web3.0

web3.0

Three months after the launch of Bitcoin spot ETF, a comprehensive analysis of its development status and future impact

Three months after the launch of Bitcoin spot ETF, a comprehensive analysis of its development status and future impact

Three months after the launch of Bitcoin spot ETF, a comprehensive analysis of its development status and future impact

Original title: "Bitcoin Spot ETF has been launched for three months, comprehensively analyzing its development status and future impact (with Bitcoin ETF and Grayscale Crypto Fund stock orders)"

Written by: RockFlow

Source: Deep Wave TechFlow

Key points

① Three months after the advent of the Bitcoin spot ETF, tens of billions of dollars of traditional funds poured in, effectively helping the price of Bitcoin hit a record high of $73,000.

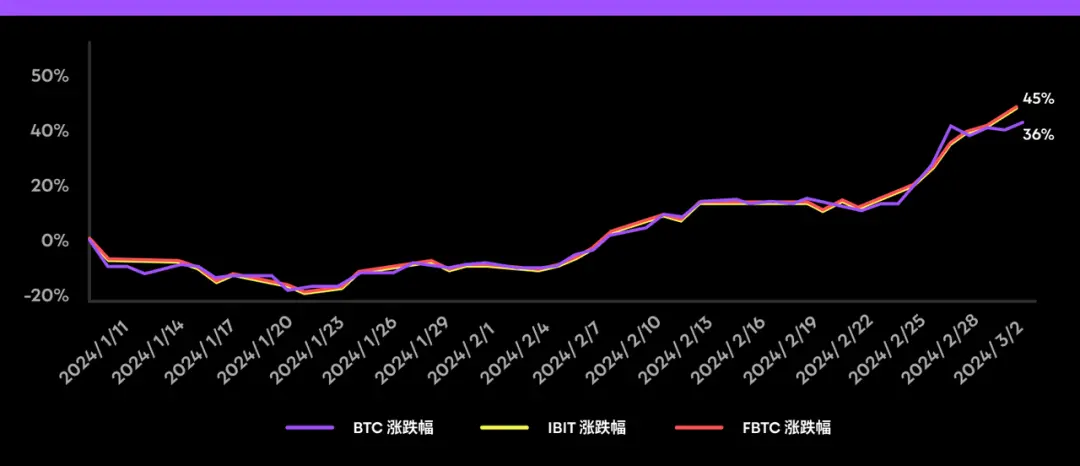

② The price of the Bitcoin spot ETF firmly tracks Bitcoin itself. In the three months since their launch, BlackRock IBIT and Fidelity FBTC have returned nearly 45% (other smaller ETFs have largely matched this gain).

③ This bull market in Bitcoin is consistent with the global liquidity cycle and the Bitcoin halving cycle. The passage of spot ETFs means that the crypto industry is entering a "turning point" stage - it will become more integrated with the traditional financial system.

2024 is the year Bitcoin becomes mainstream.

#In January, the U.S. SEC approved Bitcoin spot ETFs from dozens of issuers, including BlackRock. Many believe this is Bitcoin’s moment of maturity for the emerging asset class. Bitcoin has officially landed on Wall Street.

