Use Python to make a house price prediction gadget!

Hello, everyone.

This is a case of housing price prediction, which comes from the Kaggle website. It is the first competition question for many algorithm beginners.

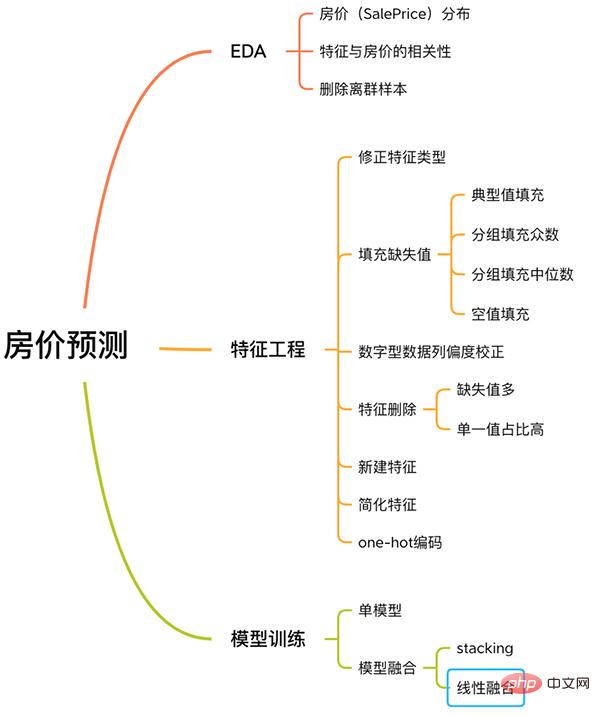

This case has a complete process for solving machine learning problems, including EDA, feature engineering, model training, model fusion, etc.

House Price Prediction Process

Follow me and learn about this case.

No long words, no redundant code, just simple explanations.

1. EDA

The purpose of Exploratory Data Analysis (EDA) is to give us a full understanding of the data set. At this step, the content we explore is as follows:

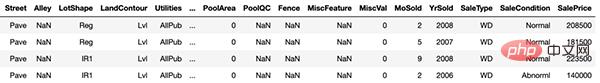

train = pd.read_csv('./data/train.csv')

test = pd.read_csv('./data/test.csv')

Copy after login

train = pd.read_csv('./data/train.csv')

test = pd.read_csv('./data/test.csv')

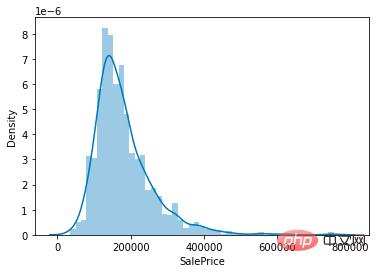

sns.distplot(train['SalePrice']);

# 计算列之间相关性

corrmat = train.corr()

# 取 top10

k = 10

cols = corrmat.nlargest(k, 'SalePrice')['SalePrice'].index

# 绘图

cm = np.corrcoef(train[cols].values.T)

sns.set(font_scale=1.25)

hm = sns.heatmap(cm, cbar=True, annot=True, square=True, fmt='.2f', annot_kws={'size': 10}, yticklabels=cols.values, xticklabels=cols.values)

plt.show()

# 获取数值型特征 numeric_features = train.dtypes[train.dtypes != 'object'].index # 计算每个特征的离群样本 for feature in numeric_features: outs = detect_outliers(train[feature], train['SalePrice'],top=5, plot=False) all_outliers.extend(outs) # 输出离群次数最多的样本 print(Counter(all_outliers).most_common()) # 剔除离群样本 train = train.drop(train.index[outliers])

y = train.SalePrice.reset_index(drop=True) train_features = train.drop(['SalePrice'], axis=1) test_features = test features = pd.concat([train_features, test_features]).reset_index(drop=True)

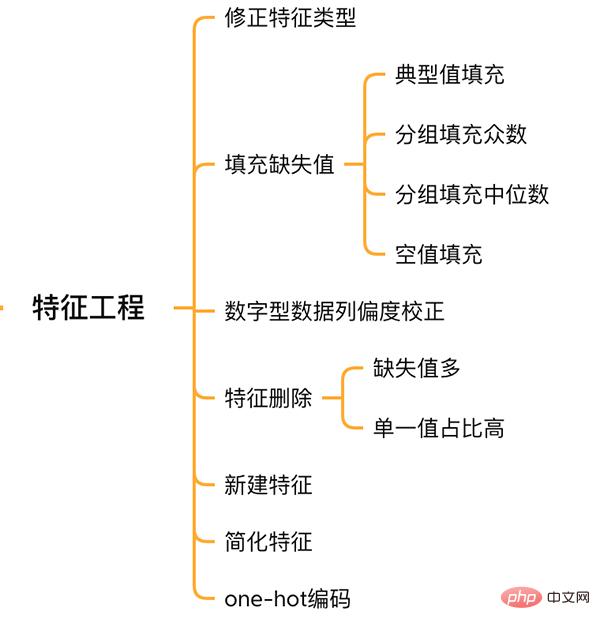

##Feature Engineering

##Feature Engineering

2.1 Correction feature type

MSSubClass (house type), YrSold (Sales year) and MoSold (Sales month) are categorical features, but they are represented by numbers, and they need to be converted into text features.

