What is Zebec Network (ZBCN)? ZBCN Token Economics and Price Forecast

In today's digital economy, the boundaries between traditional finance and blockchain technology are beginning to blur. People are eager for faster payments, borderless transactions and more control over their own funds – and they are eager to achieve it immediately. Zebec Network is one of many projects aimed at meeting this need by building programmable fund flow infrastructure. Focusing on real-time payroll, crypto payments and decentralized systems, Zebec positiones itself as a bridge connecting mature financial practices with emerging blockchain solutions.

This article provides an overview of Zebec Network—how it works, its native token, ZBCN, and what new investors should know before they get involved.

What is Zebec Network?

Zebec Network (formerly Zebec Protocol) is a decentralized payment and infrastructure network designed to support continuous, real-time flow of funds. Founded in 2021, Zebec received $35 million in investments from leading fintech companies and venture funds such as Coinbase, Circle and Solana Ventures, aiming to modernize the way funds flow between traditional and decentralized systems.

Originally built on the Solana blockchain, Zebec has developed into a multi-chain ecosystem integrating Ethereum, BNB smart chain, Tron, Sui and other networks. Its platform supports streaming salary (payment of employee wages by seconds), cryptocurrency-to-fiat payment cards, decentralized physical infrastructure (DePIN) tools, and financial management systems for Web3 companies.

By providing these services, Zebec supports businesses and individuals to bridge the gap between Web2 financial operations and the emerging Web3 economy.

How Zebec network works

Zebec Network is built with the concept of “streaming finance”, a system that enables funds to flow in real time and continuously without the need for intermediaries. At the heart of Zebec, it allows users (especially employers) to stream to employees in units of each second, rather than traditional weekly or biweekly payments. This model not only speeds up wage payments, but also improves liquidity and financial flexibility for payers and payees.

The network achieves this with smart contracts deployed on multiple blockchains, with Solana becoming its primary infrastructure for its fast speed and low transaction fees. Zebec also supports other blockchains for cross-chain interoperability. A key component of the platform is the middleware abstraction layer, which simplifies blockchain interaction between users and enterprises by hiding backend complexity.

Zebec also includes several supporting technologies:

● ZAI (Zebec AI): The AI layer used for fraud detection, anti-money laundering compliance and intelligent transaction monitoring.

● ZePIN: A decentralized network of physical infrastructure, combined with IoT hardware (such as payment terminals) and blockchain software for real-world crypto payments.

● Zebec Pay and Zebec Cards: These products allow users to receive, manage and use their crypto assets like fiat currencies and integrate directly into platforms such as Apple Pay and Google Pay.

Together, these systems form an integrated environment for real-world value transfer—connecting on-chain protocols with traditional financial workflows.

What is ZBCN Token Economics?

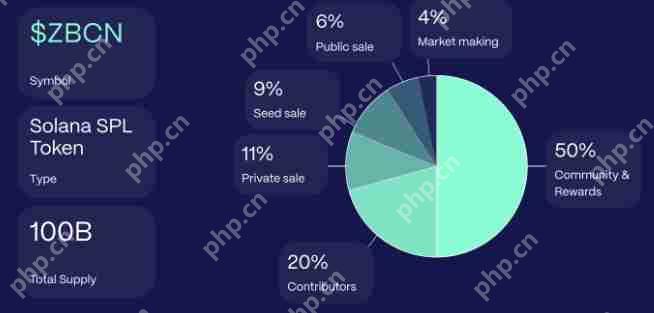

ZBCN tokens are native practical and governance tokens for Zebec Network. It evolved from the original ZBC token and underwent a 1:10 token split in 2024, aiming to simplify procedures, improve liquidity and expand practicality. The total supply limit of ZBCN is 100 billion pieces.

ZBCN Token Economics

ZBCN provides support for the core functionality of the entire network. It is used to pay transaction fees and bridge fees, some of which are destroyed to support the deflationary model. ZBCN is also integrated into Zebec's products, such as payroll applications and crypto cards, thereby supporting real-world consumption and acting as a medium of exchange in the ecosystem.

For investors and users, pledging ZBCN can earn up to 15% annualized returns, and token holders can also enjoy advanced features including reduced fees and early access to new products. In terms of governance, ZBCN holders participate in Zebec’s hybrid DAO and vote on the Improvement Proposal (ZIP) after off-chain community consultation.

