web3.0

web3.0

Will the sudden drop in DAI supply cause a liquidity crisis? MakerDAO implements multiple fee adjustments, and annualized profit estimates skyrocket

Will the sudden drop in DAI supply cause a liquidity crisis? MakerDAO implements multiple fee adjustments, and annualized profit estimates skyrocket

Will the sudden drop in DAI supply cause a liquidity crisis? MakerDAO implements multiple fee adjustments, and annualized profit estimates skyrocket

In order to deal with the potential risks caused by the significant reduction of the stablecoin DAI, MakerDAO has recently implemented a series of fee adjustments, including increasing the DAI Savings Rate (DSR) to 15%, and increasing multiple core vaults by more than 8% to 10% stable rates. With the formal implementation of this proposal, what impact will it have on MakerDAO?

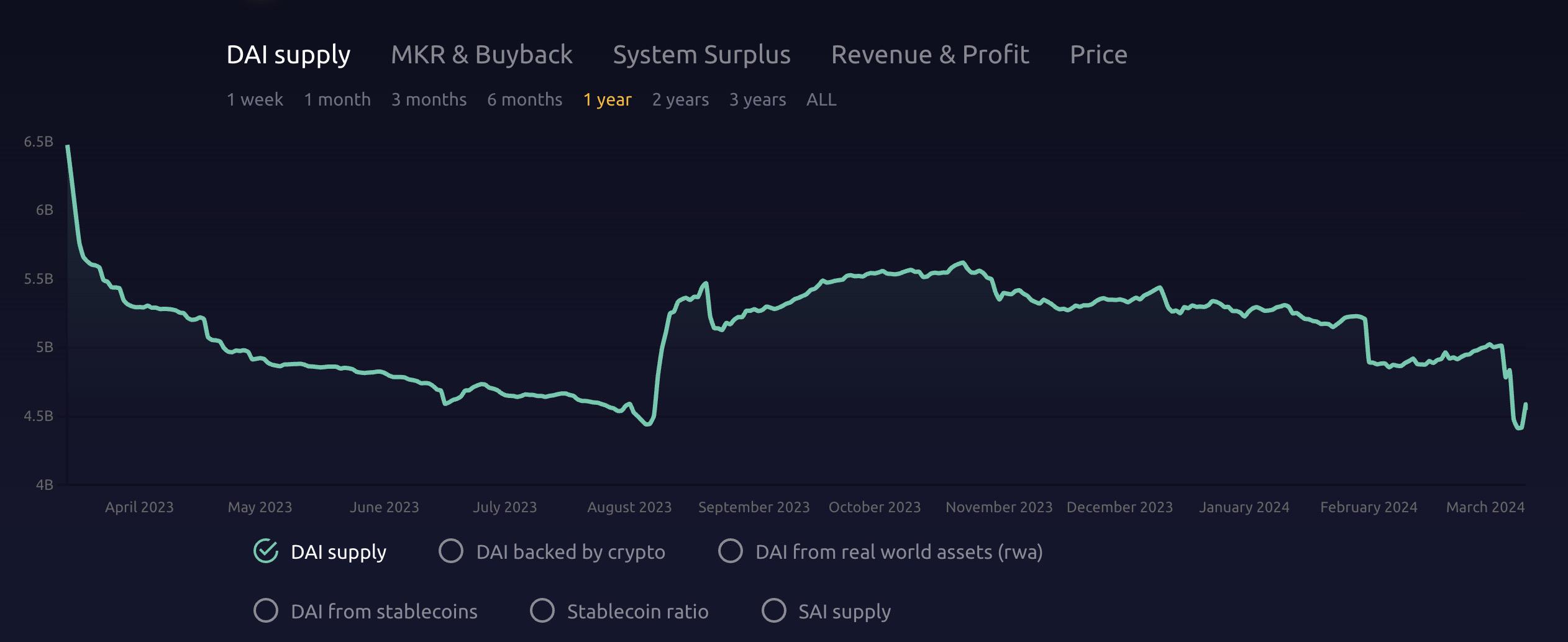

In recent times, the supply of the stablecoin DAI has dropped significantly. Maker Burn data shows that as of March 11, the total supply of DAI has fallen to $4.5 billion, the lowest level since August last year. In this regard, the proposal recently launched by BA Labs, the core development team of MakerDAO, pointed out that although the stablecoin reserves used to maintain liquidity and the reserves deployed to RWA are sufficient to maintain the pressure generated by potential bullish market sentiment, the problem lies in the stability of deployment through RWA The inherent liquidity crunch of the currency.

