web3.0

web3.0

Warning for losing all your money! 90% of people have been hit by the five major signs of contract liquidation in 2025!

Warning for losing all your money! 90% of people have been hit by the five major signs of contract liquidation in 2025!

Warning for losing all your money! 90% of people have been hit by the five major signs of contract liquidation in 2025!

In the cryptocurrency market, contract trading has attracted much attention for its high leverage and high yields. However, high returns are often accompanied by high risks. Many investors suffered heavy losses in contract trading. This article will discuss in detail the five major signs of contract liquidation in 2025 to help investors better avoid risks in trading.

2025 Global Security Exchange Recommendation

- Ouyi OKX:

- Binance Binance:

- Gate.io Sesame Opening:

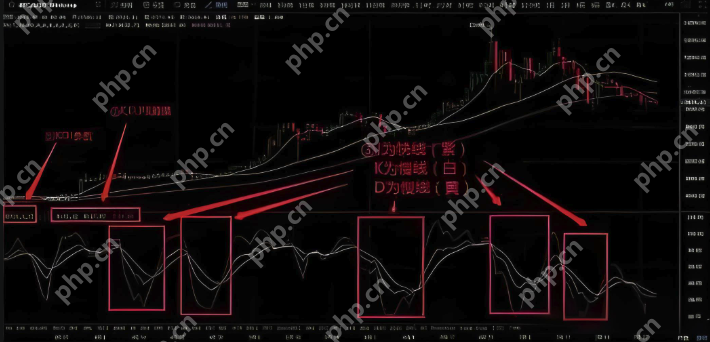

Sign 1: The market fluctuates violently

Severe market volatility is the primary sign of contract liquidation. The cryptocurrency market is already full of uncertainty, with frequent and large price fluctuations. When the market fluctuates violently, investors with positions face a sharp increase in risks, especially when high leverage is used.

For example, the price of Bitcoin fell from $50,000 to $40,000 in a short period of time, and this severe price fluctuation can easily lead to contract liquidation. Investors should pay close attention to market trends before trading and set stop loss points reasonably to reduce the risk of liquidation.

Sign 2: Use of leverage too much

Excessive use of leverage is another important sign that contract liquidation is caused. In order to pursue higher returns, many investors choose to use high leverage. However, the higher the leverage, the greater the risk. Once the market moves opposite to expectations, the possibility of a liquidation will increase greatly.

For example, if an investor uses 100 times leverage to trade, the market price needs to fluctuate by only 1% and the investor's position may face a redundant position. Therefore, investors should be cautious when choosing leverage and use leverage reasonably based on their own risk tolerance.

Sign 3: Improper position management

Improper position management is also one of the common reasons for contract liquidation. Many investors lack effective position management strategies when trading, resulting in unreasonable allocation of funds and the risks are concentrated on a few transactions.

For example, an investor invests all his funds in a contract, and once the contract is in liquidation, all funds will be lost. The correct approach is to diversify investment, allocate funds reasonably, and set reasonable stop-profit and stop-loss points to ensure that even if one position is in liquidated, other positions can still maintain profits or losses controllable.

Sign 4: Emotional trading

Emotional trading is another important factor that leads to contract liquidation. Many investors are susceptible to market sentiment during the trading process and make irrational decisions. Fear and greed often cause investors to enter or leave the market at the wrong time, thereby increasing the risk of liquidation.

For example, when the market is panic selling, investors may choose to stop loss and leave the market because of fear, and end up missing the subsequent rebound opportunity. On the contrary, when the market is in a bull market, investors may ignore risks due to greed, resulting in excessive positions and eventually breaking their positions. Therefore, investors should remain rational when trading and avoid emotional decisions.

Symptom Five: Lack of risk management

Lack of risk management is the last important sign of contract liquidation. Many investors do not develop effective risk management strategies when entering the contract trading market, which leads to off-guard when facing market fluctuations.

Effective risk management includes setting stop loss points, rational use of leverage, diversification of investment and other measures. Investors should formulate detailed risk management plans before trading and strictly implement them to ensure that losses can be stopped in time when there are adverse changes in the market and reduce losses.

FAQ

Q1: How to judge whether the market is in a period of severe volatility?

A1: To determine whether the market is in a period of severe fluctuations, you can observe it through the following aspects:

- Price fluctuation range : Observe the recent price fluctuation range. If the price fluctuates significantly in a short period of time, it may indicate that the market is in a period of severe fluctuation.

- Changes in trading volume : A sudden increase or decrease in trading volume may also indicate changes in market sentiment, resulting in price fluctuations.

- Market sentiment indicators : Some market sentiment indicators, such as the fear and greed index, can help investors understand market sentiment and judge whether the market is in a period of severe volatility.

Q2: What risk management measures can be taken when using high leverage trading?

A2: When using high leverage trading, the following risk management measures can be taken:

- Set a stop loss point : Before entering the trading, set a reasonable stop loss point to prevent adverse market changes from causing a position explosion.

- Diversified investment : Spread funds into multiple different contracts to avoid concentrating all funds on one transaction.

- Reduce the leverage multiple : According to your own risk tolerance, appropriately reduce the leverage multiple and reduce the risk of liquidation.

- Regular evaluation : Regularly evaluate your trading strategies and positions, make timely adjustments, and ensure that risks are controllable.

Q3: How to avoid emotional trading?

