This article explains in detail how to calculate gas costs.

php editor Yuzai will give you a detailed analysis of the gas cost calculation method. Gas is the fee used to execute smart contracts and transfers in the Ethereum network. The calculation method depends on the complexity of the transaction and the degree of network congestion. This article will introduce the concept of gas, calculation methods and how to optimize gas costs to help readers better understand and rationally utilize gas.

How to calculate the gas fee?

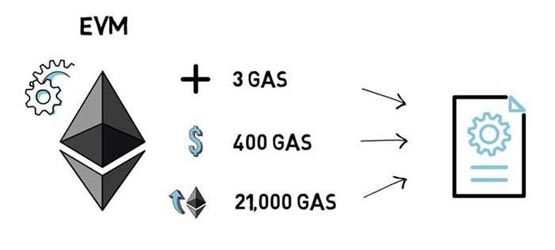

The gas price itself does not directly determine the cost of a certain transaction. To calculate transaction fees, we need to multiply the gas amount by the gas price. The gas price unit of Ethereum is usually gwei, and 1 gwei is equivalent to 0.000000001 ETH. Assuming the current price of Ethereum is $1,800, 1 ETH is equal to 1e18 wei (1 billionth of an ETH). If we want to send a simple Ethereum transaction, we need to consider the gas consumption as well as the current gas price. By multiplying the gas amount by the gas price, we can calculate the actual transaction cost. At an ETH price of $1,800, we can use this data to determine the fee we need to pay to send a transaction.

Most popular Ethereum wallets estimate the necessary gas price and allow us to choose between fast, medium and slow transaction confirmation speeds. Let's assume that if we want to confirm our transaction within a minute, the wallet estimates the gas price will be set to 100gwei (if you want a faster transaction, the gas fee will be more expensive), and we will send the gas cost of a transaction (21,000 gas) multiplied by the gas price (100gwei), it equals 2,100,000 gwei, which is 0.0021 ETH. When the ETH price was $3,800, the transaction fee was $7.98. The amount of ETH consumed = transaction fee = the amount of gas consumed for each transaction * gas price.

Reasons for gas fee changes

Gas fees will rise and fall for the following reasons:

1. Ethereum increases the block gas limit. Every time Ethereum increases the block gas limit, the gas fee will decrease;

2. The Ethereum chain is very prosperous. Gas fees are affected by the needs of the blockchain. In order to package your transactions as quickly as possible, you need more gas fees. A large number of transactions are competing, and miners give priority to transactions with the highest gas prices. Therefore, as activity on the Ethereum blockchain increases, gas usage will also increase. The increase in gas fees indicates that there is active activity on the Ethereum chain, and users are increasing their gas fees to complete transactions.

3. The Ethereum chain is getting more and more congested. The fundamental reason for the increase in Gas fees is that the Ethereum network utilization rate continues to increase and is in a state of severe congestion. Ethereum network utilization is increasing because user activity is too active, but it is also becoming increasingly congested. For example, if a famous project on Ethereum is launched and triggers a rush to buy, gas fees will skyrocket instantly. At around 0:00 on August 20 this year, the Ethereum gas fee instantly soared to more than 2,400 Gwei. This was because the sale of an NFT project called "0n1Force" triggered a rush to buy.

The above is the detailed content of This article explains in detail how to calculate gas costs.. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1664

1664

14

14

1423

1423

52

52

1321

1321

25

25

1269

1269

29

29

1249

1249

24

24

Top 10 cryptocurrency exchange apps The latest rankings of the top 10 cryptocurrency exchange apps

May 08, 2025 pm 05:57 PM

Top 10 cryptocurrency exchange apps The latest rankings of the top 10 cryptocurrency exchange apps

May 08, 2025 pm 05:57 PM

The top ten cryptocurrency exchange apps are: 1. Binance, 2. OKX, 3. Huobi, 4. Coinbase, 5. Kraken, 6. Bybit, 7. KuCoin, 8. Gemini, 9. Bitstamp, 10. Crypto.com. Each platform has its own unique advantages and features, and users can conduct cryptocurrency transactions by downloading apps, registering and completing verification, depositing, selecting transaction pairs and confirming transactions.