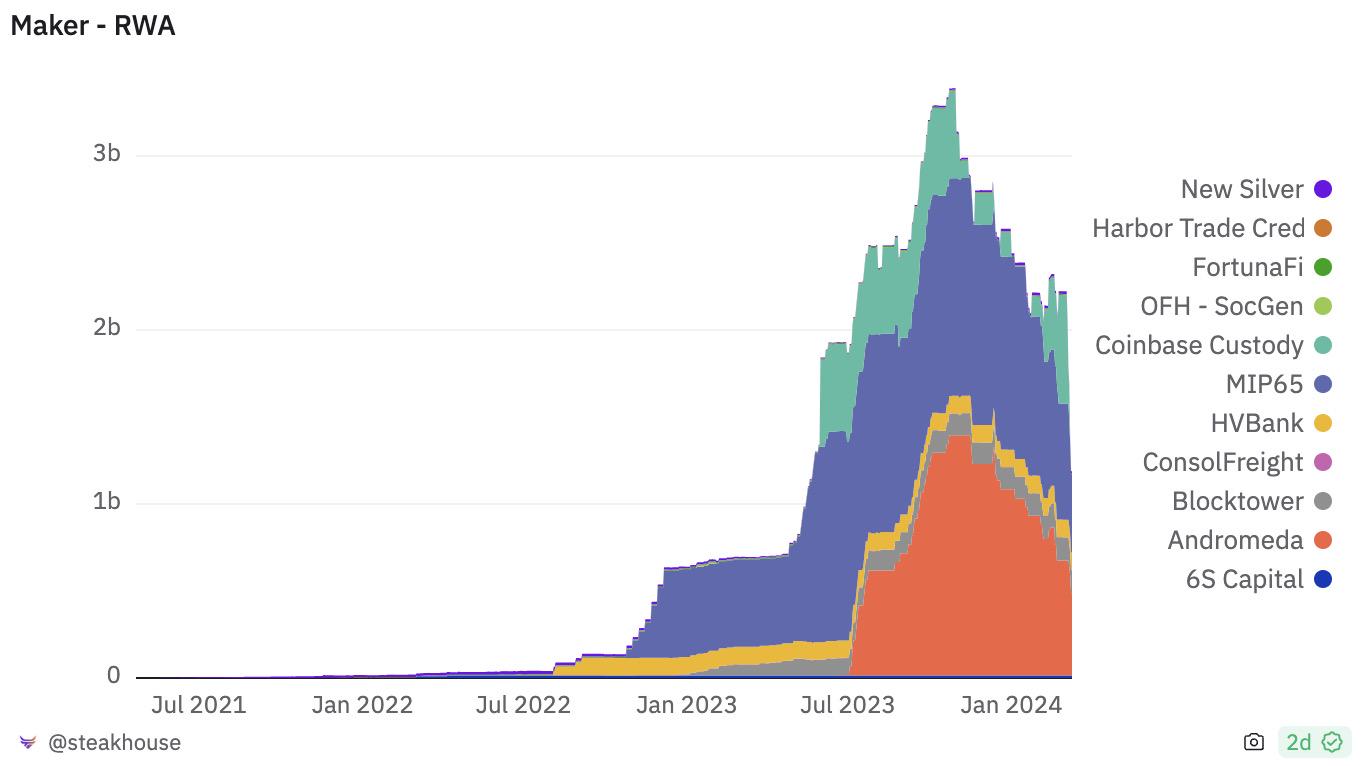

According to Dune data, Maker has invested more than US$1.77 billion in the RWA field. However, due to the characteristics of RWA products, the daily redemption of mortgaged crypto assets faces certain restrictions. This may lead to a continued reduction in DAI supply or trigger the risk of a liquidity crunch. At the same time, MakerEndgame data shows that the PSM (Peg Stability Module) stablecoin reserve launched for DAI liquidity has reached more than 790 million US dollars.

