Technology peripherals

Technology peripherals

AI

AI

IDC forecasts: Global AR/VR headset shipments in 2023 will be 8.1 million units, down 8.3% from the same period last year

IDC forecasts: Global AR/VR headset shipments in 2023 will be 8.1 million units, down 8.3% from the same period last year

IDC forecasts: Global AR/VR headset shipments in 2023 will be 8.1 million units, down 8.3% from the same period last year

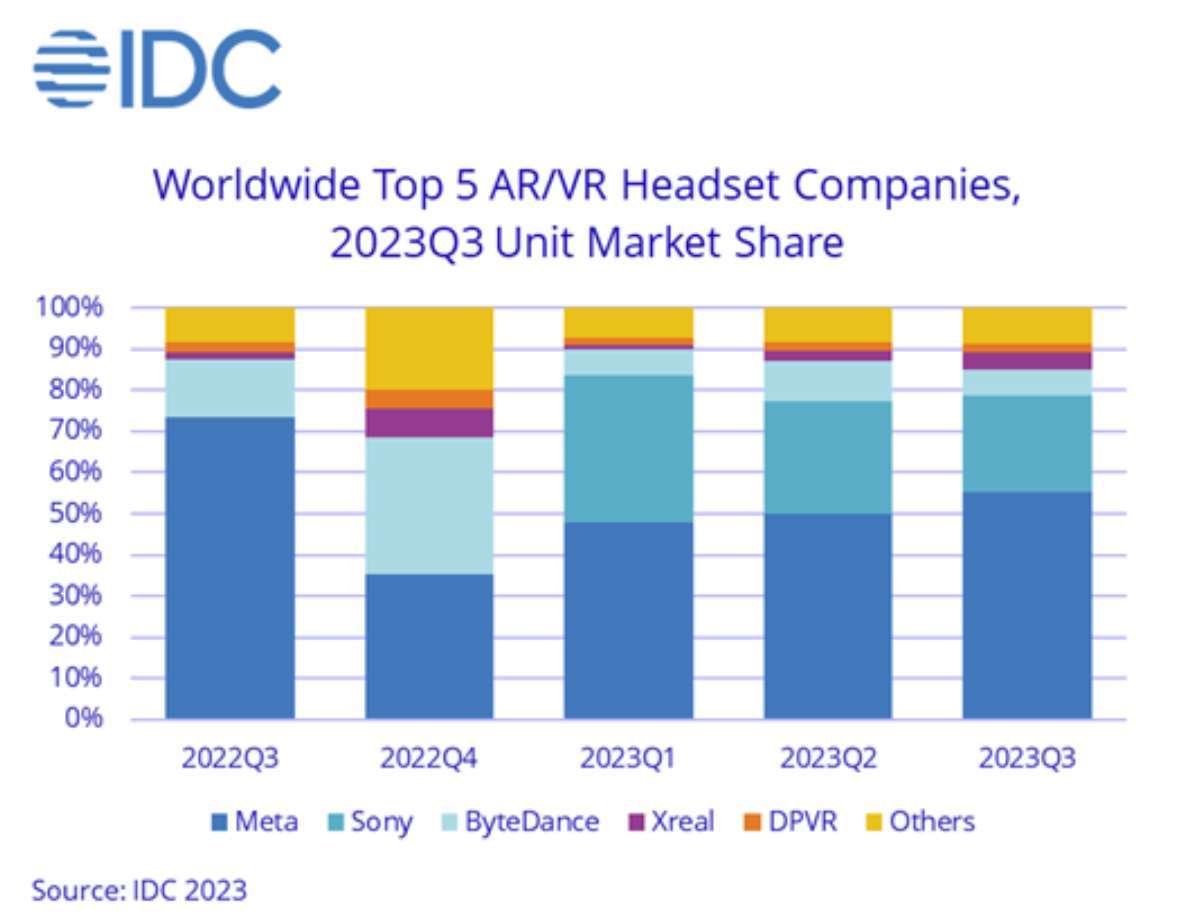

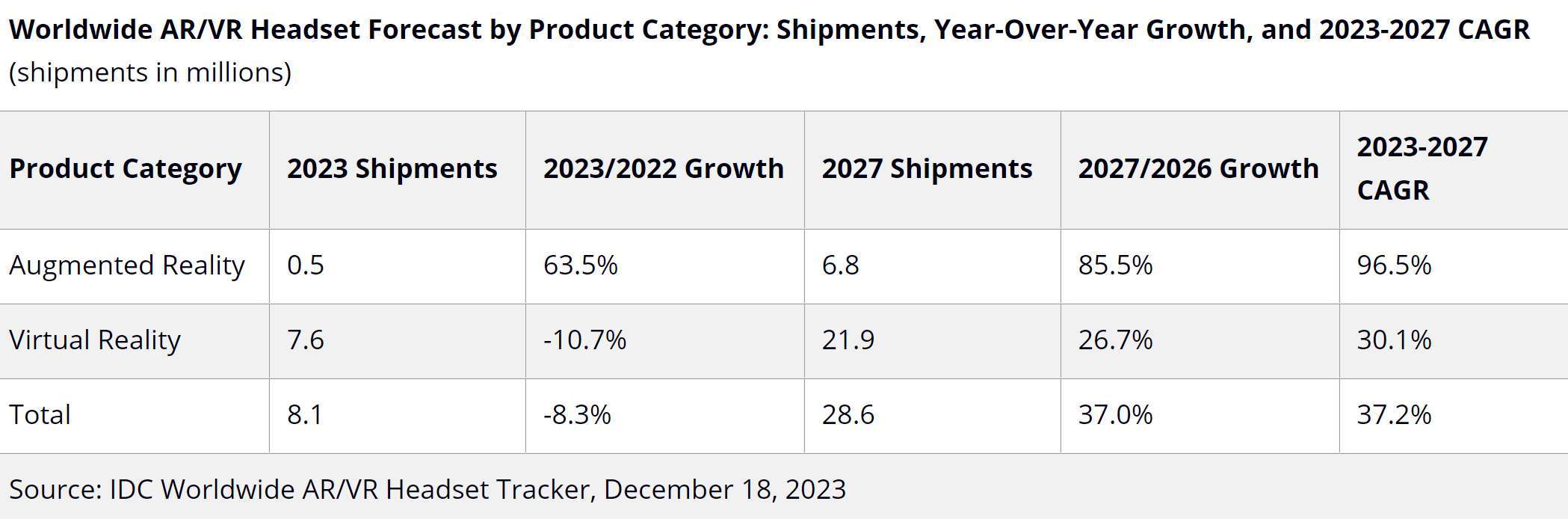

According to the latest data released by IDC, although new AR/VR head-mounted display products have been launched in the global market this year, shipments are expected to drop 8.3% year-on-year to 8.1 million units by 2023. Sony's PSVR 2 and Meta's Quest 3 are popular, but growth has been hampered by macroeconomic pressures on households and slowing spending in the business sector

2024 is expected to be a year of recovery, with AR/VR headset shipments expected to grow by 46.4%

Growth in 2024 can be attributed to Meta Quest 3 and Apple Vision Pro. According to IDC predictions, Apple's head-mounted display devices will receive a lot of attention, but shipments within the year may be less than 200,000. In contrast, Meta's shipments in the first three quarters of 2023 have exceeded Apple's expectations by 10 times (as of Q3 2023, accounting for 55.2% of the market), and are very likely to achieve year-on-year growth in 2024 Growth

IDC said: "While the new VR headsets are expected to drive sales, they may turn off some consumers as average selling prices trend upward. The Vision Pro's high price may position it as an enterprise device, while Quest 3 is also pushing the limits of consumer wallets, making VR a rich person’s pleasure, especially as production of older and more affordable headsets declines."

Augmented reality headsets are expected to grow through 2024 as companies like Xreal and Rokid launch lower-cost tethered headsets. These headsets can often replace monitors to increase productivity or improve the media consumption experience. All-in-one computers like Microsoft's HoloLens 2 or Magic Leap 2 will continue to evolve, but at a slower pace. It is expected that by 2024, total AR headset shipments will reach 845,000 units, an increase of 85.6% from 2023

IDC finally added: "It is expected that the sales growth rate of AR headsets will be slower compared with VR headsets, but the diversification of different products will meet more needs. 3D immersive and interactive augmented reality will still gain traction and find a way to favor enterprise users. Assisted reality technology (AR devices that display content only within the user's line of sight) will also have its own audience and can be extended to gaming and multimedia users. Finally, the recent focus on mixed reality Will increase the visibility of augmented reality, especially for those who just want or need an augmented reality experience."

