Technology peripherals

Technology peripherals

It Industry

It Industry

EA's revenue in the third fiscal quarter was US$1.945 billion, with net profit of US$290 million, a year-on-year increase of 42%

EA's revenue in the third fiscal quarter was US$1.945 billion, with net profit of US$290 million, a year-on-year increase of 42%

EA's revenue in the third fiscal quarter was US$1.945 billion, with net profit of US$290 million, a year-on-year increase of 42%

In the morning news on January 31st, Beijing time, Electronic Arts (EA) today announced the company’s third quarter financial report for fiscal year 2024.

The report shows that Electronic Arts’ total net revenue in the third fiscal quarter was US$1.945 billion, compared with US$1.881 billion in the same period last year, a year-on-year increase; not in accordance with U.S. GAAP, Electronic Arts’ third fiscal quarter net bookings were US$2.366 billion, compared with US$2.342 billion in the same period last year, a year-on-year increase of 1%, excluding the impact of exchange rate changes, a year-on-year increase of 2%; net profit was US$290 million, a year-on-year increase of 1%. An increase of 42% compared to US$204 million in the same period.

Both Electronic Arts’ third-quarter net bookings and earnings per share failed to meet Wall Street analysts’ previous expectations, and its performance outlook for the first quarter and full-year fiscal 2024 also fell short of expectations, leading to Shares fell nearly 2% after hours.

Main results:

In the fiscal quarter ended December 31, Electronic Arts Net profit was US$290 million, an increase of 42% compared with US$204 million in the same period last year; diluted earnings per share was US$1.07, an increase compared with US$0.73 in the same period last year, but this performance still failed to reach analysts expected. According to data provided by Yahoo Finance, 20 analysts had expected Electronic Arts to earn $2.93 per share in the third quarter.

Electronic Arts’ total net revenue in the third fiscal quarter was $1.945 billion, compared with $1.881 billion in the same period last year, a year-on-year increase. Among them, EA’s net revenue from the full game business in the third fiscal quarter was US$618 million, compared with US$622 million in the same period last year; net revenue from streaming services and other businesses was US$1.327 billion. US dollars, compared with US$1.259 billion in the same period last year.

By platform, Electronic Arts’ net revenue from game console platforms in the third fiscal quarter was US$1.229 billion, an increase of 7% compared with US$1.152 billion in the same period last year; from PC and other platforms Net revenue was US$420 million, a decrease of 3% compared with US$435 million in the same period last year; net revenue from the mobile platform was US$296 million, an increase of 1% compared with US$294 million in the same period last year.

Not in accordance with U.S. GAAP, EA's net bookings (net bookings) in the third fiscal quarter were US$2.366 billion, compared with US$2.342 billion in the same period last year, a year-on-year increase of 1%, excluding exchange rates The impact of the change was a year-on-year increase of 2%, a performance that failed to meet analyst expectations. According to data provided by Yahoo Finance, 16 analysts had expected EA's net bookings to reach $2.39 billion in the third fiscal quarter.

Electronic Arts’ cost of revenue in the third fiscal quarter was US$529 million, compared with US$568 million in the same period last year, a year-on-year decrease. Electronic Arts' third-quarter gross profit was $1.416 billion, up from $1.313 billion a year earlier.

Electronic Arts’ total operating expenses for the fiscal third quarter were $1.051 billion, up from $1.024 billion a year earlier. Among them, R&D expenses were US$584 million, compared with US$556 million in the same period last year; marketing and sales expenses were US$276 million, compared with US$256 million in the same period last year; general and administrative expenses were US$170 million, compared with US$170 million in the same period last year. Amortization expense of intangible assets was US$21 million, compared with US$50 million in the same period last year.

Electronic Arts’ fiscal third-quarter operating profit was $365 million, an increase from $289 million in the same period a year earlier.

Electronic Arts’ net cash from operating activities in the third fiscal quarter was $1.264 billion, an increase of 13% compared with the same period last year. Over the last 12 months, EA had $2.352 billion in net cash from operating activities.

In the third fiscal quarter, Electronic Arts repurchased 2.5 million shares, and the total amount of funds used to repurchase shares was $325 million; in the past 12 months, Electronic Arts repurchased a total of 10.4 million shares were purchased, and the total amount of funds used to repurchase shares was US$1.300 billion.

Electronic Arts announced that the company will pay a cash dividend of $0.19 per share to common shareholders. The dividend will be paid on March 20, 2024 to all shareholders of record as of the close of business on February 28, 2024. Disbursed to shareholders.