In response to the potential excessive DAI demand impact caused by further market volatility and bullish sentiment, BA Labs proposed a fee adjustment proposal, and after being voted on that day, it has been approved on 3 It was officially implemented in the early morning of March 11th. According to the proposal, key changes include increasing DAI’s savings rate from the original 5% to 15%, and implementing stability fee adjustments to its core treasury, which is expected to increase by approximately 9-10%.

In addition to approving an increase in the stable rates of mortgage assets such as ETH, WSTET and WBTC vaults to 15% to 17.25%, the savings rate of DAI has also been increased from the original 5% to 15%, making holding DAI more convenient attractiveness, thereby boosting demand and easing downward pressure on prices. At the same time, MakerDAO will also shorten the PSM cooling-off period for increasing the debt ceiling from 24 hours to 12 hours, thereby increasing USDC deposits and DAI minting throughput; the GSM suspension delay will be shortened from 48 hours to 16 hours for faster implementation. Future adjustments. In addition, Spark Lend, the lending market in the Maker ecosystem, has also implemented relevant changes, increasing the annual interest rate for DAI borrowing from 6.7% to 16%

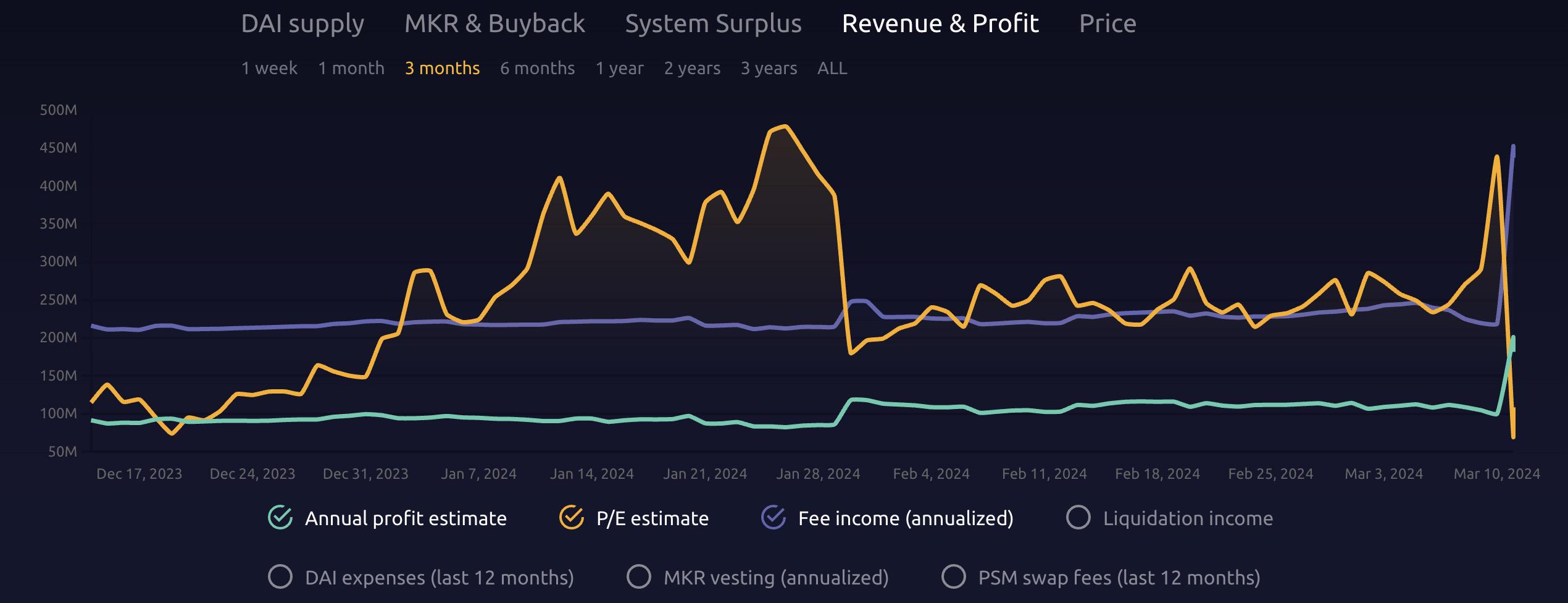

According to the passing of the new interest rate proposal, Maker Burn data shows that in the past Within 24 hours, Maker’s annualized profit estimate increased by 81.8% to $182 million, and annualized fee revenue also increased by 97.2% to $437 million. Additionally, the PE estimate fell to 13.4 from 22.36.

In addition, affected by this, CoinGecko data shows that the Maker token MKR has increased by more than 33.2% in the past 24 hours. It is worth mentioning that in addition to boosting token prices through fee adjustments, MakerDAO founder Rune Christensen has also been selling tokens such as LDO and SHIB worth hundreds of thousands or even millions of dollars this month. It has continued to increase its position by over 1,900 MKR, with the current value exceeding US$5.14 million.

However, many practitioners have given different views on this plan. For example, Mindao, the founder of dForce, pointed out that the current funding rate continues to be high, and stablecoins continue to be sucked by arbitrage. If the minting volume cannot be stabilized, the income of the agreement will be ineffective.

