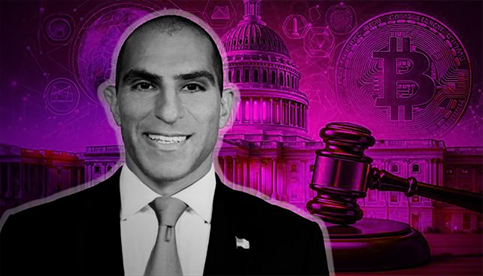

CFTC Chairman Urges Congress to Enact Cryptocurrency Regulations

Rostin Behnam also told Congress that under the current regulatory framework, Bitcoin and Ethereum can only be considered commodities.

CFTC Chairman Rostin Behnam said before Congress that legislation is urgently needed to provide regulatory clarity to the crypto industry to ensure investors are properly protected.

Behnam made the statement while testifying before the Senate Agriculture Committee on March 6 to discuss the CFTC’s fiscal year 2025 budget request.

“The idea that cryptocurrencies are going away is wrong,” Behnam said.

He further noted that in the 12 months ending in October 2023, more than 49% of CFTC lawsuits involved conduct related to digital assets, although “no federal agency currently directly regulates the crypto industry.”

Develop framework within 12 months

During the hearing, Behnam mentioned the challenges and opportunities posed to the crypto market by the digital assets Bitcoin (BTC) and Ethereum (ETH), which account for a significant proportion of the total market capitalization.

He pointed out that regulators and lawmakers may have a misunderstanding that the relevance of the digital asset market may weaken. However, the past decade has made it clear that this view is wrong, as demand for these assets has grown exponentially during this time.

Behnam emphasized the need to proactively enact legislative measures to ensure a stable and transparent regulatory environment. He added that protecting investors should be the government’s top priority, given the huge interest in digital assets since the beginning of the year.

Behnam said that if Congress passes the 21st Century Financial Innovation Technologies Act (FIT Act), it will take the CFTC about 12 months to develop a comprehensive regulatory framework for digital assets.

The FIT bill, which has passed the Senate Agriculture and Financial Services Committee but has not yet reached a floor vote, aims to clarify regulations regarding regulatory responsibilities for digital assets.

BTC, ETH belong to commodity

In her testimony, Behnam also responded to questions from committee members about whether digital currencies are commodities or securities, a distinction that affects regulatory jurisdiction.

In response to a question from Congressman John Duarte, Behnam explained that digital assets are often considered commodities if they are deemed not to meet the standards required to be securities, illustrating the nuanced approach required to effectively regulate these assets.

Behnam added that while Bitcoin and Ethereum cannot be classified as securities, they do not meet the criteria to be considered commodities, meaning they are automatically classified as commodities, despite being very similar to physical commodities such as gold or corn. Big difference.

The CFTC chairman told Duarte that there is huge interest in Bitcoin from retail and institutional investors, regardless of whether governments want to legalize it.

Behnam acknowledged that regulators have been trying to shoehorn cryptocurrencies into other frameworks and that the industry needs to be considered independently.

The above is the detailed content of CFTC Chairman Urges Congress to Enact Cryptocurrency Regulations. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

What currency does Ripple (XRP currency) belong to? Detailed tutorial for beginners

Apr 28, 2025 pm 07:57 PM

What currency does Ripple (XRP currency) belong to? Detailed tutorial for beginners

Apr 28, 2025 pm 07:57 PM

Created by Ripple, Ripple is used for cross-border payments, which are fast and low-cost and suitable for small transaction payments. After registering a wallet and exchange, purchase and storage can be made.

Which of the top ten currency trading platforms in the world are the latest version of the top ten currency trading platforms

Apr 28, 2025 pm 08:09 PM

Which of the top ten currency trading platforms in the world are the latest version of the top ten currency trading platforms

Apr 28, 2025 pm 08:09 PM

The top ten cryptocurrency trading platforms in the world include Binance, OKX, Gate.io, Coinbase, Kraken, Huobi Global, Bitfinex, Bittrex, KuCoin and Poloniex, all of which provide a variety of trading methods and powerful security measures.

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

The top ten digital currency exchanges such as Binance, OKX, gate.io have improved their systems, efficient diversified transactions and strict security measures.

Which of the top ten currency trading platforms in the world are among the top ten currency trading platforms in 2025

Apr 28, 2025 pm 08:12 PM

Which of the top ten currency trading platforms in the world are among the top ten currency trading platforms in 2025

Apr 28, 2025 pm 08:12 PM

The top ten cryptocurrency exchanges in the world in 2025 include Binance, OKX, Gate.io, Coinbase, Kraken, Huobi, Bitfinex, KuCoin, Bittrex and Poloniex, all of which are known for their high trading volume and security.

Binance official website entrance Binance official latest entrance 2025

Apr 28, 2025 pm 07:54 PM

Binance official website entrance Binance official latest entrance 2025

Apr 28, 2025 pm 07:54 PM

Visit Binance official website and check HTTPS and green lock logos to avoid phishing websites, and official applications can also be accessed safely.

What are the top currency trading platforms? The top 10 latest virtual currency exchanges

Apr 28, 2025 pm 08:06 PM

What are the top currency trading platforms? The top 10 latest virtual currency exchanges

Apr 28, 2025 pm 08:06 PM

Currently ranked among the top ten virtual currency exchanges: 1. Binance, 2. OKX, 3. Gate.io, 4. Coin library, 5. Siren, 6. Huobi Global Station, 7. Bybit, 8. Kucoin, 9. Bitcoin, 10. bit stamp.

What kind of software is a digital currency app? Top 10 Apps for Digital Currencies in the World

Apr 30, 2025 pm 07:06 PM

What kind of software is a digital currency app? Top 10 Apps for Digital Currencies in the World

Apr 30, 2025 pm 07:06 PM

With the popularization and development of digital currency, more and more people are beginning to pay attention to and use digital currency apps. These applications provide users with a convenient way to manage and trade digital assets. So, what kind of software is a digital currency app? Let us have an in-depth understanding and take stock of the top ten digital currency apps in the world.

Is the digital currency app formal? Top 10 formal and legal virtual currency trading apps in the world

Apr 30, 2025 pm 07:09 PM

Is the digital currency app formal? Top 10 formal and legal virtual currency trading apps in the world

Apr 30, 2025 pm 07:09 PM

Recommended cryptocurrency trading platforms include: 1. Binance: the world's largest trading volume, supports 1,400 currencies, FCA and MAS certification. 2. OKX: Strong technical strength, supports 400 currencies, approved by the Hong Kong Securities Regulatory Commission. 3. Coinbase: The largest compliance platform in the United States, suitable for beginners, SEC and FinCEN supervision. 4. Kraken: a veteran European brand, ISO 27001 certified, holds a US MSB and UK FCA license. 5. Gate.io: The most complete currency (800), low transaction fees, and obtained a license from multiple countries. 6. Huobi Global: an old platform that provides a variety of services, and holds Japanese FSA and Hong Kong TCSP licenses. 7. KuCoin