web3.0

web3.0

Tether made $6.2 billion last year! USDT scale has grown by more than 60% since the beginning of the year

Tether made $6.2 billion last year! USDT scale has grown by more than 60% since the beginning of the year

Tether made $6.2 billion last year! USDT scale has grown by more than 60% since the beginning of the year

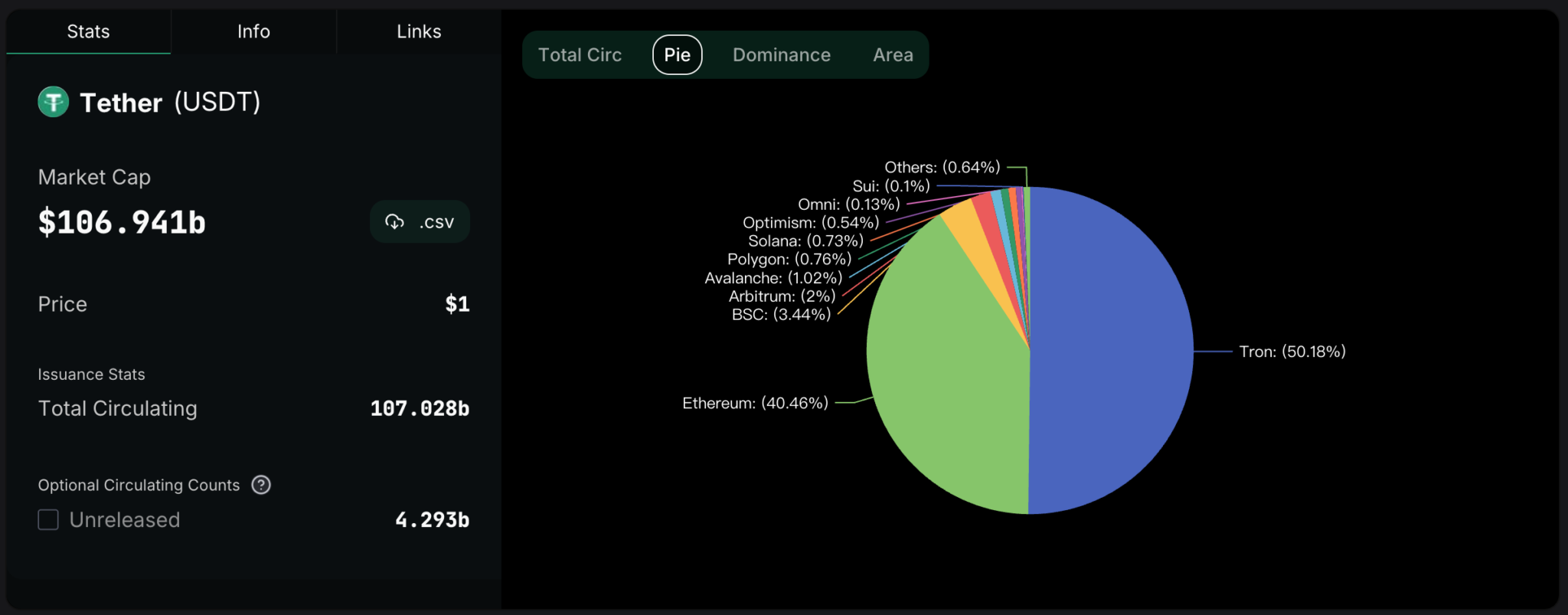

USDT, the leader in the stablecoin market, currently has a market capitalization of over US$107 billion. Its issuer Tether also achieved a net profit of US$2.85 billion in the fourth quarter of last year, setting a record high. , and accumulated a record high excess reserves of US$5.4 billion in the quarter.

Tether’s outstanding financial performance attracted the attention of Bitwise President Teddy Fusaro. Yesterday (8), he cited Maelstrom’s data and pointed out that Tether will achieve a net profit of US$6.2 billion in 2023, which is equivalent to 78% of Goldman Sachs’ net profit of $7.9 billion, and 72% of Morgan Stanley’s net profit of $8.5 billion. Fusaro specifically pointed out: But Tether has only about 100 employees, while Goldman Sachs and Morgan Stanley have 49,000 and 82,000 employees respectively.

This shows that Tether’s net profit per employee is approximately US$62 million, far exceeding Goldman Sachs’s US$160,000 and Morgan Stanley’s US$100,000 net profit per employee.