Performance Outlook:

Performance Outlook for the Fourth Quarter of Fiscal Year 2024:

Electronic Arts expects net revenue for the fourth fiscal quarter of Fiscal Year 2024 Will reach between US$1.625 billion and US$1.925 billion; net profit is expected to be between US$54 million and US$183 million; diluted earnings per share is expected to be between US$0.20 and US$0.68, lower than analyst expectations; net bookings It is expected to reach between US$1.625 billion and US$1.925 billion, with an average of US$1.775 billion, which is lower than analysts' expectations; revenue costs are expected to reach between US$360 million and US$410 million; operating expenses are expected to reach US$1.125 billion. to US$1.205 billion; pretax profit before income tax provisions is expected to be between US$158 million and US$325 million.

According to data provided by Yahoo Finance Channel, 17 analysts had previously expected on average that Electronic Arts’ net bookings in the fourth fiscal quarter would reach US$1.82 billion, and 20 analysts had previously expected on average that Electronic Arts’ fourth fiscal quarter net bookings would reach US$1.82 billion. Earnings per share will be $1.56.

Full-year performance outlook for fiscal year 2024:

Electronic Arts estimates that net revenue in fiscal year 2024 is expected to reach between US$7.408 billion and US$7.708 billion; net profit is expected to reach US$1.145 billion to US$1.274 billion Between US$1.95 billion and US$2.10 billion; diluted earnings per share are expected to be between US$4.21 and US$4.68, lower than analysts' expectations; operating cash flow is expected to be between US$1.950 billion and US$2.100 billion; net bookings are expected to reach US$7.389 billion to US$7.689 billion, with an average of US$7.539 billion, lower than analyst expectations; revenue costs are expected to be between US$1.713 billion and US$1.763 billion; operating expenses are expected to be between US$4.274 billion and US$4.351 billion ; Pre-tax profit excluding income tax provisions is expected to be between US$1.487 billion and US$1.654 billion.

According to data provided by Yahoo Finance Channel, 22 analysts had previously expected on average that Electronic Arts’ net bookings in fiscal year 2024 would reach US$7.64 billion, and 23 analysts had previously expected on average that Electronic Arts’ net bookings per share in fiscal year 2024 would be The gain will be $7.14.

Stock price changes:

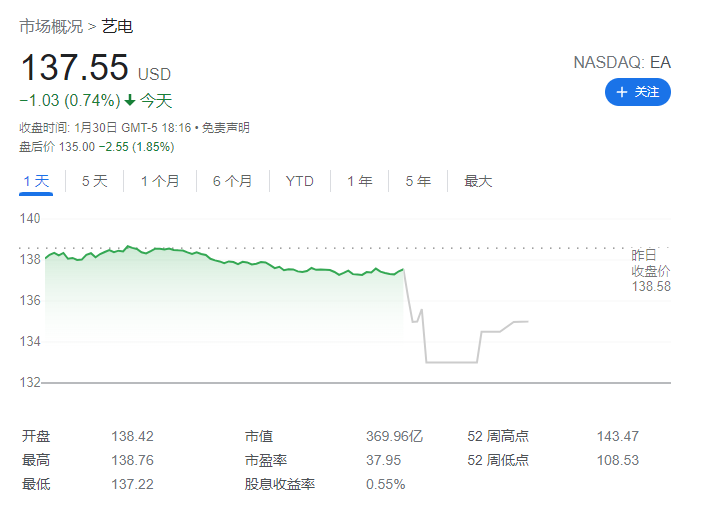

On that day, Electronic Arts’ stock price fell $1.03 in regular trading, closing at $137.55, a decrease of 0.74%. In subsequent after-hours trading as of 5:50 pm ET on Tuesday (6:50 am on Wednesday, Beijing time), EA shares fell another $2.58, or 1.88%, to $134.97. Over the past 52 weeks, Electronic Arts' high price was $143.47 and its low price was $108.53.

The above is the detailed content of EA's revenue in the third fiscal quarter was US$1.945 billion, with net profit of US$290 million, a year-on-year increase of 42%. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Alibaba's semi-annual financial report for fiscal year 2024 shows that revenue reached 458.946 billion yuan, a year-on-year increase of 11%, and net profit attributable to the parent company increased by 2748% year-on-year.

Jan 04, 2024 pm 06:44 PM

Alibaba's semi-annual financial report for fiscal year 2024 shows that revenue reached 458.946 billion yuan, a year-on-year increase of 11%, and net profit attributable to the parent company increased by 2748% year-on-year.

