100% of voters support Uniswap fee reward proposal

Summary:

•The Uniswap community is supporting a proposal to reallocate protocol fees to UNI token holders.

• Blockchain analysis company Token Terminal noted that UNI holders could earn more than $50 million.

• UNI has been trending upward since the proposal was made, and observers believe there is room for further gains.

Uniswap is an Ethereum-based decentralized exchange (DEX) on the verge of change in the decentralized finance (DeFi) space.

Designed to redistribute protocol fees to UNI token holders, this marks a major step forward in democratizing the network.

Uniswap community supports new proposal

Snapshot voting shows overwhelming community support for the fee reward proposal, which is expected to end on March 7.

The proposal includes upgrading the UniswapV3 Factory contract and giving the ability to seamlessly and programmatically collect protocol fee revenue. This strategic move aims to strengthen the governance framework and give UNI token holders greater influence in the decision-making process.

Erin Koen, head of governance at the Uniswap Foundation, outlined, “Overall, we are proposing to upgrade the protocol so that its fee mechanism rewards holders who have delegated and staked their UNI tokens.”

In essence, Uniswap’s reformed governance structure is designed to incentivize active participation from UNI token holders, thereby enhancing the sustainability of the protocol and promoting its expansion.

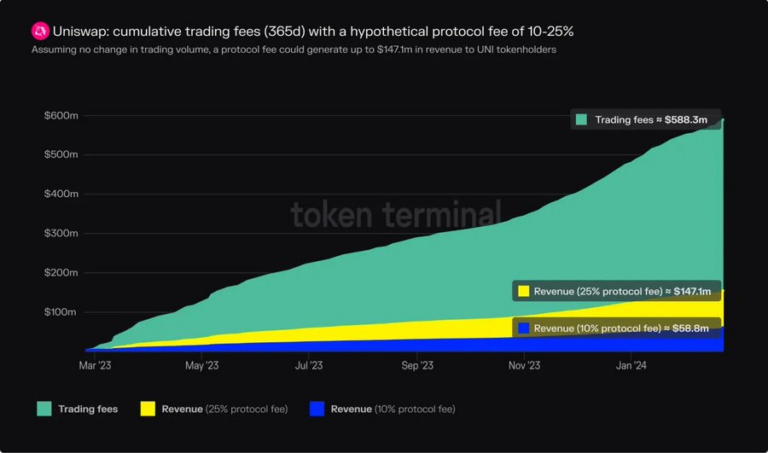

Uniswap protocol fee estimate|Source: Token

Terminal

Due to the unanimous support of voters, more than 10 million UNI tokens have now been pledged for the upgrade.

Blockchain analytics firm Token Terminal highlighted the huge benefits that UNI holders will receive from the proposal. Analysis shows that if the fee switch is activated, UNI holders have accumulated a cumulative income of up to US$58 million in the past year by facilitating US$437.7 billion in transaction volume and generating US$588.3 million in transaction fees.

Token Terminal explains, “Assuming a 10% protocol fee is implemented, Uniswap will become the ninth largest revenue-generating protocol in crypto, ranking between Optimism mainnet and Avalanche.”

However, with the fee switch dormant, Uniswap has yet to realize revenue generation from these fees, leaving huge potential for future development.

UNI Price Forecast: Further upside potential

The price of UNI has risen sharply in recent weeks, gaining significant momentum following the introduction of new governance proposals. Data shows that Uniswap’s market capitalization has surged 100% in the past month.

It peaked at over $13, up from less than $5 previously, and is currently trading at $12.43, reflecting a slight correction.

UNI Price Chart | Source: TradingView

Market analysts attribute this significant growth to widespread optimism surrounding fee award proposals. Notably, one analyst highlighted the key role the proposed development protocol could play in shaping the coin’s trajectory.

Analyst DaanCrypto said, "The weekly chart is quite clear. We hold the cost price around $9.8, and I will look for opportunities to break through $13 at some point in the future. This will likely depend on the progress surrounding the fee agreement proposal."

