web3.0

web3.0

VanEck: Institutions are not yet on board! 90% of Bitcoin spot ETF funds come from retail investors

VanEck: Institutions are not yet on board! 90% of Bitcoin spot ETF funds come from retail investors

VanEck: Institutions are not yet on board! 90% of Bitcoin spot ETF funds come from retail investors

It has been exactly three months since the U.S. Securities and Exchange Commission (SEC) approved the listing of multiple Bitcoin spot ETFs. Currently, market investors are very enthusiastic about purchasing this product and continue to do so. Bringing incremental funds also promoted the rise of BTC.

VanEck CEO: 90% of the funds come from retail investors

Originally, the market thought that the Bitcoin spot ETF would attract a large number of institutional funds to enter the market and increase their holdings of Bitcoin. However, the Bitcoin spot ETF Janvan Eck, CEO of issuer VanEck, said in a recent interview that the current flow of funds into Bitcoin ETFs does not mainly come from traditional financial institutions, but from retail investors: the initial success of these ETFs since their launch has exceeded expectations. There have even been billions of dollars in inflows on some trading days, but I think traditional funds have not yet entered the market on a large scale. I still think 90% of the funds come from retail investors. Although some Bitcoin whales and other institutions have invested some assets, they have already been exposed to Bitcoin before.

What is worth thinking about here is whether, compared to institutional investors, retail investors, due to their small capital size, speculative nature and other factors, will amplify FUD sentiment during the decline in Bitcoin prices, thus Triggered a series of accelerated declines and liquidations of BTC?

But on the other hand, does this mean that when institutions enter the market (real big funds), it will further promote the rise of BTC prices? However, there is also a possibility that these institutions do not want to cause market fluctuations because of their large funds, so they choose to conduct OTC privately. It deserves our continued attention and verification in the future.

Traditional funds may enter the market in May

Janvan Eck added that so far no U.S. bank has officially approved or allowed its financial advisors to recommend Bitcoin. But next month, we may see some investment from banks and traditional financial companies. Bitcoin ETF is still in its infancy: there is still a lot to be perfected, a lot of technology is being developed on the chain, and we have a long way to go. Way to go.

BlackRock IBIT is expected to become the largest Bitcoin ETF

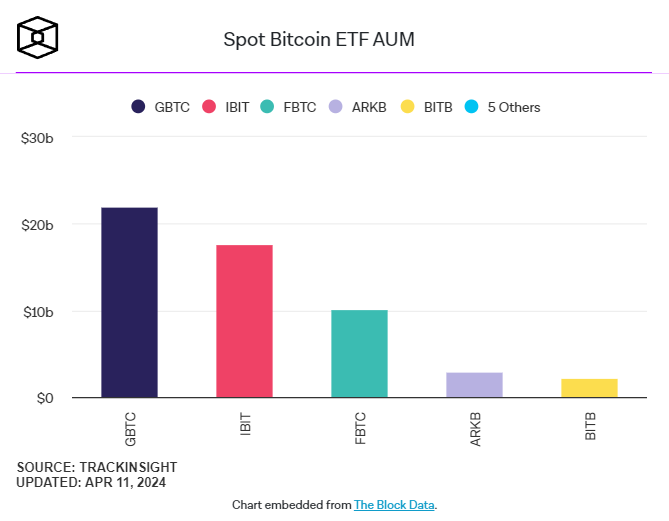

In addition, according to statistics from The Block, among all the Bitcoin spot ETFs currently on the market, the asset management giant BlackRock ’s IBIT holdings have soared from US$4.4 billion two months ago to US$18.2 billion, approaching Grayscale’s US$23.2 billion.

At the same time, due to the high management fees of Grayscale’s Bitcoin ETF, there may be further outflows of funds. Therefore, the market judges that IBIT may surpass Grayscale GBTC and become the largest Bitcoin ETF on the market.