"Since the income in the DSR system is 5% of the U.S. debt, if too much USDC rushes in and takes away 15% of the interest, which is equivalent to a subsidy of 10%, then the income of the agreement will decrease. Currently, RWA accounts for 25%, this part is posted, you need to pay attention to the changes in the share of this part.” Super Junze, the host of Benmo Community, reminded.

The above is the detailed content of Will the sudden drop in DAI supply cause a liquidity crisis? MakerDAO implements multiple fee adjustments, and annualized profit estimates skyrocket. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

Top 10 global digital currency trading apps recommended (2025 currency trading software ranking)

Mar 12, 2025 pm 05:48 PM

Top 10 global digital currency trading apps recommended (2025 currency trading software ranking)

Mar 12, 2025 pm 05:48 PM

This article recommends the top ten digital currency trading apps in the world, including Binance, OKX, Huobi Global, Coinbase, Kraken, Gate.io, KuCoin, Bitfinex, Gemini and Bitstamp. These platforms have their own characteristics in terms of transaction pair quantity, transaction speed, security, compliance, user experience, etc. For example, Binance is known for its high transaction speed and extensive services, while Coinbase is more suitable for novices. Choosing a platform that suits you requires comprehensive consideration of your own needs and risk tolerance. Learn about the world's mainstream digital currency trading platforms to help you conduct digital asset trading safely and efficiently.

What exchange is Nexo? Is Nexo exchange safe?

Mar 05, 2025 pm 07:39 PM

What exchange is Nexo? Is Nexo exchange safe?

Mar 05, 2025 pm 07:39 PM

Nexo: Not only is it a cryptocurrency exchange, but also your digital financial manager. Nexo is not a traditional cryptocurrency exchange, but a financial platform that focuses more on cryptocurrency lending. It allows users to obtain loans in cryptocurrency as collateral and provides services to earn interest. While Nexo also offers cryptocurrency buying, selling and redemption capabilities, its core business is crypto lending. This article will explore the operating model and security of Nexo in depth to provide investors with a more comprehensive understanding. Nexo's operating model was founded in 2018 and is headquartered in Zug, Switzerland, and is a pioneer in the field of digital finance. It is different from other centralized exchanges and focuses more on providing comprehensive financial services. Users can buy, sell, trade cryptocurrencies without selling assets and

