Ethereum (ETH) Market Analysis and Trading Strategy: May 8, 2025

Under the current market environment, the price of Ethereum (ETH) shows a significant sideways contraction trend, and price volatility has decreased, but market sentiment still needs to be treated with caution. The following is a detailed analysis of the latest Ethereum market and corresponding short-term trading strategy suggestions.

Market behavior and price structure

The current price of Ethereum is US$1,805, at 3:30 am Beijing time. In yesterday's trading, Ethereum price started north from around $1,750, hitting a maximum of $1,850. This price trend shows that the main funds may be operating at high levels to pull up shipments, which has occurred many times in the past market.

Judging from the daily chart, the price is up to $1,850 and the lowest is $1,785. The current price just stood firm at the bottom support level of $1,785 for the EMA trend indicator. The overall trend has entered a sideways contraction stage, and the large-level trend indicators are also shrinking, and the MACD indicator shows that the volume is reduced. If the price cannot hold $1,780, DIF and DEA will form a dead fork, and the bear momentum may be further strengthened. The upper rail pressure is at $1,935, and the lower rail support is at $1,760. It is worth noting that both the pressure level and the support point are moving downward, showing a weakening of the overall market trend.

Short-term trading strategy

In short-term operations, safety is the first priority. The market is full of uncertainty, so be sure to bring a stop loss to ensure the safety of the principal. Small losses and big profits are the goal of short-term trading.

The northbound test position is recommended to set the defensive position between 1760 and 1780 US dollars, set the defensive position at US$1740, stop loss at 30 points, and the target is to US$1800 to US$1840. If it breaks further, it can be seen to US$1870.

The southward test position is recommended to set the defensive position between 1830 and 1850 US dollars, set the defensive position at US$1870, stop loss at 30 points, and the target is to US$1800 to US$1790. If it breaks further, it can be seen to US$1760.

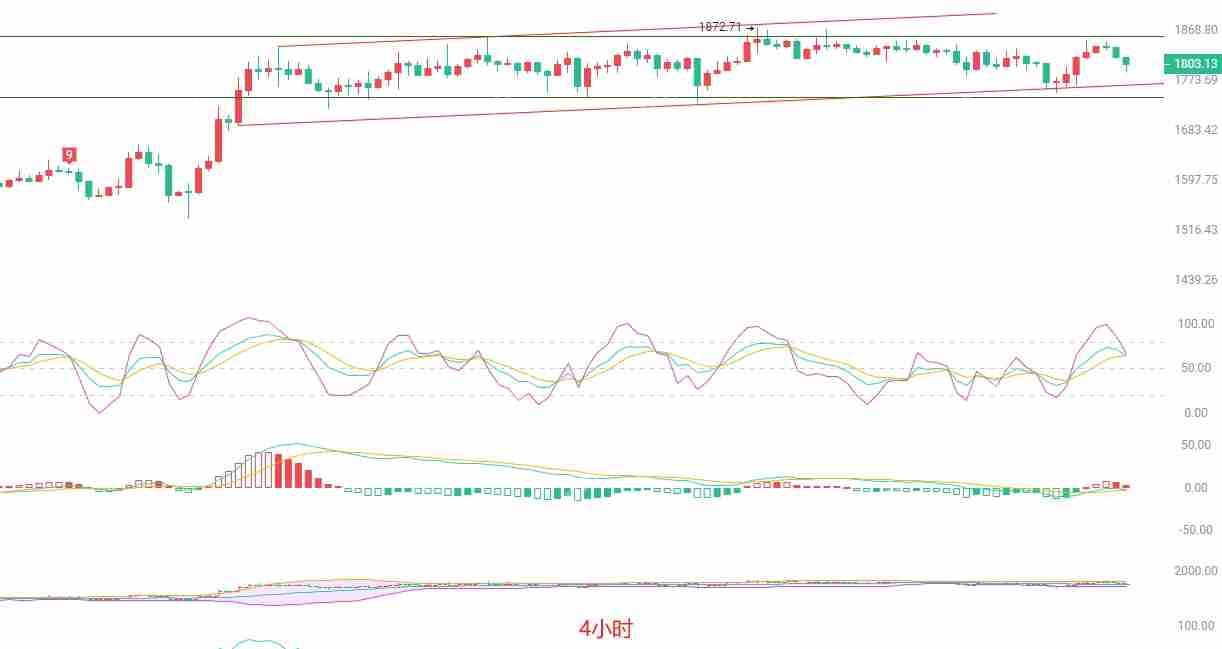

Judging from the four-hour chart, the price shows a "painted door" market. The main force began to fall back after rising. The price has fallen into the EMA trend indicator, blocked by the EMA90 support level of US$1,787. The MACD indicator shows that the increase is reduced, the DIF and DEA fail to hit the 0 axis, the Bollinger band is focused on $1,850 in the upper rail and the lower rail is focused on $1,770 in the lower rail. Overall, the bear trend is relatively strong, and further pressure from the Air Force is not ruled out. Therefore, investors who plan to buy at the bottom may need to wait patiently to see if there are better opportunities to enter.

Interpretation of technical indicator signals

The MACD indicator shows a decrease in volume on the daily chart. If the K-line cannot hold US$1,780, DIF and DEA will form a dead cross, indicating the increase in the bear momentum. On the four-hour chart, the MACD indicator also showed a decrease in volume, and DIF and DEA failed to hit the 0 axis, further confirming the short pressure in the market in the short term.