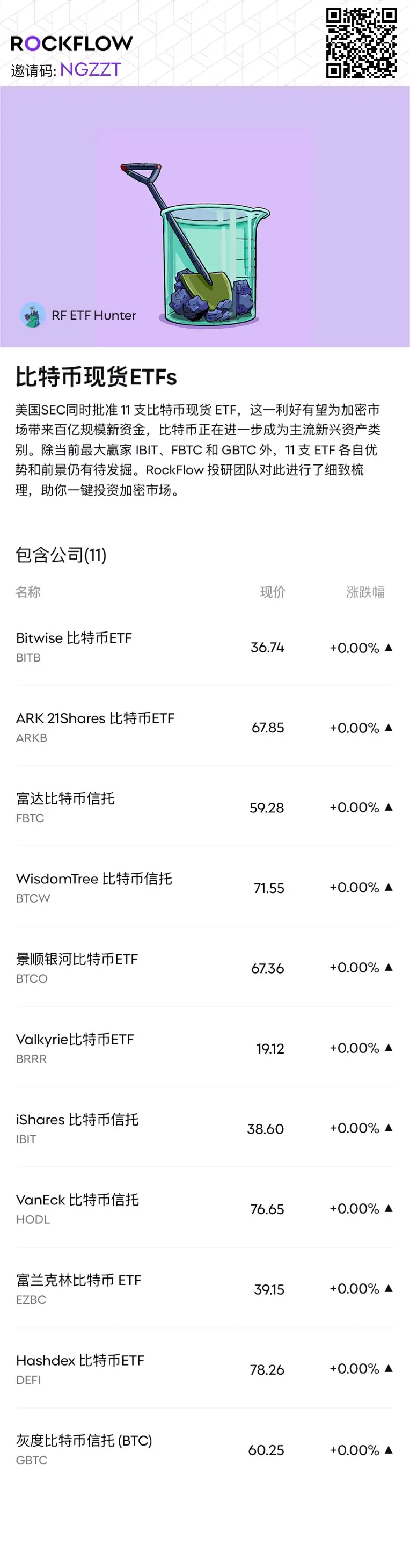

BlackRock’s IBIT quickly emerged as the leader. It set a new record by reaching $10 billion in just 7 weeks. The previous record belonged to SPDR's gold ETF, GLD, which took 27 months. In less than three months, IBIT is close to $18 billion, and second-place Fidelity’s FBTC has also surpassed the $10 billion mark.

This article will provide an in-depth review of the market’s enthusiasm and expectations since the launch of the Bitcoin spot ETF three months ago. As an emerging product category, why are investors so fond of it? What is its development status? What impact has it had on Bitcoin prices?

In addition, scan the QR code below to track the Bitcoin spot ETF with one click. Latest news:

##1. Advantages of Bitcoin ETF

In terms of results, Bitcoin spot ETF has completely achieved the effect of following the price fluctuations of Bitcoin. In about three months since their launch on January 11, BlackRock IBIT and Fidelity FBTC have returned nearly 45% (other smaller ETFs have largely matched that gain).

A question that investors are very concerned about is why buy Bitcoin through ETF instead of owning Bitcoin directly through Coinbase and so on?

The RockFlow investment research team summarized the five advantages of Bitcoin spot ETFs:

1) Low cost:

Compared to buying Bitcoin through crypto platforms, buying Bitcoin ETFs is cheaper. Stock trading reduces the fees and friction of crypto trading as well as deposits and withdrawals. Moreover, many Bitcoin ETFs are now free of fees, and commissions on U.S. stocks are very low and can be ignored.

2) Security:

Compared to buying and storing Bitcoin yourself, Bitcoin Spot ETF’s Security is more guaranteed. If assets are damaged, the Bitcoin custodian will compensate investors based on commercial insurance. Taking BlackRock IBIT as an example, its prospectus reads:

"Direct investment in Bitcoin requires you to decide on your own storage method (crypto wallet or crypto exchange), which makes investors Bear certain risks (such as private keys being stolen or lost, etc.). Holding a Bitcoin spot ETF is different. Investors do not need to bear management risks, which will be the responsibility of the ETF custodian."

3) Convenience:

ETFs can alleviate the hassle of opening accounts on multiple platforms and the complexity of tax reporting. For most ordinary people, it is much more convenient to buy Bitcoin through the same brokerage firm where you buy stocks than to buy it on a crypto platform.

4) Compliance:

Bitcoin itself may not comply with the requirements of some professional investment institutions or advisors Customer demand. Before spot ETFs came along, Bitcoin futures ETFs used to be an option. But clearly, spot ETFs have a wider audience, and their regulatory compliance brings additional security.

5) Diversity:

Although the Bitcoin Spot ETF currently only offers a single asset (Bitcoin) risk exposure, but it is conceivable that in the future these funds are expected to offer a diverse range of investment classes. This diversification may further broaden its appeal.

Bitcoin Spot ETF provides a cheaper, safer, more compliant, and simpler way to invest. At the same time, we will also see the arrival of more new funds as more traditional institutions incorporate them into asset allocation categories and launch them for users.