Is USDT price stable? Will it fluctuate? Understand the price fluctuations of Tether

Mar 20, 2025 pm 06:09 PM

Is USDT price stable? Will it fluctuate? Understand the price fluctuations of Tether

Mar 20, 2025 pm 06:09 PM

As one of the most popular stablecoins on the market, USDT (Tether) has always attracted much attention. Although USDT is intended to be 1:1 linked to the US dollar, in actual transactions, its prices will fluctuate due to factors such as market supply and demand, investor sentiment, regulatory policies, etc., resulting in slight premiums or discounts, panic selling, etc. This article will deeply analyze the causes of USDT price fluctuations, including market supply and demand relationships, TEDA reserves, regulatory policies, market sentiment, and trading platform credibility, and discuss how to avoid risks and help investors better understand and use USDT.

What are the Ethereum trading platforms?

Mar 26, 2025 pm 04:48 PM

What are the Ethereum trading platforms?

Mar 26, 2025 pm 04:48 PM

Want to play Ethereum? Choose the right trading platform first! There are centralized exchanges (CEXs) such as Binance, Ouyi, Coinbase, Kraken, and Gate.io. The advantages are fast speed and good liquidity, while the disadvantages are centralized risks. There are also decentralized exchanges (DEXs) such as Uniswap, SushiSwap, Balancer, and Curve. The advantages are security and transparency, while the disadvantages are slow speed and poor experience.

gateio Sesame Open Door Exchange official website login the latest entrance

Mar 05, 2025 pm 08:12 PM

gateio Sesame Open Door Exchange official website login the latest entrance

Mar 05, 2025 pm 08:12 PM

Gate.io is a crypto asset exchange that provides a wide range of services including registration, account verification, deposits, transactions and withdrawals. Users can start using Gate.io by creating an account, completing verification, selecting a deposit method, and then sending funds to the generated address. The platform provides a variety of transaction pairs, order types and trading tools to facilitate users to conduct transactions. Users can also withdraw money from Gate.io by selecting a withdrawal method, generating a withdrawal address, entering the withdrawal amount, and completing security verification.

Which country is the Nexo exchange from? Where is it? A comprehensive introduction to the Nexo exchange

Mar 05, 2025 pm 05:09 PM

Which country is the Nexo exchange from? Where is it? A comprehensive introduction to the Nexo exchange

Mar 05, 2025 pm 05:09 PM

Nexo Exchange: Swiss cryptocurrency lending platform In-depth analysis Nexo is a platform that provides cryptocurrency lending services, supporting the mortgage and lending of more than 40 crypto assets, fiat currencies and stablecoins. It dominates the European and American markets and is committed to improving the efficiency, security and compliance of the platform. Many investors want to know where the Nexo exchange is registered, and the answer is: Switzerland. Nexo was founded in 2018 by Swiss fintech company Credissimo. Nexo Exchange Geographical Location and Regulation: Nexo is headquartered in Zug, Switzerland, a well-known cryptocurrency-friendly region. The platform actively cooperates with the supervision of various governments and has been in the US Financial Crime Law Enforcement Network (FinCEN) and Canadian Finance

Top 10 mobile blockchain app rankings (2025 blockchain mobile software rankings)

Mar 12, 2025 pm 06:03 PM

Top 10 mobile blockchain app rankings (2025 blockchain mobile software rankings)

Mar 12, 2025 pm 06:03 PM

Based on factors such as influence, function and security, this article selects the top ten best mobile blockchain applications. The list covers well-known trading platforms such as Binance, Ouyi OKX, Sesame Open Gate.io, KuCoin, Bitfinex, Coinbase, Huobi Global, Kraken, Bitstamp and Gemini. These platforms have their own characteristics in spot, futures, leveraged trading, etc. Some focus on user-friendly experiences, while others provide advanced functions to professional investors to meet the needs of different users. When choosing a suitable platform, you need to consider comprehensively based on your own investment experience and risk tolerance.