web3.0

web3.0

Comprehensive analysis of Ethena's second season points strategy! How to increase APY above 1100%

Comprehensive analysis of Ethena's second season points strategy! How to increase APY above 1100%

Comprehensive analysis of Ethena's second season points strategy! How to increase APY above 1100%

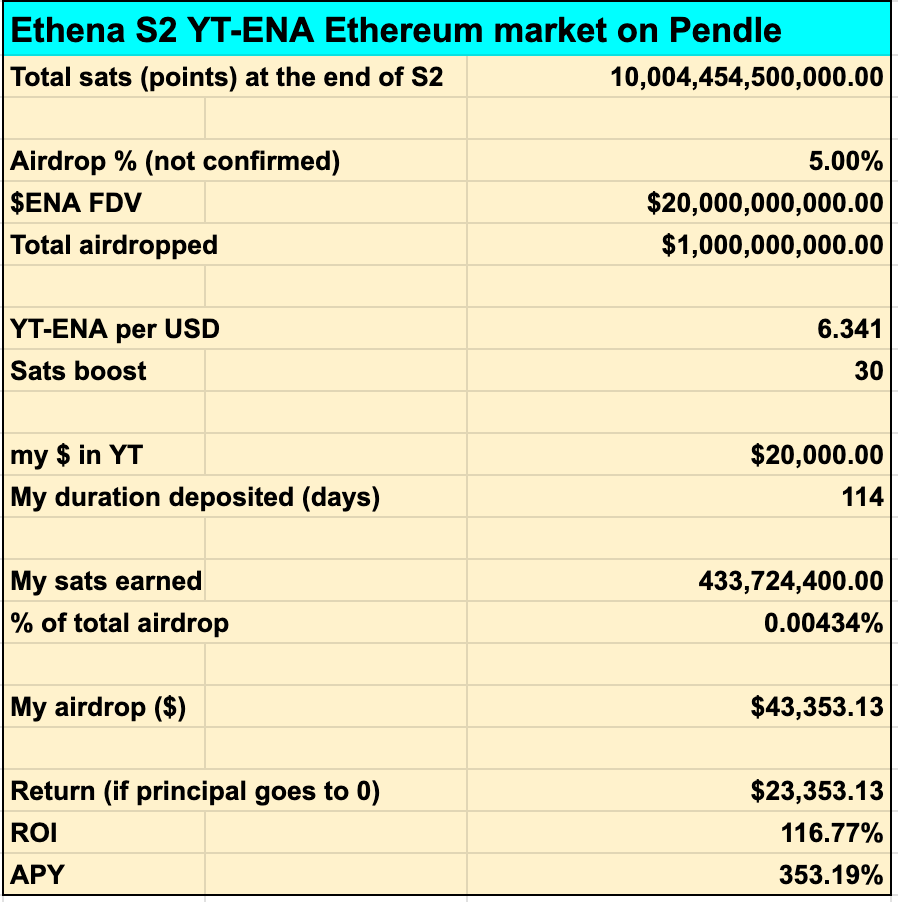

Ethena, the fastest-growing stablecoin project in recent times, updated the points (sats) bonus measures on May 4th to encourage the YT-ENA price (Implied APY) on Pendle to increase from 64% once soared to 82%, and was temporarily reported at 80% before the deadline, which shows how much the market is paying for this additional measure.

The latest point bonus measure is: users lock $ENA and can obtain 20% to 100% point bonus based on the amount of locked $ENA relative to their USDe holdings. For example, assuming you have locked $1,000 in USDe, if you lock another $200 in $ENA, you can get a 20% bonus, that is, you can get 36sats for every 1USDe per day (original 30sats multiplied by 1.2); if you lock the same amount $ENA can get up to 60x points!

In the following, we will refer to former Bankless analysts Donovan Choy and Thor's "Comprehensive Guide to Ethena Season 2" to analyze four different Ethena investment strategies and their potential returns for interested readers. Research preparation does not constitute investment advice.

