Gemini to repay more than $1.8 billion to win customers in regulatory settlement

Cryptocurrency exchange Gemini announces it will return more than $1 billion to Earn program customers under a regulatory settlement with the New York State Department of Financial Services (NYDFS)

Repay all customers’ assets at the price of the day

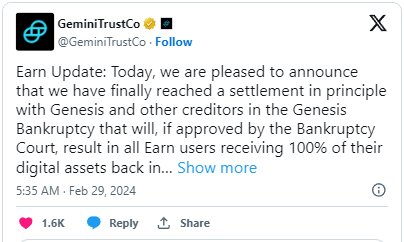

On February 28, Gemini, founded by the Winklevoss brothers in 2014 Trust Company announced that it has reached an in-principle settlement with Genesis and other creditors in the company's bankruptcy proceedings.

The settlement will allow Earn Project clients to “recover 100% of their digital assets in physical form.”

The announcement further explains that if approved by the bankruptcy court, users can expect to recover their assets on a 1:1 basis:

After lending Bitcoins in the Earn program, you will get the same amount of Bitcoins back when you choose to redeem. Therefore, any appreciation in value since the asset was borrowed into the Earn plan will also be returned to you.

According to the cryptocurrency exchange’s claims, they will return more than $1.8 billion in assets at that day’s price, which is $700 million more than what Genesis’ assets were worth when it stopped withdrawals two years ago.

Upon approval of the settlement, users can expect to receive approximately 97% of their assets within 2 months. The remaining 3% of assets are expected to be returned within 12 months of approval.

Gemini clarified that the required bankruptcy court proceedings could take up to two months to complete. Furthermore, it said that, in principle, the settlement was subject to final documentation.

Genesis Agreement with SEC

Gemini and Genesis Global Capital (GGC) co-launched the Earn program. Launched in February 2021, the program allows users to earn passive income through interest payments.

These interests are accrued after users lend their digital assets to GGC through the Earn program, and the company then lends these assets to its peers.

Customers raised the alarm in November 2022 when Genesis requested that withdrawals from the program be suspended. Two months later, in January 2023, the service was permanently terminated.

Soon after, the U.S. Securities and Exchange Commission (SEC) filed charges against the two companies, saying they then offered unregistered securities through the Earn program.

Earlier this month, GGC reached a settlement with the SEC, ending civil litigation against the company. Under the settlement, it agreed to pay a $21 million civil penalty, with the amount contingent on the company's repayment to customers and creditors.

Gemini fined for failure to exercise due diligence

On Wednesday, Adrienne Harries, head of the New York State Department of Financial Services (NYDFS), announced that the cryptocurrency exchange will contribute $40 million to the Genesis Global Capital bankruptcy case.

In addition, Gemini will pay a $37 million fine to NYDFS for "significant failures" in protecting customers that "threatened the company's security."

NYDFS concluded that the company failed to conduct adequate due diligence on GGC and failed to "maintain adequate reserves throughout the life of Earn."

Chief Harries said the settlement was a win for Earn users. Customers will regain rights to assets they entrusted to the exchange and failed to protect.

Harries said:

"Gemini's failure to conduct due diligence on unregulated third parties, resulting in subsequent accusations of massive fraud, harmed Earn customers who were suddenly unable to access their assets following Genesis Global Capital's financial crisis."

Finally, NYDFS announced that as part of the settlement, it reserves the right to take further legal action if the company fails to meet its obligation to return at least $1.1 billion to Earn program customers.

The above is the detailed content of Gemini to repay more than $1.8 billion to win customers in regulatory settlement. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1665

1665

14

14

1424

1424

52

52

1322

1322

25

25

1269

1269

29

29

1249

1249

24

24

Top 10 cryptocurrency exchange apps The latest rankings of the top 10 cryptocurrency exchange apps

May 08, 2025 pm 05:57 PM

Top 10 cryptocurrency exchange apps The latest rankings of the top 10 cryptocurrency exchange apps

May 08, 2025 pm 05:57 PM

The top ten cryptocurrency exchange apps are: 1. Binance, 2. OKX, 3. Huobi, 4. Coinbase, 5. Kraken, 6. Bybit, 7. KuCoin, 8. Gemini, 9. Bitstamp, 10. Crypto.com. Each platform has its own unique advantages and features, and users can conduct cryptocurrency transactions by downloading apps, registering and completing verification, depositing, selecting transaction pairs and confirming transactions.

