web3.0

web3.0

Why does Polymer, the Ethereum L2 cross-chain protocol, gain support from the head encryption VC?

Why does Polymer, the Ethereum L2 cross-chain protocol, gain support from the head encryption VC?

Why does Polymer, the Ethereum L2 cross-chain protocol, gain support from the head encryption VC?

Polymer Labs recently launched the Polyverse testnet, which is not far away from the launch of the mainnet. Among various projects working on cross-chain interoperability, Polymer Labs chose to focus on interoperability protocols on Ethereum.

In January this year, Polymer Labs completed a $23 million Series A round of financing, led by Blockchain Capital and others, with participation from Coinbase Ventures, Placeholder and others. The seed round of financing will be traced back to March 2022. Distributed Global and North Island Ventures jointly led the investment, with participation from Digital Currency Group (DCG), Coinbase Ventures and others.

What is Polymer?

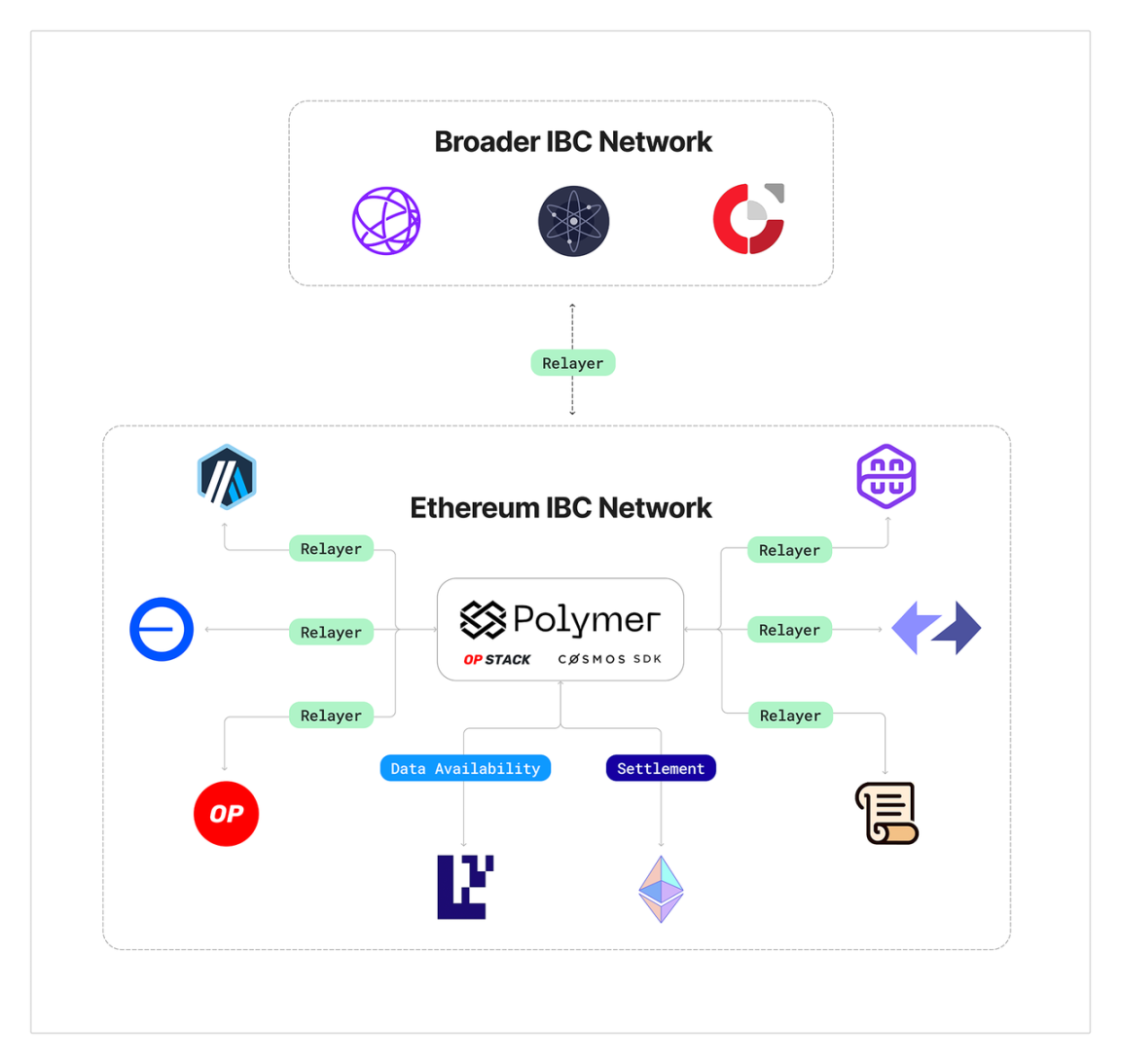

Polymer’s main focus is to implement cross-chain functionality on Layer 2 of Ethereum. It leverages IBC technology as an interoperability bridge in the Ethereum network, enabling applications to achieve composability between Ethereum Rollups. Through Polymer, applications are able to take advantage of the IBC network and features such as inter-chain accounts, application data callbacks, and more.

