Technology peripherals

Technology peripherals

AI

AI

IDC: The accelerated server market will reach US$3.1 billion in the first half of 2023, with GPU servers still dominating

IDC: The accelerated server market will reach US$3.1 billion in the first half of 2023, with GPU servers still dominating

IDC: The accelerated server market will reach US$3.1 billion in the first half of 2023, with GPU servers still dominating

News on October 9th, according to IDC Consulting’s official public account, IDC today released the “China Semi-Annual Accelerated Computing Market (First Half of 2023) Tracking”, which shows that in the first half of 2023 The accelerated server market size reached US$3.1 billion in the first half of the year, an increase of 54% year-on-year in the first half of 2022.

IDC also stated that In this year’s accelerated server market, GPU servers still dominate, with a market share of 88%, accounting for US$3 billion (note on this site: currently about 21.93 billion yuan). At the same time, non-GPU accelerated servers such as NPU, ASIC and FPGA accounted for 8% of the market share with a year-on-year growth rate of 17%, reaching US$200 million (currently approximately 1.462 billion yuan).

According to manufacturer sales, Inspur, H3C and Ningchang ranked among the top three in the first half of 2023, accounting for more than 70% of the market share; and from the perspective of server shipments, Inspur , Kunqian and Ningchang rank in the top three, accounting for nearly 60% of the market share

From an industry perspective, the Internet is still the largest procurement industry, accounting for more than half of the entire accelerated server market. In addition, the growth rates of the financial, telecommunications and government industries have all more than doubled

IDC believes that AI is moving from completing specific tasks such as image recognition and speech recognition to the level of human-like intelligence. Achieve independent learning, judgment and creation. Based on the training of massive data and continuous optimization of the model, the large AI model has more accurate execution capabilities and stronger scene transferability, providing comprehensive support for artificial intelligence in such areas as the metaverse, urban governance, medical health, scientific research, etc. Provides better solutions for a wide range of applications in complex scenarios.

Chinese companies particularly recognize the value of generative artificial intelligence in accelerating decision-making, improving efficiency, optimizing user and employee experience and other dimensions, and will continue to increase investment in the next three years.

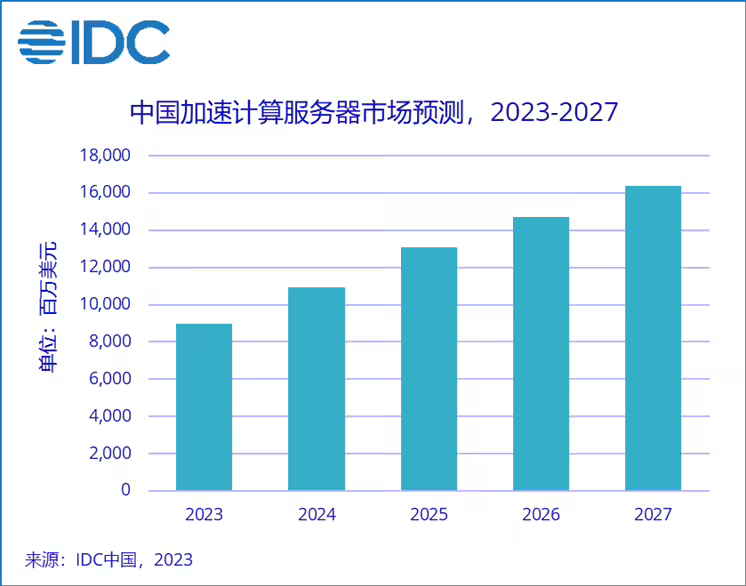

IDC predicts that China’s accelerated server market will reach US$16.4 billion by 2027 (currently approximately RMB 119.884 billion). Among them, the non-GPU server market size will exceed 12%.

▲ Picture source IDC Consulting Official Public Account

▲ Picture source IDC Consulting Official Public Account

Generative artificial intelligence has significantly promoted the development of China’s artificial intelligence market. The rich application scenarios and the enthusiasm for continuous iteration of technological innovation have significantly increased the attention and demand for artificial intelligence servers in the Chinese market. Due to the influence of factors such as the supply chain and the requirements of relevant departments, the Chinese market Facing the problem of insufficient computing power, this has brought new opportunities for domestic chip development. China's local artificial intelligence chip manufacturers are growing rapidly and have made remarkable achievements, attracting a lot of investment and attention. These companies have certain strengths and competitive advantages in artificial intelligence chip design, algorithm optimization, production and manufacturing. In addition, policy support from relevant departments also plays an important role in promoting.

In the first half of 2023, the market size of China’s acceleration chips exceeded 500,000. From a technical perspective, GPU cards account for 90% of the market share; from a brand perspective, China's local AI chip brands have shipped more than 50,000 units, accounting for about 10% of the entire market.▲ Picture source IDC consultation official public account

The above is the detailed content of IDC: The accelerated server market will reach US$3.1 billion in the first half of 2023, with GPU servers still dominating. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

What is the analysis chart of Bitcoin finished product structure? How to draw?