2. How do Bitcoin ETFs affect Bitcoin itself?

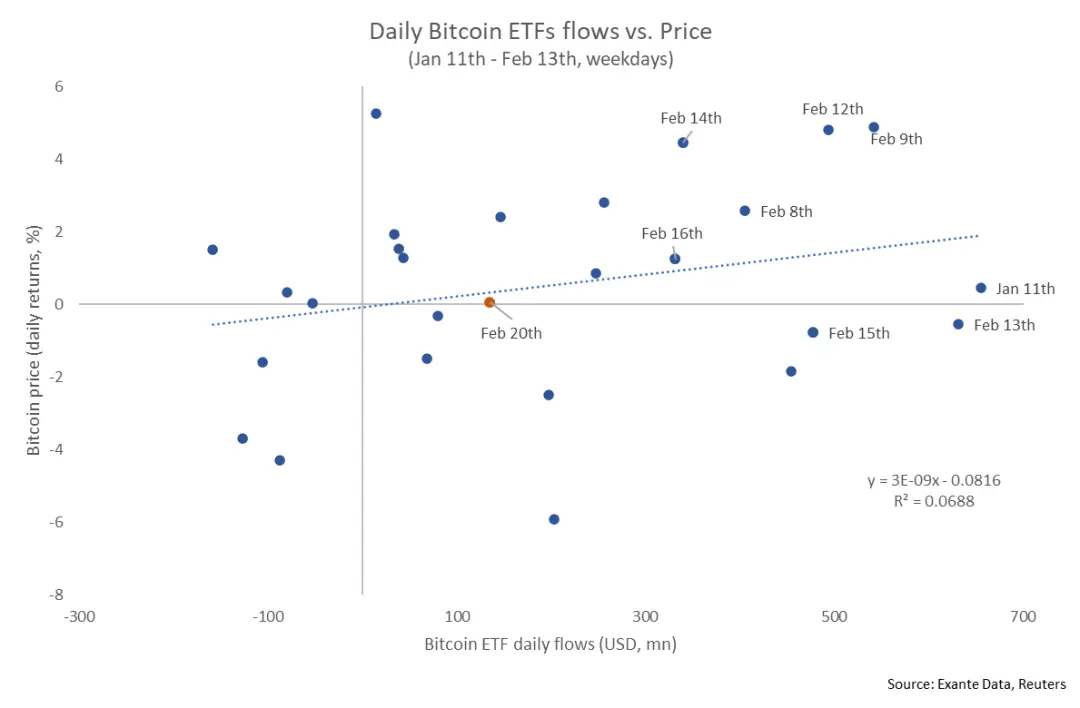

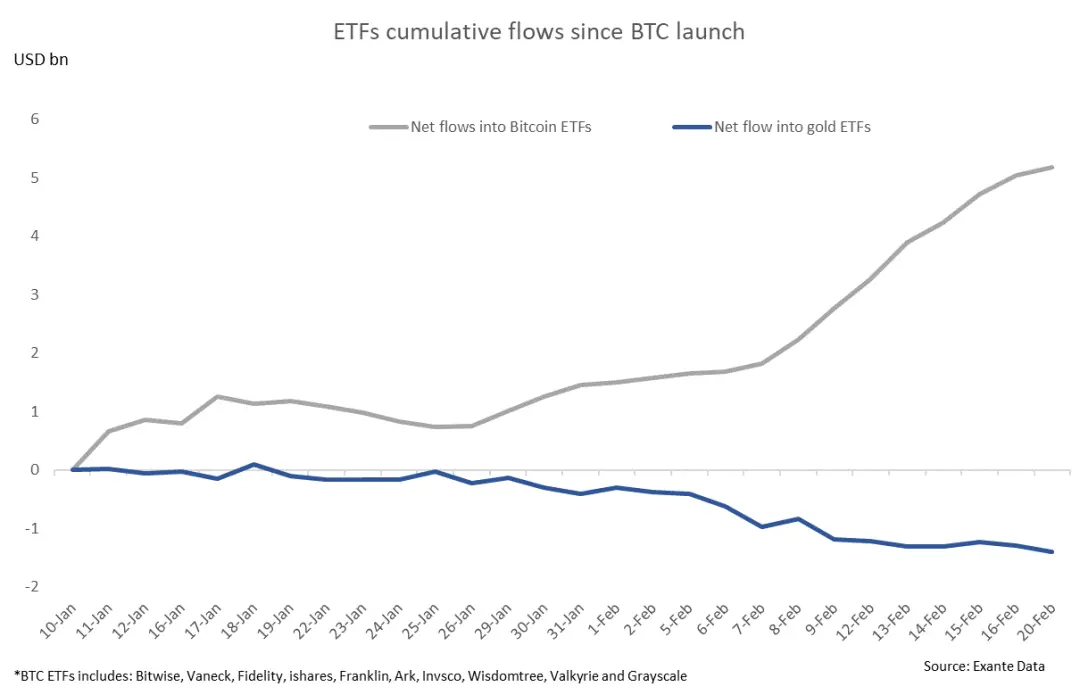

The chart below shows the correlation between Bitcoin ETF inflows and the price of Bitcoin. In the ten days or so after launch (January 11-23), Bitcoin prices fell 15%, somewhat discouraging inflows. But over the next three weeks, Bitcoin prices rose by around 30%, driving a flood of money into the crypto market.