Jan 04, 2024 pm 06:44 PM

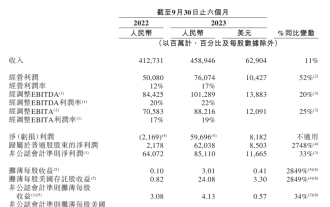

According to news from this site on December 23, Alibaba announced its interim report for fiscal year 2024 (six months ending September 30, 2023), achieving revenue of 458.946 billion yuan, a year-on-year increase of 11%; operating profit of 76.074 billion yuan, a year-on-year increase of 52% %; net profit attributable to parent companies was 62.038 billion yuan, a year-on-year increase of 2748%; diluted earnings per share was 3.01 yuan, a year-on-year increase of 2849%. This site noticed that Taotian Group’s revenue increased by 8% year-on-year. Alibaba International Digital Business Group's overseas business performed strongly, with revenue increasing by 47%. Cainiao Group's revenue increased 29%. Local Living Group's revenue increased 22%. Dawen Entertainment Group's revenue increased 21% for the six-month period ended September 30, 2023, Cainiao

EA Frostbite game engine undergoes brand identity update

Dec 19, 2023 pm 12:49 PM

EA Frostbite game engine undergoes brand identity update

Dec 19, 2023 pm 12:49 PM

Frostbite is EA's cross-platform game engine, providing technical support for games such as the "Battlefield" series. Today's news on this site: EA recently announced on its official website that it will launch a new logo and brand identity for the Frostbite engine, and will reshape it into EA's collaborative innovation platform. ▲Frost Engine’s new logo EA officials stated that this rebranding reflects the company’s image today and marks not only a visual change for Frostbite Engine, but also a philosophical shift that refocuses on collaboration with teams and creators. In this new era, the Frostbite Engine team's mission is to unite and expand expertise across every EA game team using the engine. ▲Frost Engine Logo Evolution Chart Through the display in the picture, we can observe the Frost Engine logo pattern

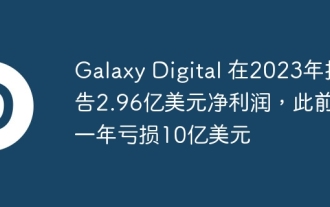

Galaxy Digital reports $296 million in net profit in 2023, after losing $1 billion the year before

Apr 01, 2024 pm 06:55 PM

Galaxy Digital reports $296 million in net profit in 2023, after losing $1 billion the year before

Apr 01, 2024 pm 06:55 PM

As of the end of February this year, Galaxy Digital’s assets under management (AUM) surged to $10.1 billion. The recently released financial statements of Galaxy Digital, a digital asset financial services company owned by Mike Novogratz, show that it achieved a net profit of US$29.6 million for the entire year. This is a significant turnaround after losing $1 billion in 2022. The company said that the fourth quarter of 2023 is particularly turning point for the company. In its official statement, Galaxy Digital said there was a positive change in fortunes in the last quarter of 2023, pushing its net profit to $302 million. This coincides with the much-needed rebound the crypto market has experienced, emerging from a prolonged crypto slump.

Ubisoft's net bookings in the first half of the year were 822.4 million euros, a year-on-year increase of 17.6%, with 'Rainbow Six: Siege' being the best

Oct 27, 2023 pm 06:49 PM

Ubisoft's net bookings in the first half of the year were 822.4 million euros, a year-on-year increase of 17.6%, with 'Rainbow Six: Siege' being the best

Oct 27, 2023 pm 06:49 PM

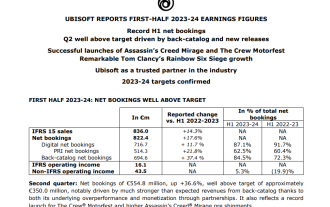

According to news from this site on October 27, Ubisoft announced its results for the first half of the 2023-2024 fiscal year (March-September), with operating income of 16.1 million euros (notes from this site: currently about 124 million yuan), compared with 2.15 in the first half of last year billion euros; cumulative revenue reached 836 million euros, a year-on-year increase of 14%; net bookings in the first half of the year reached 822.4 million euros, a significant increase of 17.6% over the previous year. Net bookings in the second quarter were 554.8 million euros (currently approximately 4.283 billion yuan), an increase of 36.6%, much higher than the target of approximately 350 million euros. Ubisoft's revenue growth was partly due to the launch of racing simulation game The Crew: The Crew in September and pre-shipments of Assassin's Creed Phantoms in early October. "rainbow

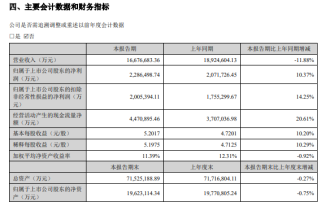

CATL's net profit in the first half of 2024 was 22.865 billion yuan, a year-on-year increase of 10.37%

Jul 27, 2024 am 11:41 AM

CATL's net profit in the first half of 2024 was 22.865 billion yuan, a year-on-year increase of 10.37%

