ArkStream Capital: Why we invest in IO.Net

Why invest in IO.Net: Invest in the new oil in the AI era, decentralize the mining of human computing power

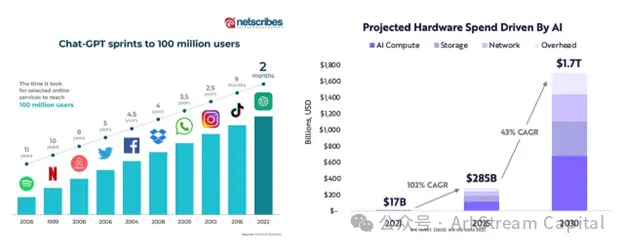

##Image source: NetScribes, Ark Invest

IO.Net’s Unique Solution

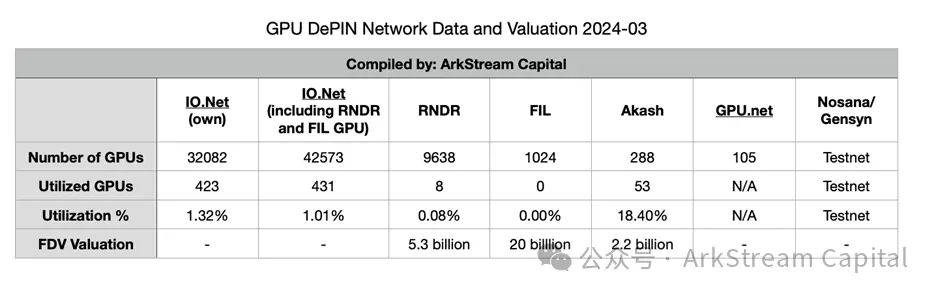

IO.Net not only provides customers with relevant Compared with centralized cloud service providers' low prices of 10-20% off and instant online services without permission, more computing power providers provide additional startup incentives through the upcoming IO tokens to jointly help connect 1 million GPUs. The goal. Compared with other DePIN computing projects, IO.Net focuses on GPU computing capabilities, and the scale of its GPU network is more than 100 times ahead of similar projects. In addition, IO.Net is also the first in the blockchain industry to integrate the most advanced ML technology stack (such as Ray cluster, Kubernetes cluster and giant cluster) into the GPU DePIN project and put it into large-scale practice, which makes it not only the number of GPUs , and is in a leading position in technology application and model training capabilities.

With the continuous development of IO.Net, its The engineering team will increase the GPU capacity of the network to 500,000 concurrent GPUs across the entire network to compete with centralized cloud service providers, thereby providing services similar to Web 2 at a lower cost. Through close partnerships with major DePIN and AI players, including Render Network, Filecoin, Solana, Ritual, and more, IO.Net is gradually establishing its core position in the field. We believe that IO.Net will become the leader and settlement layer of decentralized GPU networks in the medium to long term, bringing vitality to the entire Web 3xAI ecosystem.

Conclusion

ArkStream Capital’s investment is not only a recognition of the future development potential of IO.Net, He is also firmly optimistic about the future direction of AI, DePIN and broader technology fields. As an industry pioneer and supporter, ArkStream Capital will continue to provide computing infrastructure and ecological connection support for IO.Net, and jointly create a new era of AI and decentralized networks.

View the original English text of this announcement: https://x.com/ark_stream/status/1766494990862303553?s=20

Appendix: The complete list of IO.Net Series A investors includes:

Hack VC, Multicoin, 6th Man Ventures, OKX Ventures, M13, Mo and Avery from Aptos, Aptos Labs, Toly from Solana, Matty Taylor, Ian Krotinsky, MH Ventures, Amber Group, Arkstream Capital, Modular Capital, Continue Capital, Foresight, Longhash, SevenX, Delphi Digital, Animoca Brands, Yat Siu, The The Sandbox, Sebastian Borget from The Sandbox, Solana Ventures, Web3 Ventures

The above is the detailed content of ArkStream Capital: Why we invest in IO.Net. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

When choosing a digital currency trading platform suitable for beginners, you need to consider security, ease of use, educational resources and cost transparency: 1. Priority is given to platforms that provide cold storage, two-factor verification and asset insurance; 2. Apps with a simple interface and clear operation are more suitable for beginners; 3. The platform should provide learning tools such as tutorials and market analysis; 4. Pay attention to hidden costs such as transaction fees and cash withdrawal fees.