features['MSSubClass'] = features['MSSubClass'].apply(str) features['YrSold'] = features['YrSold'].astype(str) features['MoSold'] = features['MoSold'].astype(str)

2.2 Filling missing values in features

There is no unified standard for filling missing values. It is necessary to decide how to fill in based on different features.

# Functional:文档提供了典型值 Typ

features['Functional'] = features['Functional'].fillna('Typ') #Typ 是典型值

# 分组填充需要按照相似的特征分组,取众数或中位数

# MSZoning(房屋区域)按照 MSSubClass(房屋)类型分组填充众数

features['MSZoning'] = features.groupby('MSSubClass')['MSZoning'].transform(lambda x: x.fillna(x.mode()[0]))

#LotFrontage(到接到举例)按Neighborhood分组填充中位数

features['LotFrontage'] = features.groupby('Neighborhood')['LotFrontage'].transform(lambda x: x.fillna(x.median()))

# 车库相关的数值型特征,空代表无,使用0填充空值。

for col in ('GarageYrBlt', 'GarageArea', 'GarageCars'):

features[col] = features[col].fillna(0)

2.3 Skewness Correction

Similar to exploring the SalePrice column, features with high skewness are smoothed.

# skew()方法,计算特征的偏度(skewness)。 skew_features = features[numeric_features].apply(lambda x: skew(x)).sort_values(ascending=False) # 取偏度大于 0.15 的特征 high_skew = skew_features[skew_features > 0.15] skew_index = high_skew.index # 处理高偏度特征,将其转化为正态分布,也可以使用简单的log变换 for i in skew_index: features[i] = boxcox1p(features[i], boxcox_normmax(features[i] + 1))

2.4 Feature deletion and addition

Features that are almost all missing values or have a high proportion of single values (99.94%) can be deleted directly.

features = features.drop(['Utilities', 'Street', 'PoolQC',], axis=1)

At the same time, multiple features can be fused to generate new features.

Sometimes it is difficult for the model to learn the relationship between features. Manual fusion of features can reduce the learning difficulty of the model and improve the effect.

# 将原施工日期和改造日期融合 features['YrBltAndRemod']=features['YearBuilt']+features['YearRemodAdd'] # 将地下室面积、1楼、2楼面积融合 features['TotalSF']=features['TotalBsmtSF'] + features['1stFlrSF'] + features['2ndFlrSF']

It can be found that the features we fuse are all features that are strongly related to SalePrice.

Finally simplify the features, and perform 01 processing on features with monotonous distribution (for example: 99 out of 100 data have a value of 0.9, and the other one has a value of 0.1).

features['haspool'] = features['PoolArea'].apply(lambda x: 1 if x > 0 else 0) features['has2ndfloor'] = features['2ndFlrSF'].apply(lambda x: 1 if x > 0 else 0)

2.6 生成最终训练数据

到这里特征工程就做完了, 我们需要从features中将训练集和测试集重新分离出来,构造最终的训练数据。

X = features.iloc[:len(y), :] X_sub = features.iloc[len(y):, :] X = np.array(X.copy()) y = np.array(y) X_sub = np.array(X_sub.copy())

三. 模型训练

因为SalePrice是数值型且是连续的,所以需要训练一个回归模型。

3.1 单一模型

首先以岭回归(Ridge) 为例,构造一个k折交叉验证模型。

from sklearn.linear_model import RidgeCV from sklearn.pipeline import make_pipeline from sklearn.model_selection import KFold kfolds = KFold(n_splits=10, shuffle=True, random_state=42) alphas_alt = [14.5, 14.6, 14.7, 14.8, 14.9, 15, 15.1, 15.2, 15.3, 15.4, 15.5] ridge = make_pipeline(RobustScaler(), RidgeCV(alphas=alphas_alt, cv=kfolds))

岭回归模型有一个超参数alpha,而RidgeCV的参数名是alphas,代表输入一个超参数alpha数组。在拟合模型时,会从alpha数组中选择表现较好某个取值。

由于现在只有一个模型,无法确定岭回归是不是最佳模型。所以我们可以找一些出场率高的模型多试试。

# lasso lasso = make_pipeline( RobustScaler(), LassoCV(max_iter=1e7, alphas=alphas2, random_state=42, cv=kfolds)) #elastic net elasticnet = make_pipeline( RobustScaler(), ElasticNetCV(max_iter=1e7, alphas=e_alphas, cv=kfolds, l1_ratio=e_l1ratio)) #svm svr = make_pipeline(RobustScaler(), SVR( C=20, epsilon=0.008, gamma=0.0003, )) #GradientBoosting(展开到一阶导数) gbr = GradientBoostingRegressor(...) #lightgbm lightgbm = LGBMRegressor(...) #xgboost(展开到二阶导数) xgboost = XGBRegressor(...)

