web3.0

web3.0

BlackRock tokenization fund BUIDL surpasses $1 billion! The highest proportion of RWA assets deployed on Ethereum

BlackRock tokenization fund BUIDL surpasses $1 billion! The highest proportion of RWA assets deployed on Ethereum

BlackRock tokenization fund BUIDL surpasses $1 billion! The highest proportion of RWA assets deployed on Ethereum

It is said that BlackRock announced the launch of its first asset tokenization fund "BlackRock USD Institutional Digital Liquidity Fund" (BUIDL) on the 20th. The assets are 100% invested in cash, U.S. Treasury bonds and repurchase agreements, allowing investors to earn income while holding tokens on the blockchain.

Currently, BUIDL has only been launched for a week, and its market value has reached US$244.8 million, making it the second largest tokenized U.S. Treasury bond fund.

Dune Analytics data shows that BUIDL’s current asset size has only declined after Franklin Templeton launched the “Franklin On Chain US Government Money Fund (FOBXX)” for 11 months. The fund currently holds about $360.2 million in U.S. Treasury securities.

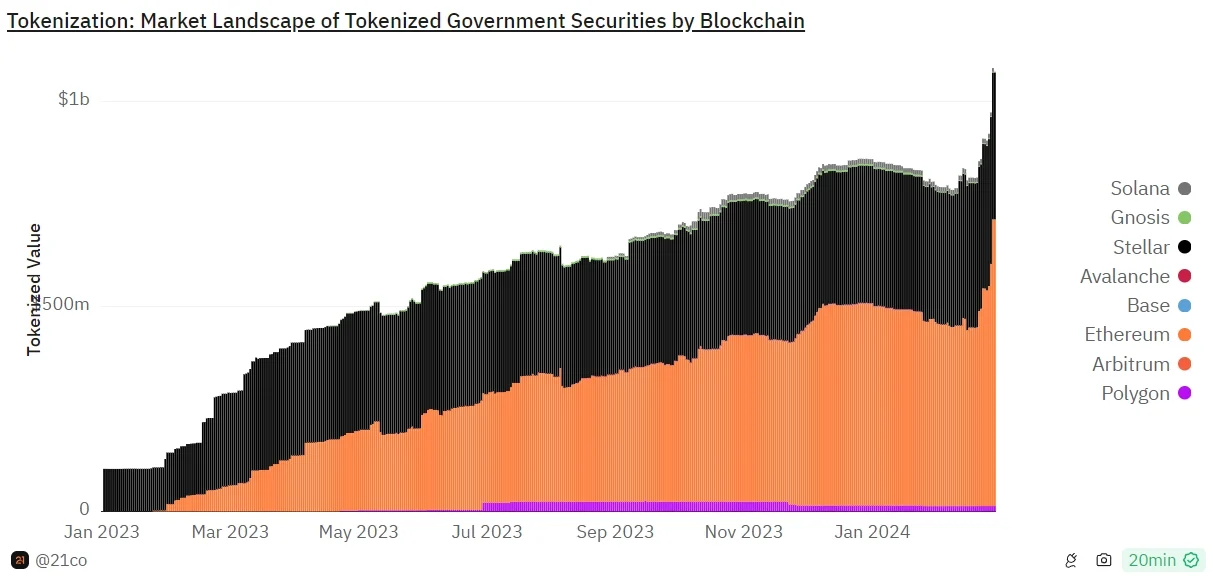

With the support of the launch of BUIDL, currently US$1.08 billion worth of U.S. Treasury bonds have been tokenized through 17 products, setting a milestone record.

$1.08 billion worth of U.S. Treasuries tokenized through 17 products

The latest transaction, which injects $79.3 million into BUIDL, was funded by a real-life Conducted by Ondo Finance, a company that provides world asset tokenization (RWA) services. Ondo Finance currently owns 38% of BUIDL, which is priced 1:1 with the U.S. dollar and pays interest directly to investors every month. The fund is deployed on Ethereum via the Securitize protocol.

Ethereum accounts for the highest proportion

BlackRock CEO Larry Fink recently said that tokenization can improve the efficiency of capital markets. The Boston Consulting Group also predicts that the tokenized asset market will flourish. , its size may surge to $16 trillion by 2030.

Currently, RWA assets deployed on Ethereum reach US$700 million, accounting for the highest proportion

RWA deployed on Stellar and Polygon The asset size is the second and third largest respectively, reaching US$358 million and US$13 million

Franklin Templeton's FOBXX is deployed on Stellar and Polygon.