USDT’s scale has grown by over 60% year-to-date

As the scale of USDT continues to expand, Tether is expected to achieve stronger financial results this year. According to the latest data from DeFiLlama, the total circulating supply of USDT has exceeded the US$107 billion mark, an astonishing increase of US$40.75 billion or 61.5% compared to US$66.25 billion at the beginning of the year.

Among various blockchain networks, the circulation of USDT is dominated by Tron, accounting for more than 50% of the overall circulation, followed by Ethereum, which accounts for 40.46%. BSC and Arbitrum hold 3.44% and 2% shares respectively.

USDT’s proportion of circulation in each chain

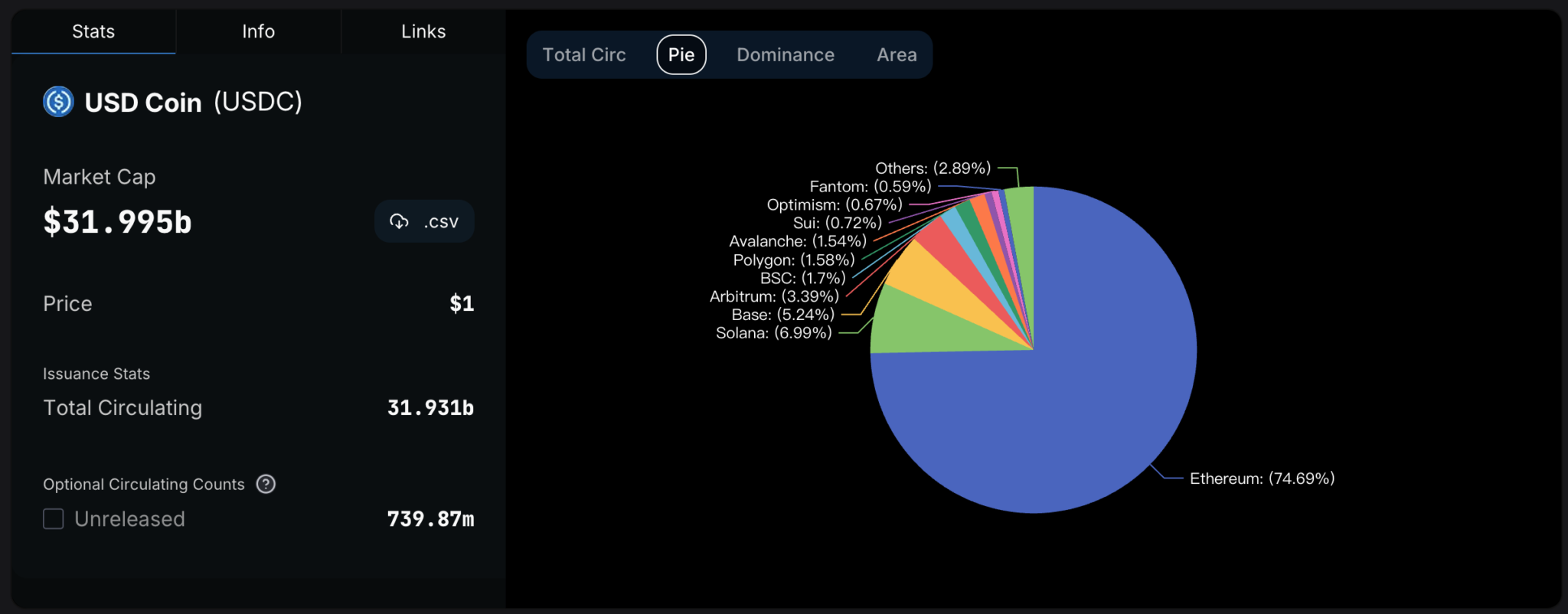

The second largest stable currency USDC has also expanded significantly this year. According to the latest data from DeFiLlama, the total circulating supply of USDC The volume reached nearly US$32 billion, a significant increase of US$8.14 billion or 34% compared with US$23.86 billion at the beginning of the year. In addition, USDC is mainly circulated in Ethereum, accounting for nearly 75%, followed by Solana, Base and Arbitrum, accounting for approximately 7%, 5.24% and 3.4% respectively.

USDC’s proportion of circulation in each chain

10x Research: Stablecoin supply growth is the key driver of the bull market, surpassing ETF capital inflows

The size of stablecoins is often seen as a key measure of cryptocurrency market liquidity. When the issuance of stablecoins continues to increase, it often means that the market is attracting new capital inflows, which is a positive sign for the formation of a bull market.