有了多个模型,我们可以再定义一个得分函数,对模型评分。

#模型评分函数 def cv_rmse(model, X=X): rmse = np.sqrt(-cross_val_score(model, X, y, scoring="neg_mean_squared_error", cv=kfolds)) return (rmse)

以岭回归为例,计算模型得分。

score = cv_rmse(ridge)

print("Ridge score: {:.4f} ({:.4f})n".format(score.mean(), score.std()), datetime.now(), ) #0.1024

运行其他模型发现得分都差不多。

这时候我们可以任选一个模型,拟合,预测,提交训练结果。还是以岭回归为例

# 训练模型

ridge.fit(X, y)

# 模型预测

submission.iloc[:,1] = np.floor(np.expm1(ridge.predict(X_sub)))

# 输出测试结果

submission = pd.read_csv("./data/sample_submission.csv")

submission.to_csv("submission_single.csv", index=False)

submission_single.csv是岭回归预测的房价,我们可以把这个结果上传到 Kaggle 网站查看结果的得分和排名。

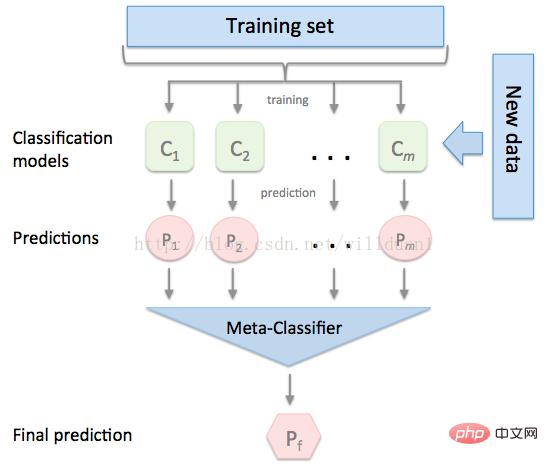

3.2 模型融合-stacking

有时候为了发挥多个模型的作用,我们会将多个模型融合,这种方式又被称为集成学习。

stacking 是一种常见的集成学习方法。简单来说,它会定义个元模型,其他模型的输出作为元模型的输入特征,元模型的输出将作为最终的预测结果。

stacking

这里,我们用mlextend库中的StackingCVRegressor模块,对模型做stacking。

stack_gen = StackingCVRegressor( regressors=(ridge, lasso, elasticnet, gbr, xgboost, lightgbm), meta_regressor=xgboost, use_features_in_secondary=True)

训练、预测的过程与上面一样,这里不再赘述。

3.3 模型融合-线性融合

多模型线性融合的思想很简单,给每个模型分配一个权重(权重加和=1),最终的预测结果取各模型的加权平均值。

# 训练单个模型 ridge_model_full_data = ridge.fit(X, y) lasso_model_full_data = lasso.fit(X, y) elastic_model_full_data = elasticnet.fit(X, y) gbr_model_full_data = gbr.fit(X, y) xgb_model_full_data = xgboost.fit(X, y) lgb_model_full_data = lightgbm.fit(X, y) svr_model_full_data = svr.fit(X, y) models = [ ridge_model_full_data, lasso_model_full_data, elastic_model_full_data, gbr_model_full_data, xgb_model_full_data, lgb_model_full_data, svr_model_full_data, stack_gen_model ] # 分配模型权重 public_coefs = [0.1, 0.1, 0.1, 0.1, 0.15, 0.1, 0.1, 0.25] # 线性融合,取加权平均 def linear_blend_models_predict(data_x,models,coefs, bias): tmp=[model.predict(data_x) for model in models] tmp = [c*d for c,d in zip(coefs,tmp)] pres=np.array(tmp).swapaxes(0,1) pres=np.sum(pres,axis=1) return pres

到这里,房价预测的案例我们就讲解完了,大家可以自己运行一下,看看不同方式训练出来的模型效果。

回顾整个案例会发现,我们在数据预处理和特征工程上花费了很大心思,虽然机器学习问题模型原理比较难学,但实际过程中往往特征工程花费的心思最多。

The above is the detailed content of Use Python to make a house price prediction gadget!. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

What are the free market viewing software websites? Ranking of the top ten free market viewing software in the currency circle

Apr 22, 2025 am 10:57 AM

What are the free market viewing software websites? Ranking of the top ten free market viewing software in the currency circle

Apr 22, 2025 am 10:57 AM

The top three top ten free market viewing software in the currency circle are OKX, Binance and gate.io. 1. OKX provides a simple interface and real-time data, supporting a variety of charts and market analysis. 2. Binance has powerful functions, accurate data, and is suitable for all kinds of traders. 3. gate.io is known for its stability and comprehensiveness, and is suitable for long-term and short-term investors.

