What is ZORA Coin? What is the economics of ZORA tokens and its future potential?

Zora was originally an Ethereum-based NFT platform that allows users to purchase, sell, and create NFT collections without paying transaction fees. With continued development, the project has transformed into a social platform and continues to enhance creativity by allowing anyone to easily convert their content into tradable currencies.

Zora has attracted market attention due to the Base Meme Coin incident. In addition, the network announced that it would airdrop ZORA tokens on April 23 and will be launched on the Binance Alpha platform on the same day, marking an important milestone in the development of Zora.

So, what is Zora (ZORA) cryptocurrency? What is its future potential? Below we will give a detailed introduction to ZORA coins.

What is ZORA Coin? What is the economics of ZORA tokens and its future potential?

ZORA Coin Latest News and Updates

Zora announced on April 21 that its native token $ZORA will be officially released (TGE) on April 23, 2025.

In addition, Binance Alpha will launch Zora (ZORA) at 21:00 on the same day. Binance Exchange users who meet the criteria and have purchase records on Alpha will receive airdrops of 4276 ZORA tokens in their Alpha account before 21:10 on April 23, 2025.

What is Zora?

Zora was officially launched in 2021 and is an NFT market centered on creators. On this platform, creators and collectors can independently set and negotiate the value of NFTs, thereby promoting decentralized market dynamics.

With continuous development, Zora began to transform into social networks and leverages blockchain technology to build a sustainable economy for creators. The network is designed to provide creators with a free platform to promote creativity and financial stability.

Zora offers a new creator economic model. Content published on this platform can become unique tradable tokens.

It is reported that when a new post is published on Zora, the platform will immediately create a liquidity pool for the token on Uniswap and allow anyone to trade related tokens on Zora's content page.

The creator's income will be measured by trading volume. The higher the trading volume, the more the creator earns. Zora offers different rewards to allow creators, collectors, developers and platforms to profit through trading activities.

To date, Zora has a community of over 2 million creators and collectors and has distributed over 3.5K ETH to creators as a reward.

Who founded Zora? Zora Development Team and Investment

Zora Network was founded in 2020 by Jacob Horne and Slava Kim, both of whom have extensive experience in the cryptocurrency space.

- Zora co-founder Jacob Horne: worked as a product manager at Coinbase for more than 3 years;

- Zora co-founder Slava Kim: Slava Kim also worked with Jacob Horne at Coinbase, and he also worked as a product designer at Coinbase for more than 3 years.

Led by the Zora development team, Zora has successfully raised $60 million through three rounds of financing, with investors participating in the investment including Coinbase Ventures (the former company of the two co-founders), Haun Capital and Kindred Ventures.

How does Zora work?

Zora's social network redefines content creation using token-based systems. Each content (image, video or text) will automatically mint an ERC - 20 token with a fixed supply of 1 billion units. As the original poster, the creator immediately received 10 million tokens.

The value of content does not depend on likes or calculation algorithms, but is determined by open market transactions. When others trade the coins you posted, you will receive a portion of the transaction fee through the Uniswap liquidity pool.

With the upgrade of Coins, these tokens can now be traded immediately on the Zora desktop platform and on the mobile app. Additionally, when others trade coins from creator posts, the creator will receive a 50% transaction fee and a 50% LP fee, thus obtaining a direct source of income.

What is ZORA Coin?

ZORA is a native cryptocurrency for the Zora network and was launched in April 2025.

However, its official website stated that ZORA is for entertainment only, and holders do not enjoy any governance rights, nor have any equity relations with Zora or its products.

In addition, although Zora has its own layer 2 network, Zora coins are still launched on Base—probably the reason why PENGU started on Solana. Given that ZORA is a currency designed for entertainment only (similar to meme coins), launching it on Base will give it a wider user base and potential new users.

