web3.0

web3.0

S&P Ratings: Ethereum spot ETF integration of pledges may lead to the risk of pledge concentration

S&P Ratings: Ethereum spot ETF integration of pledges may lead to the risk of pledge concentration

S&P Ratings: Ethereum spot ETF integration of pledges may lead to the risk of pledge concentration

The Block cited an S&P analysis report. Analysts Andrew O'Neill and Alexandre Birry pointed out that the Ethereum spot ETF that contains a "staking function" may continue to expand its asset size. Will significantly change the concentration of Ethereum validators.

Ethereum ETF introduces staking, or will it lead to the centralization of staking?

As an example of the Bitcoin ETF, Coinbase serves as the custodian for 8 issuers out of 11 tranches. In addition, Coinbase has been selected as the staking institution for 4 Ethereum staking ETFs outside the United States.

Analysts pointed out that to reduce the risk of centralization (possibly referring to Coinbase’s dominance of the staking market), ETF issuers need to consider decentralizing Ethereum staking to multiple emerging large custodians. Doing so helps increase market diversity, reduce systemic risk, and provide more institutions with the opportunity to participate in the staking market. With the emergence of new custodians, Ethereum's staking ecosystem will become more robust and healthy, including issuers such as Ark Invest and Franklin Templeton, which have already negotiated with regulators on the staking function in their application documents.

S&P: Issuers will not choose Lido for staking

Liquidity staking protocol Lido is currently the largest Ethereum validator, followed by Coinbase.

S&P analysts believe that ETF issuers are unlikely to choose decentralized protocols such as Lido. Instead, they may choose custodians.

JP Morgan Chase analysts also recently warned of the concentration risk of Ethereum staking, pointing out that Lido is the largest validator and may have a single point of failure, become a target of attacks, or deliberately monopolize to strengthen the Lido protocol itself.

Does S&P think too much?

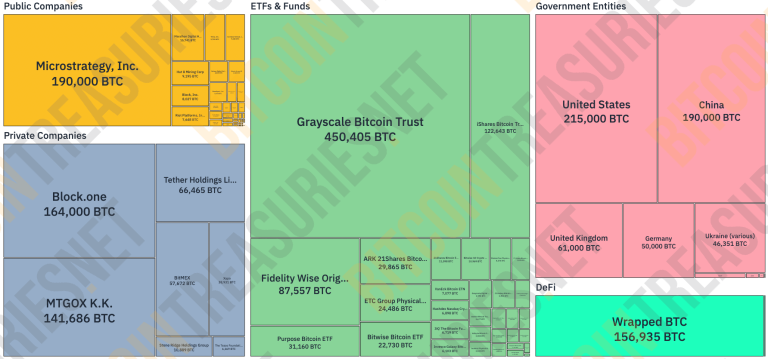

However, according to Bitcoin Treasures data, all Bitcoin ETF products hold a total of 876,000 BTC, accounting for only about 4.17% of Bitcoin circulation.

So if you switch to an Ethereum ETF with lower attractiveness and lower trading volume, how much ETH will be locked in the circulation? Can it change the staking ecology of Ethereum on a large scale, leading to centralization?

Perhaps instead of worrying about the rising staking market share of institutions such as Coinbase, it is better to try to solve Lido’s dominance. This is also the case for Ethereum developers and even Ethereum founder Vitalik Buterin The issue that has been raised before is to limit the proportion of a single verification entity through handling rates and other methods.

Perhaps instead of worrying about the rising staking market share of institutions such as Coinbase, it is better to try to solve Lido’s dominance. This is also the case for Ethereum developers and even Ethereum founder Vitalik Buterin The issue that has been raised before is to limit the proportion of a single verification entity through handling rates and other methods.

The above is the detailed content of S&P Ratings: Ethereum spot ETF integration of pledges may lead to the risk of pledge concentration. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

How to trade quantum chains

Apr 21, 2025 pm 11:42 PM

How to trade quantum chains

Apr 21, 2025 pm 11:42 PM

The quantum chain (Qtum) transaction process includes three stages: preliminary preparation, purchase and sale. 1. Preparation: Select a compliant exchange, register an account, perform identity verification, and set up a wallet. 2. Purchase quantum chains: recharge funds, find trading pairs, place orders (market orders or limit orders), and confirm transactions. 3. Sell quantum chains: Enter the trading page, select the trading pair and order type (market order or limit order), confirm the transaction and withdraw cash.

What does cross-chain transaction mean? What are the cross-chain transactions?

Apr 21, 2025 pm 11:39 PM

What does cross-chain transaction mean? What are the cross-chain transactions?

Apr 21, 2025 pm 11:39 PM

Exchanges that support cross-chain transactions: 1. Binance, 2. Uniswap, 3. SushiSwap, 4. Curve Finance, 5. Thorchain, 6. 1inch Exchange, 7. DLN Trade, these platforms support multi-chain asset transactions through various technologies.

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

Cryptocurrency data platforms suitable for beginners include CoinMarketCap and non-small trumpet. 1. CoinMarketCap provides global real-time price, market value, and trading volume rankings for novice and basic analysis needs. 2. The non-small quotation provides a Chinese-friendly interface, suitable for Chinese users to quickly screen low-risk potential projects.

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

The top ten digital virtual currency apps are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

Recommended essential software for currency contract parties

Apr 21, 2025 pm 11:21 PM

Recommended essential software for currency contract parties

Apr 21, 2025 pm 11:21 PM

The top ten cryptocurrency contract exchange platforms in 2025 are: 1. Binance Futures, 2. OKX Futures, 3. Gate.io, 4. Huobi Futures, 5. BitMEX, 6. Bybit, 7. Deribit, 8. Bitfinex, 9. CoinFLEX, 10. Phemex, these platforms are widely recognized for their high liquidity, diversified trading functions and strict security measures.

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

APP software that can purchase mainstream coins includes: 1. Binance, the world's leading, large transaction volume and fast speed; 2. OKX, innovative products, low fees, high security; 3. Gate.io, a variety of assets and trading options, focusing on security; 4. Huobi (HTX), low fees, good user experience; 5. Coinbase, suitable for novices, high security; 6. Kraken, safe and compliant, providing a variety of services; 7. KuCoin, low fees, suitable for professional traders; 8. Gemini, emphasizes compliance, and provides custodial services; 9. Crypto.com, providing a variety of offers and services; 10. Bitstamp, an old exchange, strong liquidity,

The latest updates to the oldest virtual currency rankings

Apr 22, 2025 am 07:18 AM

The latest updates to the oldest virtual currency rankings

Apr 22, 2025 am 07:18 AM

The ranking of virtual currencies’ “oldest” is as follows: 1. Bitcoin (BTC), issued on January 3, 2009, is the first decentralized digital currency. 2. Litecoin (LTC), released on October 7, 2011, is known as the "lightweight version of Bitcoin". 3. Ripple (XRP), issued in 2011, is designed for cross-border payments. 4. Dogecoin (DOGE), issued on December 6, 2013, is a "meme coin" based on the Litecoin code. 5. Ethereum (ETH), released on July 30, 2015, is the first platform to support smart contracts. 6. Tether (USDT), issued in 2014, is the first stablecoin to be anchored to the US dollar 1:1. 7. ADA,

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

When choosing a digital currency trading platform suitable for beginners, you need to consider security, ease of use, educational resources and cost transparency: 1. Priority is given to platforms that provide cold storage, two-factor verification and asset insurance; 2. Apps with a simple interface and clear operation are more suitable for beginners; 3. The platform should provide learning tools such as tutorials and market analysis; 4. Pay attention to hidden costs such as transaction fees and cash withdrawal fees.