The token also incentivizes use through repos funded by product revenue, partner airdrops and ecosystem subsidies, aiming to enhance token demand and utility.

Zebec Network (ZBCN) Price Forecast for 2025, 2026-2030

Outlook for 2025

By 2025, Zebec Network's expanding ecosystem and product popularity may begin to be reflected in the market value of its native token, ZBCN. Price forecasts during this period are typically between $0.0015 and $0.008 depending on the overall market conditions, network usage, and the popularity of features such as real-time payroll, DePIN infrastructure and crypto card payments.

2026–2027 Forecast

Looking ahead to 2026 and 2027, ZBCN is likely to grow gradually as the Zebec ecosystem expands, especially as ZePIN point-of-sale system develops and physical partners continue to grow. The price range is expected to be between $0.002 and $0.005, and the valuation may be higher if the market is bullish. However, this period may also have an adjustment or consolidation phase, depending on the cryptocurrency market cycle and regulatory development.

2030 long-term forecast

By 2030, ZBCN's long-term price forecast is between $0.003 and $0.01, reflecting expectations for its increased utility, wider integration with retail and payroll systems, and enhanced governance applications. If Zebec continues to innovate and expand globally, the role of the token in staking, governance, DeFi collateral and real-world spending will support its sustained value. However, this prospect is premised on the favorable state of both the crypto industry and the macroeconomic environment.

in conclusion

Zebec Network focuses on practical financial use cases such as salary, payments and decentralized infrastructure, demonstrating its unique approach to blockchain application. With its multi-chain support, real-time payment capabilities and an expanding suite of products, Zebec Network aims to provide practical solutions for businesses and individual users in the evolving digital economy.

However, like any crypto project, it also has risks. The future of ZBCN depends on its popularity, technological developments, and broader market trends. For investors, Zebec provides an attractive use case, but investors need to maintain rational expectations and make informed decisions after fully understanding the situation. As always, good investment starts with understanding, not hype.

What is Zebec Network (ZBCN)? This is all about the article on ZBCN token economics and price forecast. For more comprehensive introduction to ZBCN coins, please search for previous articles from Script Home or continue to browse the related articles below. I hope everyone will support Script Home in the future!

The above is the detailed content of What is Zebec Network (ZBCN)? ZBCN Token Economics and Price Forecast. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1672

1672

14

14

1428

1428

52

52

1332

1332

25

25

1277

1277

29

29

1257

1257

24

24

What is Solayer(LAYER)? Solayer Token Economics and Price Forecast

May 14, 2025 pm 10:06 PM

What is Solayer(LAYER)? Solayer Token Economics and Price Forecast

May 14, 2025 pm 10:06 PM

Introduction Decentralized Finance (DeFi) is changing the way users interact with blockchain technology, creating seamless and flexible ways for transactions, lending and earnings creation. Solayer (LAYER) is at the heart of this change, building a protocol that connects liquidity and practicality across multiple blockchains. With the popularity of DeFi and the growing demand for efficient cross-chain infrastructure, Solayer is attracting the attention of traders, developers and investors who are looking for the next major opportunity. This article will explain the concept of Solayer, detail its innovative features and token economics, and look forward to its 2030

One article to clarify the role of stablecoins during economic fluctuations

May 14, 2025 pm 09:15 PM

One article to clarify the role of stablecoins during economic fluctuations

May 14, 2025 pm 09:15 PM

You don't need to be an economist to feel the economic turmoil. Prices fall, job stability declines, and everyone seems to be anxious about their financial future. What is a stablecoin? Stablecoins are like life jackets in the crypto world: a digital currency designed to keep its value stable, often linked to stable assets such as the US dollar or gold. Unlike cryptocurrencies with severe price fluctuations such as Bitcoin or Ethereum, stablecoins pursue stability. When an economic storm strikes, investors will naturally seek stability, and stablecoins just provide this safe-haven asset – free from volatility. Why stablecoins thrive when economic instability is

What are the cryptocurrency arbitrage strategies? Four common arbitrage strategies and risk analysis

May 14, 2025 pm 09:18 PM

What are the cryptocurrency arbitrage strategies? Four common arbitrage strategies and risk analysis

