How will Lorenzo Protocol's BANK develop after it soars? Is it a rebound or a callback?

Lorenzo Protocol's BANK token price soared over 135% within 24 hours after Binance announced the launch of the BANKUSDT perpetual contract. As Binance offers up to 50 times leverage, this has sparked strong interest among investors and pushed BANK prices to new heights, becoming one of the hottest assets of the day. Let's explore the reasons for this surge and the possible trend of BANK prices in the short term.

How will Lorenzo Protocol's BANK token develop after it soars? Will it continue to rise or will there be a pullback?

Why BANK tokens attract much attention

Binance, the world's largest cryptocurrency exchange, announced that it will launch the BANKUSDT perpetual futures contract at 18:30 on April 18, 2025 (UTC time). This allows traders to use up to 50 times of leverage to bet on the price of BANKUSDT, greatly increasing market exposure and liquidity.

Previously, BANK tokens were marked as high-risk, high-return speculative assets in Binance's Alpha market. Today, entering Binance’s contract trading platform marks the entry of BANK tokens into the mainstream market, which will open up new channels for increasing trading volume and wider market participation.

After the announcement, BANK token price surged by more than 160%

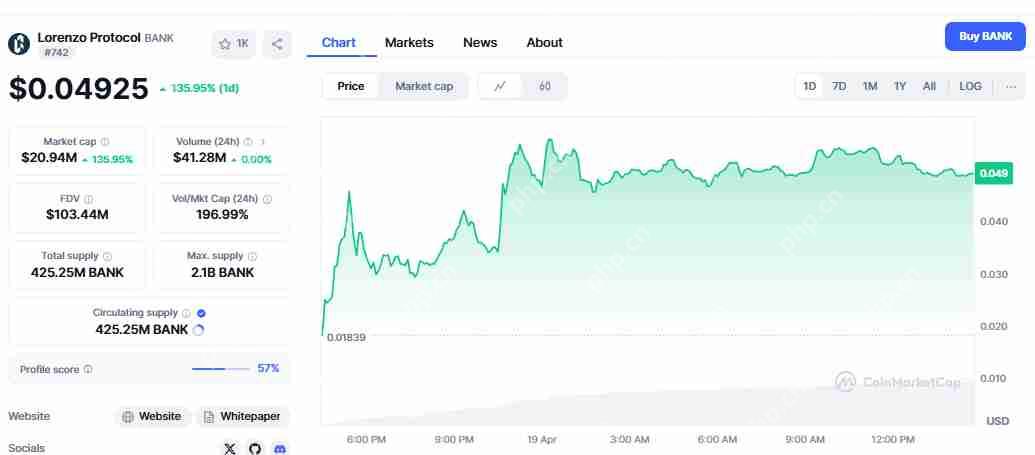

According to CoinMarketCap, after Binance issued the announcement, the price of BANK token soared to US$0.05627, an increase of up to 160%. Despite the price drop, it still rose 135.95%, trading at nearly $0.04925 and market capitalization of nearly $24 million.

Data source: CoinMarketCap

This clearly reflects the healthy sentiment of the market and shows that traders are looking for higher returns after futures are listed.

Bullish signal: 15 minutes technical analysis chart

On the 15-minute chart, the BANK token is forming a downward channel pattern structure, which usually indicates that the bullish trend will continue after a sharp rise. Currently, the token price is located in this channel and is consolidated.

The following are some things worth paying attention to:

Bullish breakthrough scenario

- Key Breakthrough Level: $0.05050 to $0.05100

- Breakthroughs above the upper trend line and rising trading volumes may cause the price to soar to the $0.052 to $0.055 range.

- The MACD indicator shows signs of flattening and may soon turn positive, which will further verify the potential of the breakthrough.

Bearish Breakthrough Risk

- Key support level: $0.045

- If there is a long-term decline below this point, it is expected to fall further to $0.042, invalidating the bullish scenario.

Short-term BANK Price Forecast: Bullish Bias Stay Always

If the bullish trend continues, the BANK token may:

- Retest and break through the resistance level of $0.0515 in the coming days, looking for $0.055-0.058.

- As futures market participation increases, it will eventually begin to gain momentum, resulting in short-term volatility and more bullish price movements.

Data source: Bitget

However, traders need to pay close attention to support near $0.045, as if this level cannot be held, it may turn to a more consolidated or revised short-term trend.

This article will introduce this article. Regarding the development of Lorenzo Protocol's BANK token after the surge, whether it will rebound or pullback, please continue to pay attention to Script Home for more analysis of BANK's future trends. I hope everyone will support Script Home in the future!

The above is the detailed content of How will Lorenzo Protocol's BANK develop after it soars? Is it a rebound or a callback?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1672

1672

14

14

1428

1428

52

52

1332

1332

25

25

1277

1277

29

29

1257

1257

24

24

Recommended websites for free viewing market software. What are the websites for free viewing market software?

May 13, 2025 pm 06:18 PM

Recommended websites for free viewing market software. What are the websites for free viewing market software?

May 13, 2025 pm 06:18 PM

The three recommended free market viewing software websites are: 1. OKX, 2. Binance, 3. Huobi. 1. OKX provides rich market data and user-friendly interface, supporting multiple languages and mobile applications. 2. Binance provides simple design and rich market data, supporting advanced charting tools and mobile applications. 3. Huobi is known for its comprehensive and accurate market data, providing intuitive interfaces and mobile applications.