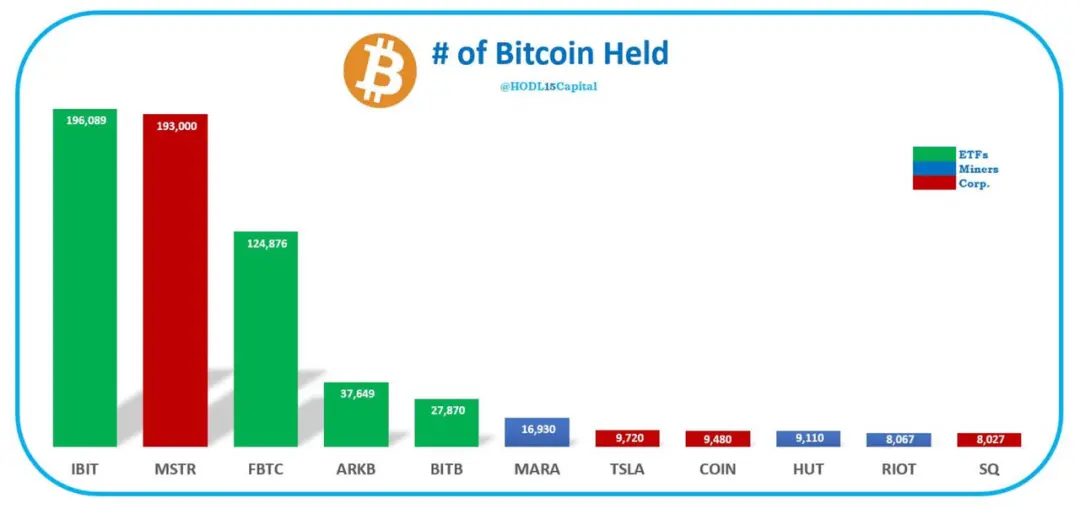

#As mentioned above, three months after launch, the scale of BlackRock IBIT and Fidelity FBTC reached US$18 billion and US$10 billion respectively. The total size of Bitcoin spot ETFs already accounts for more than 4% of Bitcoin’s current total supply. We believe the influx of OTC funds played an important role in sustaining Bitcoin buying and countering sell-side pressure from long-term holders taking profits.