Meme Coin Exchange Ranking Meme Coin Main Exchange Top 10 Spots

Apr 22, 2025 am 09:57 AM

Meme Coin Exchange Ranking Meme Coin Main Exchange Top 10 Spots

Apr 22, 2025 am 09:57 AM

The most suitable platforms for trading Meme coins include: 1. Binance, the world's largest, with high liquidity and low handling fees; 2. OkX, an efficient trading engine, supporting a variety of Meme coins; 3. XBIT, decentralized, supporting cross-chain trading; 4. Redim (Solana DEX), low cost, combined with Serum order book; 5. PancakeSwap (BSC DEX), low transaction fees and fast speed; 6. Orca (Solana DEX), user experience optimization; 7. Coinbase, high security, suitable for beginners; 8. Huobi, well-known in Asia, rich trading pairs; 9. DEXRabbit, intelligent

Reliable and easy-to-use virtual currency exchange app recommendations The latest ranking of the top ten exchanges in the currency circle

Apr 22, 2025 pm 01:21 PM

Reliable and easy-to-use virtual currency exchange app recommendations The latest ranking of the top ten exchanges in the currency circle

Apr 22, 2025 pm 01:21 PM

The reliable and easy-to-use virtual currency exchange apps are: 1. Binance, 2. OKX, 3. Gate.io, 4. Coinbase, 5. Kraken, 6. Huobi Global, 7. Bitfinex, 8. KuCoin, 9. Bittrex, 10. Poloniex. These platforms were selected as the best for their transaction volume, user experience and security, and all offer registration, verification, deposit, withdrawal and transaction operations.

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

Cryptocurrency data platforms suitable for beginners include CoinMarketCap and non-small trumpet. 1. CoinMarketCap provides global real-time price, market value, and trading volume rankings for novice and basic analysis needs. 2. The non-small quotation provides a Chinese-friendly interface, suitable for Chinese users to quickly screen low-risk potential projects.

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

When choosing a digital currency trading platform suitable for beginners, you need to consider security, ease of use, educational resources and cost transparency: 1. Priority is given to platforms that provide cold storage, two-factor verification and asset insurance; 2. Apps with a simple interface and clear operation are more suitable for beginners; 3. The platform should provide learning tools such as tutorials and market analysis; 4. Pay attention to hidden costs such as transaction fees and cash withdrawal fees.

What are the digital currency trading platforms in 2025? The latest rankings of the top ten digital currency apps

Apr 22, 2025 pm 03:09 PM

What are the digital currency trading platforms in 2025? The latest rankings of the top ten digital currency apps

Apr 22, 2025 pm 03:09 PM

Recommended apps for the top ten virtual currency viewing platforms: 1. OKX, 2. Binance, 3. Gate.io, 4. Huobi, 5. Coinbase, 6. Kraken, 7. Bitfinex, 8. KuCoin, 9. Bybit, 10. Bitstamp, these platforms provide real-time market trends, technical analysis tools and user-friendly interfaces to help investors make effective market analysis and trading decisions.

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

The top ten digital virtual currency apps are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

Recommended top 10 for easy access to digital currency trading apps (latest ranking in 25)

Apr 22, 2025 am 07:45 AM

Recommended top 10 for easy access to digital currency trading apps (latest ranking in 25)

Apr 22, 2025 am 07:45 AM

The core advantage of gate.io (global version) is that the interface is minimalist, supports Chinese, and the fiat currency trading process is intuitive; Binance (simplified version) has the highest global trading volume, and the simple version model only retains spot trading; OKX (Hong Kong version) has the simple version of the interface is simple, supports Cantonese/Mandarin, and has a low threshold for derivative trading; Huobi Global Station (Hong Kong version) has the core advantage of being an old exchange, launches a meta-universe trading terminal; KuCoin (Chinese Community Edition) has the core advantage of supporting 800 currencies, and the interface adopts WeChat interaction; Kraken (Hong Kong version) has the core advantage of being an old American exchange, holding a Hong Kong SVF license, and the interface is simple; HashKey Exchange (Hong Kong licensed) has the core advantage of being a well-known licensed exchange in Hong Kong, supporting France