The TOP5 of the safest exchanges in 2025: Black U's guide to avoid pits, the rule of 100% of funds to save lives

May 08, 2025 pm 08:27 PM

The TOP5 of the safest exchanges in 2025: Black U's guide to avoid pits, the rule of 100% of funds to save lives

May 08, 2025 pm 08:27 PM

In the field of cryptocurrency trading, the security of exchanges has always been the focus of users. In 2025, after years of development and evolution, some exchanges stand out with their outstanding security measures and user experience. This article will introduce the five most secure exchanges in 2025 and provide practical guides on how to avoid Black U (hacker attacks users) to ensure your funds are 100% secure.

Guide to 'picking money' in the 2025 currency circle: Learn to leverage in contracts in 5 minutes and earn 100,000 a day!

May 08, 2025 pm 08:39 PM

Guide to 'picking money' in the 2025 currency circle: Learn to leverage in contracts in 5 minutes and earn 100,000 a day!

May 08, 2025 pm 08:39 PM

Contract leveraged trading is a common trading method in the currency circle, which allows traders to trade larger amounts with less funds. By using leverage, traders can amplify their profit potential, but also increase risks. Leverage is usually expressed in multiples, for example, 10 times leverage means that you can trade 10 Bitcoin contracts with margin of 1 Bitcoin.

How to register in the ok exchange in China? ok trading platform registration and use guide for beginners in mainland China

May 08, 2025 pm 10:51 PM

How to register in the ok exchange in China? ok trading platform registration and use guide for beginners in mainland China

May 08, 2025 pm 10:51 PM

In the cryptocurrency market, choosing a reliable trading platform is crucial. As a world-renowned digital asset exchange, the OK trading platform has attracted a large number of novice users in mainland China. This guide will introduce in detail how to register and use it on the OK trading platform to help novice users get started quickly.

TOP10 futures trading platforms: Perpetual contracts and options trading

May 08, 2025 pm 07:12 PM

TOP10 futures trading platforms: Perpetual contracts and options trading

May 08, 2025 pm 07:12 PM

In the cryptocurrency market, futures trading platforms play an important role, especially in perpetual contracts and options trading. Here are the top ten highly respected futures trading platforms in the market, and provide detailed introduction to their characteristics and advantages in perpetual contract and option trading.

Top 10 cryptocurrency platforms in the world that support multi-chain transactions are authoritatively released in 2025

May 08, 2025 pm 07:15 PM

Top 10 cryptocurrency platforms in the world that support multi-chain transactions are authoritatively released in 2025

May 08, 2025 pm 07:15 PM

According to the latest evaluations and industry trends from authoritative institutions in 2025, the following are the top ten cryptocurrency platforms in the world that support multi-chain transactions, combining transaction volume, technological innovation, compliance and user reputation comprehensive analysis:

Top 10 cryptocurrency app exchanges 2025 reliable currency trading platform app inventory points

May 08, 2025 pm 10:21 PM

Top 10 cryptocurrency app exchanges 2025 reliable currency trading platform app inventory points

May 08, 2025 pm 10:21 PM

The top ten cryptocurrency exchange apps are: 1. Binance, 2. OKX, 3. Huobi, 4. Coinbase, 5. Kraken, 6. Bybit, 7. KuCoin, 8. Gemini, 9. Bitstamp, 10. Crypto.com. Each platform has its own unique advantages and features, and users can conduct cryptocurrency transactions by downloading apps, registering and completing verification, depositing, selecting transaction pairs and confirming transactions.

Ethereum (ETH) Market Analysis and Trading Strategy: May 8, 2025

May 08, 2025 pm 08:12 PM

Ethereum (ETH) Market Analysis and Trading Strategy: May 8, 2025

May 08, 2025 pm 08:12 PM

Ethereum's current market profile and short-term trading strategy