The TOP5 of the safest exchanges in 2025: Black U's guide to avoid pits, the rule of 100% of funds to save lives

May 08, 2025 pm 08:27 PM

The TOP5 of the safest exchanges in 2025: Black U's guide to avoid pits, the rule of 100% of funds to save lives

May 08, 2025 pm 08:27 PM

In the field of cryptocurrency trading, the security of exchanges has always been the focus of users. In 2025, after years of development and evolution, some exchanges stand out with their outstanding security measures and user experience. This article will introduce the five most secure exchanges in 2025 and provide practical guides on how to avoid Black U (hacker attacks users) to ensure your funds are 100% secure.

Guide to 'picking money' in the 2025 currency circle: Learn to leverage in contracts in 5 minutes and earn 100,000 a day!

May 08, 2025 pm 08:39 PM

Guide to 'picking money' in the 2025 currency circle: Learn to leverage in contracts in 5 minutes and earn 100,000 a day!

May 08, 2025 pm 08:39 PM

Contract leveraged trading is a common trading method in the currency circle, which allows traders to trade larger amounts with less funds. By using leverage, traders can amplify their profit potential, but also increase risks. Leverage is usually expressed in multiples, for example, 10 times leverage means that you can trade 10 Bitcoin contracts with margin of 1 Bitcoin.

How to register in the ok exchange in China? ok trading platform registration and use guide for beginners in mainland China

May 08, 2025 pm 10:51 PM

How to register in the ok exchange in China? ok trading platform registration and use guide for beginners in mainland China

May 08, 2025 pm 10:51 PM

In the cryptocurrency market, choosing a reliable trading platform is crucial. As a world-renowned digital asset exchange, the OK trading platform has attracted a large number of novice users in mainland China. This guide will introduce in detail how to register and use it on the OK trading platform to help novice users get started quickly.

TOP10 futures trading platforms: Perpetual contracts and options trading

May 08, 2025 pm 07:12 PM

TOP10 futures trading platforms: Perpetual contracts and options trading

May 08, 2025 pm 07:12 PM

In the cryptocurrency market, futures trading platforms play an important role, especially in perpetual contracts and options trading. Here are the top ten highly respected futures trading platforms in the market, and provide detailed introduction to their characteristics and advantages in perpetual contract and option trading.

Top 10 cryptocurrency platforms in the world that support multi-chain transactions are authoritatively released in 2025

May 08, 2025 pm 07:15 PM

Top 10 cryptocurrency platforms in the world that support multi-chain transactions are authoritatively released in 2025

May 08, 2025 pm 07:15 PM

According to the latest evaluations and industry trends from authoritative institutions in 2025, the following are the top ten cryptocurrency platforms in the world that support multi-chain transactions, combining transaction volume, technological innovation, compliance and user reputation comprehensive analysis:

Top 10 cryptocurrency app exchanges 2025 reliable currency trading platform app inventory points

May 08, 2025 pm 10:21 PM

Top 10 cryptocurrency app exchanges 2025 reliable currency trading platform app inventory points

May 08, 2025 pm 10:21 PM

The top ten cryptocurrency exchange apps are: 1. Binance, 2. OKX, 3. Huobi, 4. Coinbase, 5. Kraken, 6. Bybit, 7. KuCoin, 8. Gemini, 9. Bitstamp, 10. Crypto.com. Each platform has its own unique advantages and features, and users can conduct cryptocurrency transactions by downloading apps, registering and completing verification, depositing, selecting transaction pairs and confirming transactions.

Strategy for making money with zero foundation: 5 types of altcoins that must be stocked in 2025, make sure to make 50 times more profitable!

May 08, 2025 pm 08:30 PM

Strategy for making money with zero foundation: 5 types of altcoins that must be stocked in 2025, make sure to make 50 times more profitable!

May 08, 2025 pm 08:30 PM

In cryptocurrency markets, altcoins are often seen by investors as potentially high-return assets. Although there are many altcoins on the market, not all altcoins can bring the expected benefits. This article will provide a detailed guide for investors with zero foundation, introducing the 5 altcoins worth hoarding in 2025, and explaining how to achieve the goal of making a 50x steady profit through these investments.