May 14, 2025 pm 09:18 PM

The English name of cryptocurrency arbitrage is CryptoArbitrage, which refers to a strategy of trading on two exchanges at the same time and making profits by locking the spread on both sides. Cryptocurrency investment has large fluctuations and high risks. Investors want to find strategies that can reduce risks and make profits. Cryptocurrency arbitrage is one of the types of strategies, but is arbitrage strategies really necessarily low risk? What is cryptocurrency arbitrage? When there are different quotes for the same cryptocurrency pair, buy low and sell high at the same time, and use risk-free or extremely low risk to earn the profits of the spread, which is the arbitrage transaction conducted by cryptocurrency arbitrage in the cryptocurrency field, which generally refers to buying and selling on different exchanges.

XDC and XRP: Which one is more attractive to investment?

May 14, 2025 pm 10:09 PM

XDC and XRP: Which one is more attractive to investment?

May 14, 2025 pm 10:09 PM

The two tokens are highlighted by their different use cases and technical characteristics, namely XDC and XRP. Both are in compliance with ISO20022 standards, meaning they comply with global financial messaging standards for seamless interoperability. However, their purpose, market, and the technology differences behind them are significant. In this article, we will compare XDC and XRP in detail to explore their strengths, weaknesses, market potential, and investment considerations in depth. XDC and XRP: Which one is more attractive to investment? Both XDC and XRP are decentralized tokens, but they target different industries and take a unique approach. Here are them

What should I do if I don't get the account after the recharge of Huobi Huobi? Solution to the recharge of Huobi

May 14, 2025 pm 08:42 PM

What should I do if I don't get the account after the recharge of Huobi Huobi? Solution to the recharge of Huobi

May 14, 2025 pm 08:42 PM

When you recharge on Huobi Huobi platform, if you find that the funds have not arrived, this may cause you to be anxious and confused. Fortunately, there are some specific steps and methods to help you solve this problem. The following are detailed solutions and operating guides to help you quickly find solutions when you encounter the problem of recharge not being received.

What is the future of VINU coins? VINU coin price analysis and investment strategy in 2025

May 14, 2025 pm 09:30 PM

What is the future of VINU coins? VINU coin price analysis and investment strategy in 2025

May 14, 2025 pm 09:30 PM

Table of Contents What is VitaInu (VINU)? What is VINU token? 2025 VINU Coin Price Forecast VitaInu (VINU) Price Forecast 2025-2030 to 2030 VitaInu (VINU) Price Forecast 2025 VitaInu Price Forecast 2026 VitaInu Price Forecast 2027 VitaInu Price Forecast 2028 VitaInu Price Forecast 2029 VitaInu Price Forecast 2030 VitaInu Price Forecast Interpretation of VINU’s Market Performance

The best currency trading platform recommended by the top ten currency exchange platforms

May 14, 2025 pm 09:36 PM

The best currency trading platform recommended by the top ten currency exchange platforms

May 14, 2025 pm 09:36 PM

Best currency trading platform: 1. Binance is the world's largest exchange, providing diversified financial products. 2. Ouyi is known for its powerful derivative trading functions. 3.Gate.io provides a wide range of currency options. 4. Huobi is famous for its stable system and diverse financial products. All platforms support fiat currency transactions, have a user-friendly interface, and provide mobile applications and multiple payment methods.

Introduction to Cryptocurrency Investment: What are currency standard contracts and U standard contracts? How to use it?

May 14, 2025 pm 09:42 PM

Introduction to Cryptocurrency Investment: What are currency standard contracts and U standard contracts? How to use it?

May 14, 2025 pm 09:42 PM

With the rapid development of the digital currency market, cryptocurrency derivatives trading has attracted increasing attention from investors. Among many trading tools, contract trading has become a trading method favored by many investors due to its leveraged trading characteristics and high risk and high returns. However, for beginners, the concepts of coin-prime contracts and U-prime contracts are often confusing. This article will analyze the characteristics, differences and their application in cryptocurrency investment in detail. What is a currency standard contract? A currency standard contract is a derivative contract that uses cryptocurrencies as margin and settlement currency. In this model, investors use Bitcoin or other cryptocurrencies as collateral to trade