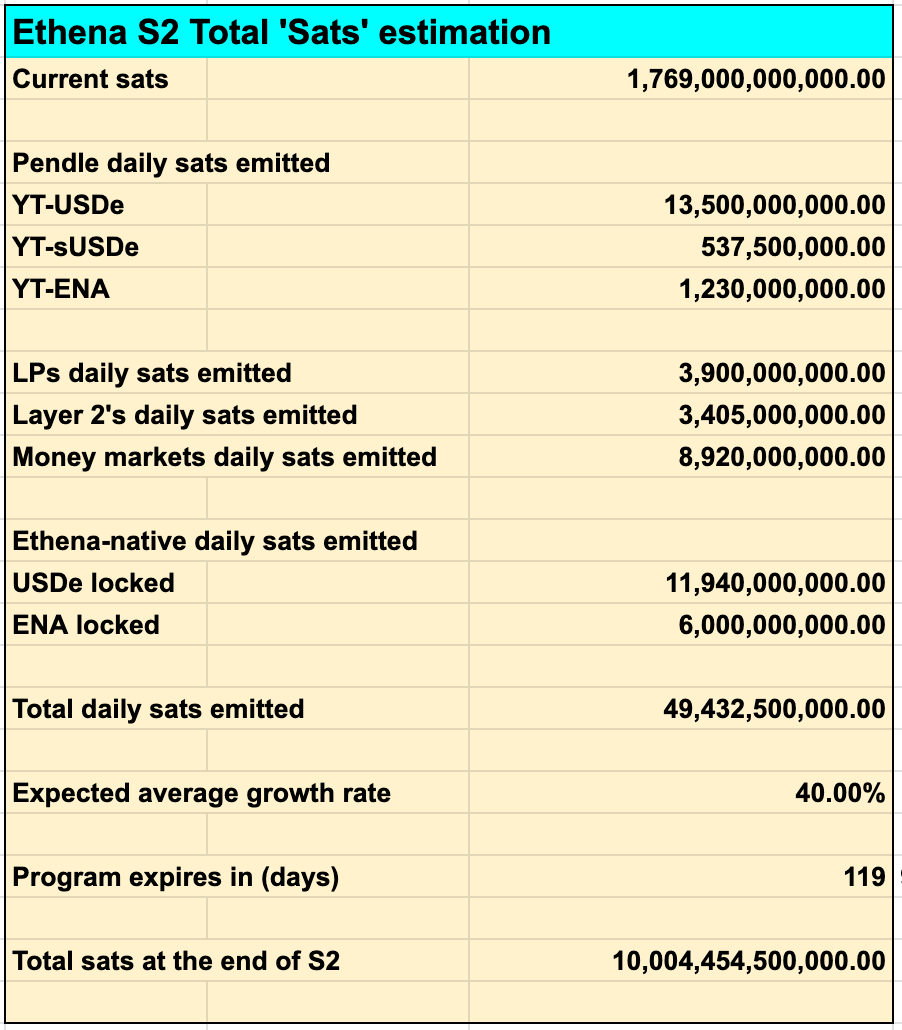

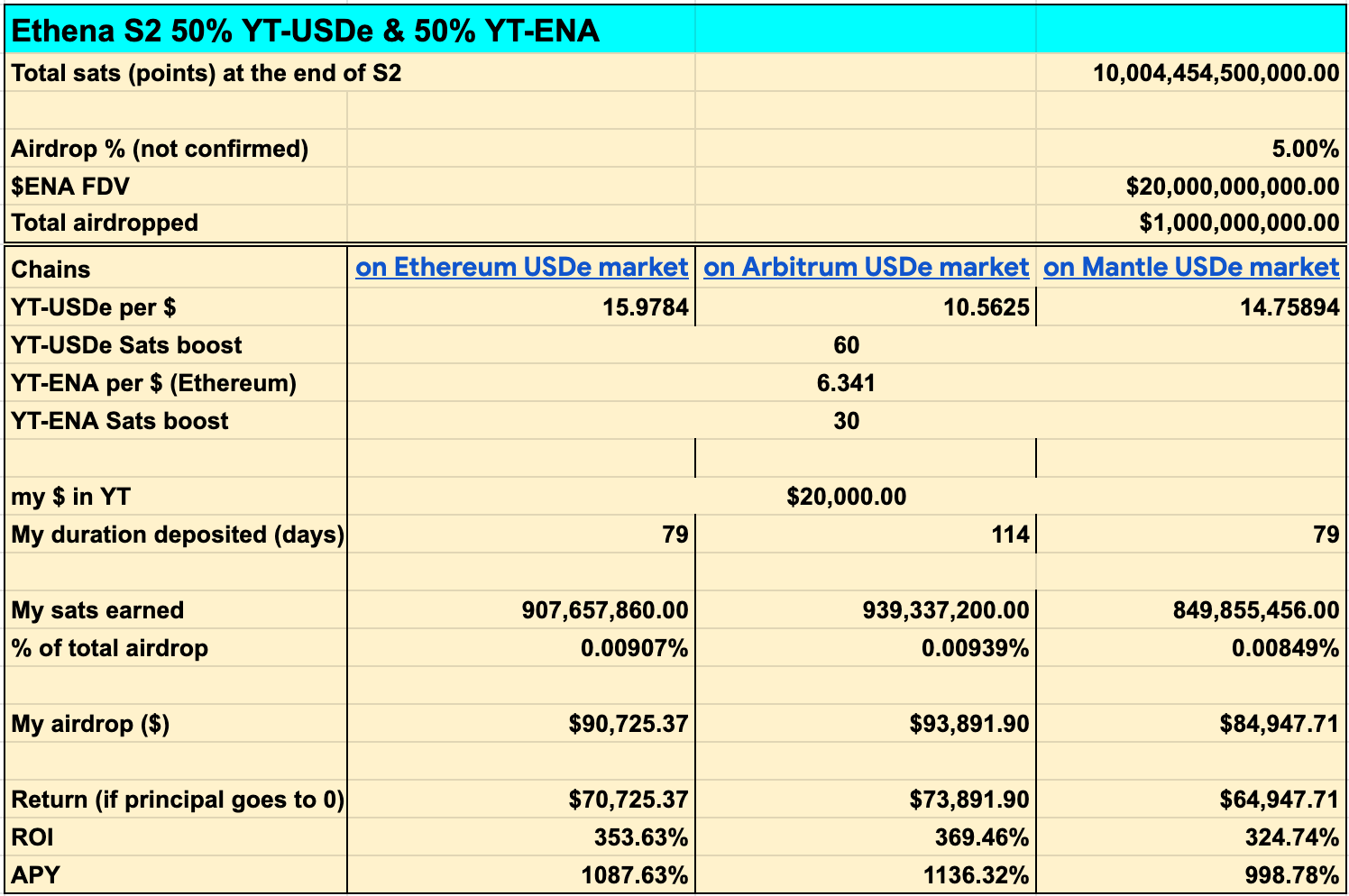

When estimating the potential returns of each strategy, we must first estimate how many sats will be distributed in total after the second quarter event ends on September 2, so as to estimate our airdrop allocation and decide which strategy can provide Best reward. According to Ethena’s official website, 1.76 trillion sats have been issued so far. Without taking into account the sats issued by USDe or ENA on the CEX wallet, according to the Choy and Thor method, it is estimated that the size of sats will reach approximately 10 trillion by the end of the second quarter event. .

In addition, we also assume that ENA’s FDV will reach US$20 billion (currently nearly US$13.8 billion), and that the airdrop allocation in the second quarter will be the same as in the first quarter, both at 5%, which means The value of the airdrop will reach $1 billion.

