web3.0

web3.0

MicroStrategy bought 31,000 Bitcoins in Q4, the largest growth in 3 years! Current total holdings are 190,000 coins

MicroStrategy bought 31,000 Bitcoins in Q4, the largest growth in 3 years! Current total holdings are 190,000 coins

MicroStrategy bought 31,000 Bitcoins in Q4, the largest growth in 3 years! Current total holdings are 190,000 coins

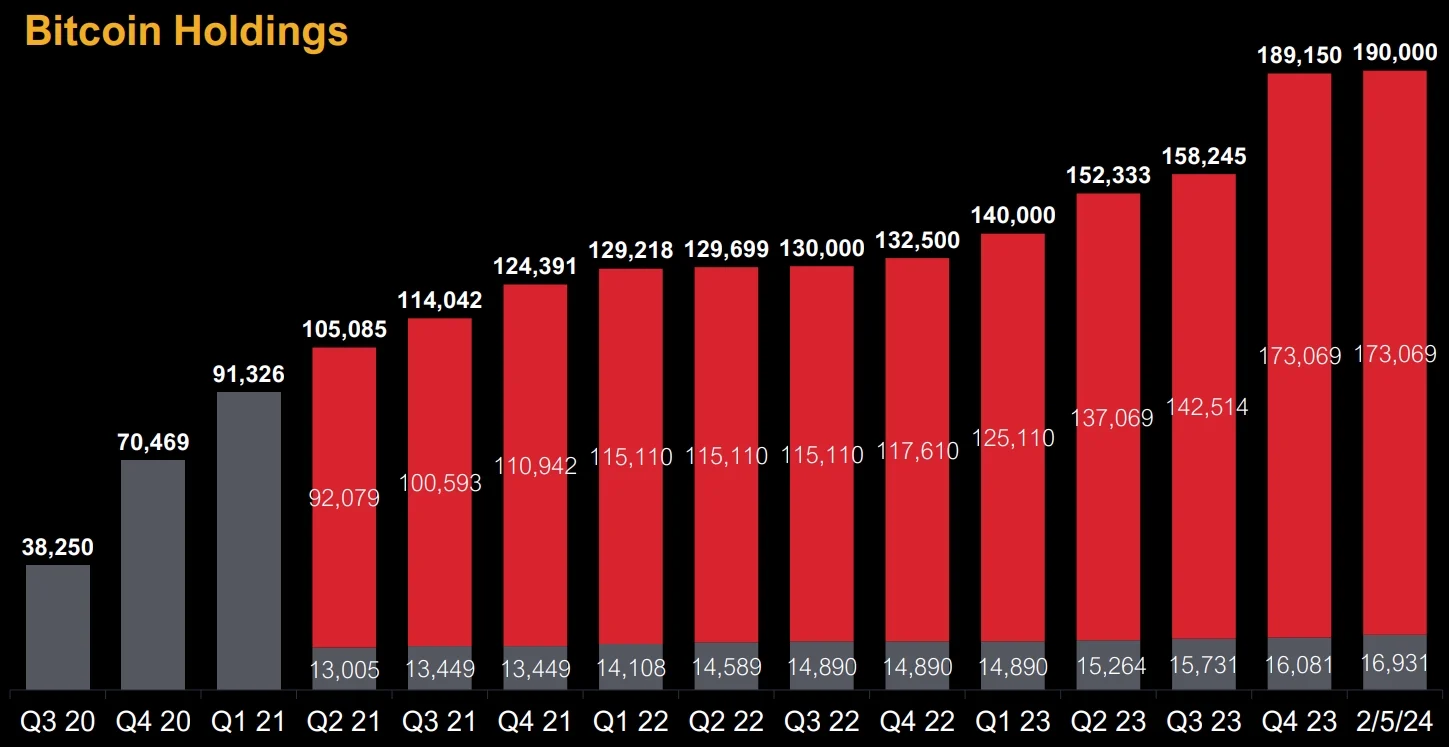

MicroStrategy, a listed company in the United States, announced its fourth quarter financial report yesterday, announcing that it purchased 30,555 Bitcoins through proceeds from capital market activities and used excess cash to purchase 350 Bitcoins, a total investment of US$1.2 billion. This move further solidifies MicroStrategy’s position in the Bitcoin market and demonstrates their long-term bullishness on Bitcoin. MicroStrategy, a leading company in data analytics and business intelligence, views Bitcoin as an important asset and includes it as part of an investment portfolio. The decision to purchase Bitcoin was based on their confidence in the long-term value of Bitcoin and concerns about the risk of depreciation of traditional currencies.

In early 2024, MicroStrategy invested another $37.2 million, purchasing 850 Bitcoins. Since the fourth quarter of last year, MicroStrategy has accumulated a total of 31,755 Bitcoins, which is the company’s largest quarterly increase in the past three years and the 13th consecutive quarter that it has added Bitcoin to its balance sheet.

How many BTC does MicroStrategy currently have?

As of February 5, 2024, according to data disclosed by MicroStrategy, the company held 190,000 Bitcoins, with an average purchase price of US$31,224 and a total purchase cost of US$5.93 billion. Currently, the market value of these Bitcoins has reached US$8.19 billion, equivalent to a floating profit of US$2.26 billion.

