web3.0

web3.0

How Will Expiration of $2 Billion in Bitcoin and Ethereum Options Impact Crypto Markets?

How Will Expiration of $2 Billion in Bitcoin and Ethereum Options Impact Crypto Markets?

How Will Expiration of $2 Billion in Bitcoin and Ethereum Options Impact Crypto Markets?

Brief:

•18,000 BTC and 270,000 ETH options contracts expiring on April 5th.

•The total value of these expiring options contracts exceeds $2 billion.

•Options traders are becoming increasingly bearish as BTC falls below $70,000.

The market is paying attention to the price volatility and impact of the upcoming expiration of Bitcoin (BTC) and Ethereum (ETH) options contracts. With more than $2 billion in Bitcoin and Ethereum options contracts set to expire on April 5, the market is focused on the price volatility and impact of the two largest cryptocurrencies by market capitalization.

It is reported that the nominal values of Bitcoin and Ethereum options contracts are US$1.2 billion and US$890 million respectively.

Will this expiration trigger increased market volatility and impact the prices of the two largest cryptocurrencies by market capitalization?

Shorts Dominate Cryptocurrency Options Market

Options traders are becoming increasingly bearish as Bitcoin prices fall below $70,000. Options allow traders to buy or sell an asset at a specific price on a specific date, a feature that provides flexibility to the holder. Unlike futures, options holders are under no obligation to buy or sell.

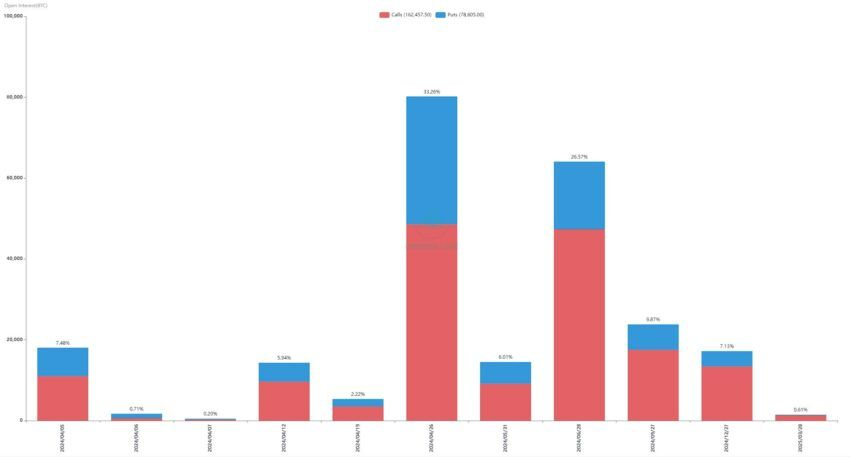

According to data from Greeks.live, Bitcoin’s put/call ratio is currently 0.64, and the maximum pain point price is $68,000, which means that this price may cause the largest number of holders to suffer significant financial losses. Likewise, Ethereum has a put/call ratio of 0.8 and its maximum pain point is $3,400.

Bitcoin Put Ratio | Source: Greeks.live

Analysts pointed out that the crypto market had a weak week, with the $70,000 mark ending in victory for short-term short sellers, while selling call options became the top trade of the week, with implied volatility (IVs) across all major tenors. dropped significantly.

This week has been quite rough for Bitcoin, with the price failing to stay above $70,000 and falling below $65,000. As of now, Bitcoin is trading at around $67,500.

Ethereum has shown similar dynamics, with the price falling below $3,250 earlier this week. In addition, analysts said that Bitcoin has received emotional support after the halving, while other cryptocurrencies have entered a short-term bear market, ETF inflows have also slowed recently, and the market is digesting the premium of ETFs.

Market performance on many contract expiration dates is difficult to predict, especially if there are events that affect the background of the news. Nonetheless, traders must monitor market conditions closely to ensure that increased volatility does not lead to unexpected stop-loss orders or poor trading decisions.