Estimated points scale at the end of the second quarter

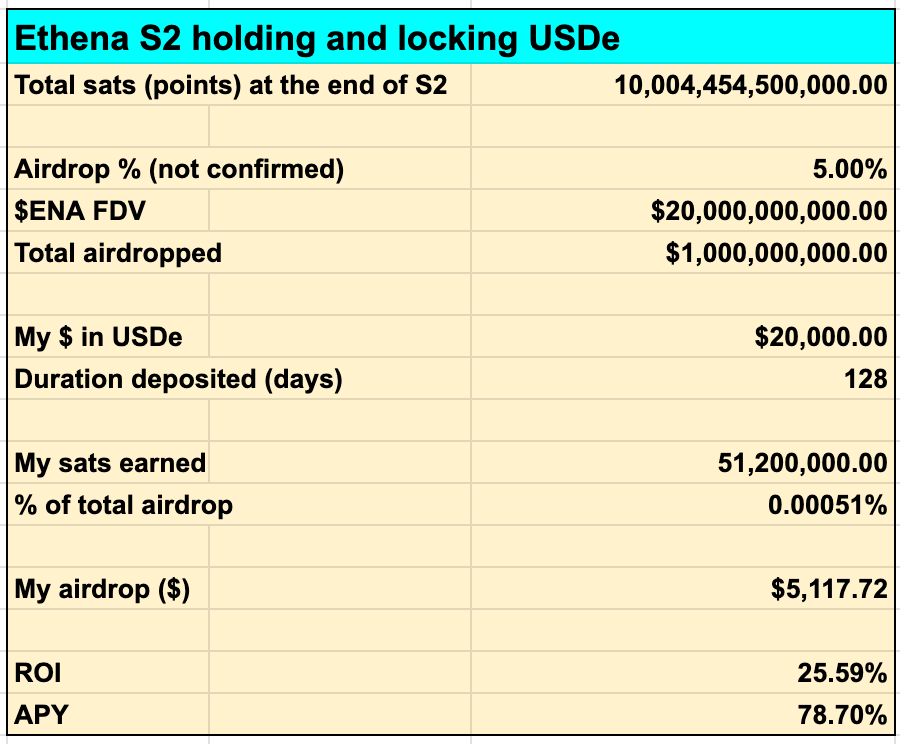

Hold and lock USDe

If you only hold and provide liquidity lock USDe, you can get 20sats for every 1USDe every day, and you will eventually get 0.00051% airdrop allocation, which is an income of 5,117 US dollars, which will be an investment return rate of 25.59% (or an annualized rate of return of 72.45%).

The following table does not take into account the additional 20% points bonus that can be obtained by using OKX, Binance, Bybit and Bitget Web3 wallets. Therefore, if you want to adopt this strategy, you may as well use the above CEX wallet to lock USDe and you will be able to get Higher returns.