Overall, MicroStrategy’s net profit last year was US$89.1 million, with a loss of US$249.7 million, and revenue decreased by 6.1% year-on-year to US$124.5 million. Michael Saylor, executive chairman of MicroStrategy, said at the conference that the company's performance last year can be attributed to investors recognizing the "digital transformation" of assets. He believes that 2024 will be the year when Bitcoin is born as an institutional-grade asset class. This is the first brand-new asset class in modern times. The next 15 years will be a period when Bitcoin is regulated, institutionalized and grows rapidly. It will be different from the past. 15 years are very different. This view shows that MicroStrategy is optimistic about Bitcoin’s long-term prospects.

Optimistic about Bitcoin rising another 100 times

Michael Saylor believes that the listing of Bitcoin spot ETF will be an important moment, which will transform Bitcoin from a medium of exchange to a store of value means. This way, people will no longer face past criticism of Bitcoin’s failure to fulfill its role as a currency. As a store of value, Bitcoin has reason to continue to outperform the market and even rise another 100x.

Looking forward, Michael Saylor noted that MicroStrategy will continue to develop software and work with Bitcoin developers to develop Bitcoin-based L2, as well as other ecosystem players to add in the coming years. The company’s earnings, and the micro-strategy will continue to buy more Bitcoin.

The above is the detailed content of MicroStrategy bought 31,000 Bitcoins in Q4, the largest growth in 3 years! Current total holdings are 190,000 coins. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

How to trade quantum chains

Apr 21, 2025 pm 11:42 PM

How to trade quantum chains

Apr 21, 2025 pm 11:42 PM

The quantum chain (Qtum) transaction process includes three stages: preliminary preparation, purchase and sale. 1. Preparation: Select a compliant exchange, register an account, perform identity verification, and set up a wallet. 2. Purchase quantum chains: recharge funds, find trading pairs, place orders (market orders or limit orders), and confirm transactions. 3. Sell quantum chains: Enter the trading page, select the trading pair and order type (market order or limit order), confirm the transaction and withdraw cash.

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

The top ten digital virtual currency apps are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

Cryptocurrency data platforms suitable for beginners include CoinMarketCap and non-small trumpet. 1. CoinMarketCap provides global real-time price, market value, and trading volume rankings for novice and basic analysis needs. 2. The non-small quotation provides a Chinese-friendly interface, suitable for Chinese users to quickly screen low-risk potential projects.

Recommended essential software for currency contract parties

Apr 21, 2025 pm 11:21 PM

Recommended essential software for currency contract parties

Apr 21, 2025 pm 11:21 PM

The top ten cryptocurrency contract exchange platforms in 2025 are: 1. Binance Futures, 2. OKX Futures, 3. Gate.io, 4. Huobi Futures, 5. BitMEX, 6. Bybit, 7. Deribit, 8. Bitfinex, 9. CoinFLEX, 10. Phemex, these platforms are widely recognized for their high liquidity, diversified trading functions and strict security measures.

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

APP software that can purchase mainstream coins includes: 1. Binance, the world's leading, large transaction volume and fast speed; 2. OKX, innovative products, low fees, high security; 3. Gate.io, a variety of assets and trading options, focusing on security; 4. Huobi (HTX), low fees, good user experience; 5. Coinbase, suitable for novices, high security; 6. Kraken, safe and compliant, providing a variety of services; 7. KuCoin, low fees, suitable for professional traders; 8. Gemini, emphasizes compliance, and provides custodial services; 9. Crypto.com, providing a variety of offers and services; 10. Bitstamp, an old exchange, strong liquidity,

Can two exchanges convert coins to each other? Can two exchanges convert coins to each other?

Apr 22, 2025 am 08:57 AM

Can two exchanges convert coins to each other? Can two exchanges convert coins to each other?

Apr 22, 2025 am 08:57 AM

Can. The two exchanges can transfer coins to each other as long as they support the same currency and network. The steps include: 1. Obtain the collection address, 2. Initiate a withdrawal request, 3. Wait for confirmation. Notes: 1. Select the correct transfer network, 2. Check the address carefully, 3. Understand the handling fee, 4. Pay attention to the account time, 5. Confirm that the exchange supports this currency, 6. Pay attention to the minimum withdrawal amount.

The latest updates to the oldest virtual currency rankings

Apr 22, 2025 am 07:18 AM

The latest updates to the oldest virtual currency rankings

Apr 22, 2025 am 07:18 AM

The ranking of virtual currencies’ “oldest” is as follows: 1. Bitcoin (BTC), issued on January 3, 2009, is the first decentralized digital currency. 2. Litecoin (LTC), released on October 7, 2011, is known as the "lightweight version of Bitcoin". 3. Ripple (XRP), issued in 2011, is designed for cross-border payments. 4. Dogecoin (DOGE), issued on December 6, 2013, is a "meme coin" based on the Litecoin code. 5. Ethereum (ETH), released on July 30, 2015, is the first platform to support smart contracts. 6. Tether (USDT), issued in 2014, is the first stablecoin to be anchored to the US dollar 1:1. 7. ADA,

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

When choosing a digital currency trading platform suitable for beginners, you need to consider security, ease of use, educational resources and cost transparency: 1. Priority is given to platforms that provide cold storage, two-factor verification and asset insurance; 2. Apps with a simple interface and clear operation are more suitable for beginners; 3. The platform should provide learning tools such as tutorials and market analysis; 4. Pay attention to hidden costs such as transaction fees and cash withdrawal fees.