The highest proportion of RWA assets deployed on Ethereum

The above is the detailed content of BlackRock tokenization fund BUIDL surpasses $1 billion! The highest proportion of RWA assets deployed on Ethereum. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

How to trade quantum chains

Apr 21, 2025 pm 11:42 PM

How to trade quantum chains

Apr 21, 2025 pm 11:42 PM

The quantum chain (Qtum) transaction process includes three stages: preliminary preparation, purchase and sale. 1. Preparation: Select a compliant exchange, register an account, perform identity verification, and set up a wallet. 2. Purchase quantum chains: recharge funds, find trading pairs, place orders (market orders or limit orders), and confirm transactions. 3. Sell quantum chains: Enter the trading page, select the trading pair and order type (market order or limit order), confirm the transaction and withdraw cash.

Meme Coin Exchange Ranking Meme Coin Main Exchange Top 10 Spots

Apr 22, 2025 am 09:57 AM

Meme Coin Exchange Ranking Meme Coin Main Exchange Top 10 Spots

Apr 22, 2025 am 09:57 AM

The most suitable platforms for trading Meme coins include: 1. Binance, the world's largest, with high liquidity and low handling fees; 2. OkX, an efficient trading engine, supporting a variety of Meme coins; 3. XBIT, decentralized, supporting cross-chain trading; 4. Redim (Solana DEX), low cost, combined with Serum order book; 5. PancakeSwap (BSC DEX), low transaction fees and fast speed; 6. Orca (Solana DEX), user experience optimization; 7. Coinbase, high security, suitable for beginners; 8. Huobi, well-known in Asia, rich trading pairs; 9. DEXRabbit, intelligent

What does cross-chain transaction mean? What are the cross-chain transactions?

Apr 21, 2025 pm 11:39 PM

What does cross-chain transaction mean? What are the cross-chain transactions?

Apr 21, 2025 pm 11:39 PM

Exchanges that support cross-chain transactions: 1. Binance, 2. Uniswap, 3. SushiSwap, 4. Curve Finance, 5. Thorchain, 6. 1inch Exchange, 7. DLN Trade, these platforms support multi-chain asset transactions through various technologies.

Quantum Chain Exchange Ranking Top 10 Recommended (Updated in 2025)

Apr 21, 2025 pm 11:48 PM

Quantum Chain Exchange Ranking Top 10 Recommended (Updated in 2025)

Apr 21, 2025 pm 11:48 PM

Quantum chains can be traded on the following exchanges: 1. Binance: One of the world's largest exchanges, with large trading volume, rich currency and high security. 2. Sesame Open Door (Gate.io): a large exchange, providing a variety of digital currency transactions, with good trading depth. 3. Ouyi (OKX): operated by OK Group, with strong comprehensive strength, large transaction volume, and complete safety measures. 4. Bitget: Fast development, provides quantum chain transactions, and improves security. 5. Bithumb: operated in Japan, supports transactions of multiple mainstream virtual currencies, and is safe and reliable. 6. Matcha Exchange: a well-known exchange with a friendly interface and supports quantum chain trading. 7. Huobi: a large exchange that provides quantum chain trading,

What are the hybrid blockchain trading platforms?

Apr 21, 2025 pm 11:36 PM

What are the hybrid blockchain trading platforms?

Apr 21, 2025 pm 11:36 PM

Suggestions for choosing a cryptocurrency exchange: 1. For liquidity requirements, priority is Binance, Gate.io or OKX, because of its order depth and strong volatility resistance. 2. Compliance and security, Coinbase, Kraken and Gemini have strict regulatory endorsement. 3. Innovative functions, KuCoin's soft staking and Bybit's derivative design are suitable for advanced users.

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

Cryptocurrency data platforms suitable for beginners include CoinMarketCap and non-small trumpet. 1. CoinMarketCap provides global real-time price, market value, and trading volume rankings for novice and basic analysis needs. 2. The non-small quotation provides a Chinese-friendly interface, suitable for Chinese users to quickly screen low-risk potential projects.

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

The top ten digital virtual currency apps are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

APP software that can purchase mainstream coins includes: 1. Binance, the world's leading, large transaction volume and fast speed; 2. OKX, innovative products, low fees, high security; 3. Gate.io, a variety of assets and trading options, focusing on security; 4. Huobi (HTX), low fees, good user experience; 5. Coinbase, suitable for novices, high security; 6. Kraken, safe and compliant, providing a variety of services; 7. KuCoin, low fees, suitable for professional traders; 8. Gemini, emphasizes compliance, and provides custodial services; 9. Crypto.com, providing a variety of offers and services; 10. Bitstamp, an old exchange, strong liquidity,