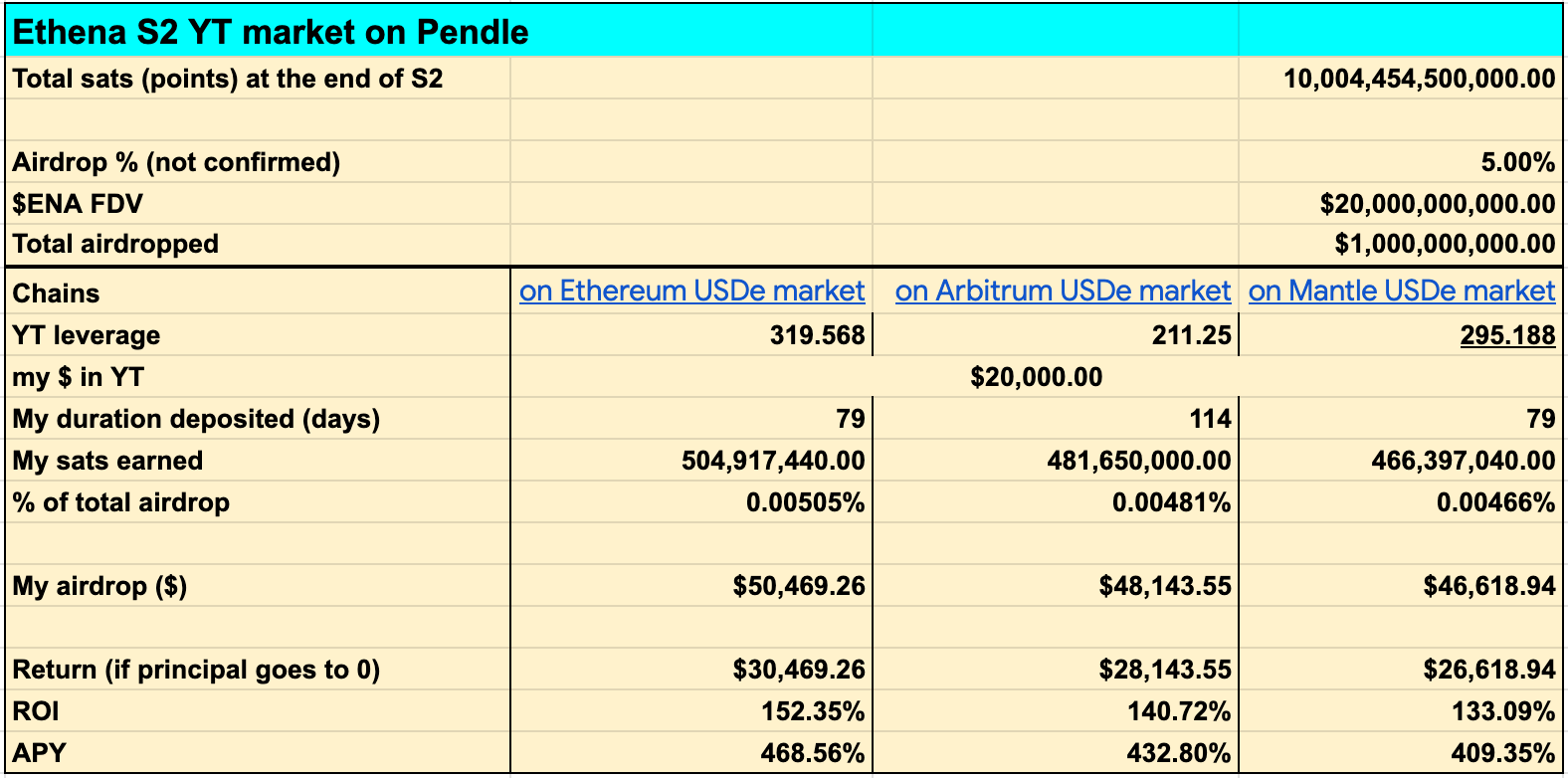

Invest in Pendle YT-USDe

Following the previous article, taking the liquidity re-pledge protocol Renzo as an example, we will introduce the trial calculation method of the return rate of investing in Pendle YT Finally, the same concept applies to investing in other YT products. Pendle has USDe markets in Ethereum (expires on 7/29), Arbitrum (expires on 8/29) and Mantle (expires on 7/29), and you can also get 20sats per 1USDe every day. The following table compares the return rate of investing in YT-USDe on these three chains. It can be observed that the APY of each chain is significantly ahead of the first strategy by 78.7%. In particular, the Ethereum mainnet has the highest return rate of US$20,000. At the cost, the airdrop profit can reach US$50,469, with a return rate as high as 468.56%.

It is worth noting that Mantle also enjoys an additional 0.019 EigenLayer points for every 1USDe due to its Mantle Rewards Station plan. This is an additional benefit not taken into account in the table below.

This article explores Ethena’s four strategies for the second quarter through detailed calculation of return rates. On the one hand, it provides readers with a comprehensive guide to participate in the Ethena second quarter point activity, and on the other hand, it enhances investors’ confidence and decision-making in investing in YT. Base. In addition, the Excel spreadsheet of Choy and Thor is also attached. Interested readers can modify the relevant assumptions after copying it as in this article.