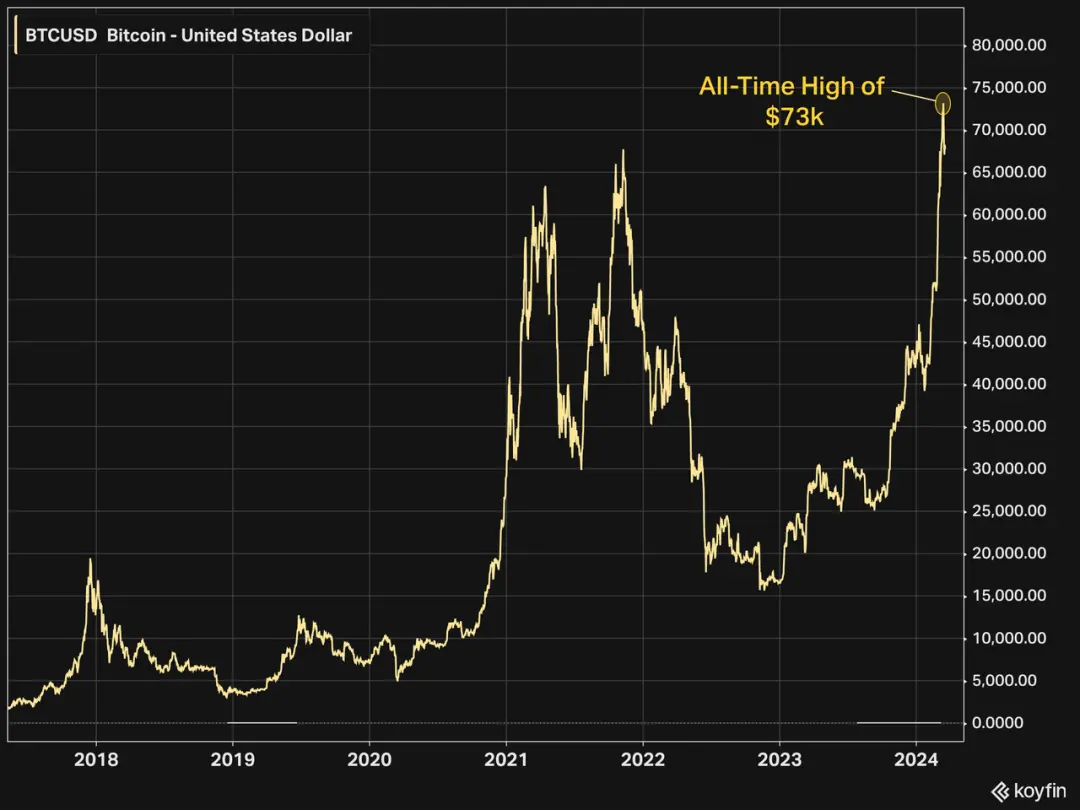

At the same time, the price of Bitcoin also hit a record high of $73,000 due to the influx of tens of billions of dollars in traditional funds - this is after $19,450 in 2017 and $19,450 in April 2021. After $63,400 in November 2021 and $67,700 in November 2021, Bitcoin reached its fourth all-time high.

Looking at another number, the amount of funds raised by U.S. VCs in 2023 will be approximately $67 billion. At this pace, BlackRock IBIT alone (just one of 11 existing Bitcoin spot ETFs) is on track to equal the total raised by all U.S. VCs last year this year.

Separately, according to data from The Block, Bitcoin spot ETF trading volume nearly tripled in March to $111 billion, compared with $42 billion in February.

February marked the product’s first full month of trading since its launch on January 11, and March’s volume growth highlights rising interest in new financial instruments. The size was more than double that of February and January combined. So, how big will the trading volume be in April? Well worth the wait.

3. Will Bitcoin ETF cannibalize the size of gold ETF?

The traditional tool to fight inflation is gold, and later there was a new option of "digital gold" called Bitcoin. In the past period, as the price of Bitcoin itself climbed, the price of gold also hit new highs. Some investors wonder whether the two may compete?

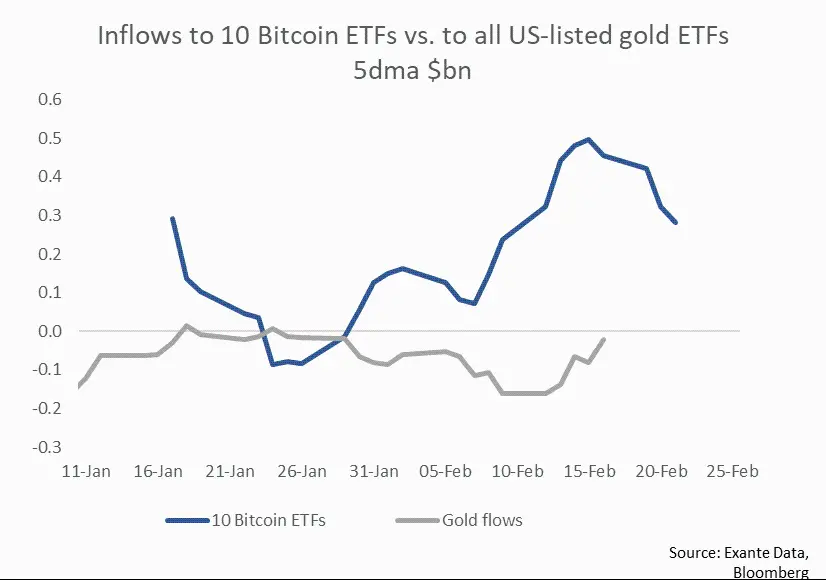

Comparing the recent data of GLD, the largest gold ETF, we can see that since the launch of Bitcoin ETF, the capital inflow of gold ETF has turned negative, which means that Bitcoin ETF may indeed A portion of the funds originally intended to be invested in gold ETFs were diverted.