The above is the detailed content of 100% of voters support Uniswap fee reward proposal. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Bitcoin price today

Apr 28, 2025 pm 07:39 PM

Bitcoin price today

Apr 28, 2025 pm 07:39 PM

Bitcoin’s price fluctuations today are affected by many factors such as macroeconomics, policies, and market sentiment. Investors need to pay attention to technical and fundamental analysis to make informed decisions.

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

The top ten digital currency exchanges such as Binance, OKX, gate.io have improved their systems, efficient diversified transactions and strict security measures.

Free coins trading market software recommendations The top ten easy-to-use coins trading apps

Apr 28, 2025 pm 04:33 PM

Free coins trading market software recommendations The top ten easy-to-use coins trading apps

Apr 28, 2025 pm 04:33 PM

The top ten recommended cryptocurrency trading software are: 1. OKX, 2. Binance, 3. Coinbase, 4. KuCoin, 5. Huobi, 6. Crypto.com, 7. Kraken, 8. Bitfinex, 9. Bybit, 10. Gate.io. These apps all provide real-time market data and trading tools, suitable for users at different levels.

Which of the top ten currency trading platforms in the world are the latest version of the top ten currency trading platforms

Apr 28, 2025 pm 08:09 PM

Which of the top ten currency trading platforms in the world are the latest version of the top ten currency trading platforms

Apr 28, 2025 pm 08:09 PM

The top ten cryptocurrency trading platforms in the world include Binance, OKX, Gate.io, Coinbase, Kraken, Huobi Global, Bitfinex, Bittrex, KuCoin and Poloniex, all of which provide a variety of trading methods and powerful security measures.

Recommended reliable digital currency trading platforms. Top 10 digital currency exchanges in the world. 2025

Apr 28, 2025 pm 04:30 PM

Recommended reliable digital currency trading platforms. Top 10 digital currency exchanges in the world. 2025

Apr 28, 2025 pm 04:30 PM

Recommended reliable digital currency trading platforms: 1. OKX, 2. Binance, 3. Coinbase, 4. Kraken, 5. Huobi, 6. KuCoin, 7. Bitfinex, 8. Gemini, 9. Bitstamp, 10. Poloniex, these platforms are known for their security, user experience and diverse functions, suitable for users at different levels of digital currency transactions

Download the official website of Ouyi Exchange app for Apple mobile phone

Apr 28, 2025 pm 06:57 PM

Download the official website of Ouyi Exchange app for Apple mobile phone

Apr 28, 2025 pm 06:57 PM

The Ouyi Exchange app supports downloading of Apple mobile phones, visit the official website, click the "Apple Mobile" option, obtain and install it in the App Store, register or log in to conduct cryptocurrency trading.

How much is Bitcoin worth

Apr 28, 2025 pm 07:42 PM

How much is Bitcoin worth

Apr 28, 2025 pm 07:42 PM

Bitcoin’s price ranges from $20,000 to $30,000. 1. Bitcoin’s price has fluctuated dramatically since 2009, reaching nearly $20,000 in 2017 and nearly $60,000 in 2021. 2. Prices are affected by factors such as market demand, supply, and macroeconomic environment. 3. Get real-time prices through exchanges, mobile apps and websites. 4. Bitcoin price is highly volatile, driven by market sentiment and external factors. 5. It has a certain relationship with traditional financial markets and is affected by global stock markets, the strength of the US dollar, etc. 6. The long-term trend is bullish, but risks need to be assessed with caution.

What currency does Ripple (XRP currency) belong to? Detailed tutorial for beginners

Apr 28, 2025 pm 07:57 PM

What currency does Ripple (XRP currency) belong to? Detailed tutorial for beginners

Apr 28, 2025 pm 07:57 PM

Created by Ripple, Ripple is used for cross-border payments, which are fast and low-cost and suitable for small transaction payments. After registering a wallet and exchange, purchase and storage can be made.