If traditional institutions enter Bitcoin, what is the appropriate position?

In the rapidly evolving world of investing, diversification has always been a key strategy for reducing risk and increasing returns. With the emergence of cryptocurrencies, especially Bitcoin, investors have found a new asset class to add to their portfolios. This article delves into the implications of incorporating Bitcoin into a traditional 60/40 stock and bond portfolio.

By taking a closer look at various numerical indicators, we dive into the impact of different Bitcoin allocation levels on overall portfolio performance, risk, and return. From gradually increasing Bitcoin holdings to large-scale inclusion of Bitcoin in investment portfolios, we reveal the subtle relationship between risk and reward in the Bitcoin investment environment.

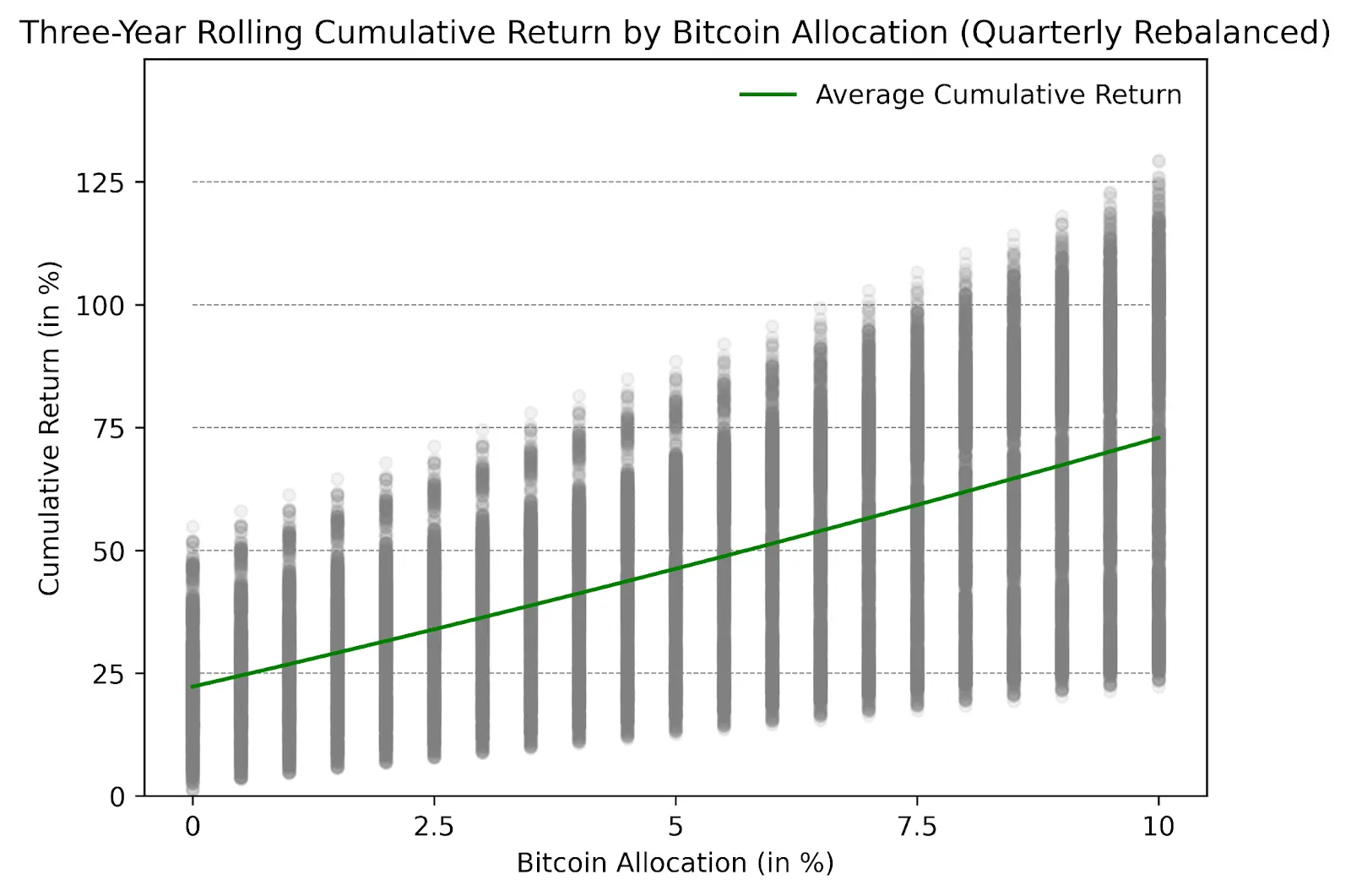

In the chart, the first column on the left shows the situation without Bitcoin in the portfolio, while subsequent columns show gradual increases in Bitcoin holdings (up to 10%) situation at the time. These columns do not change over time and simply represent the number of Bitcoins held. It is worth noting that according to historical data, as the allocation of Bitcoin increases, the return on investment will increase accordingly.

Figure 1: Three-year rolling cumulative return of Bitcoin allocation (rebalanced quarterly), Source: Cointelegraph Research