Apr 21, 2025 pm 07:42 PM

What is the analysis chart of Bitcoin finished product structure? How to draw?

Apr 21, 2025 pm 07:42 PM

The steps to draw a Bitcoin structure analysis chart include: 1. Determine the purpose and audience of the drawing, 2. Select the right tool, 3. Design the framework and fill in the core components, 4. Refer to the existing template. Complete steps ensure that the chart is accurate and easy to understand.

What does cross-chain transaction mean? What are the cross-chain transactions?

Apr 21, 2025 pm 11:39 PM

What does cross-chain transaction mean? What are the cross-chain transactions?

Apr 21, 2025 pm 11:39 PM

Exchanges that support cross-chain transactions: 1. Binance, 2. Uniswap, 3. SushiSwap, 4. Curve Finance, 5. Thorchain, 6. 1inch Exchange, 7. DLN Trade, these platforms support multi-chain asset transactions through various technologies.

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

Cryptocurrency data platforms suitable for beginners include CoinMarketCap and non-small trumpet. 1. CoinMarketCap provides global real-time price, market value, and trading volume rankings for novice and basic analysis needs. 2. The non-small quotation provides a Chinese-friendly interface, suitable for Chinese users to quickly screen low-risk potential projects.

Aavenomics is a recommendation to modify the AAVE protocol token and introduce token repurchase, which has reached the quorum number of people.

Apr 21, 2025 pm 06:24 PM

Aavenomics is a recommendation to modify the AAVE protocol token and introduce token repurchase, which has reached the quorum number of people.

Apr 21, 2025 pm 06:24 PM

Aavenomics is a proposal to modify the AAVE protocol token and introduce token repos, which has implemented a quorum for AAVEDAO. Marc Zeller, founder of the AAVE Project Chain (ACI), announced this on X, noting that it marks a new era for the agreement. Marc Zeller, founder of the AAVE Chain Initiative (ACI), announced on X that the Aavenomics proposal includes modifying the AAVE protocol token and introducing token repos, has achieved a quorum for AAVEDAO. According to Zeller, this marks a new era for the agreement. AaveDao members voted overwhelmingly to support the proposal, which was 100 per week on Wednesday

Ranking of leveraged exchanges in the currency circle The latest recommendations of the top ten leveraged exchanges in the currency circle

Apr 21, 2025 pm 11:24 PM

Ranking of leveraged exchanges in the currency circle The latest recommendations of the top ten leveraged exchanges in the currency circle

Apr 21, 2025 pm 11:24 PM

The platforms that have outstanding performance in leveraged trading, security and user experience in 2025 are: 1. OKX, suitable for high-frequency traders, providing up to 100 times leverage; 2. Binance, suitable for multi-currency traders around the world, providing 125 times high leverage; 3. Gate.io, suitable for professional derivatives players, providing 100 times leverage; 4. Bitget, suitable for novices and social traders, providing up to 100 times leverage; 5. Kraken, suitable for steady investors, providing 5 times leverage; 6. Bybit, suitable for altcoin explorers, providing 20 times leverage; 7. KuCoin, suitable for low-cost traders, providing 10 times leverage; 8. Bitfinex, suitable for senior play

What are the hybrid blockchain trading platforms?

Apr 21, 2025 pm 11:36 PM

What are the hybrid blockchain trading platforms?

Apr 21, 2025 pm 11:36 PM

Suggestions for choosing a cryptocurrency exchange: 1. For liquidity requirements, priority is Binance, Gate.io or OKX, because of its order depth and strong volatility resistance. 2. Compliance and security, Coinbase, Kraken and Gemini have strict regulatory endorsement. 3. Innovative functions, KuCoin's soft staking and Bybit's derivative design are suitable for advanced users.

A list of special services for major virtual currency trading platforms

Apr 22, 2025 am 08:09 AM

A list of special services for major virtual currency trading platforms

Apr 22, 2025 am 08:09 AM

Institutional investors should choose compliant platforms such as Coinbase Pro and Genesis Trading, focusing on cold storage ratios and audit transparency; retail investors should choose large platforms such as Binance and Huobi, focusing on user experience and security; users in compliance-sensitive areas can conduct fiat currency trading through Circle Trade and Huobi Global, and mainland Chinese users need to go through compliant over-the-counter channels.

okx online okx exchange official website online

Apr 22, 2025 am 06:45 AM

okx online okx exchange official website online

Apr 22, 2025 am 06:45 AM

The detailed introduction of OKX Exchange is as follows: 1) Development history: Founded in 2017 and renamed OKX in 2022; 2) Headquartered in Seychelles; 3) Business scope covers a variety of trading products and supports more than 350 cryptocurrencies; 4) Users are spread across more than 200 countries, with tens of millions of users; 5) Multiple security measures are adopted to protect user assets; 6) Transaction fees are based on the market maker model, and the fee rate decreases with the increase in trading volume; 7) It has won many honors, such as "Cryptocurrency Exchange of the Year".