#At the same time, as Bitcoin ETF inflows decreased in the second half of February, gold ETF outflows also decreased in parallel. This indicates that the diversion phenomenon has been alleviated to a certain extent in the short term.

But in general, both have become ideal asset allocation categories in the current global inflation environment due to their anti-inflation properties, and therefore have the potential to benefit in the long term.

4. In addition to ETFs, the price driving force of Bitcoin

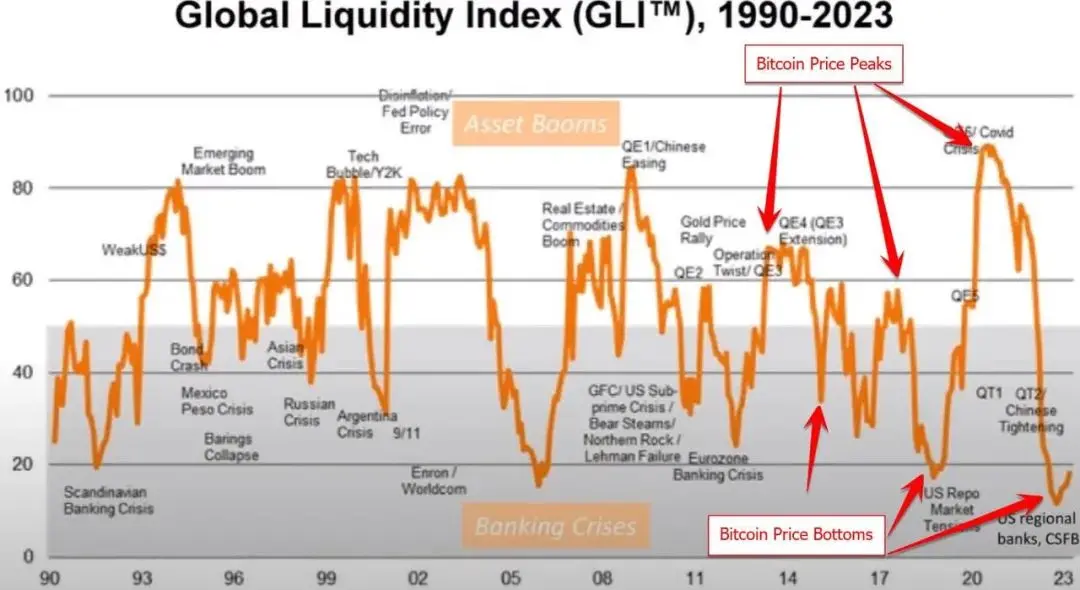

We can see that this wave of Bitcoin’s bull market is closely related to the global The liquidity cycle and the Bitcoin halving cycle remain consistent.

In addition, the frequent moves by some companies also once again reflect the interest of commercial institutions in Bitcoin. MicroStrategy spent $821.7 million buying approximately 12,000 Bitcoins between February 26 and March 10, increasing its total Bitcoin holdings to 205,000 Bitcoins, very close to BlackRock IBIT’s current Bitcoin holdings.

The fourth Bitcoin halving in two weeks is also expected to increase the market's attention and enthusiasm for Bitcoin. Historically, halvings have increased Bitcoin price volatility and ultimately led to price increases.

We believe that the crypto industry represented by Bitcoin is the same as countless previous innovation cycles. As the industry matures, investment based on speculation and narrative will gradually shift to one based on value and Fundamental investing. The passage of the Bitcoin spot ETF means that the encryption industry is entering a "turning point" stage - it will be more integrated with the traditional financial system.

