Bitcoin Surges to $62K as BlackRock Primes the Crypto Market for a Major Move

The bitcoin price has climbed to over $62,000 per bitcoin, with traders now turning to a China "shock and awe" earthquake

Bitcoin price suddenly surged higher following the Federal Reserve's first post-pandemic interest rate cut that could send the bitcoin price "skyrocketing."

The bitcoin price climbed to over $62,000 per bitcoin, with traders now turning to a China "shock and awe" earthquake. The Fed surprised traders with a 50 basis point cut, kicking off what's expected to be a fresh liquidity cycle that could put the bitcoin and crypto market on the "cusp" of a major move.

Now, as fears swirl the U.S. dollar is on "the verge of a total collapse," the world's largest asset manager BlackRock has warned of "growing concerns" around the spiraling $35 trillion U.S. debt pile that's predicted to drive "institutional interest in bitcoin."

Today’s NYT ‘Strands’ Hints, Spangram And Answers For Sunday, September 22

Could Comet A3 Be Visible In Daylight And The Brightest For 100 Years?

Kathryn Crosby, Actress And Widow Of Bing Crosby, Dies At 90

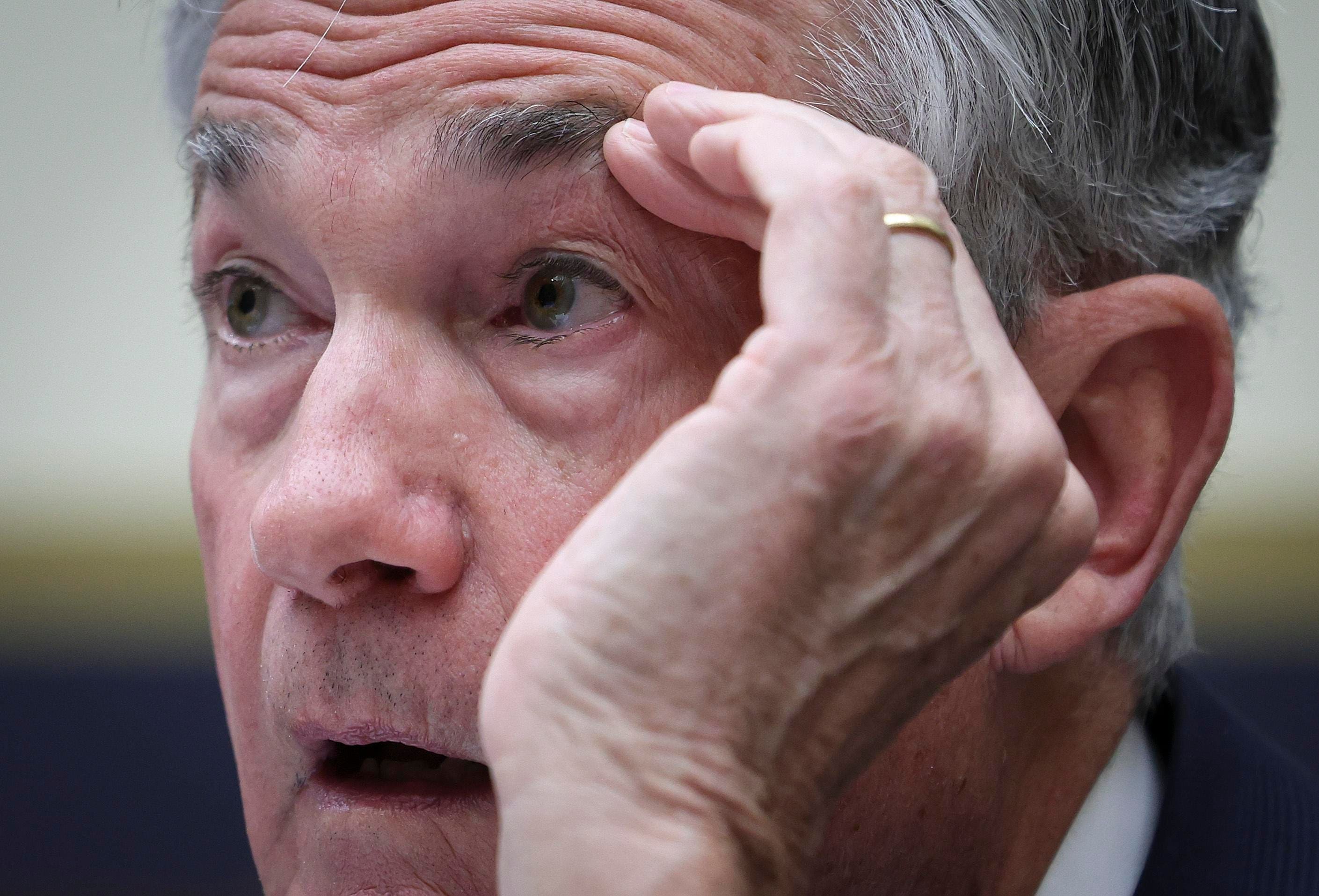

Federal Reserve chair Jerome Powell has this week announced the first post-pandemic interest rate ... [+] cut, sending the bitcoin price sharply higher as BlackRock primes the crypto market for a major move.