It should be noted that under the new points bonus measure, the inflation of points may be more serious, which may dilute the airdrop allocation obtained by the above strategy. In addition, on-chain operating costs and ENA price performance are also key considerations.

Today, Ethereum L2 Mode also announced that USDe and sUSDe will be introduced in the second quarter point activity. Readers who are interested in Ethena can pay attention to it, and there may also be potential investment opportunities.

The above is the detailed content of Comprehensive analysis of Ethena's second season points strategy! How to increase APY above 1100%. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

When choosing a digital currency trading platform suitable for beginners, you need to consider security, ease of use, educational resources and cost transparency: 1. Priority is given to platforms that provide cold storage, two-factor verification and asset insurance; 2. Apps with a simple interface and clear operation are more suitable for beginners; 3. The platform should provide learning tools such as tutorials and market analysis; 4. Pay attention to hidden costs such as transaction fees and cash withdrawal fees.

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

The top ten digital virtual currency apps are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

A list of special services for major virtual currency trading platforms

Apr 22, 2025 am 08:09 AM

A list of special services for major virtual currency trading platforms

Apr 22, 2025 am 08:09 AM

Institutional investors should choose compliant platforms such as Coinbase Pro and Genesis Trading, focusing on cold storage ratios and audit transparency; retail investors should choose large platforms such as Binance and Huobi, focusing on user experience and security; users in compliance-sensitive areas can conduct fiat currency trading through Circle Trade and Huobi Global, and mainland Chinese users need to go through compliant over-the-counter channels.

A list of top ten virtual currency trading platforms that support multiple currencies

Apr 22, 2025 am 08:15 AM

A list of top ten virtual currency trading platforms that support multiple currencies

Apr 22, 2025 am 08:15 AM

Priority is given to compliant platforms such as OKX and Coinbase, enabling multi-factor verification, and asset self-custody can reduce dependencies: 1. Select an exchange with a regulated license; 2. Turn on the whitelist of 2FA and withdrawals; 3. Use a hardware wallet or a platform that supports self-custody.

Top 10 latest releases of virtual currency trading platforms for bulk transactions

Apr 22, 2025 am 08:18 AM

Top 10 latest releases of virtual currency trading platforms for bulk transactions

Apr 22, 2025 am 08:18 AM

The following factors should be considered when choosing a bulk trading platform: 1. Liquidity: Priority is given to platforms with an average daily trading volume of more than US$5 billion. 2. Compliance: Check whether the platform holds licenses such as FinCEN in the United States, MiCA in the European Union. 3. Security: Cold wallet storage ratio and insurance mechanism are key indicators. 4. Service capability: Whether to provide exclusive account managers and customized transaction tools.

Top 10 digital currency exchanges Top 10 digital currency app exchanges

Apr 22, 2025 pm 03:15 PM

Top 10 digital currency exchanges Top 10 digital currency app exchanges

Apr 22, 2025 pm 03:15 PM

The top ten digital currency exchanges are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

What is on-chain transaction? What are the global transactions?

Apr 22, 2025 am 10:06 AM

What is on-chain transaction? What are the global transactions?

Apr 22, 2025 am 10:06 AM

EU MiCA compliance certification, covering 50 fiat currency channels, cold storage ratio 95%, and zero security incident records. The US SEC licensed platform has convenient direct purchase of fiat currency, a ratio of 98% cold storage, institutional-level liquidity, supports large-scale OTC and custom orders, and multi-level clearing protection.

Top 10 digital virtual currency trading app rankings Top 10 digital currency exchange rankings in 2025

Apr 22, 2025 pm 02:45 PM

Top 10 digital virtual currency trading app rankings Top 10 digital currency exchange rankings in 2025

Apr 22, 2025 pm 02:45 PM

The top ten digital currency exchanges are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.