A3: To avoid emotional trading, the following measures can be taken:

- Formulate a trading plan : Develop a detailed trading plan before trading, including entry points, exit points, stop-profit and stop-loss points, etc., strictly follow the plan to avoid being affected by market sentiment.

- Stay rational : Stay calm and rational in the trading process and avoid making irrational decisions due to fear or greed.

- Use automated trading tools : Using automated trading tools can help investors reduce the impact of emotional trading and ensure the execution of trading strategies.

Q4: What are the effective risk management strategies?

A4: An effective risk management strategy includes the following aspects:

- Set Stop Loss Point : Set a reasonable stop loss point in each transaction to control the losses of a single transaction.

- Use leverage reasonably : Choose leverage multiple reasonably based on your own risk tolerance to avoid excessive use of leverage.

- Diversified investment : Spread funds into multiple different assets or contracts, reducing the risk of a single asset or contract.

- Regular evaluation and adjustment : Regularly evaluate your trading strategies and positions, adjust in a timely manner according to market changes, and ensure that risks are controllable.

The above is the detailed content of Warning for losing all your money! 90% of people have been hit by the five major signs of contract liquidation in 2025!. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1664

1664

14

14

1422

1422

52

52

1316

1316

25

25

1268

1268

29

29

1240

1240

24

24

The TOP5 of the safest exchanges in 2025: Black U's guide to avoid pits, the rule of 100% of funds to save lives

May 08, 2025 pm 08:27 PM

The TOP5 of the safest exchanges in 2025: Black U's guide to avoid pits, the rule of 100% of funds to save lives

May 08, 2025 pm 08:27 PM

In the field of cryptocurrency trading, the security of exchanges has always been the focus of users. In 2025, after years of development and evolution, some exchanges stand out with their outstanding security measures and user experience. This article will introduce the five most secure exchanges in 2025 and provide practical guides on how to avoid Black U (hacker attacks users) to ensure your funds are 100% secure.

How to register in the ok exchange in China? ok trading platform registration and use guide for beginners in mainland China

May 08, 2025 pm 10:51 PM

How to register in the ok exchange in China? ok trading platform registration and use guide for beginners in mainland China

May 08, 2025 pm 10:51 PM

In the cryptocurrency market, choosing a reliable trading platform is crucial. As a world-renowned digital asset exchange, the OK trading platform has attracted a large number of novice users in mainland China. This guide will introduce in detail how to register and use it on the OK trading platform to help novice users get started quickly.

Guide to 'picking money' in the 2025 currency circle: Learn to leverage in contracts in 5 minutes and earn 100,000 a day!

May 08, 2025 pm 08:39 PM

Guide to 'picking money' in the 2025 currency circle: Learn to leverage in contracts in 5 minutes and earn 100,000 a day!

May 08, 2025 pm 08:39 PM

Contract leveraged trading is a common trading method in the currency circle, which allows traders to trade larger amounts with less funds. By using leverage, traders can amplify their profit potential, but also increase risks. Leverage is usually expressed in multiples, for example, 10 times leverage means that you can trade 10 Bitcoin contracts with margin of 1 Bitcoin.

Detailed Guide to Installation and Registration of Binance Binance Exchange (2025 Latest Steps)

May 08, 2025 pm 11:06 PM

Detailed Guide to Installation and Registration of Binance Binance Exchange (2025 Latest Steps)

May 08, 2025 pm 11:06 PM

Binance is one of the world's leading cryptocurrency trading platforms, providing trading services for a variety of digital assets. If you are considering using Binance for cryptocurrency trading, this article will provide you with a detailed installation and registration guide.

TOP10 futures trading platforms: Perpetual contracts and options trading

May 08, 2025 pm 07:12 PM

TOP10 futures trading platforms: Perpetual contracts and options trading

May 08, 2025 pm 07:12 PM

In the cryptocurrency market, futures trading platforms play an important role, especially in perpetual contracts and options trading. Here are the top ten highly respected futures trading platforms in the market, and provide detailed introduction to their characteristics and advantages in perpetual contract and option trading.

Ethereum (ETH) Market Analysis and Trading Strategy: May 8, 2025

May 08, 2025 pm 08:12 PM

Ethereum (ETH) Market Analysis and Trading Strategy: May 8, 2025

May 08, 2025 pm 08:12 PM

Ethereum's current market profile and short-term trading strategy

Top 10 cryptocurrency app exchanges 2025 reliable currency trading platform app inventory points

May 08, 2025 pm 10:21 PM

Top 10 cryptocurrency app exchanges 2025 reliable currency trading platform app inventory points

May 08, 2025 pm 10:21 PM

The top ten cryptocurrency exchange apps are: 1. Binance, 2. OKX, 3. Huobi, 4. Coinbase, 5. Kraken, 6. Bybit, 7. KuCoin, 8. Gemini, 9. Bitstamp, 10. Crypto.com. Each platform has its own unique advantages and features, and users can conduct cryptocurrency transactions by downloading apps, registering and completing verification, depositing, selecting transaction pairs and confirming transactions.

Top 10 cryptocurrency platforms in the world that support multi-chain transactions are authoritatively released in 2025

May 08, 2025 pm 07:15 PM

Top 10 cryptocurrency platforms in the world that support multi-chain transactions are authoritatively released in 2025

May 08, 2025 pm 07:15 PM

According to the latest evaluations and industry trends from authoritative institutions in 2025, the following are the top ten cryptocurrency platforms in the world that support multi-chain transactions, combining transaction volume, technological innovation, compliance and user reputation comprehensive analysis: