Huobi HTX exchange contract trading operation tutorial

1. Open the Huobi APP (official download) and log in to your Huobi account (new user registration), click "Contracts" on the bottom navigation bar, click U-based contract at the top of the contract page, and then select the contract and account type.

#2. Transfer funds.

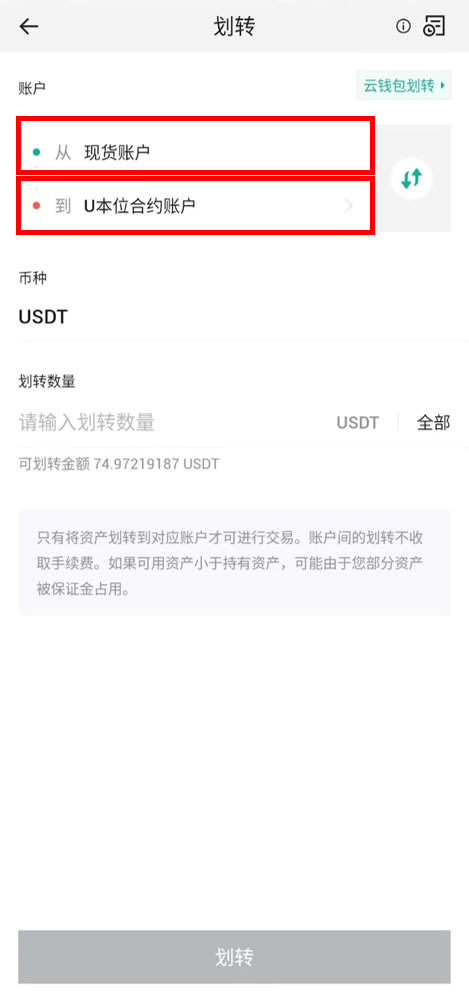

U-standard contract accounts are divided into cross-margin accounts and isolated margin accounts. There is only one cross-margin account. All delivery and perpetual contracts in U-standard share the collateral assets of this account; isolated margin accounts are divided into different types. The isolated margin accounts are independent of each other, such as the BTC/USDT isolated margin account. Only the BTC/USDT perpetual contract can use the collateral assets of this account. The current guaranteed asset of the U-standard contract is only USDT, which supports transfer from currency to currency accounts. It also supports transfers between isolated margin accounts and cross margin accounts of various types of contracts.

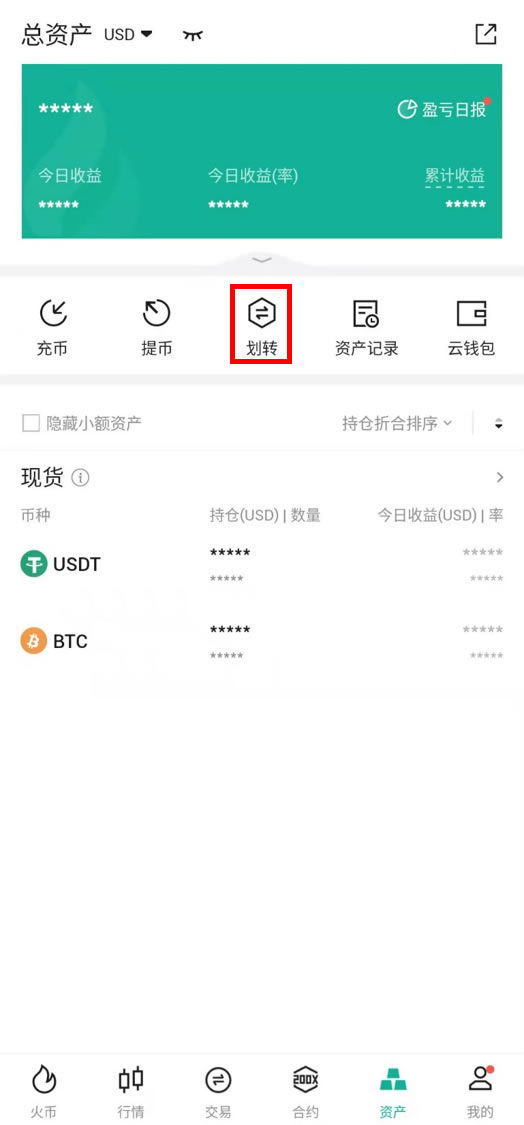

2.1 Click the transfer button

Entrance 1: Click the transfer button on the transaction page

Entrance 2: Click the [. ..] [Secured Asset Transfer]

Entrance 3: Enter the contract asset page, click the corresponding asset to enter the asset details page, and click the [Transfer] button

2.2. Select the transfer-in/out account and variety

to perform U-standard contract cross-margin trading. You need to transfer USDT to the U-standard contract account- USDT full position. Can be transferred from spot account.

