Grayscale launches new pledge income fund designed for high-net-worth individuals

Asset management firm Grayscale has launched a new “Dynamic Income Fund” (GDIF) focused on staking returns, designed specifically for high-net-worth individuals.

Grayscale launches dynamic income fund

According to the asset management company’s announcement on Friday, the actively managed investment product optimizes returns through staking rewards tied to Proof-of-Stake (PoS) digital assets.

Friday’s announcement also spelled out key steps for the fund, which include raising capital from investors, allocating capital to a portfolio of proof-of-stake tokens using qualitative and quantitative factors, staking tokens to earn rewards, weekly Convert token rewards into cash and distribute cash to investors quarterly while rebalancing tokens based on demand to maximize returns.

Grayscale hinted that GDIF will initially include tokens such as Osmosis (OSMO), Solana (SOL), Polkadot (DOT), and others to be announced soon.

The Asset Management Company clarifies that token holdings may vary at the discretion of the Management Company and the percentage allocated to each token may not total 100% due to rounding.

In order to deepen the understanding of grayscale images, a new study proposes that pledge parties and investors actively participate in verifying blockchain network transactions, and at the same time earn pledge rewards from the transaction fees for their services. To stake, investors stake a certain amount of tokens into the network, allowing them to contribute to its security and governance.

Grayscale acts as a simplification and guarantor in the world of digital currencies, unblocking the complexities associated with staking multiple tokens, as each token has its own unique staking and unstaking requirements and timelines.

It’s worth noting that GDIF is only open to qualified clients, defined as individuals with $1.1 million in assets under management or $2.2 million in net worth.

Bitcoin ETF Market Shows Strong rebound

The Bitcoin ETF market has witnessed significant developments over the past few days, according to new data from BitMEX Research. In particular, the $887 million in outflows reported last week has almost reversed course, indicating a resurgence in investor interest.

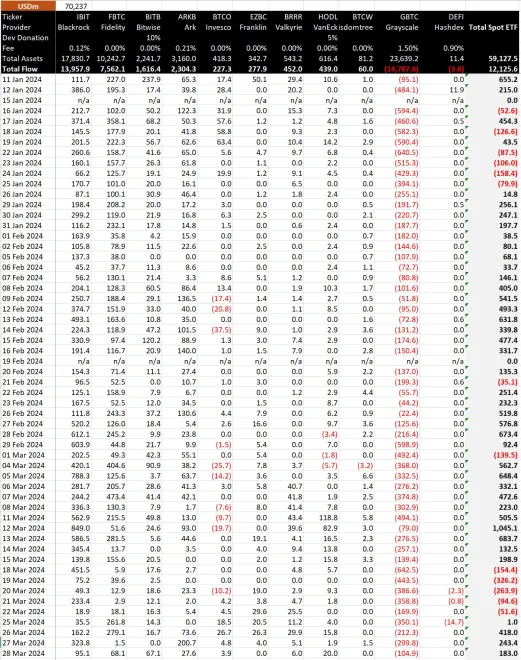

Grayscale is one of the well-known players in this space with its GBTC The ETF saw only modest outflows of $1.049 million on Thursday, its lowest level since March 12, as shown in the chart below.

In contrast, Grayscale's rivals posted a strong performance, recording $84.4 million in net inflows in just four days. On March 28, Blackrock’s ETF IBIT emerged as the front-runner, achieving a significant increase of $95.1 million. On the same day, Fidelity’s FBTC followed suit, achieving an inflow of $68 million.

However, it's worth noting that these figures represent a significant decline from the best-performing periods in the history of both asset managers.

Blackrock's ETF IBIT peaked on March 12 with total inflows of more than $849 million. Likewise, Fidelity’s FBTC experienced its highest inflows on March 7, reaching $473 million.

BitMEX research data further shows that since trading began on January 11, the cumulative flow of the Bitcoin ETF market has approached $1.25 billion in just three months.