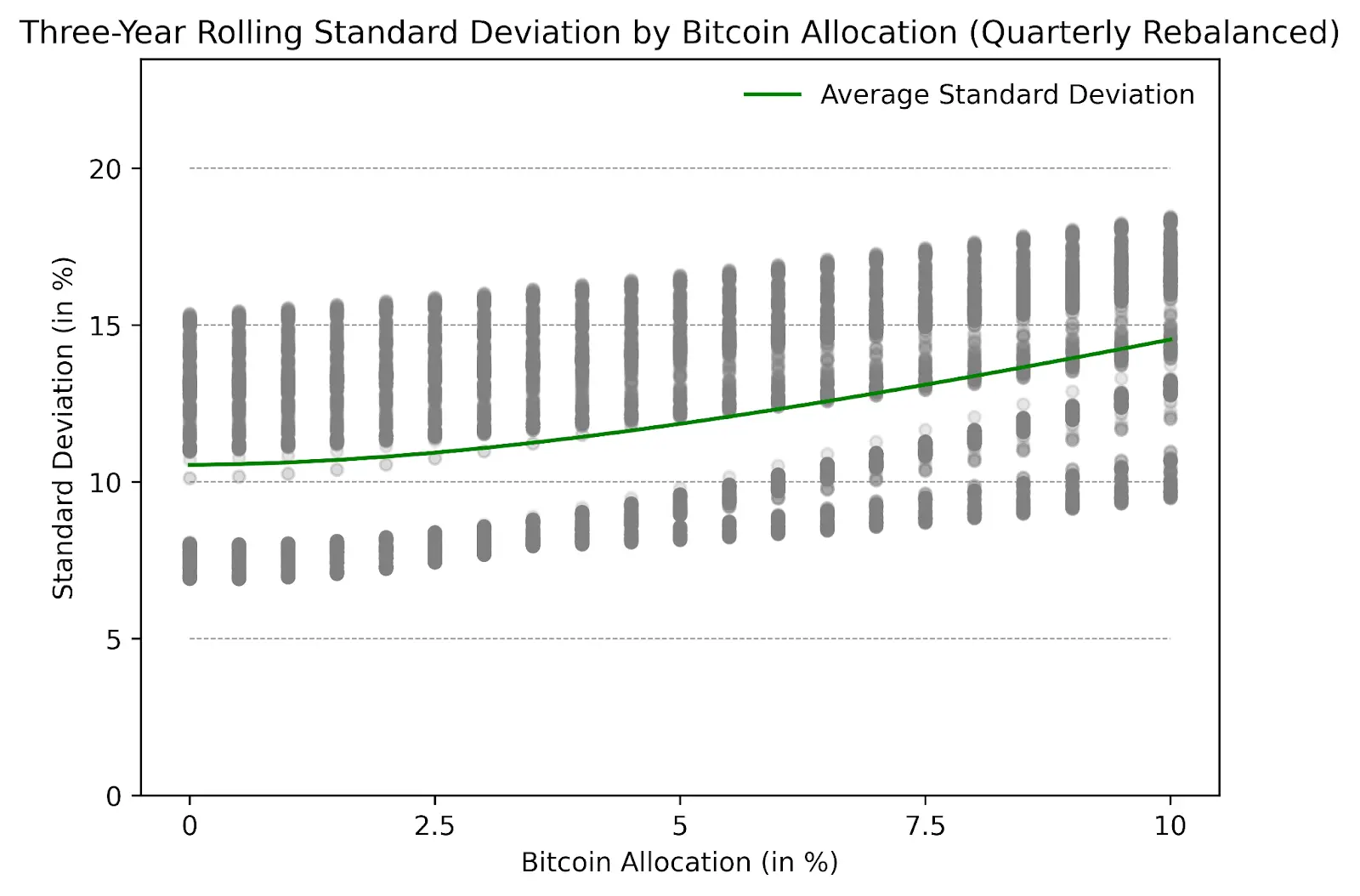

While adding Bitcoin to a 60/40 stock and bond portfolio will increase cumulative returns, there's a catch: it may also increase uncertainty and risk. Figure 2 shows the change in volatility after allocating to Bitcoin. While the risk has increased, it hasn't been in a straight line. Instead, the line has a curvature. This means that if you add just a little bit of Bitcoin, say between 0.5% and 2%, it doesn't make your investment much riskier. But as you add more Bitcoins, things quickly become unpredictable.

Figure 2: Three-year rolling standard deviation of Bitcoin allocation (rebalanced quarterly), Source: Cointelegraph Research

Figure 2: Three-year rolling standard deviation of Bitcoin allocation (rebalanced quarterly), Source: Cointelegraph Research

In Figure 3, we combine the information from Figure 1 to look at the Sharpe ratio of the portfolio. The shape of the graph is very interesting: it rises quickly at first, then levels off as you put more Bitcoin into your investment. The chart shows that when you add some Bitcoin to your investment, it usually means you will receive more returns to make up for the risk you take. But there’s no such thing as a free lunch: once you start adding more and more Bitcoins, especially after around 5% of your total investment, the increased risks outweigh the benefits. Therefore, allocating a small amount of Bitcoin may help, but after a certain point, the cost of allocating more Bitcoins is significantly increased risk. Based on historical returns and mean-variance optimization, the optimal proportion of Bitcoin to add to a portfolio is between 3% and 5%.

Figure 3: Three-year rolling Sharpe ratio of Bitcoin allocations (rebalanced quarterly), Source: Cointelegraph Research

Figure 3: Three-year rolling Sharpe ratio of Bitcoin allocations (rebalanced quarterly), Source: Cointelegraph Research