However, market participants should remember that the impact of option expiration on the price of the underlying asset is short-term.

The above is the detailed content of How Will Expiration of $2 Billion in Bitcoin and Ethereum Options Impact Crypto Markets?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Bitcoin price today

Apr 28, 2025 pm 07:39 PM

Bitcoin price today

Apr 28, 2025 pm 07:39 PM

Bitcoin’s price fluctuations today are affected by many factors such as macroeconomics, policies, and market sentiment. Investors need to pay attention to technical and fundamental analysis to make informed decisions.

Which of the top ten currency trading platforms in the world are the latest version of the top ten currency trading platforms

Apr 28, 2025 pm 08:09 PM

Which of the top ten currency trading platforms in the world are the latest version of the top ten currency trading platforms

Apr 28, 2025 pm 08:09 PM

The top ten cryptocurrency trading platforms in the world include Binance, OKX, Gate.io, Coinbase, Kraken, Huobi Global, Bitfinex, Bittrex, KuCoin and Poloniex, all of which provide a variety of trading methods and powerful security measures.

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

The top ten digital currency exchanges such as Binance, OKX, gate.io have improved their systems, efficient diversified transactions and strict security measures.

What currency does Ripple (XRP currency) belong to? Detailed tutorial for beginners

Apr 28, 2025 pm 07:57 PM

What currency does Ripple (XRP currency) belong to? Detailed tutorial for beginners

Apr 28, 2025 pm 07:57 PM

Created by Ripple, Ripple is used for cross-border payments, which are fast and low-cost and suitable for small transaction payments. After registering a wallet and exchange, purchase and storage can be made.

Which of the top ten currency trading platforms in the world are among the top ten currency trading platforms in 2025

Apr 28, 2025 pm 08:12 PM

Which of the top ten currency trading platforms in the world are among the top ten currency trading platforms in 2025

Apr 28, 2025 pm 08:12 PM

The top ten cryptocurrency exchanges in the world in 2025 include Binance, OKX, Gate.io, Coinbase, Kraken, Huobi, Bitfinex, KuCoin, Bittrex and Poloniex, all of which are known for their high trading volume and security.

Download the official website of Ouyi Exchange app for Apple mobile phone

Apr 28, 2025 pm 06:57 PM

Download the official website of Ouyi Exchange app for Apple mobile phone

Apr 28, 2025 pm 06:57 PM

The Ouyi Exchange app supports downloading of Apple mobile phones, visit the official website, click the "Apple Mobile" option, obtain and install it in the App Store, register or log in to conduct cryptocurrency trading.

How much is Bitcoin worth

Apr 28, 2025 pm 07:42 PM

How much is Bitcoin worth

Apr 28, 2025 pm 07:42 PM

Bitcoin’s price ranges from $20,000 to $30,000. 1. Bitcoin’s price has fluctuated dramatically since 2009, reaching nearly $20,000 in 2017 and nearly $60,000 in 2021. 2. Prices are affected by factors such as market demand, supply, and macroeconomic environment. 3. Get real-time prices through exchanges, mobile apps and websites. 4. Bitcoin price is highly volatile, driven by market sentiment and external factors. 5. It has a certain relationship with traditional financial markets and is affected by global stock markets, the strength of the US dollar, etc. 6. The long-term trend is bullish, but risks need to be assessed with caution.

Free coins trading market software recommendations The top ten easy-to-use coins trading apps

Apr 28, 2025 pm 04:33 PM

Free coins trading market software recommendations The top ten easy-to-use coins trading apps

Apr 28, 2025 pm 04:33 PM

The top ten recommended cryptocurrency trading software are: 1. OKX, 2. Binance, 3. Coinbase, 4. KuCoin, 5. Huobi, 6. Crypto.com, 7. Kraken, 8. Bitfinex, 9. Bybit, 10. Gate.io. These apps all provide real-time market data and trading tools, suitable for users at different levels.