In addition, RockFlow has also launched multiple trust funds under Grayscale that manage crypto assets. It serves institutional investors and high-net-worth investors through compliant fund operations. In addition to the famous Bitcoin trust fund GBTC, there are also trust funds for cryptocurrencies such as ETH, SOL, LINK, and LPT, as well as composite crypto trust funds including mainstream currencies:

The above is the detailed content of Three months after the launch of Bitcoin spot ETF, a comprehensive analysis of its development status and future impact. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Reliable and easy-to-use virtual currency exchange app recommendations The latest ranking of the top ten exchanges in the currency circle

Apr 22, 2025 pm 01:21 PM

Reliable and easy-to-use virtual currency exchange app recommendations The latest ranking of the top ten exchanges in the currency circle

Apr 22, 2025 pm 01:21 PM

The reliable and easy-to-use virtual currency exchange apps are: 1. Binance, 2. OKX, 3. Gate.io, 4. Coinbase, 5. Kraken, 6. Huobi Global, 7. Bitfinex, 8. KuCoin, 9. Bittrex, 10. Poloniex. These platforms were selected as the best for their transaction volume, user experience and security, and all offer registration, verification, deposit, withdrawal and transaction operations.

Top 10 digital currency exchange app recommendations, top ten virtual currency exchanges in the currency circle

Apr 22, 2025 pm 03:03 PM

Top 10 digital currency exchange app recommendations, top ten virtual currency exchanges in the currency circle

Apr 22, 2025 pm 03:03 PM

Recommended apps on top ten digital currency exchanges: 1. OKX, 2. Binance, 3. gate.io, 4. Huobi, 5. Coinbase, 6. KuCoin, 7. Kraken, 8. Bitfinex, 9. Bybit, 10. Bitstamp, these apps provide real-time market trends, technical analysis and price reminders to help users monitor market dynamics in real time and make informed investment decisions.

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

The top ten digital virtual currency apps are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

What are the digital currency trading platforms in 2025? The latest rankings of the top ten digital currency apps

Apr 22, 2025 pm 03:09 PM

What are the digital currency trading platforms in 2025? The latest rankings of the top ten digital currency apps

Apr 22, 2025 pm 03:09 PM

Recommended apps for the top ten virtual currency viewing platforms: 1. OKX, 2. Binance, 3. Gate.io, 4. Huobi, 5. Coinbase, 6. Kraken, 7. Bitfinex, 8. KuCoin, 9. Bybit, 10. Bitstamp, these platforms provide real-time market trends, technical analysis tools and user-friendly interfaces to help investors make effective market analysis and trading decisions.

What are the top ten digital currency trading software? The top ten exchange platforms in the currency circle

Apr 22, 2025 pm 03:06 PM

What are the top ten digital currency trading software? The top ten exchange platforms in the currency circle

Apr 22, 2025 pm 03:06 PM

The top ten trading softwares in the currency exchange platform are: 1. OKX, 2. Binance, 3. gate.io, 4. Huobi Global, 5. KuCoin, 6. Coinbase, 7. Kraken, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These platforms provide a variety of trading modes and security measures to ensure the safety of user assets.

Top 10 digital currency exchange apps Recommended by the top ten digital currency exchanges

Apr 22, 2025 pm 03:12 PM

Top 10 digital currency exchange apps Recommended by the top ten digital currency exchanges

Apr 22, 2025 pm 03:12 PM

The top ten digital currency exchange apps are ranked: 1. Binance, 2. OKX, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bybit, 9. Bitfinex, 10. Bittrex, these platforms were selected for their excellent performance in user experience, security, handling fees and transaction volume.

Top 10 safe and easy-to-use virtual currency trading platforms, ranking of the top ten reliable digital currency exchanges

Apr 22, 2025 pm 12:45 PM

Top 10 safe and easy-to-use virtual currency trading platforms, ranking of the top ten reliable digital currency exchanges

Apr 22, 2025 pm 12:45 PM

The top ten safe and easy-to-use virtual currency trading platforms are: Binance, OKX, gate.io, Coinbase, Kraken, Huobi, Bybit, KuCoin, Bitfinex, and Bittrex. These platforms are highly praised for their high liquidity, low transaction fees, diversified trading products, global layout, strong technical support, innovative trading systems, high security, rich currency and user-friendly interface.

gate.io sesame door latest official app address

Apr 22, 2025 pm 01:03 PM

gate.io sesame door latest official app address

Apr 22, 2025 pm 01:03 PM

The official Gate.io APP can be downloaded in the following ways: 1. Visit the official website gate.io to download; 2. Search "Gate.io" on the App Store or Google Play to download. Be sure to download it through the official channel to ensure safety.