#3. Switch trading mode/unit/multiple.

Mode: Currently, the U-based perpetual contract supports full position and isolated position modes, which can be switched on the trading page. Both can be used at the same time, and switching to full position or isolated position for trading will not affect existing transactions. position. The U-standard delivery contract only supports the cross position mode

Unit: You can choose BTC and USDT as the unit

Multiple: You can switch the multiple before opening a position or when there is a position without any pending orders.

4. Make a transaction. Users can choose limit orders, plan orders, and grid trading to open positions.

Limit price order. Confirm the price (you can enter or select the range) and quantity (you can enter or slide the percentage) to place an order. Limit orders can be used for both opening and closing positions, and take-profit and stop-loss can be set at the same time when opening a position [>>>Take-profit and stop-loss operation instructions]. Limit orders can choose three effective mechanisms, "Make only (Post only)", "Full or cancel immediately (FillOrKill)", "Fill immediately and cancel the remaining (ImmediateOrCancel)"; if you do not choose the effective mechanism, the price will be limited. Delegation defaults to "always valid". >>>Limit price order operation instructions

Plan order: Set the trigger price, order price and quantity. When the latest transaction price in the market reaches the trigger condition, the system will place a limit order based on the order price and quantity set in advance. >>>Guidelines for planned commission operations

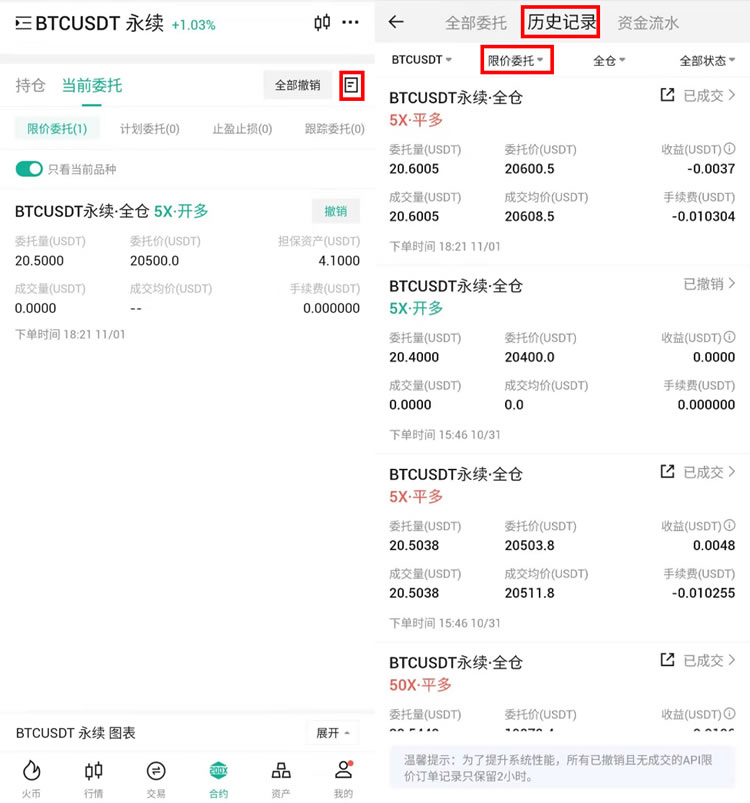

5. After the order is successfully placed, the completed position will be displayed in the "Position" column, and operations such as position closing and stop-profit and stop-loss operations can be performed; The unfinished part is displayed in the "Current Order" column, and the order can be canceled before the transaction is completed.

6. When closing a position, you can choose a limit order or a plan order to close the position according to the situation on the position closing page. You can also close the position or close the position quickly on the position page. , among them, using the "flash closing" function, the closing order issued by the user can be quickly entrusted at the 30th price of the opponent's order, improving the order completion rate.

7. Click "All" on the "Current Order" page, and then click "History" to view the transaction records of the past three months.