The above is the detailed content of IDC forecasts: Global AR/VR headset shipments in 2023 will be 8.1 million units, down 8.3% from the same period last year. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

'The King of Mobile Phones in Africa'! Transsion ranks fourth in the world in terms of shipments in the first quarter of 2024, increasing by 86%

May 02, 2024 pm 12:43 PM

'The King of Mobile Phones in Africa'! Transsion ranks fourth in the world in terms of shipments in the first quarter of 2024, increasing by 86%

May 02, 2024 pm 12:43 PM

According to news on May 2, the analysis agency Canalys recently released global smartphone market data for the first quarter of 2024. In this quarter, the global smartphone market increased by 10% year-on-year to 296.2 million units. Data shows that the top five mobile phone manufacturers in the first quarter were Samsung, Apple, Xiaomi, Transsion and OPPO. Among them, Transsion, known as the "King of African Mobile Phones", performed well. In the first quarter, Transsion mobile phone shipments reached 28.6 million units, with a market share of 10%, achieving strong growth of 86%. The financial report shows that Transsion's operating income in 2023 was 62.295 billion yuan, a year-on-year increase of 33.69%, and its net profit was 5.537 billion yuan, a year-on-year increase of 122.93%. In the main business, Transsion mobile phone revenue is 573

Well stocked! Huawei Pura 70 has shipped at least 10 million units

Apr 17, 2024 pm 10:37 PM

Well stocked! Huawei Pura 70 has shipped at least 10 million units

Apr 17, 2024 pm 10:37 PM

After the Huawei P series was upgraded to Huawei Pura, the popularity has surged again. It is reported that the Pura70 series will be launched this month. Online stores said that the new opportunity will arrive in stores around the 18th. At the same time, there will be no press conference, but will be launched directly on the official website. for sale. Analyst Guo Mingchui predicts that Huawei's Pura70 series shipments will grow significantly in 2024. If inventory replenishment demand is strong, 70 series shipments are expected to increase by 230% to 13-15 million units, even if sales slow down. It is also expected to reach 10-12 million units.

Full of confidence! iPhone 16 stock levels raised to 90 million units

Jul 17, 2024 am 03:37 AM

Full of confidence! iPhone 16 stock levels raised to 90 million units

Jul 17, 2024 am 03:37 AM

Recently, people in the Apple industry chain revealed that Apple is optimistic about iPhone 16 shipments and has increased its stocking volume to 90 million units. Foreign media also reported that Apple has strong confidence in iPhone 16 and has slightly raised its stocking target for iPhone 16. 1. Morgan Stanley analysts said that the introduction of Apple AI will stimulate consumer demand for iPhone 16. Currently, the only models that support AI are iPhone15Pro and iPhone15ProMax. If Apple Intelligence performs well, it will trigger a wave of phone replacements. Apple comes standard with 8GB of memory on the iPhone 16 to meet the needs of AI.

Super-concentrated retractable camera reshapes the art of moving images

Jul 19, 2024 pm 04:12 PM

Super-concentrated retractable camera reshapes the art of moving images

Jul 19, 2024 pm 04:12 PM

On the morning of July 18, Huawei officially launched the video "The Birth of a Star - Revealing the Story Behind the Super Condensing Retractable Camera", revealing the innovative technology of Huawei Pura70 Ultra to the outside world for the first time. "Star" is an internal code name within Huawei, referring to the super-concentrating retractable camera equipped with Huawei Pura70Ultra. This code name shows the "engineer" style of technological romance of Huawei's R&D team, and once again echoes the technological aesthetics represented by the Pura series. In the field of mobile imaging, while flagship brands are still sacrificing body thickness to improve the imaging capabilities of mobile phones, Huawei Pura70 Ultra redefines the possibilities of mobile imaging with its super-concentrated retractable camera.