ZORA Token Economics

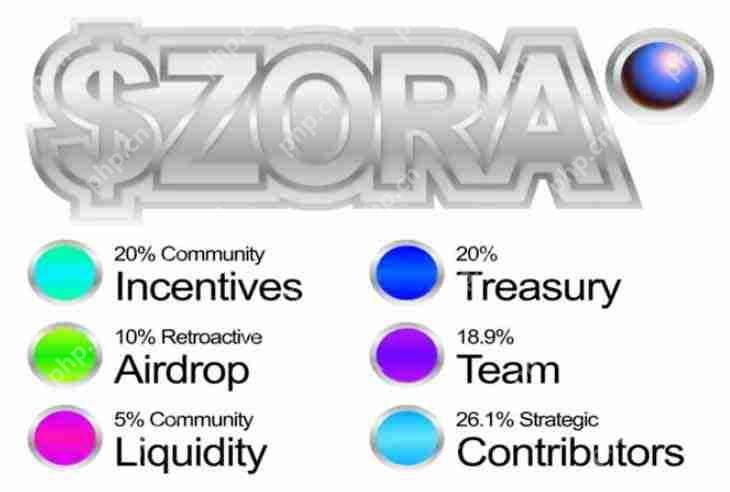

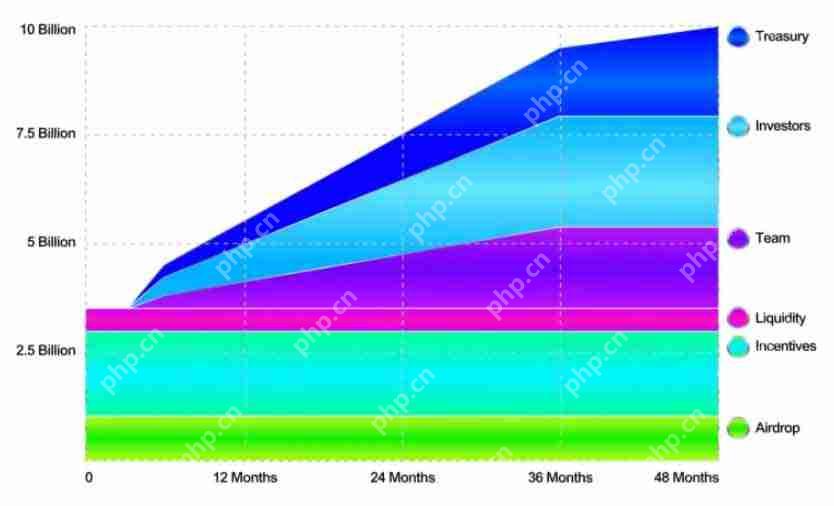

The total supply of ZORA tokens is 10 billion, and its initial token allocation is as follows:

- Incentives (20%) : This is a future grant, public goods, hackathons and other types of incentives determined by the Zora team. There is no lock limit for this category.

- Airdrop (10%) : Will be distributed to eligible community members, including creators, collectors, developers and other contributors to the Zora brand. There is no lock limit for this category.

- Liquidity (5%) : used to provide liquidity to exchanges and market makers.

- Finance (20%) : ZORA assigned to the company is designed to align the company with the community to support and develop the Zora brand. Tokens in this category will be unlocked monthly for 48 months starting six months after the Token Generation Event (TGE).

- Team (18.9%) : Current and future teams will also receive ZORA allocation for their work for the Zora brand in the crypto creator economy. Tokens in this category will start six months after TGE and will be unlocked every month for 36 months.

- Strategy Contributor (26.1%) : Strategy Contributors are investors who provide Zora development advice and guidance to the Zora team. Like the team allocation, this category of tokens will start after TGE six months and will be unlocked every month for 36 months.

From the moment, the initial circulating supply of ZORA is roughly $1 billion to $1.5 billion (10-15% of the total supply), depending on the number of liquid tokens used by TGE. The remaining portions (community incentive funds, teams, strategy contributors) are locked for at least 6 months, so they will not contribute to the initial circulation supply.

Zora Token Airdrop

According to the official announcement, Zora will conduct airdrops on April 23, and the official has completed two rounds of airdrop snapshots, as follows:

- Snapshot 1: 2020/01/01 to 2025/03/03

- Snapshot 2: 2025/03/03 to 2025/04/20

Zora Airdrop aims to reward communities that contribute to Zora's development, especially over 2.4 million collectors and 618,000 creators. Snapshots not only recognize the contribution of loyal users, but also create opportunities for new users to join the ecosystem.

