web3.0

web3.0

Bitcoin continues to fluctuate at $43,000! Take stock of 2 signs of a bull market outbreak

Bitcoin continues to fluctuate at $43,000! Take stock of 2 signs of a bull market outbreak

Bitcoin continues to fluctuate at $43,000! Take stock of 2 signs of a bull market outbreak

Bitcoin (BTC) once fell below the US$42,000 mark on the 1st, hitting a low of US$41,884, but then rebounded to US$42,000 on the 2nd, and has continued to trade at US$42,000 for the past three days. It fluctuated between US$42,600 and US$43,500, with no obvious fluctuations. As of press time, Bitcoin was quoted at $43,033, down 0.3%.

Ethereum (ETH) reached a high of $2,391 on January 31, but then slid to a low of $2,240 on the 1st. After that, the price recovered slightly and continued to fluctuate between $2,280 and $2,330 over the past 3 days. As of now, the price of Ethereum is at $2,285, down 0.8% from the past 24 hours.

Trend Observation 1: GBTC capital outflows slow down

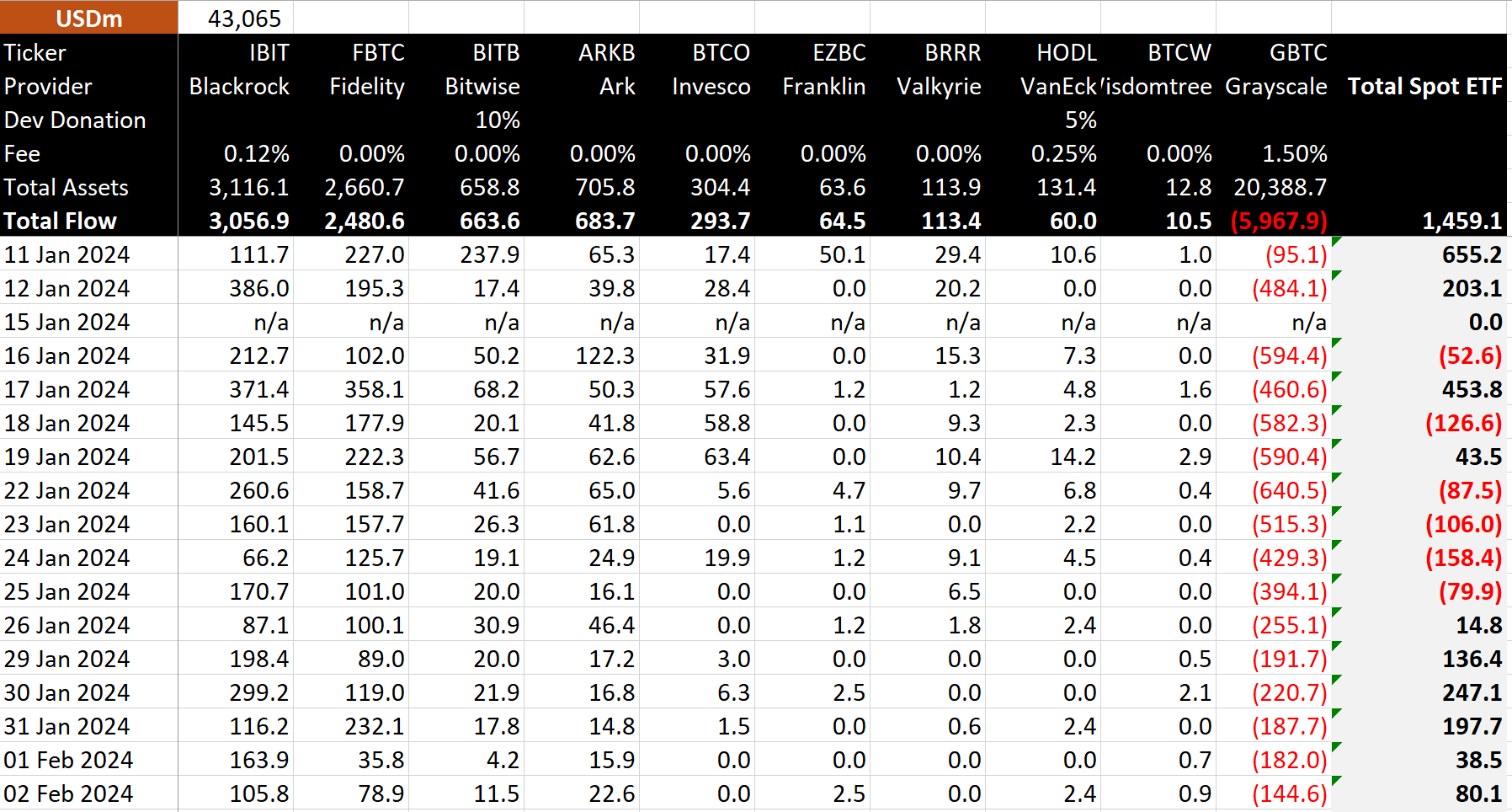

It is worth noting that the latest data shows that the scale of grayscale GBTC capital outflows is continuing to decrease. According to data from BitMEX Research, the Bitcoin spot ETF experienced a single-day outflow of US$145 million on February 2, the 16th trading day of its launch. Nine trading days have passed since the single-day outflow reached its peak of US$640 million on January 22, and the scale of outflows has begun to slow down (except for a slight increase on the 30th). This shows that investor outflow pressure on Bitcoin has weakened, which may mean that market sentiment is gradually improving.