Glory to overseas milestone achievements! Breaking into the top five in the Latin American market for the first time: shipments surged 293%

Jul 02, 2024 am 02:26 AM

Glory to overseas milestone achievements! Breaking into the top five in the Latin American market for the first time: shipments surged 293%

Jul 02, 2024 am 02:26 AM

According to news on July 1, a report by market analysis agency Canalys showed that Honor mobile phones ranked among the top five mobile phone brands in Latin America for the first time in the first quarter of 2024, with market share increasing to 7%, and year-on-year growth reaching an astonishing 293%. The top four ranked ahead of Honor are Samsung, Motorola, Xiaomi, and Transsion. 1. Honor’s rapid growth is due to many factors: As a sub-brand of Huawei, Honor quickly established a foothold in the market with the help of Huawei’s business structure and sales channel network. After the brand became independent, Honor continued to develop traditional channels and established cooperative relationships with major operators and retailers to increase market penetration. In terms of product strategy, Honor implements differentiated competition in the mid-to-high-end market, launches high-quality products such as the Magic series, and boasts excellent device specifications.

2023 fourth quarter global mobile phone shipments report: Apple takes the top spot, Xiaomi ranks third, and Huawei achieves triple-digit growth!

Mar 01, 2024 pm 04:00 PM

2023 fourth quarter global mobile phone shipments report: Apple takes the top spot, Xiaomi ranks third, and Huawei achieves triple-digit growth!

Mar 01, 2024 pm 04:00 PM

According to a recent report released by market research agency Counterpoint Research, global smartphone shipments reached 323.2 million units in the fourth quarter of 2023, a year-on-year increase of 7% and a month-on-month increase of 8%. This data reflects the continued growth momentum of the smartphone market and brings positive signals to the entire industry. According to report data, Apple grew by 2% year-on-year in the fourth quarter of 2023, with shipments reaching 23%, surpassing Samsung to become the first in global mobile phone shipments. At the same time, Samsung's sales fell 9% year-on-year, losing to Apple in the high-end market, Chinese OEMs such as Xiaomi in the mid-range market, and Transsion in the entry-level market. Nonetheless, on an annual basis, Samsung still maintains its sales in 2023

End the slide! China's smartphone shipments in Q1 2024 will increase by 1% year-on-year: OPPO honors Huawei in the top three

May 06, 2024 pm 06:31 PM

End the slide! China's smartphone shipments in Q1 2024 will increase by 1% year-on-year: OPPO honors Huawei in the top three

May 06, 2024 pm 06:31 PM

According to news on May 6, according to the latest report released by market research organization TechInsights, China’s smartphone market achieved steady growth in shipments in the first quarter of 2024, with shipments reaching 63.3 million units, a year-on-year increase of 1%. This growth marks the end of 11 consecutive quarters of annual decline in China's smartphone market, showing a positive recovery in the market. In terms of manufacturers, the four major manufacturers OPPO/OnePlus, Honor, Huawei and vivo have particularly outstanding market performance. Their market shares are almost equal and they jointly occupy a dominant position in the market. Among them, OPPO/OnePlus leads the Chinese smartphone market with a market share of 17.1%, showing its strong market competitiveness. Honor, Huawei and vivo followed closely behind.

IDC forecasts: Global AR/VR headset shipments in 2023 will be 8.1 million units, down 8.3% from the same period last year

Dec 21, 2023 pm 12:03 PM

IDC forecasts: Global AR/VR headset shipments in 2023 will be 8.1 million units, down 8.3% from the same period last year

Dec 21, 2023 pm 12:03 PM

According to the latest data released by IDC, despite the launch of new AR/VR head-mounted display products in the global market this year, shipments are expected to drop 8.3% year-on-year to 8.1 million units by 2023. Sony's PSVR2 and Meta's Quest3 are popular, but growth has been hampered by macroeconomic pressures on households and slowing spending in the business sector. 2024 is expected to be a year of recovery, with AR/VR headset shipments expected to Growth of 46.4% The growth in 2024 can be attributed to MetaQuest 3 and Apple Vision Pro. According to IDC predictions, Apple's head-mounted display devices will receive a lot of attention, but shipments within the year may be less than 200,000. In contrast, Meta will be in the top three in 2023