web3.0

web3.0

Ethena Reserve into Bitcoin! It is said that USDe's current scale of 2 billion can be expanded by 2.5 times.

Ethena Reserve into Bitcoin! It is said that USDe's current scale of 2 billion can be expanded by 2.5 times.

Ethena Reserve into Bitcoin! It is said that USDe's current scale of 2 billion can be expanded by 2.5 times.

This site (120bTC.coM) synthesizes the US dollar stable currency protocol Ethena and issues the US dollar stable currency USDe with its "Delta Neutral" mechanism. The original composition behind this mechanism is based on Ethena. The value of spot ETH and ETH futures short positions are hedged to become a "Delta neutral" stable asset. Today (4th), in view of the unprecedented growth of USDe, with the current market value exceeding US$2 billion, Ethena officially announced that Bitcoin will be included as a reserve asset of USDe to support the further expansion of the scale of USDe.

Reason for inclusion in Bitcoin

Ethena noted that hedging transactions conducted by Ethena have accounted for one-fifth of the value of all Ethereum open interest (OI) currently on the market so far. one. As the size of USDe continues to expand, the existing Ethereum open interest constraints in the market may not be sufficient for Ethena to perform sufficient hedging operations. Therefore, the introduction of Bitcoin as a reserve asset has become a crucial decision. Ethena said that every $25 billion of Bitcoin open interest constraints allows Ethena to perform delta hedging, which allows the potential size of USDe to be expanded by more than 2.5 times.

Over the past year, Bitcoin’s open interest on major exchanges (excluding CME) has surged 150% to $25 billion, while Ethereum’s growth rate has been 100%, unflattering The volume of open positions reached US$10 billion. In this regard, Ethereum stated: The rapid growth of the Bitcoin derivatives market exceeds that of Ethereum, but Delta hedging transactions provide better scalability and liquidity.

In addition, Ethena also mentioned that compared to Ethereum liquidity pledged tokens, Bitcoin has greater advantages in liquidity and term characteristics.

Will Bitcoin’s lack of staking income affect USDe APY?

The original USDe income mainly comes from "Ethereum PoS pledge income" and "funding rate for contract short position holdings". However, since Bitcoin does not have the native staking income like staking ETH, this change may have an impact on USDe's income. However, Ethena pointed out that during the bull market, when the funding rate exceeds 30%, the staking income of 3~4% is actually capped, and the current market conditions are extremely suitable to increase the scale and scalability of USDe.

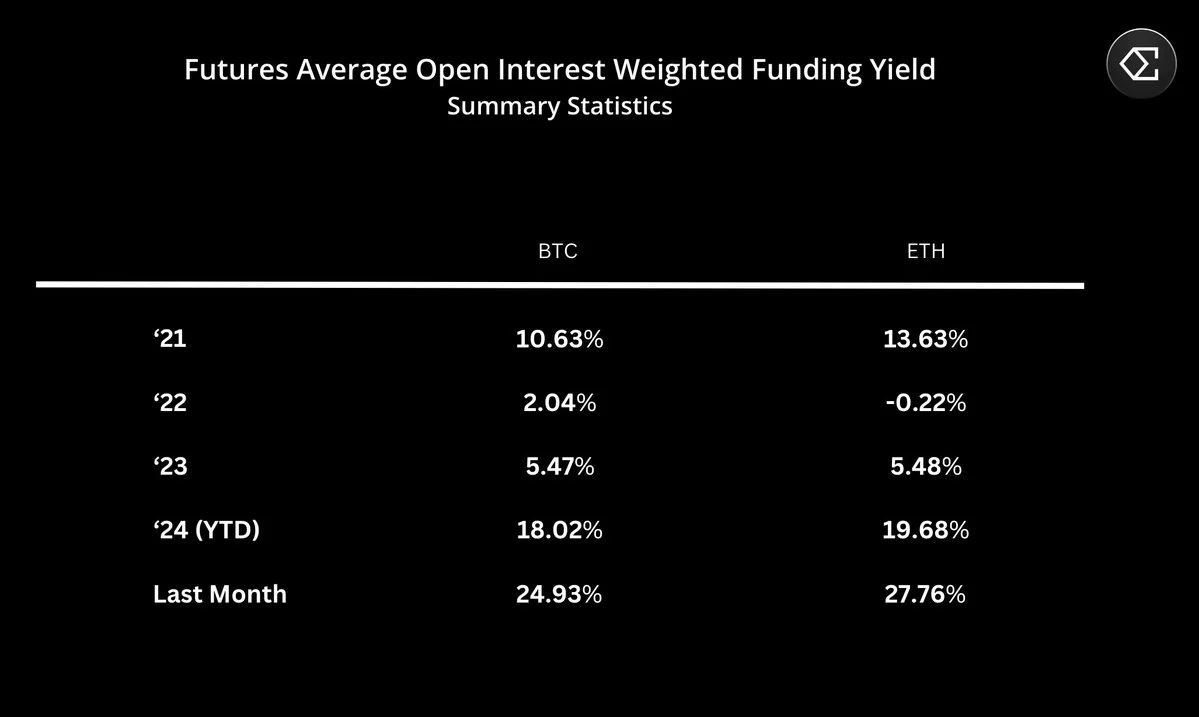

According to Ethena statistics, Bitcoin’s funding rate in 2021 is comparable to Ethereum. But in the bear market of 2022, Bitcoin’s funding rate gains exceeded those of Ethereum, at 2% and 0% respectively. During bull markets, Ethereum’s funding rate often exceeds that of Bitcoin.