The Bollinger Band shows a sideways trend on the daily chart, and the price failed to effectively break through the upper rail pressure level of $1,935. On the four-hour chart, the Bollinger band shrinks and the price hovers around the middle track, indicating that the market volatility is reduced and the price may continue to remain within the current range in the short term.

EMA trend indicators show that Ethereum price is currently firming on the daily chart at EMA bottom support at $1,785, while on the four-hour chart, the price is blocked by the EMA90 support at $1,787, indicating that prices may continue to be suppressed in the short term.

Summary and risk warning

Before conducting any trading operations, be sure to ensure the safety of the principal and set stop loss and take profit reasonably. The market is full of uncertainty, and investors need to bear the risks themselves and operate with caution. Although the current market volatility has converged, the implicit risks have not been eliminated, and controlling positions is still the top priority. The essence of trading is survival, followed by profit. Therefore, before each operation, you should first evaluate whether your operation is reasonable and whether the principal is safe. Forming a set of your own trading ideas and continuously optimizing and improving them is the key to long-term survival in the market.

On the road to chasing your dreams, you are never alone. The darkest moments are often pre-dawn moments. I hope you can persevere and achieve your financial goals.

The above is the detailed content of Ethereum (ETH) Market Analysis and Trading Strategy: May 8, 2025. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1664

1664

14

14

1423

1423

52

52

1317

1317

25

25

1268

1268

29

29

1243

1243

24

24

What kind of software is a digital currency app? Top 10 Apps for Digital Currencies in the World

Apr 30, 2025 pm 07:06 PM

What kind of software is a digital currency app? Top 10 Apps for Digital Currencies in the World

Apr 30, 2025 pm 07:06 PM

With the popularization and development of digital currency, more and more people are beginning to pay attention to and use digital currency apps. These applications provide users with a convenient way to manage and trade digital assets. So, what kind of software is a digital currency app? Let us have an in-depth understanding and take stock of the top ten digital currency apps in the world.

How to download, install and register the Hong Kong Digital Currency Exchange app 2025

Apr 30, 2025 pm 07:18 PM

How to download, install and register the Hong Kong Digital Currency Exchange app 2025

Apr 30, 2025 pm 07:18 PM

The download, installation and registration process of the Hong Kong Digital Currency Exchange app is very simple. Users can quickly obtain and use this app through the official app download link provided in this article. This article will introduce in detail how to download, install and register the Hong Kong Digital Currency Exchange app to ensure that every user can complete the operation smoothly.

Are these C2C transactions in Binance risky?

Apr 30, 2025 pm 06:54 PM

Are these C2C transactions in Binance risky?

Apr 30, 2025 pm 06:54 PM

Binance C2C transactions allow users to buy and sell cryptocurrencies directly, and pay attention to the risks of counterparty, payment and price fluctuations. Choosing high-credit users and secure payment methods can reduce risks.

uniswap on-chain withdrawal

Apr 30, 2025 pm 07:03 PM

uniswap on-chain withdrawal

Apr 30, 2025 pm 07:03 PM

Uniswap users can withdraw tokens from liquidity pools to their wallets to ensure asset security and liquidity. The process requires gas fees and is affected by network congestion.

What are the three giants in the currency circle? Top 10 Recommended Virtual Currency Main Exchange APPs

Apr 30, 2025 pm 06:27 PM

What are the three giants in the currency circle? Top 10 Recommended Virtual Currency Main Exchange APPs

Apr 30, 2025 pm 06:27 PM

In the currency circle, the so-called Big Three usually refers to the three most influential and widely used cryptocurrencies. These cryptocurrencies have a significant role in the market and have performed well in terms of transaction volume and market capitalization. At the same time, the mainstream virtual currency exchange APP is also an important tool for investors and traders to conduct cryptocurrency trading. This article will introduce in detail the three giants in the currency circle and the top ten mainstream virtual currency exchange APPs recommended.

Tether unleashes the first official proof of gold stablecoin

Apr 30, 2025 pm 05:33 PM

Tether unleashes the first official proof of gold stablecoin

Apr 30, 2025 pm 05:33 PM

Tether released its first official certification, which is the 2025 gold medal TetherGold (XAUT) in Q1. Xaut recently hit a major milestone Tether is the issuer of Stablecoin fixed with the U.S. dollar, Tether disclosed in its first official proof that its gold-backed Stablecoin TetherGold (XAUT) has reached a major milestone with a market cap of $817 million as of April 28, 2025. According to the company report prepared by El Salvador for the new regulatory framework for cryptocurrency companies, the company's report shows that each XAUT token is backed by physical gold 1:1, total

What does pins mean in transactions

Apr 30, 2025 pm 06:57 PM

What does pins mean in transactions

Apr 30, 2025 pm 06:57 PM

Pin plugs are a common phenomenon in cryptocurrency trading, which is manifested as a sharp fluctuation of prices in a short period of time, forming a long shadow line on the K-line chart, which often triggers market sentiment and stop loss triggers.

Top 10 trading platform app recommendation rankings in the currency circle (2025 authoritative list)

Apr 30, 2025 pm 05:48 PM

Top 10 trading platform app recommendation rankings in the currency circle (2025 authoritative list)

Apr 30, 2025 pm 05:48 PM

Recommended rankings of the top ten trading platforms in the 2025 cryptocurrency circle: 1. OKX, 2. Binance, 3. Huobi, 4. Coinbase, 5. Kraken, 6. KuCoin, 7. Bitfinex, 8. Bitstamp, 9. Gemini, 10. Poloniex, these platforms have their own characteristics and meet the needs of different users.