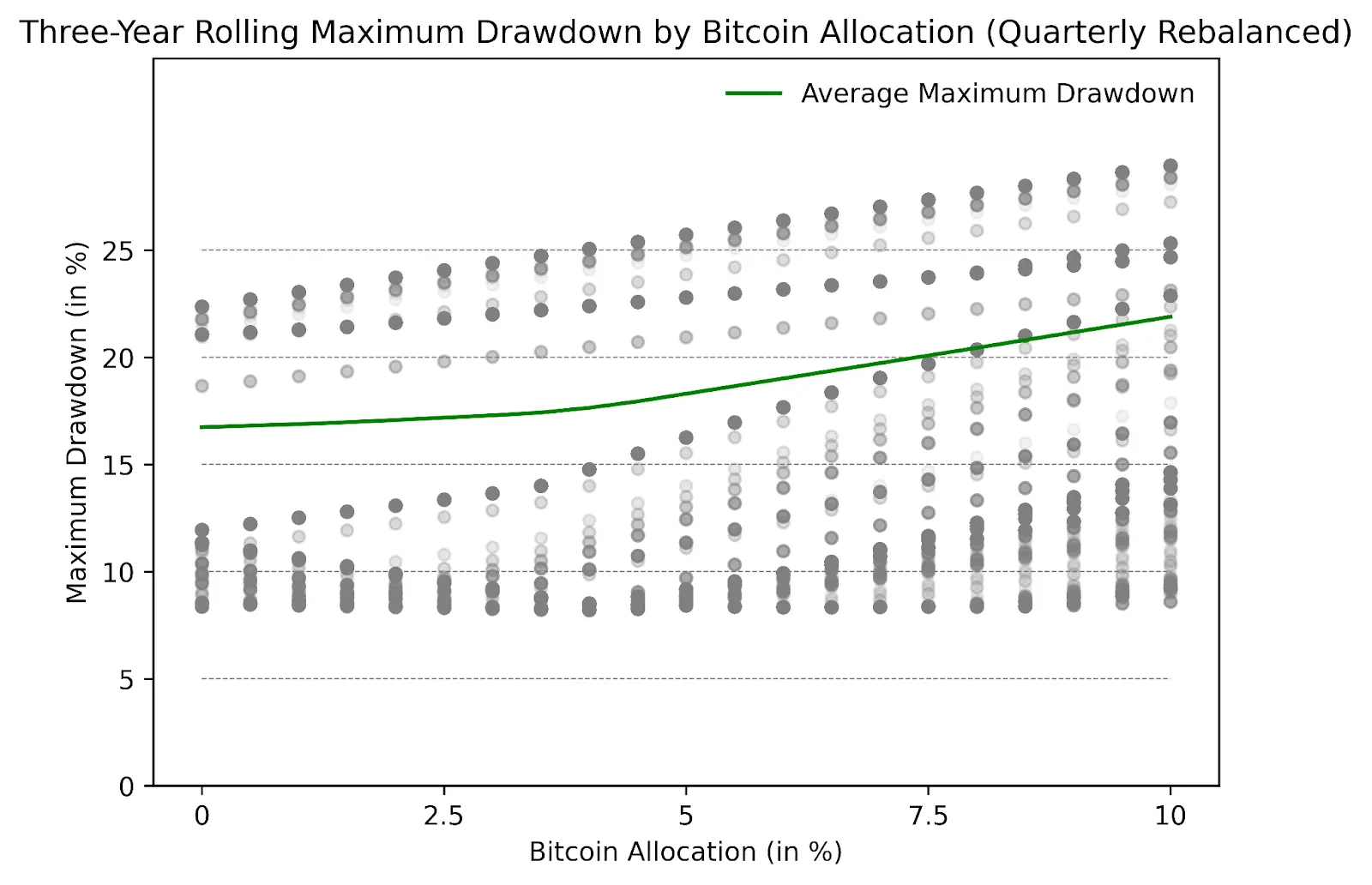

Figure 4 shows how different amounts of Bitcoin affect the “maximum drawdown” of investment value. Similar to the Sharpe ratio, the green line on the chart shows that a small allocation to Bitcoin (say, 0.5% to 4.5%) in a 60/40 stock and bond portfolio would not have much of an impact on the maximum drawdown over three years. If the allocation exceeds 5%, the impact on the maximum drawdown starts to increase significantly. For institutional investors with a lower risk appetite, keeping Bitcoin holdings at or below 5% of total investments may be the best option from a risk-adjusted and maximum drawdown perspective.

Figure 4: Bitcoin allocation three-year rolling maximum drawdown (rebalanced quarterly), Source: Cointelegraph Research

Figure 4: Bitcoin allocation three-year rolling maximum drawdown (rebalanced quarterly), Source: Cointelegraph Research

In summary, exploring Bitcoin as part of a diversified portfolio reveals the delicate balance between risk and reward. The results, presented across a variety of data, highlight the potential to increase cumulative returns by strategically increasing Bitcoin holdings, with a consequent increase in volatility. Based on historical data and mean-variance optimization, the optimal strategy is to allocate 3% to 5% of your total investment to Bitcoin.

Above this threshold, the risk-reward trade-off becomes unfavorable, highlighting the importance of careful and informed decision-making when incorporating Bitcoin into an investment strategy.

The above is the detailed content of If traditional institutions enter Bitcoin, what is the appropriate position?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1662

1662

14

14

1419

1419

52

52

1312

1312

25

25

1262

1262

29

29

1235

1235

24

24

What kind of software is a digital currency app? Top 10 Apps for Digital Currencies in the World

Apr 30, 2025 pm 07:06 PM

What kind of software is a digital currency app? Top 10 Apps for Digital Currencies in the World

Apr 30, 2025 pm 07:06 PM

With the popularization and development of digital currency, more and more people are beginning to pay attention to and use digital currency apps. These applications provide users with a convenient way to manage and trade digital assets. So, what kind of software is a digital currency app? Let us have an in-depth understanding and take stock of the top ten digital currency apps in the world.

