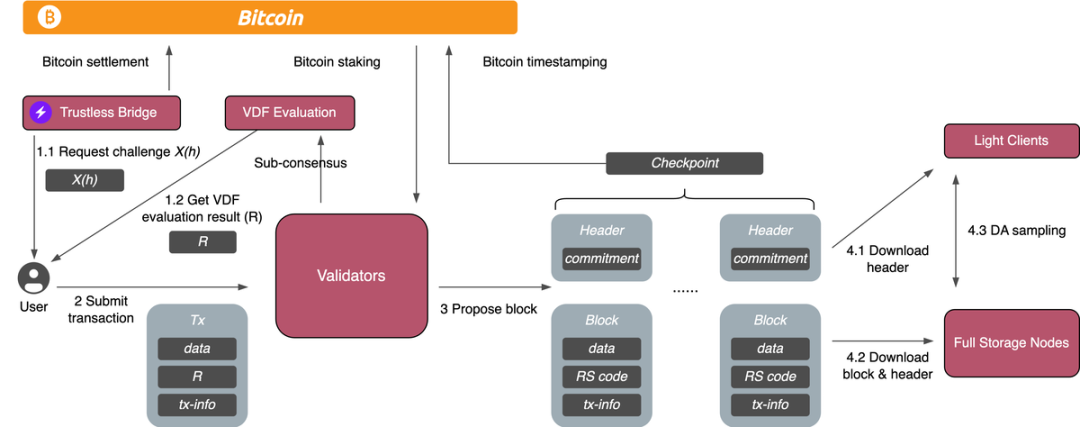

Nubit mainly consists of four basic components, validators, trustless bridges, full storage nodes and light clients.

Among them, the verifier node mainly uses the Byzantine Fault Tolerance (PBFT) consensus algorithm, and its main task is to propose, verify and ensure the integrity of transactions. The trustless bridge acts as an intermediary, charging users storage fees and distributing rewards to validators through payment channels. The full storage node is mainly responsible for the reliable storage of all data after receiving block data from the validator. The light client obtains the blocks broadcast by the validator, including data commitments, and may randomly initiate requests to full storage nodes to verify DA.

Nubit Highlights and Features

Nubit still adheres to the semi-synchronous network assumption. Introducing NuBFT, a consensus algorithm optimized for DA depth. NuBFT is a variant of the BFT consensus algorithm that combines the data partitioning process based on RS encoding and the generation of KZG. Even if some data nodes are damaged, the original data can be recovered using RS encoding.

In addition, the KZG submitted to Bitcoin ensures the validity of the original data. By integrating RS-encoded block division and KZG generation into the consensus algorithm, the integrity, availability, and scalability of stored data are directly linked to the consensus process, significantly enhancing the "robustness" of the entire DA system.

It is worth noting that Nubit uses BTC as the main token of the consensus protocol, inheriting the economic security of Bitcoin through Bitcoin’s native staking mechanism such as Babylon. In contrast, general-purpose DA layers like Celestia introduce additional trust assumptions outside of Bitcoin using their network tokens.

In terms of data availability, in order to solve potential network outages caused by node data encoding errors, Nubit adopts a hybrid approach, integrating full nodes and light nodes to ensure data integrity. First, Nubit uses KZG as a proof of validity to ensure DA, reducing memory, bandwidth, and storage requirements while maintaining simplicity. Even in the event of a complete collapse of the Nubit network, nodes can still use full nodes and KZG commitments submitted on Bitcoin for data recovery. To further enhance network scalability, Nubit employs light nodes equipped with Data Availability Sampling (DAS). This addition expands the block size to meet growing demands for data availability.

However, unlike other Bitcoin L2 solutions, Nubit does not have a smart contract execution layer.

In terms of trustless cross-chain bridges, previous Bitcoin L2 usually relied on centralized cross-chain bridges, which caused potential security vulnerabilities due to Bitcoin’s specific architectural limitations. Nubit directly chose Lightning. network, enabling Nubit to build a secure and trustless bridge into the Bitcoin ecosystem.

Nubit uses Bitcoin payment channels for network fee settlement, also a key differentiator from other BTC bridge solutions. Nubit users are not required to incur any pre-deposit requirements. Instead, they handle transaction fees directly within the state channel of each transaction, ensuring that the security of user funds is directly tied to the security of Bitcoin itself. In addition, Nubit is designed to allow emergency withdrawals, and even if Nubit ceases operations, users can recover their funds by closing the Bitcoin payment channel.

Summary

In the past BTC technology practice, to a certain extent, SegWit, Taproot, etc. have more or less enhanced Bitcoin DA, but the emergence of Nubit seems to be just right. It's time, because at that time the modular and L2 wave was still not emerging, and a completely new solution is now on the horizon. After Nubit has been working non-stop with projects such as Babylon, Merlin, and BounceBit, it said it will officially launch the mainnet later this year. Future development deserves attention.