"The growing concerns in the U.S. and abroad over the state of U.S. federal deficits and debt has increased the appeal of potential alternative reserve assets as a potential hedge against possible future events affecting the U.S. dollar," BlackRock's exchange-traded fund (ETF) chief investment officer, its head of crypto and its head of fixed income global macro wrote in a paper outlining the investment case for bitcoin.

"This is why some have called bitcoin the 2nd amendment of money," Bloomberg Intelligence ETF analyst Eric Balchunas posted to X, adding the U.S. debt pile of $35 trillion that's growing at a clip of $1 trillion every 100 days has "no end in sight."

"This dynamic appears to be also taking hold in other countries where debt accumulation has been significant," the authors of the BlackRock paper added. "In our experience with clients to date, this explains a substantial portion of the recent broadening institutional interest in bitcoin."

The above is the detailed content of Bitcoin Surges to $62K as BlackRock Primes the Crypto Market for a Major Move. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

BlackRock's Larry Fink on what's really driving Bitcoin: 'I truly don't believe it's a function of regulation'

Oct 19, 2024 am 07:34 AM

BlackRock's Larry Fink on what's really driving Bitcoin: 'I truly don't believe it's a function of regulation'

Oct 19, 2024 am 07:34 AM

It doesn’t matter if Donald Trump or Kamala Harris wins on November 5 for that to happen, the BlackRock CEO said.

BlackRock Now Owns 2% of the Total Bitcoin (BTC) Supply

Sep 12, 2024 pm 06:43 PM

BlackRock Now Owns 2% of the Total Bitcoin (BTC) Supply

Sep 12, 2024 pm 06:43 PM

This happened eight months after the launch of its spot Bitcoin exchange-traded fund (ETF).

Rexas Finance (RXS) Token Could Skyrocket as BlackRock Considers Transitioning from Bitcoin to Ethereum

Oct 25, 2024 pm 07:12 PM

Rexas Finance (RXS) Token Could Skyrocket as BlackRock Considers Transitioning from Bitcoin to Ethereum

Oct 25, 2024 pm 07:12 PM

BlackRock's possible transition from Bitcoin to Ethereum may very well be the shifting factor that ignites a new altcoin season which will in turn enable projects

Nasdaq and NYSE Withdraw Bitcoin ETF Options Proposals, But Interest Remains

Aug 17, 2024 am 03:30 AM

Nasdaq and NYSE Withdraw Bitcoin ETF Options Proposals, But Interest Remains

Aug 17, 2024 am 03:30 AM

The long-awaited path to Bitcoin ETFs Options on traditional exchanges has hit yet another roadblock. Nasdaq and the New York Stock Exchange (NYSE) have unexpectedly pulled their applications to list and trade options based on two prominent Bitcoin i

BlackRock Expands Crypto Offerings as SEC Approves Bitcoin ETF Options

Sep 22, 2024 am 06:45 AM

BlackRock Expands Crypto Offerings as SEC Approves Bitcoin ETF Options

Sep 22, 2024 am 06:45 AM

The SEC has given its approval to BlackRock's 19-b4 application allowing the trading of options in its iShares Bitcoin Trust (IBIT).

Stock Trading

Sep 21, 2024 pm 03:00 PM

Stock Trading

Sep 21, 2024 pm 03:00 PM

Markets 101: An Insight into Trendlines and Momentum By - Rohit Srivastava, Founder Stock Trading Markets 102: Mastering Sentiment Indicators for Swing and Positional Trading By - Rohit Srivastava, Founder Stock Trading Market 103: Mastering Trends w

MicroStrategy ETF's Record Volume Hints Bitcoin (BTC) Price Will Rise, Mirroring Past 'Blue Years' Cycles

Aug 17, 2024 am 03:17 AM

MicroStrategy ETF's Record Volume Hints Bitcoin (BTC) Price Will Rise, Mirroring Past 'Blue Years' Cycles

Aug 17, 2024 am 03:17 AM

MicroStrategy, a major Bitcoin [BTC] player, achieved $22 million in volume on the first day of the ETF, possibly setting a record for leveraged ETFs.

BlackRock Launches iShares Ethereum Trust (ETHA) via BDR on B3 Stock Exchange in Brazil

Aug 29, 2024 am 09:46 AM

BlackRock Launches iShares Ethereum Trust (ETHA) via BDR on B3 Stock Exchange in Brazil

Aug 29, 2024 am 09:46 AM

This follows the successful introduction of BlackRock’s Bitcoin ETF (IBIT39) in the country, marking another significant step in making crypto assets