Quantitative Exchange Ranking 2025 Top 10 Recommendations for Digital Currency Quantitative Trading APPs

Apr 30, 2025 pm 07:24 PM

Quantitative Exchange Ranking 2025 Top 10 Recommendations for Digital Currency Quantitative Trading APPs

Apr 30, 2025 pm 07:24 PM

The built-in quantization tools on the exchange include: 1. Binance: Provides Binance Futures quantitative module, low handling fees, and supports AI-assisted transactions. 2. OKX (Ouyi): Supports multi-account management and intelligent order routing, and provides institutional-level risk control. The independent quantitative strategy platforms include: 3. 3Commas: drag-and-drop strategy generator, suitable for multi-platform hedging arbitrage. 4. Quadency: Professional-level algorithm strategy library, supporting customized risk thresholds. 5. Pionex: Built-in 16 preset strategy, low transaction fee. Vertical domain tools include: 6. Cryptohopper: cloud-based quantitative platform, supporting 150 technical indicators. 7. Bitsgap:

Is the digital currency app formal? Top 10 formal and legal virtual currency trading apps in the world

Apr 30, 2025 pm 07:09 PM

Is the digital currency app formal? Top 10 formal and legal virtual currency trading apps in the world

Apr 30, 2025 pm 07:09 PM

Recommended cryptocurrency trading platforms include: 1. Binance: the world's largest trading volume, supports 1,400 currencies, FCA and MAS certification. 2. OKX: Strong technical strength, supports 400 currencies, approved by the Hong Kong Securities Regulatory Commission. 3. Coinbase: The largest compliance platform in the United States, suitable for beginners, SEC and FinCEN supervision. 4. Kraken: a veteran European brand, ISO 27001 certified, holds a US MSB and UK FCA license. 5. Gate.io: The most complete currency (800), low transaction fees, and obtained a license from multiple countries. 6. Huobi Global: an old platform that provides a variety of services, and holds Japanese FSA and Hong Kong TCSP licenses. 7. KuCoin

How to download, install and register the Hong Kong Digital Currency Exchange app 2025

Apr 30, 2025 pm 07:18 PM

How to download, install and register the Hong Kong Digital Currency Exchange app 2025

Apr 30, 2025 pm 07:18 PM

The download, installation and registration process of the Hong Kong Digital Currency Exchange app is very simple. Users can quickly obtain and use this app through the official app download link provided in this article. This article will introduce in detail how to download, install and register the Hong Kong Digital Currency Exchange app to ensure that every user can complete the operation smoothly.

uniswap on-chain withdrawal

Apr 30, 2025 pm 07:03 PM

uniswap on-chain withdrawal

Apr 30, 2025 pm 07:03 PM

Uniswap users can withdraw tokens from liquidity pools to their wallets to ensure asset security and liquidity. The process requires gas fees and is affected by network congestion.

Huobi Digital Currency Trading App Download Official Website. Correct Address. Domestic

Apr 30, 2025 pm 07:21 PM

Huobi Digital Currency Trading App Download Official Website. Correct Address. Domestic

Apr 30, 2025 pm 07:21 PM

Huobi Digital Currency Trading App is one of the world's leading digital asset trading platforms and is favored by the majority of users. In order to facilitate users to quickly and safely download and install Huobi app, this article will provide you with detailed download and installation tutorials. Please note that this article provides a download link to Huobi official app. Use the download link to this article to download safely to avoid mistakenly entering a copycat website or downloading to unofficial versions. Next, let us download and install Huobi app step by step.

Are these C2C transactions in Binance risky?

Apr 30, 2025 pm 06:54 PM

Are these C2C transactions in Binance risky?

Apr 30, 2025 pm 06:54 PM

Binance C2C transactions allow users to buy and sell cryptocurrencies directly, and pay attention to the risks of counterparty, payment and price fluctuations. Choosing high-credit users and secure payment methods can reduce risks.

How to download the Hong Kong Digital Currency Exchange app? The top ten digital currency exchange apps are included

Apr 30, 2025 pm 07:12 PM

How to download the Hong Kong Digital Currency Exchange app? The top ten digital currency exchange apps are included

Apr 30, 2025 pm 07:12 PM

The methods to download the Hong Kong Digital Currency Exchange APP include: 1. Select a compliant platform, such as OSL, HashKey or Binance HK, etc.; 2. Download through official channels, iOS users download on the App Store, Android users download through Google Play or official website; 3. Register and verify their identity, use Hong Kong mobile phone number or email address to upload identity and address certificates; 4. Set security measures, enable two-factor authentication and regularly check account activities.