Polymer co-founders Bo Du and Peter Kim revealed in a recent interview that they had been working on building the Cosmos chain. Nearing completion, they made a change and decided to move to an L2 cross-chain direction. This strategic adjustment demonstrates the team's keen insight into market needs and technology trends, laying a solid foundation for future development.

One reason is that you can directly leverage existing Cosmos SDK code without making large-scale modifications. Another more important reason is that Ethereum has launched many Rollup solutions. As a distribution mechanism for IBC technology, cross-chain interaction between these application chains is not very necessary, because there is already a relationship between Rollup itself and the settlement layer where it is located. interaction mechanism.

How does Polymer solve the problem of Ethereum ecological fragmentation?

With the continuous emergence of Ethereum’s second-layer network protocols, the fragmentation of the ecosystem has become more obvious. Composability and security become issues of great concern. These challenges are not obvious when the size of the Layer 2 network is small, but as the size of the Layer 2 network increases, these problems become more urgent and need to be solved.

Previous different L2 solutions usually focused on building zero-knowledge provers and shared ordering to improve their interoperability. However, these solutions often only apply to their respective frameworks and fail to comprehensively solve the problem. Polymer believes that the fragmentation problem caused by the lack of unified standards can be solved by using the IBC protocol.

Polymer is a form of Ethereum Rollup, including components such as settlement layer, execution layer, data availability and proof. Unlike other Rollups, Polymer's focus is on supporting interoperability with applications on other Rollups, rather than directly executing decentralized applications.

The settlement layer is built by OP Stack, and the execution layer is interoperated by Cosmos SDK and connected Rollups and IBC. Data availability is powered by EigenDA. During the proof process, OP Stack provides modular failure proof while performing interactive fraud detection and ZK validity proof.

Polymer takes a hybrid approach, combining the settlement capabilities of the OP stack with the developer experience and interoperability of the Cosmos SDK, and also leverages the data availability of Eigenlayer to scale the data availability throughput of the Ethereum network by 10 mb/s.

The official explanation for building the settlement layer based on OP Stack is because of its scalability, flexibility and high performance, the prosperity and development of the ecosystem, and its connection with Ethereum. Factors such as workshop security and consistency should be comprehensively considered.

In terms of data availability, EigenLayer was chosen because EigenDA is second only to Ethereum DA in security. EigenDA borrows the security of Ethereum staking and validators themselves. Scalability and cross-chain interoperability also perform well.

Polymer completely outsources the transport layer and partially outsources the state layer. The IBC transport layer runs on Polymer, while the IBC application layer runs on IBC-enabled chains.

In addition, Polymer applications can build their own cross-chain bridges and use an L1 trust layer to control the verification of messages in and out, thus eliminating the need for additional trust assumptions on third parties.

The difference between this method and Wormhole is that Wormhole needs to rely on a majority of 13/19 nodes to verify the message before generating or sending a message. Another cross-chain protocol, Axelar, relies on validators for proof.

Testnet

The testnet will be launched in three phases, called "Basecamp", "Into the Unknown" and "Discovery". The first phase of Basecamp is now live, designed to incentivize developers to enter the testnet. Currently, you need to connect to its Github account on the official website to verify your qualifications.

The second phase will start next week. Polymer will select some decentralized applications to promote to end users, and end users will also be able to receive rewards.

The final stage "Discovery" focuses on improving and optimizing the incentive mechanism to promote user participation.

Summary

It is foreseeable that with the proliferation of Ethereum L2 protocols and the increasing popularity of modularity, the demand for L2 interoperability protocols like Polymer will increase significantly in the future.

The above is the detailed content of Why does Polymer, the Ethereum L2 cross-chain protocol, gain support from the head encryption VC?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

How long does it take to recharge digital currency to arrive? Recommended mainstream digital currency recharge platform

Apr 21, 2025 pm 08:00 PM

How long does it take to recharge digital currency to arrive? Recommended mainstream digital currency recharge platform

Apr 21, 2025 pm 08:00 PM

The time for recharge of digital currency varies depending on the method: 1. Bank transfer usually takes 1-3 working days; 2. Recharge of credit cards or third-party payment platforms within a few minutes to a few hours; 3. The time for recharge of digital currency transfer is usually 10 minutes to 1 hour based on the blockchain confirmation time, but it may be delayed due to factors such as network congestion.