The above is the detailed content of VanEck: Institutions are not yet on board! 90% of Bitcoin spot ETF funds come from retail investors. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

How to trade quantum chains

Apr 21, 2025 pm 11:42 PM

How to trade quantum chains

Apr 21, 2025 pm 11:42 PM

The quantum chain (Qtum) transaction process includes three stages: preliminary preparation, purchase and sale. 1. Preparation: Select a compliant exchange, register an account, perform identity verification, and set up a wallet. 2. Purchase quantum chains: recharge funds, find trading pairs, place orders (market orders or limit orders), and confirm transactions. 3. Sell quantum chains: Enter the trading page, select the trading pair and order type (market order or limit order), confirm the transaction and withdraw cash.

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

Cryptocurrency data platforms suitable for beginners include CoinMarketCap and non-small trumpet. 1. CoinMarketCap provides global real-time price, market value, and trading volume rankings for novice and basic analysis needs. 2. The non-small quotation provides a Chinese-friendly interface, suitable for Chinese users to quickly screen low-risk potential projects.

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

The top ten digital virtual currency apps are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

Recommended essential software for currency contract parties

Apr 21, 2025 pm 11:21 PM

Recommended essential software for currency contract parties

Apr 21, 2025 pm 11:21 PM

The top ten cryptocurrency contract exchange platforms in 2025 are: 1. Binance Futures, 2. OKX Futures, 3. Gate.io, 4. Huobi Futures, 5. BitMEX, 6. Bybit, 7. Deribit, 8. Bitfinex, 9. CoinFLEX, 10. Phemex, these platforms are widely recognized for their high liquidity, diversified trading functions and strict security measures.

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

APP software that can purchase mainstream coins includes: 1. Binance, the world's leading, large transaction volume and fast speed; 2. OKX, innovative products, low fees, high security; 3. Gate.io, a variety of assets and trading options, focusing on security; 4. Huobi (HTX), low fees, good user experience; 5. Coinbase, suitable for novices, high security; 6. Kraken, safe and compliant, providing a variety of services; 7. KuCoin, low fees, suitable for professional traders; 8. Gemini, emphasizes compliance, and provides custodial services; 9. Crypto.com, providing a variety of offers and services; 10. Bitstamp, an old exchange, strong liquidity,

The latest updates to the oldest virtual currency rankings

Apr 22, 2025 am 07:18 AM

The latest updates to the oldest virtual currency rankings

Apr 22, 2025 am 07:18 AM

The ranking of virtual currencies’ “oldest” is as follows: 1. Bitcoin (BTC), issued on January 3, 2009, is the first decentralized digital currency. 2. Litecoin (LTC), released on October 7, 2011, is known as the "lightweight version of Bitcoin". 3. Ripple (XRP), issued in 2011, is designed for cross-border payments. 4. Dogecoin (DOGE), issued on December 6, 2013, is a "meme coin" based on the Litecoin code. 5. Ethereum (ETH), released on July 30, 2015, is the first platform to support smart contracts. 6. Tether (USDT), issued in 2014, is the first stablecoin to be anchored to the US dollar 1:1. 7. ADA,

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

When choosing a digital currency trading platform suitable for beginners, you need to consider security, ease of use, educational resources and cost transparency: 1. Priority is given to platforms that provide cold storage, two-factor verification and asset insurance; 2. Apps with a simple interface and clear operation are more suitable for beginners; 3. The platform should provide learning tools such as tutorials and market analysis; 4. Pay attention to hidden costs such as transaction fees and cash withdrawal fees.

What is a quantum chain? What are the quantum chain transactions?

Apr 21, 2025 pm 11:51 PM

What is a quantum chain? What are the quantum chain transactions?

Apr 21, 2025 pm 11:51 PM

Quantum Chain (Qtum) is an open source decentralized smart contract platform and value transmission protocol. 1. Technical features: BIP-compatible POS smart contract platform, combining the advantages of Bitcoin and Ethereum, introduces off-chain factors and enhances the flexibility of consensus mechanisms. 2. Design principle: realize on-chain and off-chain data interaction through main control contracts, be compatible with different blockchain technologies, flexible consensus mechanisms, and consider industry compliance. 3. Team and Development: An international team led by Shuai Chu, 80% of the quantum coins are used in the community, and 20% rewards the team and investors. Quantum chains are traded on Binance, Gate.io, OKX, Bithumb and Matcha exchanges.