After TVL approaches US$1 billion, Swell Network announces it will launch L2

In March 2024, Swell Network announced that it would launch its Layer 2 rollup chain, and it is expected that the mainnet will be officially launched in the second half of this year. This Layer 2 network uses a unique "restaked rollup" framework developed by AltLayer, which is different from traditional Layer 2 designs. It is built based on Polygon's Chain Development Kit (CDK) and supported by AltLayer. The network aims to bring multiple benefits to Swell users including native re-staking benefits, better scalability and lower transaction fees. Swell’s upcoming token will be used for the governance of the network. The following is an overview of the Swell Network project.

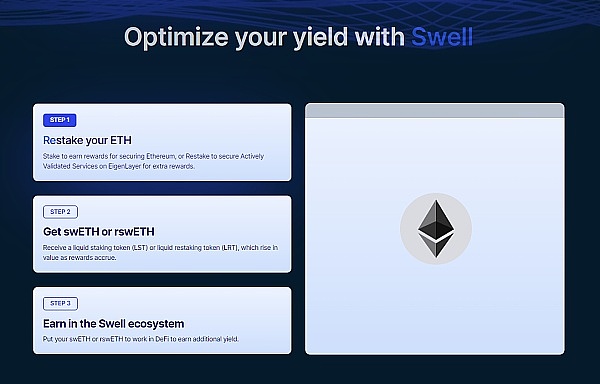

TVL is approaching $1 billion, providing users with staking income on LST or LRT

Swell Network, a leading non-custodial staking protocol, is about to launch its innovative product rswETH. Through Swell, users can continue to earn passve income by staking or re-staking ETH, which includes blockchain rewards and AVS rewards.

As a reward, users will receive yield-generating liquidity tokens (LST or LRT) that can not only be held but also participate in a wider range of DeFi ecosystem to gain additional benefits. Next we will discuss this cooperation in more detail.

Swell’s L2 solution focuses on liquid rehypothecation assets on EigenLayer based on a total value locked (TVL) of approximately $1 billion in its LST and LRT.

Different from traditional Rollup technology, Swell uses AltLayer's innovative "restaked rollup" framework and utilizes a series of active verification services (AVS) to enhance its security and decentralization. These services include decentralized ordering, verification, and accelerated transaction finality.

#Swell’s L2 network not only provides native re-staking benefits, but also brings higher scalability and lower fees to users through LRTfi’s new flywheel mechanism. These advantages are based on native staking and re-staking yields, introducing new and familiar primitives to the DeFi space. Swell’s native Gas token, rswETH, and its governance token, SWELL, were developed in collaboration with industry experts to further govern and optimize the network.

From EigenLabs to Chainlink, take a look at Swell Network’s multiple partners

In the rapid development of blockchain technology, the role of partners is crucial. The following are several key technology partners of Swell Network in advancing its Layer 2 rollup chain cooperation.

1. EigenLabs:

EigenLabs, a leading research organization, is responsible for developing EigenDA. Founded by Sreeram Kannan, EigenLabs is supported by well-known companies such as Blockchain Capital, Polychain Capital, and Ethereal Ventures, and is committed to promoting the innovation and application of blockchain technology.

AltLayer, founded in 2021, is an open and decentralized protocol that accelerates the launch of Rollup through Optimistic and ZK Rollup technology. Its flagship product "restaked rollups" has become an industry disruptor, unlocking the true potential of rollups through enhanced security, decentralization, rapid finality and interoperability. AltLayer’s replay rollup includes three vertically integrated Active Validation Services (AVS): MACH, VITAL, and SQUAD, which leverage the permissionless nature of the rollup stack and the recollateralization principle, allowing the network to borrow economic security from Ethereum.

Swell will be one of the first Rollups instances back operational, supported by three key AltLayer products: MACH (for faster finalization), VITAL (for decentralized verification) and SQUAD (for decentralized sorting). These services run as AVS, borrowing security from Ethereum through EigenLayer's re-mortgage mechanism. Built on top of the Swell protocol is a multi-chain, multi-VM compatible Rollups as a Service (RaaS) launcher that provides developers with A hassle-free platform to quickly launch custom rollups.

In response, Swell founder Daniel Dizon said that expanding Swell’s liquidity re-collateralization product to L2 is a natural step for the development of the community and DAO, which not only expands the vision of the protocol, but also provides the DeFi ecosystem with Provide a high-quality liquidity remortgage experience. AltLayer CEO Jia Yaoqi also expressed his expectations for this cooperation, believing that the introduction of restakted rollups will greatly enhance the security and decentralization of the network and bring new innovations to DeFi.

2. Polygon Labs:

Polygon Labs develops Ethereum scaling solutions for the Polygon protocol and collaborates with other ecosystem developers to provide scalable, affordable, secure and sustainable Blockchain infrastructure. The scaling solutions developed by Polygon Labs have been widely adopted, supporting tens of thousands of decentralized applications, processing 3.5 billion transactions, and have become the choice of many large Web3 projects and well-known enterprises.

3. Chainlink:

Chainlink, as an industry-standard decentralized computing platform, provides support for verifiable networks by providing access to real-world data, off-chain computing and secure cross-chain interaction. Operational access to support global financial institutions, startups and developers. Chainlink has enabled over $9 trillion in transaction value, powering verifiable applications and marketplaces across multiple industries.