Zora (ZORA) future prospects

Zora’s mission is centered on reinvesting its creative ecosystem rather than extracting value. With the development of on-chain social platforms, Zora stands out for combining monetization, community governance and creator tools in one environment.

However, Zora's native tokens are not governance tokens, but are described by Zora as meme coins with "entertainment-centric" purpose. This means that the token does not give its holders control over the protocol, but rather has more community-based elements, consistent with trends in recent NFT projects such as Pudgy Penguin (PENGU), Milady (CULT), and Magic Eden (ME).

This also caused a lot of controversy.

Crypto KOL @basedkarbon pointed out, "Since it's just for entertainment, why do the team still have to keep 65%? Why do contributors take 26%? If this coin is useless, why do you need to set up a vault? "

ZachXBT, a well-known on-chain investigator, also said that if you really want to make meme coins that are purely entertainment, you should adopt the "100% fair issuance" model, otherwise the so-called meme coins will lose their rationality.

For ZORA coins, if Zora cannot give it corresponding value in the future, then the cryptocurrency is likely to be as difficult as most meme coins to break out of the siege and be buried in the torrent of meme coins.

Summarize

To sum up, Zora has evolved from a simple NFT market to a social platform where content created by users (images, videos or texts) can be converted into tokens on the blockchain, thereby achieving profitability.

Zora native token ZORA will be launched on the Base network on April 23, 2025 and airdropped, but the cryptocurrency only has entertainment features and future development remains to be seen. Through this article, you may have some basic information about the project in order to make your own investment decisions.

What is ZORA coins here? What is the economics of ZORA tokens and its future potential? That’s all for the article. For more relevant ZORA coin development analysis content, please search for previous articles from Script Home or continue browsing the related articles below. I hope everyone will support Script Home in the future!

The above is the detailed content of What is ZORA Coin? What is the economics of ZORA tokens and its future potential?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1672

1672

14

14

1428

1428

52

52

1332

1332

25

25

1277

1277

29

29

1257

1257

24

24

What is Solayer(LAYER)? Solayer Token Economics and Price Forecast

May 14, 2025 pm 10:06 PM

What is Solayer(LAYER)? Solayer Token Economics and Price Forecast

May 14, 2025 pm 10:06 PM

Introduction Decentralized Finance (DeFi) is changing the way users interact with blockchain technology, creating seamless and flexible ways for transactions, lending and earnings creation. Solayer (LAYER) is at the heart of this change, building a protocol that connects liquidity and practicality across multiple blockchains. With the popularity of DeFi and the growing demand for efficient cross-chain infrastructure, Solayer is attracting the attention of traders, developers and investors who are looking for the next major opportunity. This article will explain the concept of Solayer, detail its innovative features and token economics, and look forward to its 2030

One article to clarify the role of stablecoins during economic fluctuations

May 14, 2025 pm 09:15 PM

One article to clarify the role of stablecoins during economic fluctuations

May 14, 2025 pm 09:15 PM

You don't need to be an economist to feel the economic turmoil. Prices fall, job stability declines, and everyone seems to be anxious about their financial future. What is a stablecoin? Stablecoins are like life jackets in the crypto world: a digital currency designed to keep its value stable, often linked to stable assets such as the US dollar or gold. Unlike cryptocurrencies with severe price fluctuations such as Bitcoin or Ethereum, stablecoins pursue stability. When an economic storm strikes, investors will naturally seek stability, and stablecoins just provide this safe-haven asset – free from volatility. Why stablecoins thrive when economic instability is

What are the cryptocurrency arbitrage strategies? Four common arbitrage strategies and risk analysis

May 14, 2025 pm 09:18 PM

What are the cryptocurrency arbitrage strategies? Four common arbitrage strategies and risk analysis

