web3.0

web3.0

Coinbase CEO: Cryptocurrencies will become an essential asset in a diversified investment portfolio

Coinbase CEO: Cryptocurrencies will become an essential asset in a diversified investment portfolio

Coinbase CEO: Cryptocurrencies will become an essential asset in a diversified investment portfolio

Over the past year, the total market capitalization of the cryptocurrency market has achieved staggering growth, reaching $2.1 trillion, an increase of nearly 80%. Bitcoin and Ethereum achieved gains of more than 100% and 75% respectively, showing the strong performance of these two mainstream cryptocurrencies. In addition, the successful launch of the U.S. Bitcoin Spot ETF continues to attract the attention of more traditional investors. These factors have combined to make the cryptocurrency market experience a booming phase in the past year, attracting the attention of more investors. The reasons behind this growth may be multi-faceted, including increased market acceptance of digital assets and growing interest in

Zann Kwan, chief investment officer and partner at the Revo Digital family office, recently said , Asian family offices plan to increase their investment in cryptocurrencies. Investors who once took a wait-and-see attitude are now actively exploring how to integrate cryptocurrencies into their portfolios in pursuit of higher returns.

Coinbase CEO: Cryptocurrency will become an indispensable asset in a diversified investment group

As Brian Armstrong, CEO of Coinbase, the largest exchange in the United States, in last week’s fourth quarter financial report According to the conference call, including crypto assets in investment portfolios has become an inevitable trend. He pointed out that every institution is now starting to hold cryptocurrencies, making crypto assets an integral part of a diversified investment portfolio. Armstrong’s comments highlight the market’s growing interest in and recognition of crypto-assets, signaling that cryptocurrencies will continue to expand in importance in the financial sector. This trend also reflects the growing confidence of institutional investors in the digital asset market and their optimism about cryptocurrencies as a safe haven and value-added asset. Armstrong’s remarks further emphasized the place of crypto assets in today’s investment environment

Armstrong added that the financial system’s official acceptance of cryptocurrencies is an excellent development and stated that Coinbase is the most trusted in this field. Partner, he pointed out that Coinbase is the custodian of 8 of the 11 Bitcoin spot ETFs, which allows the Bitcoin under its custody to account for 90% of the assets of the Bitcoin spot ETF, and emphasized that: the Bitcoin spot ETF has released new capital inflows into cryptography The currency space... we've seen huge demand as Bitcoin is now the second largest ETF commodity in the U.S., surpassing silver.

Institutions will use cryptocurrencies in many ways

Armstrong believes that beyond exposure to cryptocurrencies through ETFs, more possibilities await. As more institutions get involved in the cryptocurrency space, whether through ETFs or other avenues, that's a good thing. He believes these institutions will eventually explore more ways to leverage cryptocurrencies, such as adding them to their balance sheets, using them to pay suppliers or as compensation for their employees. Armstrong is confident in the potential of cryptocurrencies and believes they will be more widely used in the future.

Armstrong concluded that they hope that cryptocurrencies can become an important driver of global GDP growth. To achieve this goal, they must seize every possible opportunity. From his perspective, ETFs would be a huge benefit to their business.

Research report: Allocating crypto assets can increase investment group returns

When Coinbase jointly published the first quarter of 2024 crypto market guide with Glassnode early last month, it also studied the allocation of cryptocurrencies to traditional The results are surprising, showing that adding cryptocurrencies to a portfolio improves both absolute and risk-adjusted returns.