The latest updates to the oldest virtual currency rankings

Apr 22, 2025 am 07:18 AM

The latest updates to the oldest virtual currency rankings

Apr 22, 2025 am 07:18 AM

The ranking of virtual currencies’ “oldest” is as follows: 1. Bitcoin (BTC), issued on January 3, 2009, is the first decentralized digital currency. 2. Litecoin (LTC), released on October 7, 2011, is known as the "lightweight version of Bitcoin". 3. Ripple (XRP), issued in 2011, is designed for cross-border payments. 4. Dogecoin (DOGE), issued on December 6, 2013, is a "meme coin" based on the Litecoin code. 5. Ethereum (ETH), released on July 30, 2015, is the first platform to support smart contracts. 6. Tether (USDT), issued in 2014, is the first stablecoin to be anchored to the US dollar 1:1. 7. ADA,

Meme Coin Exchange Ranking Meme Coin Main Exchange Top 10 Spots

Apr 22, 2025 am 09:57 AM

Meme Coin Exchange Ranking Meme Coin Main Exchange Top 10 Spots

Apr 22, 2025 am 09:57 AM

The most suitable platforms for trading Meme coins include: 1. Binance, the world's largest, with high liquidity and low handling fees; 2. OkX, an efficient trading engine, supporting a variety of Meme coins; 3. XBIT, decentralized, supporting cross-chain trading; 4. Redim (Solana DEX), low cost, combined with Serum order book; 5. PancakeSwap (BSC DEX), low transaction fees and fast speed; 6. Orca (Solana DEX), user experience optimization; 7. Coinbase, high security, suitable for beginners; 8. Huobi, well-known in Asia, rich trading pairs; 9. DEXRabbit, intelligent

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

Cryptocurrency data platforms suitable for beginners include CoinMarketCap and non-small trumpet. 1. CoinMarketCap provides global real-time price, market value, and trading volume rankings for novice and basic analysis needs. 2. The non-small quotation provides a Chinese-friendly interface, suitable for Chinese users to quickly screen low-risk potential projects.

A list of special services for major virtual currency trading platforms

Apr 22, 2025 am 08:09 AM

A list of special services for major virtual currency trading platforms

Apr 22, 2025 am 08:09 AM

Institutional investors should choose compliant platforms such as Coinbase Pro and Genesis Trading, focusing on cold storage ratios and audit transparency; retail investors should choose large platforms such as Binance and Huobi, focusing on user experience and security; users in compliance-sensitive areas can conduct fiat currency trading through Circle Trade and Huobi Global, and mainland Chinese users need to go through compliant over-the-counter channels.

Top 10 latest releases of virtual currency trading platforms for bulk transactions

Apr 22, 2025 am 08:18 AM

Top 10 latest releases of virtual currency trading platforms for bulk transactions

Apr 22, 2025 am 08:18 AM

The following factors should be considered when choosing a bulk trading platform: 1. Liquidity: Priority is given to platforms with an average daily trading volume of more than US$5 billion. 2. Compliance: Check whether the platform holds licenses such as FinCEN in the United States, MiCA in the European Union. 3. Security: Cold wallet storage ratio and insurance mechanism are key indicators. 4. Service capability: Whether to provide exclusive account managers and customized transaction tools.

Summary of the top ten Apple version download portals for digital currency exchange apps

Apr 22, 2025 am 09:27 AM

Summary of the top ten Apple version download portals for digital currency exchange apps

Apr 22, 2025 am 09:27 AM

Provides a variety of complex trading tools and market analysis. It covers more than 100 countries, has an average daily derivative trading volume of over US$30 billion, supports more than 300 trading pairs and 200 times leverage, has strong technical strength, a huge global user base, provides professional trading platforms, secure storage solutions and rich trading pairs.

Can two exchanges convert coins to each other? Can two exchanges convert coins to each other?

Apr 22, 2025 am 08:57 AM

Can two exchanges convert coins to each other? Can two exchanges convert coins to each other?

Apr 22, 2025 am 08:57 AM

Can. The two exchanges can transfer coins to each other as long as they support the same currency and network. The steps include: 1. Obtain the collection address, 2. Initiate a withdrawal request, 3. Wait for confirmation. Notes: 1. Select the correct transfer network, 2. Check the address carefully, 3. Understand the handling fee, 4. Pay attention to the account time, 5. Confirm that the exchange supports this currency, 6. Pay attention to the minimum withdrawal amount.