According to the latest weekly report from 10x Research, the supply of USDT and USDC has increased by a total of US$10 billion in the past 30 days, which is more than twice the inflow of Bitcoin ETF funds during the same period. The agency emphasized that compared with the inflow of funds into Bitcoin ETFs, the increase in the supply of stable coins may more accurately reflect the demand conditions of the crypto market.

The above is the detailed content of Tether made $6.2 billion last year! USDT scale has grown by more than 60% since the beginning of the year. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1662

1662

14

14

1418

1418

52

52

1311

1311

25

25

1261

1261

29

29

1234

1234

24

24

What currency does Ripple (XRP currency) belong to? Detailed tutorial for beginners

Apr 28, 2025 pm 07:57 PM

What currency does Ripple (XRP currency) belong to? Detailed tutorial for beginners

Apr 28, 2025 pm 07:57 PM

Created by Ripple, Ripple is used for cross-border payments, which are fast and low-cost and suitable for small transaction payments. After registering a wallet and exchange, purchase and storage can be made.

How much is Bitcoin worth

Apr 28, 2025 pm 07:42 PM

How much is Bitcoin worth

Apr 28, 2025 pm 07:42 PM

Bitcoin’s price ranges from $20,000 to $30,000. 1. Bitcoin’s price has fluctuated dramatically since 2009, reaching nearly $20,000 in 2017 and nearly $60,000 in 2021. 2. Prices are affected by factors such as market demand, supply, and macroeconomic environment. 3. Get real-time prices through exchanges, mobile apps and websites. 4. Bitcoin price is highly volatile, driven by market sentiment and external factors. 5. It has a certain relationship with traditional financial markets and is affected by global stock markets, the strength of the US dollar, etc. 6. The long-term trend is bullish, but risks need to be assessed with caution.

Which of the top ten currency trading platforms in the world are among the top ten currency trading platforms in 2025

Apr 28, 2025 pm 08:12 PM

Which of the top ten currency trading platforms in the world are among the top ten currency trading platforms in 2025

Apr 28, 2025 pm 08:12 PM

The top ten cryptocurrency exchanges in the world in 2025 include Binance, OKX, Gate.io, Coinbase, Kraken, Huobi, Bitfinex, KuCoin, Bittrex and Poloniex, all of which are known for their high trading volume and security.

Sesame Open Door Official Website Entrance Sesame Open Door Official Latest Entrance 2025

Apr 28, 2025 pm 07:51 PM

Sesame Open Door Official Website Entrance Sesame Open Door Official Latest Entrance 2025

Apr 28, 2025 pm 07:51 PM

Sesame Open Door is a platform that focuses on cryptocurrency trading. Users can obtain portals through official websites or social media to ensure that the authenticity of SSL certificates and website content is verified during access.

What are the top currency trading platforms? The top 10 latest virtual currency exchanges

Apr 28, 2025 pm 08:06 PM

What are the top currency trading platforms? The top 10 latest virtual currency exchanges

Apr 28, 2025 pm 08:06 PM

Currently ranked among the top ten virtual currency exchanges: 1. Binance, 2. OKX, 3. Gate.io, 4. Coin library, 5. Siren, 6. Huobi Global Station, 7. Bybit, 8. Kucoin, 9. Bitcoin, 10. bit stamp.

Which of the top ten currency trading platforms in the world are the latest version of the top ten currency trading platforms

Apr 28, 2025 pm 08:09 PM

Which of the top ten currency trading platforms in the world are the latest version of the top ten currency trading platforms

Apr 28, 2025 pm 08:09 PM

The top ten cryptocurrency trading platforms in the world include Binance, OKX, Gate.io, Coinbase, Kraken, Huobi Global, Bitfinex, Bittrex, KuCoin and Poloniex, all of which provide a variety of trading methods and powerful security measures.

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

The top ten digital currency exchanges such as Binance, OKX, gate.io have improved their systems, efficient diversified transactions and strict security measures.

Binance official website entrance Binance official latest entrance 2025

Apr 28, 2025 pm 07:54 PM

Binance official website entrance Binance official latest entrance 2025

Apr 28, 2025 pm 07:54 PM

Visit Binance official website and check HTTPS and green lock logos to avoid phishing websites, and official applications can also be accessed safely.