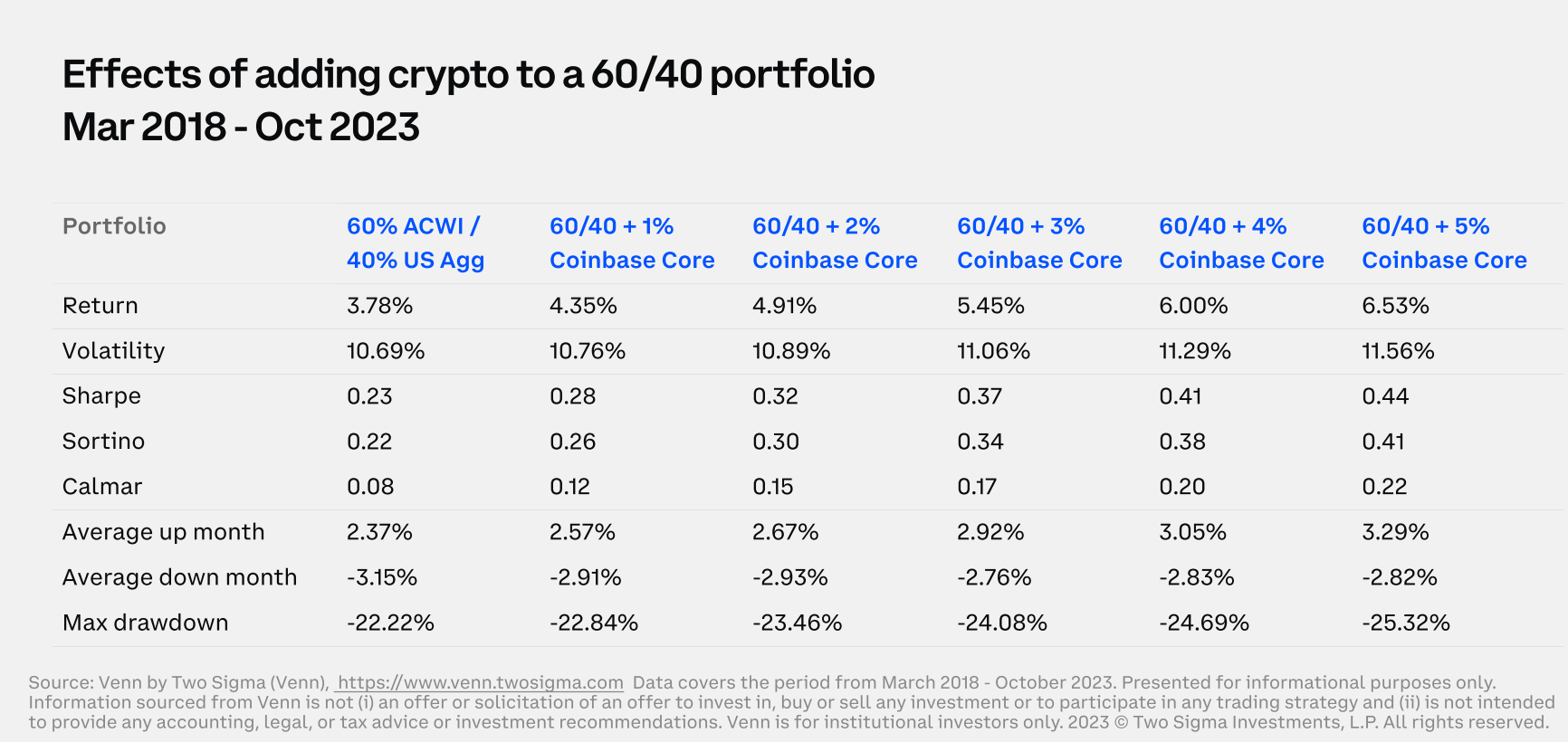

They allocate a small amount of Coinbase Core Index (COINCORE) in the traditional stock and bond investment portfolio, and adjust the proportion of stocks and bonds accordingly. The results can be seen from the table below. When no crypto-assets are allocated (the leftmost column), the absolute return rate is 3.78%. However, after allocating 1% to 5% of COINCORE, the absolute return rate gradually increases to 6.53%.

Of course, it is undeniable that the risk has also expanded. It can be observed that the volatility (Volatility) gradually increases from left to right, so we must also observe the "risk-adjusted return", which is a measure of the investor's commitment. An indicator of how much reward a unit of risk can enjoy. Coinbase lists three such indicators, namely Sharpe, Sortino and Calmar (also known as drawdown ratio). The difference between them is the way to measure risk, which are: total Risk, risk of negative returns and maximum drawdown (i.e. the bottom column of the table below), but no matter what, the results show that after allocating 1% to 5% of crypto assets, the risk-adjusted returns show an increasing trend.

Note: The stock and bond investment portfolio is a portfolio composed of 60% MSCIACWI (Global Stock Index) and 40% USAgg (U.S. Aggregate Bond Index); COINCORE is a cryptocurrency index weighted by market capitalization. It is rebalanced every quarter and is mainly allocated to eight component currencies including Bitcoin (65.3%) and Ethereum (28.7%).