Where to buy altcoins? Recommended altcoin trading platform in 2025

May 13, 2025 pm 06:15 PM

Where to buy altcoins? Recommended altcoin trading platform in 2025

May 13, 2025 pm 06:15 PM

The steps to buy altcoins include: 1. Select a reliable trading platform, 2. Register and verify an account, 3. Deposit, 4. Buy altcoins. The recommended trading platforms in 2025 are: 1. Binance, 2. OKX, 3. Huobi, 4. KuCoin, 5. Coinbase. When purchasing altcoins, you need to pay attention to research, risk management and safety measures.

With global regulation tightening, how to choose a compliant altcoin exchange?

May 13, 2025 pm 06:12 PM

With global regulation tightening, how to choose a compliant altcoin exchange?

May 13, 2025 pm 06:12 PM

In 2024, AI tokens (such as $TAO, $RNDR) and RWA track (such as $Ondo) exploded, and exchanges such as Bybit and KuCoin have become the first launch sites for potential projects. Pay attention to choosing a transaction: 1) Listing speed (Bybit is often faster than Binance); 2) Project quality (Bitget and Stanford cooperate to screen); 3) Compliance (OKX launches BlackRock $BUIDL). Investment strategy: Snipe CoinList early projects and use exchange spreads to arbitrage.

One article to clarify the role of stablecoins during economic fluctuations

May 14, 2025 pm 09:15 PM

One article to clarify the role of stablecoins during economic fluctuations

May 14, 2025 pm 09:15 PM

You don't need to be an economist to feel the economic turmoil. Prices fall, job stability declines, and everyone seems to be anxious about their financial future. What is a stablecoin? Stablecoins are like life jackets in the crypto world: a digital currency designed to keep its value stable, often linked to stable assets such as the US dollar or gold. Unlike cryptocurrencies with severe price fluctuations such as Bitcoin or Ethereum, stablecoins pursue stability. When an economic storm strikes, investors will naturally seek stability, and stablecoins just provide this safe-haven asset – free from volatility. Why stablecoins thrive when economic instability is

What is Solayer(LAYER)? Solayer Token Economics and Price Forecast

May 14, 2025 pm 10:06 PM

What is Solayer(LAYER)? Solayer Token Economics and Price Forecast

May 14, 2025 pm 10:06 PM

Introduction Decentralized Finance (DeFi) is changing the way users interact with blockchain technology, creating seamless and flexible ways for transactions, lending and earnings creation. Solayer (LAYER) is at the heart of this change, building a protocol that connects liquidity and practicality across multiple blockchains. With the popularity of DeFi and the growing demand for efficient cross-chain infrastructure, Solayer is attracting the attention of traders, developers and investors who are looking for the next major opportunity. This article will explain the concept of Solayer, detail its innovative features and token economics, and look forward to its 2030

What are the cryptocurrency arbitrage strategies? Four common arbitrage strategies and risk analysis

May 14, 2025 pm 09:18 PM

What are the cryptocurrency arbitrage strategies? Four common arbitrage strategies and risk analysis

May 14, 2025 pm 09:18 PM

The English name of cryptocurrency arbitrage is CryptoArbitrage, which refers to a strategy of trading on two exchanges at the same time and making profits by locking the spread on both sides. Cryptocurrency investment has large fluctuations and high risks. Investors want to find strategies that can reduce risks and make profits. Cryptocurrency arbitrage is one of the types of strategies, but is arbitrage strategies really necessarily low risk? What is cryptocurrency arbitrage? When there are different quotes for the same cryptocurrency pair, buy low and sell high at the same time, and use risk-free or extremely low risk to earn the profits of the spread, which is the arbitrage transaction conducted by cryptocurrency arbitrage in the cryptocurrency field, which generally refers to buying and selling on different exchanges.

XDC and XRP: Which one is more attractive to investment?

May 14, 2025 pm 10:09 PM

XDC and XRP: Which one is more attractive to investment?

May 14, 2025 pm 10:09 PM

The two tokens are highlighted by their different use cases and technical characteristics, namely XDC and XRP. Both are in compliance with ISO20022 standards, meaning they comply with global financial messaging standards for seamless interoperability. However, their purpose, market, and the technology differences behind them are significant. In this article, we will compare XDC and XRP in detail to explore their strengths, weaknesses, market potential, and investment considerations in depth. XDC and XRP: Which one is more attractive to investment? Both XDC and XRP are decentralized tokens, but they target different industries and take a unique approach. Here are them

What should I do if I don't get the account after the recharge of Huobi Huobi? Solution to the recharge of Huobi

May 14, 2025 pm 08:42 PM

What should I do if I don't get the account after the recharge of Huobi Huobi? Solution to the recharge of Huobi

May 14, 2025 pm 08:42 PM

When you recharge on Huobi Huobi platform, if you find that the funds have not arrived, this may cause you to be anxious and confused. Fortunately, there are some specific steps and methods to help you solve this problem. The following are detailed solutions and operating guides to help you quickly find solutions when you encounter the problem of recharge not being received.