How to trade quantum chains

Apr 21, 2025 pm 11:42 PM

How to trade quantum chains

Apr 21, 2025 pm 11:42 PM

The quantum chain (Qtum) transaction process includes three stages: preliminary preparation, purchase and sale. 1. Preparation: Select a compliant exchange, register an account, perform identity verification, and set up a wallet. 2. Purchase quantum chains: recharge funds, find trading pairs, place orders (market orders or limit orders), and confirm transactions. 3. Sell quantum chains: Enter the trading page, select the trading pair and order type (market order or limit order), confirm the transaction and withdraw cash.

Bitcoin outbreak Sparks crypto chaos: What traders must know now

Apr 21, 2025 pm 07:12 PM

Bitcoin outbreak Sparks crypto chaos: What traders must know now

Apr 21, 2025 pm 07:12 PM

The plunge in Bitcoin has caused turmoil in the crypto market, and the digital finance field is facing severe tests. Bitcoin (BTC) price has fallen nearly 4% recently, dragging down the overall cryptocurrency market. As of press time, Bitcoin fell 3.9% in 24 hours to $77,816.41, after hitting a high of $83,778.12. Bitcoin price trend chart (1 day): Chart: TradingView Relative Strength Indicator (RSI) Analysis: The RSI indicator is used to measure the recent price fluctuations and determine whether asset prices are overbought or oversold. The RSI value is between 0 and 100. Generally speaking, an RSI value above 70 means that the asset is overbought and may be a pullback; a lower than 30 means that it is oversold and may be a rebound. Currently, the Bitcoin RSI value is 7

What does cross-chain transaction mean? What are the cross-chain transactions?

Apr 21, 2025 pm 11:39 PM

What does cross-chain transaction mean? What are the cross-chain transactions?

Apr 21, 2025 pm 11:39 PM

Exchanges that support cross-chain transactions: 1. Binance, 2. Uniswap, 3. SushiSwap, 4. Curve Finance, 5. Thorchain, 6. 1inch Exchange, 7. DLN Trade, these platforms support multi-chain asset transactions through various technologies.

Recommended essential software for currency contract parties

Apr 21, 2025 pm 11:21 PM

Recommended essential software for currency contract parties

Apr 21, 2025 pm 11:21 PM

The top ten cryptocurrency contract exchange platforms in 2025 are: 1. Binance Futures, 2. OKX Futures, 3. Gate.io, 4. Huobi Futures, 5. BitMEX, 6. Bybit, 7. Deribit, 8. Bitfinex, 9. CoinFLEX, 10. Phemex, these platforms are widely recognized for their high liquidity, diversified trading functions and strict security measures.

What is a quantum chain? What are the quantum chain transactions?

Apr 21, 2025 pm 11:51 PM

What is a quantum chain? What are the quantum chain transactions?

Apr 21, 2025 pm 11:51 PM

Quantum Chain (Qtum) is an open source decentralized smart contract platform and value transmission protocol. 1. Technical features: BIP-compatible POS smart contract platform, combining the advantages of Bitcoin and Ethereum, introduces off-chain factors and enhances the flexibility of consensus mechanisms. 2. Design principle: realize on-chain and off-chain data interaction through main control contracts, be compatible with different blockchain technologies, flexible consensus mechanisms, and consider industry compliance. 3. Team and Development: An international team led by Shuai Chu, 80% of the quantum coins are used in the community, and 20% rewards the team and investors. Quantum chains are traded on Binance, Gate.io, OKX, Bithumb and Matcha exchanges.

gate.io Android app download gate.io Android latest version download and install

Apr 21, 2025 pm 07:54 PM

gate.io Android app download gate.io Android latest version download and install

Apr 21, 2025 pm 07:54 PM

The steps to download the Gate.io Android APP include: 1. Visit the official website of Gate.io; 2. Select the Android version and download; 3. Download the APK file and enable the "Unknown Source" option; 4. Install the Gate.io APP. The APP provides a wealth of trading pairs, real-time market display, a variety of ordering methods, asset security, convenient asset management, and rich activities and discounts.

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

APP software that can purchase mainstream coins includes: 1. Binance, the world's leading, large transaction volume and fast speed; 2. OKX, innovative products, low fees, high security; 3. Gate.io, a variety of assets and trading options, focusing on security; 4. Huobi (HTX), low fees, good user experience; 5. Coinbase, suitable for novices, high security; 6. Kraken, safe and compliant, providing a variety of services; 7. KuCoin, low fees, suitable for professional traders; 8. Gemini, emphasizes compliance, and provides custodial services; 9. Crypto.com, providing a variety of offers and services; 10. Bitstamp, an old exchange, strong liquidity,