Jul 27, 2024 am 11:41 AM

According to news from this website on July 26, CATL released its 2024 semi-annual report: revenue in the first half of this year was 166.77 billion yuan, a year-on-year decrease of 11.88%; net profit attributable to the parent company in the first half of the year was 22.865 billion yuan, a year-on-year increase of 10.37%. 1. Market share: CATL’s global market share of power battery usage from January to May 2024 was 37.5%, an increase of 2.3 percentage points from the same period last year, and continues to rank first in the world. Energy storage field: CATL has ranked first in the world in terms of energy storage battery shipments for three consecutive years. R&D investment: CATL’s R&D investment in the first half of this year reached 8.592 billion yuan, a year-on-year decrease of 12.77%. In terms of products or services, the gross profit margin of CATL's power battery system in the first half of the year reached 26.90%, an increase of 6.9% compared with the same period last year.

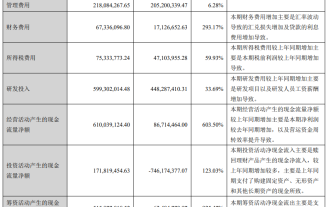

Anker Innovation: Revenue in the first half of the year was 7.066 billion yuan, a year-on-year increase of 20.01%, and net profit increased by 42.3% year-on-year

Sep 12, 2023 pm 01:45 PM

Anker Innovation: Revenue in the first half of the year was 7.066 billion yuan, a year-on-year increase of 20.01%, and net profit increased by 42.3% year-on-year

Sep 12, 2023 pm 01:45 PM

According to news from this site on September 5, Anker Innovation recently announced its 2023 semi-annual report. In the first half of the year, it achieved total operating income of 7.066 billion yuan, a year-on-year increase of 20.01%; it achieved a net profit attributable to shareholders of listed companies of 820 million yuan, a year-on-year increase of 42.33%. . In terms of product categories, the charging category achieved revenue of 3.483 billion yuan, a year-on-year revenue increase of 18.29%, accounting for 49.30% of the total revenue; the intelligent innovation category achieved revenue of 1.946 billion yuan, a year-on-year revenue increase of 16.66%, accounting for 27.54% of the total revenue. ; Wireless audio category achieved revenue of 1.563 billion yuan, with revenue increasing 29.11% year-on-year, accounting for 22.12% of total revenue. This site learned from the report that Anker’s R&D investment reached 599 million yuan, a year-on-year increase of 33.

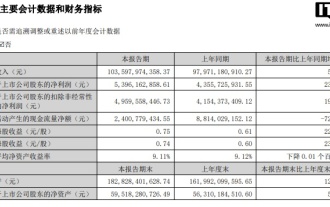

Luxshare Precision's net profit in the first half of 2024 was 5.396 billion yuan, a year-on-year increase of 23.89%

Aug 24, 2024 am 12:00 AM

Luxshare Precision's net profit in the first half of 2024 was 5.396 billion yuan, a year-on-year increase of 23.89%

Aug 24, 2024 am 12:00 AM

According to news from this site on August 23, Luxshare Precision has just released its latest 2024 semi-annual report. The highlights of this site are as follows: revenue of 103.598 billion yuan, a year-on-year increase of 5.74%, increased corporate mergers and increased product shipments. Net profit attributable to the parent company was 5.396 billion yuan, a year-on-year increase of 23.89%; basic earnings per share was 0.75 yuan, a year-on-year increase of 22.95%; R&D investment was 4.220 billion yuan, a year-on-year increase of 13.24%; in addition to fenye, Luxshare Precision also released its third According to the quarterly performance forecast, the third quarter net profit is expected to be 3.453 billion-3.822 billion yuan, a year-on-year increase of 14.39%-26.61%.

Nvidia expects its Q2 financial report to be released on August 23-24, with year-on-year growth expected to exceed 50%.

Aug 23, 2023 pm 02:21 PM

Nvidia expects its Q2 financial report to be released on August 23-24, with year-on-year growth expected to exceed 50%.

Aug 23, 2023 pm 02:21 PM

According to news from this website on August 20, according to Taiwan media Economic Daily reported early this morning, Nvidia will announce its Q2 financial report for the 2024 fiscal year on August 23, US time (between August 23 and August 24, Beijing time). According to the report, the outside world expects the company's financial report to "further verify the substantial benefits brought by AI" and learn a clear long-term outlook. As a reference, Nvidia's total revenue in Q1 of the 2024 fiscal year is US$7.19 billion (notes from this site: Currently about 52.487 billion yuan), a year-on-year decrease of 13%, but an increase of 19% compared with the previous quarter. Its data center-related performance showed double-digit growth year-on-year and month-on-month. Nvidia predicts that Q2 performance in fiscal year 2024 will exceed