web3.0

web3.0

Ethereum market circulation increased by 1 billion USDT! Are there signs of recovery in the Defi industry?

Ethereum market circulation increased by 1 billion USDT! Are there signs of recovery in the Defi industry?

Ethereum market circulation increased by 1 billion USDT! Are there signs of recovery in the Defi industry?

The growth in market value of stablecoins is similar to the increase in money supply in the traditional financial system. The increase in stablecoin market capitalization means more funds flow into the cryptocurrency market, which provides additional liquidity and facilitates trading activity on various chains. In short, the market cap of stablecoins is one of the important catalysts for the start of a bull run in the cryptocurrency market.

Tether issues an additional $1 billion USDT

According to monitoring data from @whale_alert, Tether, the largest stablecoin issuer, issued an additional 1 billion USDT on the Ethereum network yesterday afternoon. In response to this, the chief technology officer replied on X that this is an additional US$1 billion in Tether (USDT) inventory on the Ethereum network. It should be noted that this is an authorized but not yet issued transaction, and this amount will be used as inventory for the next issuance request and on-chain exchange.

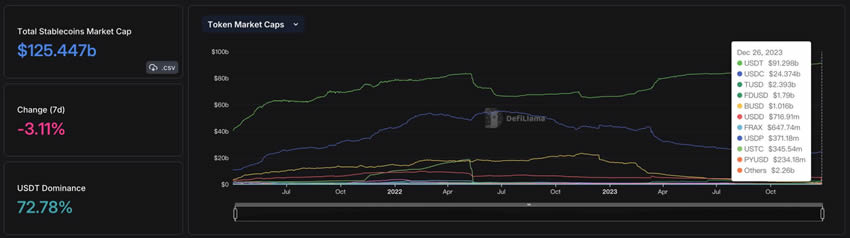

According to DeFiliama data, the current total market value of stablecoins is approximately US$125 billion, of which USDT accounts for 72.78%, reaching approximately US$91.2 billion. In the past month, the market value of USDT has increased by 2.83%, showing a growing trend. These data deserve our attention.

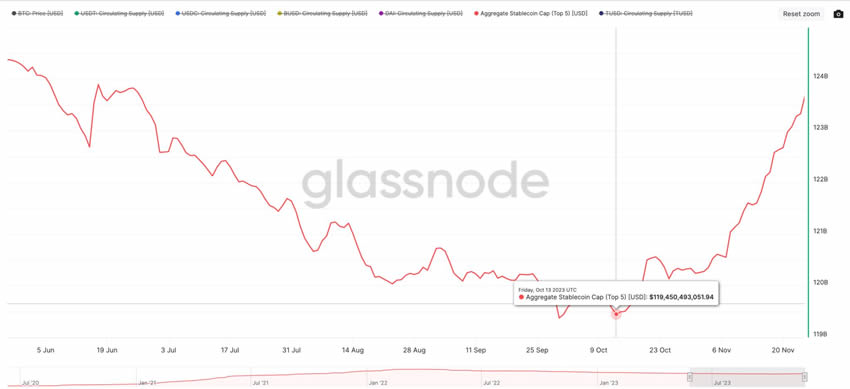

According to data, the market value of stablecoins reversed in mid-October and increased by approximately 3.36% in the past 2 and a half months, equivalent to an increase of approximately $5.6 billion. Although the data of Glassnode and Defiliama are slightly different, they both show the growth trend of market capitalization.

Stablecoin market capitalization growth

Spillover to DeFi protocols and total positions on public chains

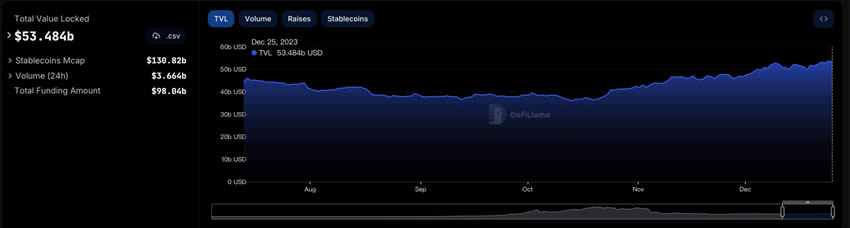

In the past, stablecoins often It is a pioneer in the Defi field. With the influx of stablecoins, the total locked-up volume of DeFi protocols and public chains will also increase.

According to data from DefiLlama, the amount locked in DeFi protocols on various chains was less than US$36 billion in mid-October this year, compared with the high of US$178 billion in November 2021. It can be said to have dropped by more than 80%. However, with the main pull of Ethereum, the locked-up amount of DeFi in various chains has returned to US$53.4 billion so far, an increase of 48% since mid-October.

Signs of funds returning to DeFi

The public chain track has also seen obvious growth. Sui’s total locked-up volume reached 1 It continued to grow after reaching US$200 million, and now exceeds US$200 million. In addition, Layer2Blast’s total locked-up volume continues to hit new highs. According to DeBank data, the total value of assets locked in the Blast contract address has exceeded $1 billion, with most of the assets including $920 million worth of ETH deposited in the Lido protocol, and more than 100 million DAI deposited in MakerDAO.

The above is the detailed content of Ethereum market circulation increased by 1 billion USDT! Are there signs of recovery in the Defi industry?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Pi Network (PI) Price Falls Despite Successful PiFest 2025 Event

Apr 03, 2025 am 10:08 AM

Pi Network (PI) Price Falls Despite Successful PiFest 2025 Event

Apr 03, 2025 am 10:08 AM

Pi Network recently held PiFest 2025, an event aimed at increasing the token's adoption. Over 125,000 sellers and 58,000 merchants participated

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

RUVI AI (RUVI) Token Presale Might 20X After an Explosive Launch

Apr 03, 2025 am 11:08 AM

RUVI AI (RUVI) Token Presale Might 20X After an Explosive Launch

Apr 03, 2025 am 11:08 AM

The crypto market continues to face turbulence, with Cardano (ADA) dropping 12% to $0.64, prompting concern across the altcoin sector.

Where to download the genuine Ouyi? Official website download. Global

Mar 31, 2025 pm 02:09 PM

Where to download the genuine Ouyi? Official website download. Global

Mar 31, 2025 pm 02:09 PM

Ouyi usually refers to Ouyi OKX. The global way to download Ouyi OKX APP is as follows: 1. Android device: Download the APK file through the official website and install it. 2. iOS device: access the official website through the browser and directly download the APP.

BlockDAG Launches Beta Testnet With $200M Raised, Ethereum Approaches $2,000 & Tether Expands Into Media

Apr 03, 2025 am 10:34 AM

BlockDAG Launches Beta Testnet With $200M Raised, Ethereum Approaches $2,000 & Tether Expands Into Media

Apr 03, 2025 am 10:34 AM

Ethereum (ETH) price edges toward resistance, Tether news reveals a €10M media deal, and BlockDAG reaches new milestones with Beta Testnet and growing adoption.

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

This article provides newbies with detailed Gate.io registration tutorials, guiding them to gradually complete the registration process, including accessing the official website, filling in information, identity verification, etc., and emphasizes the security settings after registration. In addition, the article also mentioned other exchanges such as Binance, Ouyi and Sesame Open Door. It is recommended that novices choose the right platform according to their own needs, and remind readers that digital asset investment is risky and should invest rationally.