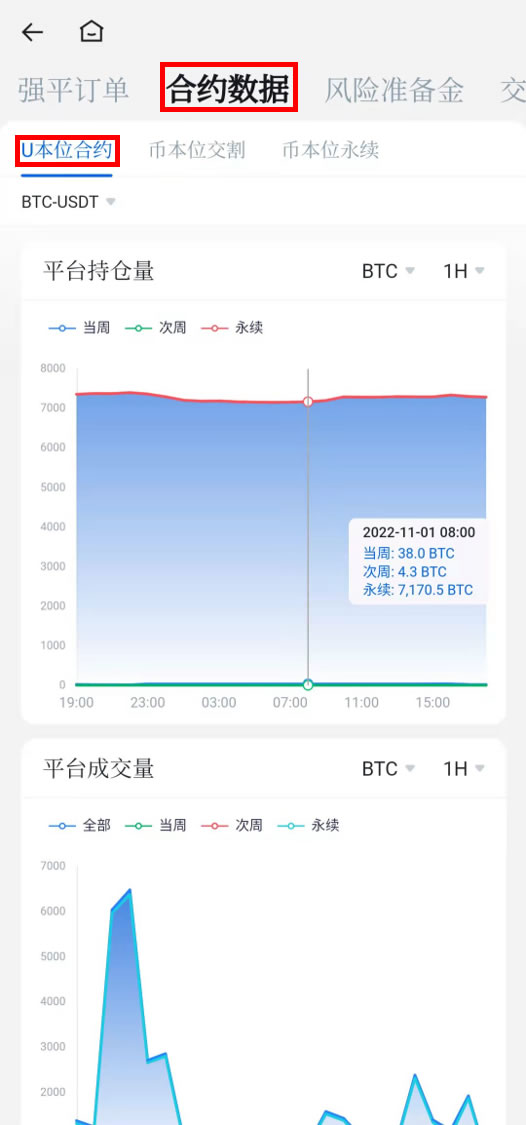

8. In the "Market Information" in the [...] upper right corner of the contract trading page, you can query information such as liquidation orders, contract data, risk reserves, etc.

#9. In the "Transaction Restrictions" in the upper right corner [...] of the contract transaction page, you can query data such as transaction restrictions, transfer restrictions, and ladder-guaranteed assets.

The above is the detailed content of Huobi HTX exchange contract trading operation tutorial. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Which of the top ten currency trading platforms in the world are the latest version of the top ten currency trading platforms

Apr 28, 2025 pm 08:09 PM

Which of the top ten currency trading platforms in the world are the latest version of the top ten currency trading platforms

Apr 28, 2025 pm 08:09 PM

The top ten cryptocurrency trading platforms in the world include Binance, OKX, Gate.io, Coinbase, Kraken, Huobi Global, Bitfinex, Bittrex, KuCoin and Poloniex, all of which provide a variety of trading methods and powerful security measures.

Bitcoin price today

Apr 28, 2025 pm 07:39 PM

Bitcoin price today

Apr 28, 2025 pm 07:39 PM

Bitcoin’s price fluctuations today are affected by many factors such as macroeconomics, policies, and market sentiment. Investors need to pay attention to technical and fundamental analysis to make informed decisions.

How much is Bitcoin worth

Apr 28, 2025 pm 07:42 PM

How much is Bitcoin worth

Apr 28, 2025 pm 07:42 PM

Bitcoin’s price ranges from $20,000 to $30,000. 1. Bitcoin’s price has fluctuated dramatically since 2009, reaching nearly $20,000 in 2017 and nearly $60,000 in 2021. 2. Prices are affected by factors such as market demand, supply, and macroeconomic environment. 3. Get real-time prices through exchanges, mobile apps and websites. 4. Bitcoin price is highly volatile, driven by market sentiment and external factors. 5. It has a certain relationship with traditional financial markets and is affected by global stock markets, the strength of the US dollar, etc. 6. The long-term trend is bullish, but risks need to be assessed with caution.

What currency does Ripple (XRP currency) belong to? Detailed tutorial for beginners

Apr 28, 2025 pm 07:57 PM

What currency does Ripple (XRP currency) belong to? Detailed tutorial for beginners

Apr 28, 2025 pm 07:57 PM

Created by Ripple, Ripple is used for cross-border payments, which are fast and low-cost and suitable for small transaction payments. After registering a wallet and exchange, purchase and storage can be made.

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

The top ten digital currency exchanges such as Binance, OKX, gate.io have improved their systems, efficient diversified transactions and strict security measures.

Binance official website entrance Binance official latest entrance 2025

Apr 28, 2025 pm 07:54 PM

Binance official website entrance Binance official latest entrance 2025

Apr 28, 2025 pm 07:54 PM

Visit Binance official website and check HTTPS and green lock logos to avoid phishing websites, and official applications can also be accessed safely.

Which of the top ten currency trading platforms in the world are among the top ten currency trading platforms in 2025

Apr 28, 2025 pm 08:12 PM

Which of the top ten currency trading platforms in the world are among the top ten currency trading platforms in 2025

Apr 28, 2025 pm 08:12 PM

The top ten cryptocurrency exchanges in the world in 2025 include Binance, OKX, Gate.io, Coinbase, Kraken, Huobi, Bitfinex, KuCoin, Bittrex and Poloniex, all of which are known for their high trading volume and security.

Ouyi official website entrance Ouyi official latest entrance 2025

Apr 28, 2025 pm 07:48 PM

Ouyi official website entrance Ouyi official latest entrance 2025

Apr 28, 2025 pm 07:48 PM

Choose a reliable trading platform such as OKEx to ensure access to the official entrance.