May 14, 2025 pm 09:18 PM

The English name of cryptocurrency arbitrage is CryptoArbitrage, which refers to a strategy of trading on two exchanges at the same time and making profits by locking the spread on both sides. Cryptocurrency investment has large fluctuations and high risks. Investors want to find strategies that can reduce risks and make profits. Cryptocurrency arbitrage is one of the types of strategies, but is arbitrage strategies really necessarily low risk? What is cryptocurrency arbitrage? When there are different quotes for the same cryptocurrency pair, buy low and sell high at the same time, and use risk-free or extremely low risk to earn the profits of the spread, which is the arbitrage transaction conducted by cryptocurrency arbitrage in the cryptocurrency field, which generally refers to buying and selling on different exchanges.

XDC and XRP: Which one is more attractive to investment?

May 14, 2025 pm 10:09 PM

XDC and XRP: Which one is more attractive to investment?

May 14, 2025 pm 10:09 PM

The two tokens are highlighted by their different use cases and technical characteristics, namely XDC and XRP. Both are in compliance with ISO20022 standards, meaning they comply with global financial messaging standards for seamless interoperability. However, their purpose, market, and the technology differences behind them are significant. In this article, we will compare XDC and XRP in detail to explore their strengths, weaknesses, market potential, and investment considerations in depth. XDC and XRP: Which one is more attractive to investment? Both XDC and XRP are decentralized tokens, but they target different industries and take a unique approach. Here are them

What should I do if I don't get the account after the recharge of Huobi Huobi? Solution to the recharge of Huobi

May 14, 2025 pm 08:42 PM

What should I do if I don't get the account after the recharge of Huobi Huobi? Solution to the recharge of Huobi

May 14, 2025 pm 08:42 PM

When you recharge on Huobi Huobi platform, if you find that the funds have not arrived, this may cause you to be anxious and confused. Fortunately, there are some specific steps and methods to help you solve this problem. The following are detailed solutions and operating guides to help you quickly find solutions when you encounter the problem of recharge not being received.

What is the future of VINU coins? VINU coin price analysis and investment strategy in 2025

May 14, 2025 pm 09:30 PM

What is the future of VINU coins? VINU coin price analysis and investment strategy in 2025

May 14, 2025 pm 09:30 PM

Table of Contents What is VitaInu (VINU)? What is VINU token? 2025 VINU Coin Price Forecast VitaInu (VINU) Price Forecast 2025-2030 to 2030 VitaInu (VINU) Price Forecast 2025 VitaInu Price Forecast 2026 VitaInu Price Forecast 2027 VitaInu Price Forecast 2028 VitaInu Price Forecast 2029 VitaInu Price Forecast 2030 VitaInu Price Forecast Interpretation of VINU’s Market Performance

The best currency trading platform recommended by the top ten currency exchange platforms

May 14, 2025 pm 09:36 PM

The best currency trading platform recommended by the top ten currency exchange platforms

May 14, 2025 pm 09:36 PM

Best currency trading platform: 1. Binance is the world's largest exchange, providing diversified financial products. 2. Ouyi is known for its powerful derivative trading functions. 3.Gate.io provides a wide range of currency options. 4. Huobi is famous for its stable system and diverse financial products. All platforms support fiat currency transactions, have a user-friendly interface, and provide mobile applications and multiple payment methods.

Introduction to Cryptocurrency Investment: What are currency standard contracts and U standard contracts? How to use it?

May 14, 2025 pm 09:42 PM

Introduction to Cryptocurrency Investment: What are currency standard contracts and U standard contracts? How to use it?

May 14, 2025 pm 09:42 PM

With the rapid development of the digital currency market, cryptocurrency derivatives trading has attracted increasing attention from investors. Among many trading tools, contract trading has become a trading method favored by many investors due to its leveraged trading characteristics and high risk and high returns. However, for beginners, the concepts of coin-prime contracts and U-prime contracts are often confusing. This article will analyze the characteristics, differences and their application in cryptocurrency investment in detail. What is a currency standard contract? A currency standard contract is a derivative contract that uses cryptocurrencies as margin and settlement currency. In this model, investors use Bitcoin or other cryptocurrencies as collateral to trade