Currently, users can view USDe’s mortgage asset portfolio through Ethena’s official website. Although it has not yet been shown that Bitcoin has been included, the mortgage assets already include USD 736 million worth of USDT and USD 870 million in ETH, respectively. Accounting for 38% and 44% of the total value of all USDe mortgage assets.

Bitcoin and Ethereum funding rate comparison table

The above is the detailed content of Ethena Reserve into Bitcoin! It is said that USDe's current scale of 2 billion can be expanded by 2.5 times.. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Top 10 digital currency exchange app recommendations, top ten virtual currency exchanges in the currency circle

Apr 22, 2025 pm 03:03 PM

Top 10 digital currency exchange app recommendations, top ten virtual currency exchanges in the currency circle

Apr 22, 2025 pm 03:03 PM

Recommended apps on top ten digital currency exchanges: 1. OKX, 2. Binance, 3. gate.io, 4. Huobi, 5. Coinbase, 6. KuCoin, 7. Kraken, 8. Bitfinex, 9. Bybit, 10. Bitstamp, these apps provide real-time market trends, technical analysis and price reminders to help users monitor market dynamics in real time and make informed investment decisions.

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

The top ten digital virtual currency apps are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

Reliable and easy-to-use virtual currency exchange app recommendations The latest ranking of the top ten exchanges in the currency circle

Apr 22, 2025 pm 01:21 PM

Reliable and easy-to-use virtual currency exchange app recommendations The latest ranking of the top ten exchanges in the currency circle

Apr 22, 2025 pm 01:21 PM

The reliable and easy-to-use virtual currency exchange apps are: 1. Binance, 2. OKX, 3. Gate.io, 4. Coinbase, 5. Kraken, 6. Huobi Global, 7. Bitfinex, 8. KuCoin, 9. Bittrex, 10. Poloniex. These platforms were selected as the best for their transaction volume, user experience and security, and all offer registration, verification, deposit, withdrawal and transaction operations.

What are the free market viewing software websites? Ranking of the top ten free market viewing software in the currency circle

Apr 22, 2025 am 10:57 AM

What are the free market viewing software websites? Ranking of the top ten free market viewing software in the currency circle

Apr 22, 2025 am 10:57 AM

The top three top ten free market viewing software in the currency circle are OKX, Binance and gate.io. 1. OKX provides a simple interface and real-time data, supporting a variety of charts and market analysis. 2. Binance has powerful functions, accurate data, and is suitable for all kinds of traders. 3. gate.io is known for its stability and comprehensiveness, and is suitable for long-term and short-term investors.

What are the top ten digital currency trading software? The top ten exchange platforms in the currency circle

Apr 22, 2025 pm 03:06 PM

What are the top ten digital currency trading software? The top ten exchange platforms in the currency circle

Apr 22, 2025 pm 03:06 PM

The top ten trading softwares in the currency exchange platform are: 1. OKX, 2. Binance, 3. gate.io, 4. Huobi Global, 5. KuCoin, 6. Coinbase, 7. Kraken, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These platforms provide a variety of trading modes and security measures to ensure the safety of user assets.

Top 10 digital currency exchange apps Recommended by the top ten digital currency exchanges

Apr 22, 2025 pm 03:12 PM

Top 10 digital currency exchange apps Recommended by the top ten digital currency exchanges

Apr 22, 2025 pm 03:12 PM

The top ten digital currency exchange apps are ranked: 1. Binance, 2. OKX, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bybit, 9. Bitfinex, 10. Bittrex, these platforms were selected for their excellent performance in user experience, security, handling fees and transaction volume.

Top 10 safe and easy-to-use virtual currency trading platforms, ranking of the top ten reliable digital currency exchanges

Apr 22, 2025 pm 12:45 PM

Top 10 safe and easy-to-use virtual currency trading platforms, ranking of the top ten reliable digital currency exchanges

Apr 22, 2025 pm 12:45 PM

The top ten safe and easy-to-use virtual currency trading platforms are: Binance, OKX, gate.io, Coinbase, Kraken, Huobi, Bybit, KuCoin, Bitfinex, and Bittrex. These platforms are highly praised for their high liquidity, low transaction fees, diversified trading products, global layout, strong technical support, innovative trading systems, high security, rich currency and user-friendly interface.

Safe and easy-to-use virtual digital currency trading software Recommended by top ten cryptocurrency trading platforms

Apr 22, 2025 pm 12:48 PM

Safe and easy-to-use virtual digital currency trading software Recommended by top ten cryptocurrency trading platforms

Apr 22, 2025 pm 12:48 PM

Safe and easy-to-use virtual digital currency trading software include: 1. Binance, 2. OKX, 3. Gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. Bittrex, 8. Poloniex, 9. Bitfinex, 10. KuCoin. These exchanges have their own characteristics, provide a variety of cryptocurrency trading and advanced functions, have a friendly user interface, strong security measures, and are suitable for traders of different levels.