The technical support and innovative cooperation of these partners provide a solid foundation for Swell Network’s Layer 2 solutions and herald significant advancements in blockchain technology in terms of security, scalability and user experience. .

Can a series of initiatives bring a better DeFi value experience to users? Swell Network’s market outlook still needs attention

In this article, we take an in-depth look at Swell Network and its latest developments in the field of blockchain technology, especially its upcoming Layer 2 solution. By working closely with industry leaders such as EigenLabs, AltLayer, Polygon Labs, and Chainlink, Swell not only demonstrates its determination to promote technological innovation, but also sets new standards for the development of the DeFi ecosystem.

Swell Network's Layer 2 solution, especially its "restaked rollups" technology, marks an important technological breakthrough that provides users with improved security, decentralization and speed of transactions. Brings unprecedented value. In addition, Swell’s technical architecture and partner support provide developers with a seamless platform to quickly launch and scale Web3 applications, whether in the NFT space, DeFi, Web3 games or the tokenization of real-world assets etc.

Just as Dolomite has gained recognition in its space through innovative and user-friendly strategies, Swell Network has set new standards for the application and popularization of blockchain technology through its Layer 2 solutions and partner network. model. Swell's vision and ambitions go far beyond that. With the continuous advancement of its technology and the expansion of its ecosystem, the future will undoubtedly bring more opportunities and possibilities to users, developers and the entire blockchain community.

In short, the progress of Swell Network is not only a technological leap, but also a clear guide to the future development direction of the DeFi ecosystem. As more protocols and applications are added, as well as the shift to DAO governance, we have reason to believe that Swell and its partners will continue to lead innovation in blockchain technology and drive the entire industry forward.

The above is the detailed content of After TVL approaches US$1 billion, Swell Network announces it will launch L2. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

The top ten digital virtual currency apps are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

When choosing a digital currency trading platform suitable for beginners, you need to consider security, ease of use, educational resources and cost transparency: 1. Priority is given to platforms that provide cold storage, two-factor verification and asset insurance; 2. Apps with a simple interface and clear operation are more suitable for beginners; 3. The platform should provide learning tools such as tutorials and market analysis; 4. Pay attention to hidden costs such as transaction fees and cash withdrawal fees.

Meme Coin Exchange Ranking Meme Coin Main Exchange Top 10 Spots

Apr 22, 2025 am 09:57 AM

Meme Coin Exchange Ranking Meme Coin Main Exchange Top 10 Spots

Apr 22, 2025 am 09:57 AM

The most suitable platforms for trading Meme coins include: 1. Binance, the world's largest, with high liquidity and low handling fees; 2. OkX, an efficient trading engine, supporting a variety of Meme coins; 3. XBIT, decentralized, supporting cross-chain trading; 4. Redim (Solana DEX), low cost, combined with Serum order book; 5. PancakeSwap (BSC DEX), low transaction fees and fast speed; 6. Orca (Solana DEX), user experience optimization; 7. Coinbase, high security, suitable for beginners; 8. Huobi, well-known in Asia, rich trading pairs; 9. DEXRabbit, intelligent

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

Cryptocurrency data platforms suitable for beginners include CoinMarketCap and non-small trumpet. 1. CoinMarketCap provides global real-time price, market value, and trading volume rankings for novice and basic analysis needs. 2. The non-small quotation provides a Chinese-friendly interface, suitable for Chinese users to quickly screen low-risk potential projects.

A list of special services for major virtual currency trading platforms

Apr 22, 2025 am 08:09 AM

A list of special services for major virtual currency trading platforms

Apr 22, 2025 am 08:09 AM

Institutional investors should choose compliant platforms such as Coinbase Pro and Genesis Trading, focusing on cold storage ratios and audit transparency; retail investors should choose large platforms such as Binance and Huobi, focusing on user experience and security; users in compliance-sensitive areas can conduct fiat currency trading through Circle Trade and Huobi Global, and mainland Chinese users need to go through compliant over-the-counter channels.

Top 10 latest releases of virtual currency trading platforms for bulk transactions

Apr 22, 2025 am 08:18 AM

Top 10 latest releases of virtual currency trading platforms for bulk transactions

Apr 22, 2025 am 08:18 AM

The following factors should be considered when choosing a bulk trading platform: 1. Liquidity: Priority is given to platforms with an average daily trading volume of more than US$5 billion. 2. Compliance: Check whether the platform holds licenses such as FinCEN in the United States, MiCA in the European Union. 3. Security: Cold wallet storage ratio and insurance mechanism are key indicators. 4. Service capability: Whether to provide exclusive account managers and customized transaction tools.

A list of top ten virtual currency trading platforms that support multiple currencies

Apr 22, 2025 am 08:15 AM

A list of top ten virtual currency trading platforms that support multiple currencies

Apr 22, 2025 am 08:15 AM

Priority is given to compliant platforms such as OKX and Coinbase, enabling multi-factor verification, and asset self-custody can reduce dependencies: 1. Select an exchange with a regulated license; 2. Turn on the whitelist of 2FA and withdrawals; 3. Use a hardware wallet or a platform that supports self-custody.

Top 10 digital currency exchanges Top 10 digital currency app exchanges

Apr 22, 2025 pm 03:15 PM

Top 10 digital currency exchanges Top 10 digital currency app exchanges

Apr 22, 2025 pm 03:15 PM

The top ten digital currency exchanges are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.