Readers who are interested in incorporating crypto assets into their investment portfolio can refer to Coinbase’s research report in May last year.

The above is the detailed content of Coinbase CEO: Cryptocurrencies will become an essential asset in a diversified investment portfolio. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Bitcoin price today

Apr 28, 2025 pm 07:39 PM

Bitcoin price today

Apr 28, 2025 pm 07:39 PM

Bitcoin’s price fluctuations today are affected by many factors such as macroeconomics, policies, and market sentiment. Investors need to pay attention to technical and fundamental analysis to make informed decisions.

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

The top ten digital currency exchanges such as Binance, OKX, gate.io have improved their systems, efficient diversified transactions and strict security measures.

Free coins trading market software recommendations The top ten easy-to-use coins trading apps

Apr 28, 2025 pm 04:33 PM

Free coins trading market software recommendations The top ten easy-to-use coins trading apps

Apr 28, 2025 pm 04:33 PM

The top ten recommended cryptocurrency trading software are: 1. OKX, 2. Binance, 3. Coinbase, 4. KuCoin, 5. Huobi, 6. Crypto.com, 7. Kraken, 8. Bitfinex, 9. Bybit, 10. Gate.io. These apps all provide real-time market data and trading tools, suitable for users at different levels.

Download the official website of Ouyi Exchange app for Apple mobile phone

Apr 28, 2025 pm 06:57 PM

Download the official website of Ouyi Exchange app for Apple mobile phone

Apr 28, 2025 pm 06:57 PM

The Ouyi Exchange app supports downloading of Apple mobile phones, visit the official website, click the "Apple Mobile" option, obtain and install it in the App Store, register or log in to conduct cryptocurrency trading.

Which of the top ten currency trading platforms in the world are the latest version of the top ten currency trading platforms

Apr 28, 2025 pm 08:09 PM

Which of the top ten currency trading platforms in the world are the latest version of the top ten currency trading platforms

Apr 28, 2025 pm 08:09 PM

The top ten cryptocurrency trading platforms in the world include Binance, OKX, Gate.io, Coinbase, Kraken, Huobi Global, Bitfinex, Bittrex, KuCoin and Poloniex, all of which provide a variety of trading methods and powerful security measures.

Recommended reliable digital currency trading platforms. Top 10 digital currency exchanges in the world. 2025

Apr 28, 2025 pm 04:30 PM

Recommended reliable digital currency trading platforms. Top 10 digital currency exchanges in the world. 2025

Apr 28, 2025 pm 04:30 PM

Recommended reliable digital currency trading platforms: 1. OKX, 2. Binance, 3. Coinbase, 4. Kraken, 5. Huobi, 6. KuCoin, 7. Bitfinex, 8. Gemini, 9. Bitstamp, 10. Poloniex, these platforms are known for their security, user experience and diverse functions, suitable for users at different levels of digital currency transactions

How much is Bitcoin worth

Apr 28, 2025 pm 07:42 PM

How much is Bitcoin worth

Apr 28, 2025 pm 07:42 PM

Bitcoin’s price ranges from $20,000 to $30,000. 1. Bitcoin’s price has fluctuated dramatically since 2009, reaching nearly $20,000 in 2017 and nearly $60,000 in 2021. 2. Prices are affected by factors such as market demand, supply, and macroeconomic environment. 3. Get real-time prices through exchanges, mobile apps and websites. 4. Bitcoin price is highly volatile, driven by market sentiment and external factors. 5. It has a certain relationship with traditional financial markets and is affected by global stock markets, the strength of the US dollar, etc. 6. The long-term trend is bullish, but risks need to be assessed with caution.

Which of the top ten currency trading platforms in the world are among the top ten currency trading platforms in 2025

Apr 28, 2025 pm 08:12 PM

Which of the top ten currency trading platforms in the world are among the top ten currency trading platforms in 2025

Apr 28, 2025 pm 08:12 PM

The top ten cryptocurrency exchanges in the world in 2025 include Binance, OKX, Gate.io, Coinbase, Kraken, Huobi, Bitfinex, KuCoin, Bittrex and Poloniex, all of which are known for their high trading volume and security.