The above is the detailed content of Grayscale launches new pledge income fund designed for high-net-worth individuals. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Meme Coin Exchange Ranking Meme Coin Main Exchange Top 10 Spots

Apr 22, 2025 am 09:57 AM

Meme Coin Exchange Ranking Meme Coin Main Exchange Top 10 Spots

Apr 22, 2025 am 09:57 AM

The most suitable platforms for trading Meme coins include: 1. Binance, the world's largest, with high liquidity and low handling fees; 2. OkX, an efficient trading engine, supporting a variety of Meme coins; 3. XBIT, decentralized, supporting cross-chain trading; 4. Redim (Solana DEX), low cost, combined with Serum order book; 5. PancakeSwap (BSC DEX), low transaction fees and fast speed; 6. Orca (Solana DEX), user experience optimization; 7. Coinbase, high security, suitable for beginners; 8. Huobi, well-known in Asia, rich trading pairs; 9. DEXRabbit, intelligent

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

The top ten digital virtual currency apps are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

What are the digital currency trading platforms in 2025? The latest rankings of the top ten digital currency apps

Apr 22, 2025 pm 03:09 PM

What are the digital currency trading platforms in 2025? The latest rankings of the top ten digital currency apps

Apr 22, 2025 pm 03:09 PM

Recommended apps for the top ten virtual currency viewing platforms: 1. OKX, 2. Binance, 3. Gate.io, 4. Huobi, 5. Coinbase, 6. Kraken, 7. Bitfinex, 8. KuCoin, 9. Bybit, 10. Bitstamp, these platforms provide real-time market trends, technical analysis tools and user-friendly interfaces to help investors make effective market analysis and trading decisions.

Top 10 digital currency exchange app recommendations, top ten virtual currency exchanges in the currency circle

Apr 22, 2025 pm 03:03 PM

Top 10 digital currency exchange app recommendations, top ten virtual currency exchanges in the currency circle

Apr 22, 2025 pm 03:03 PM

Recommended apps on top ten digital currency exchanges: 1. OKX, 2. Binance, 3. gate.io, 4. Huobi, 5. Coinbase, 6. KuCoin, 7. Kraken, 8. Bitfinex, 9. Bybit, 10. Bitstamp, these apps provide real-time market trends, technical analysis and price reminders to help users monitor market dynamics in real time and make informed investment decisions.

Top 10 safe and easy-to-use virtual currency trading platforms, ranking of the top ten reliable digital currency exchanges

Apr 22, 2025 pm 12:45 PM

Top 10 safe and easy-to-use virtual currency trading platforms, ranking of the top ten reliable digital currency exchanges

Apr 22, 2025 pm 12:45 PM

The top ten safe and easy-to-use virtual currency trading platforms are: Binance, OKX, gate.io, Coinbase, Kraken, Huobi, Bybit, KuCoin, Bitfinex, and Bittrex. These platforms are highly praised for their high liquidity, low transaction fees, diversified trading products, global layout, strong technical support, innovative trading systems, high security, rich currency and user-friendly interface.

What are the top ten digital currency trading software? The top ten exchange platforms in the currency circle

Apr 22, 2025 pm 03:06 PM

What are the top ten digital currency trading software? The top ten exchange platforms in the currency circle

Apr 22, 2025 pm 03:06 PM

The top ten trading softwares in the currency exchange platform are: 1. OKX, 2. Binance, 3. gate.io, 4. Huobi Global, 5. KuCoin, 6. Coinbase, 7. Kraken, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These platforms provide a variety of trading modes and security measures to ensure the safety of user assets.

Top 10 digital currency exchange apps Recommended by the top ten digital currency exchanges

Apr 22, 2025 pm 03:12 PM

Top 10 digital currency exchange apps Recommended by the top ten digital currency exchanges

Apr 22, 2025 pm 03:12 PM

The top ten digital currency exchange apps are ranked: 1. Binance, 2. OKX, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bybit, 9. Bitfinex, 10. Bittrex, these platforms were selected for their excellent performance in user experience, security, handling fees and transaction volume.

What is on-chain transaction? What are the global transactions?

Apr 22, 2025 am 10:06 AM

What is on-chain transaction? What are the global transactions?

Apr 22, 2025 am 10:06 AM

EU MiCA compliance certification, covering 50 fiat currency channels, cold storage ratio 95%, and zero security incident records. The US SEC licensed platform has convenient direct purchase of fiat currency, a ratio of 98% cold storage, institutional-level liquidity, supports large-scale OTC and custom orders, and multi-level clearing protection.