The above is the detailed content of The first DA layer on Bitcoin, a brief analysis of Nubit architecture and highlights. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1673

1673

14

14

1428

1428

52

52

1333

1333

25

25

1277

1277

29

29

1257

1257

24

24

What is Solayer(LAYER)? Solayer Token Economics and Price Forecast

May 14, 2025 pm 10:06 PM

What is Solayer(LAYER)? Solayer Token Economics and Price Forecast

May 14, 2025 pm 10:06 PM

Introduction Decentralized Finance (DeFi) is changing the way users interact with blockchain technology, creating seamless and flexible ways for transactions, lending and earnings creation. Solayer (LAYER) is at the heart of this change, building a protocol that connects liquidity and practicality across multiple blockchains. With the popularity of DeFi and the growing demand for efficient cross-chain infrastructure, Solayer is attracting the attention of traders, developers and investors who are looking for the next major opportunity. This article will explain the concept of Solayer, detail its innovative features and token economics, and look forward to its 2030

One article to clarify the role of stablecoins during economic fluctuations

May 14, 2025 pm 09:15 PM

One article to clarify the role of stablecoins during economic fluctuations

May 14, 2025 pm 09:15 PM

You don't need to be an economist to feel the economic turmoil. Prices fall, job stability declines, and everyone seems to be anxious about their financial future. What is a stablecoin? Stablecoins are like life jackets in the crypto world: a digital currency designed to keep its value stable, often linked to stable assets such as the US dollar or gold. Unlike cryptocurrencies with severe price fluctuations such as Bitcoin or Ethereum, stablecoins pursue stability. When an economic storm strikes, investors will naturally seek stability, and stablecoins just provide this safe-haven asset – free from volatility. Why stablecoins thrive when economic instability is

What are the cryptocurrency arbitrage strategies? Four common arbitrage strategies and risk analysis

May 14, 2025 pm 09:18 PM

What are the cryptocurrency arbitrage strategies? Four common arbitrage strategies and risk analysis

May 14, 2025 pm 09:18 PM

The English name of cryptocurrency arbitrage is CryptoArbitrage, which refers to a strategy of trading on two exchanges at the same time and making profits by locking the spread on both sides. Cryptocurrency investment has large fluctuations and high risks. Investors want to find strategies that can reduce risks and make profits. Cryptocurrency arbitrage is one of the types of strategies, but is arbitrage strategies really necessarily low risk? What is cryptocurrency arbitrage? When there are different quotes for the same cryptocurrency pair, buy low and sell high at the same time, and use risk-free or extremely low risk to earn the profits of the spread, which is the arbitrage transaction conducted by cryptocurrency arbitrage in the cryptocurrency field, which generally refers to buying and selling on different exchanges.

What is the future of VINU coins? VINU coin price analysis and investment strategy in 2025

May 14, 2025 pm 09:30 PM

What is the future of VINU coins? VINU coin price analysis and investment strategy in 2025

May 14, 2025 pm 09:30 PM

Table of Contents What is VitaInu (VINU)? What is VINU token? 2025 VINU Coin Price Forecast VitaInu (VINU) Price Forecast 2025-2030 to 2030 VitaInu (VINU) Price Forecast 2025 VitaInu Price Forecast 2026 VitaInu Price Forecast 2027 VitaInu Price Forecast 2028 VitaInu Price Forecast 2029 VitaInu Price Forecast 2030 VitaInu Price Forecast Interpretation of VINU’s Market Performance

XDC and XRP: Which one is more attractive to investment?

May 14, 2025 pm 10:09 PM

XDC and XRP: Which one is more attractive to investment?

May 14, 2025 pm 10:09 PM

The two tokens are highlighted by their different use cases and technical characteristics, namely XDC and XRP. Both are in compliance with ISO20022 standards, meaning they comply with global financial messaging standards for seamless interoperability. However, their purpose, market, and the technology differences behind them are significant. In this article, we will compare XDC and XRP in detail to explore their strengths, weaknesses, market potential, and investment considerations in depth. XDC and XRP: Which one is more attractive to investment? Both XDC and XRP are decentralized tokens, but they target different industries and take a unique approach. Here are them

What should I do if I don't get the account after the recharge of Huobi Huobi? Solution to the recharge of Huobi

May 14, 2025 pm 08:42 PM

What should I do if I don't get the account after the recharge of Huobi Huobi? Solution to the recharge of Huobi

May 14, 2025 pm 08:42 PM

When you recharge on Huobi Huobi platform, if you find that the funds have not arrived, this may cause you to be anxious and confused. Fortunately, there are some specific steps and methods to help you solve this problem. The following are detailed solutions and operating guides to help you quickly find solutions when you encounter the problem of recharge not being received.

The best currency trading platform recommended by the top ten currency exchange platforms

May 14, 2025 pm 09:36 PM

The best currency trading platform recommended by the top ten currency exchange platforms

May 14, 2025 pm 09:36 PM

Best currency trading platform: 1. Binance is the world's largest exchange, providing diversified financial products. 2. Ouyi is known for its powerful derivative trading functions. 3.Gate.io provides a wide range of currency options. 4. Huobi is famous for its stable system and diverse financial products. All platforms support fiat currency transactions, have a user-friendly interface, and provide mobile applications and multiple payment methods.

Cardano (ADA) 2025–2028 10x potential analysis: The path to revaluation of smart contract platforms

May 14, 2025 pm 10:33 PM

Cardano (ADA) 2025–2028 10x potential analysis: The path to revaluation of smart contract platforms

May 14, 2025 pm 10:33 PM

Cardano (ADA) 10x potential analysis for 2025–2028: The path to revaluation of value of smart contract platforms The current ADA price is about $0.778. If 10x growth is achieved, the potential price in the future will reach $7.78 and the market value is about $270 billion. This prediction is not a fantasy, but is based on Cardano's strong potential driven by multiple factors such as technological innovation, ecological expansion and market demand. 1. Technology Progress: The Combination of Smart Contracts and Zero Knowledge Proof Since Vasil upgraded, Cardano's smart contract platform Plutu