Bitcoin spot ETF capital inflows and changes

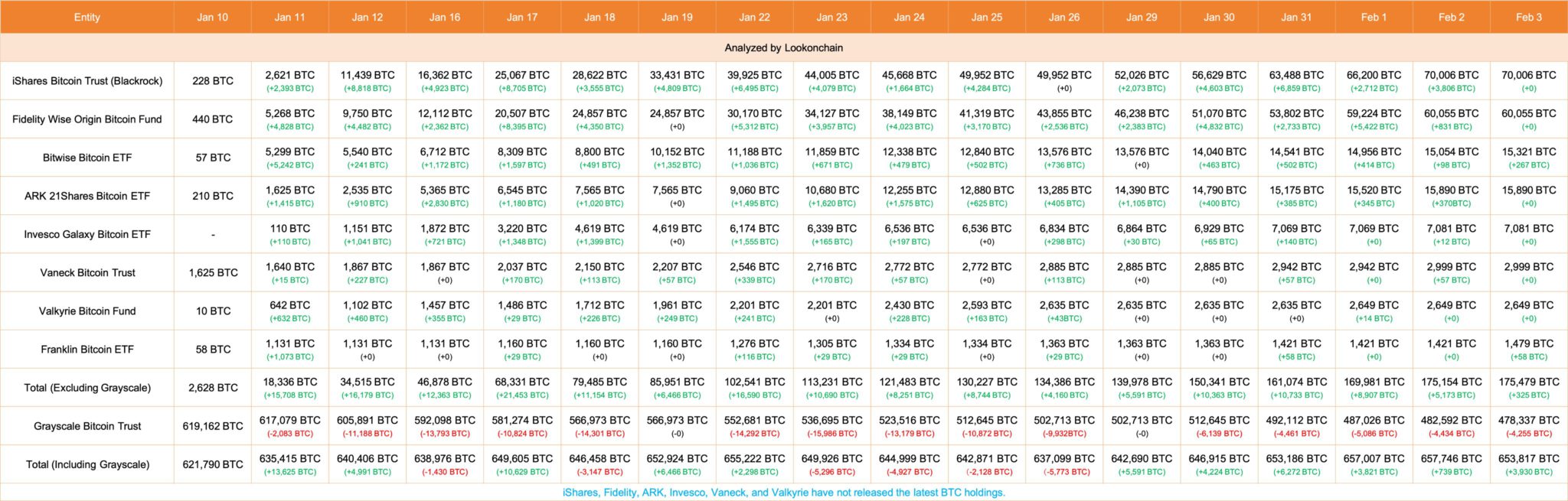

According to Lookonchain data, the latest data shows that GBTC has decreased by 4,255 BTC in the past 3 days, which is equivalent to at approximately US$183 million. Since the GBTC Conversion Bitcoin Spot ETF application was approved, GBTC has lost a total of 140,825 BTC, equivalent to approximately $6.07 billion. At the same time, eight other spot ETFs such as BlackRock added 175,479 BTC, equivalent to approximately US$7.56 billion. This means that net inflows into spot ETFs reached 34,654 BTC.

Changes in BTC holdings of Bitcoin Spot ETF

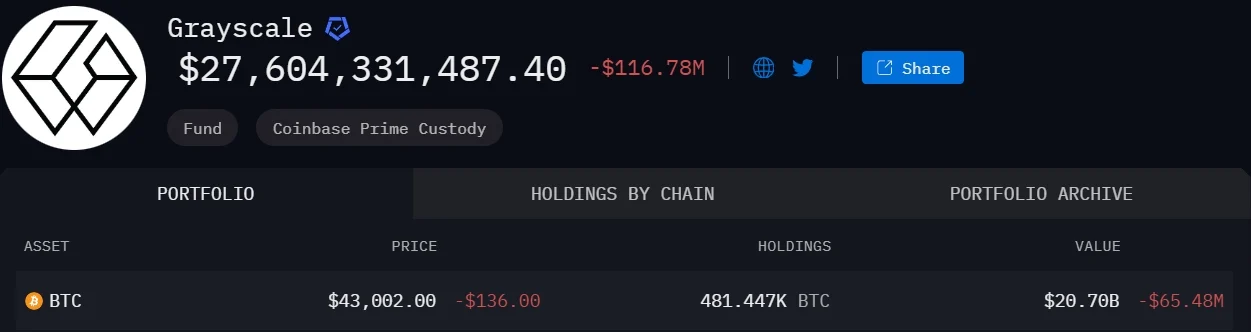

According to Arkham Intelligence data, Grayscale GBTC still holds approximately 481,000 Bitcoins. , worth approximately US$20.7 billion.

GBTC’s BTC holdings

Bloomberg analyst Eric Balchunas had previously expected GBTC’s outflow rate to be higher than 20%, but did not It will exceed 35%, and at least 1/3 of these outflows from GBTC will reinvest in Bitcoin. After including GBTC outflows, the net inflow of Bitcoin spot ETF funds this year will still reach 10 billion US dollars.

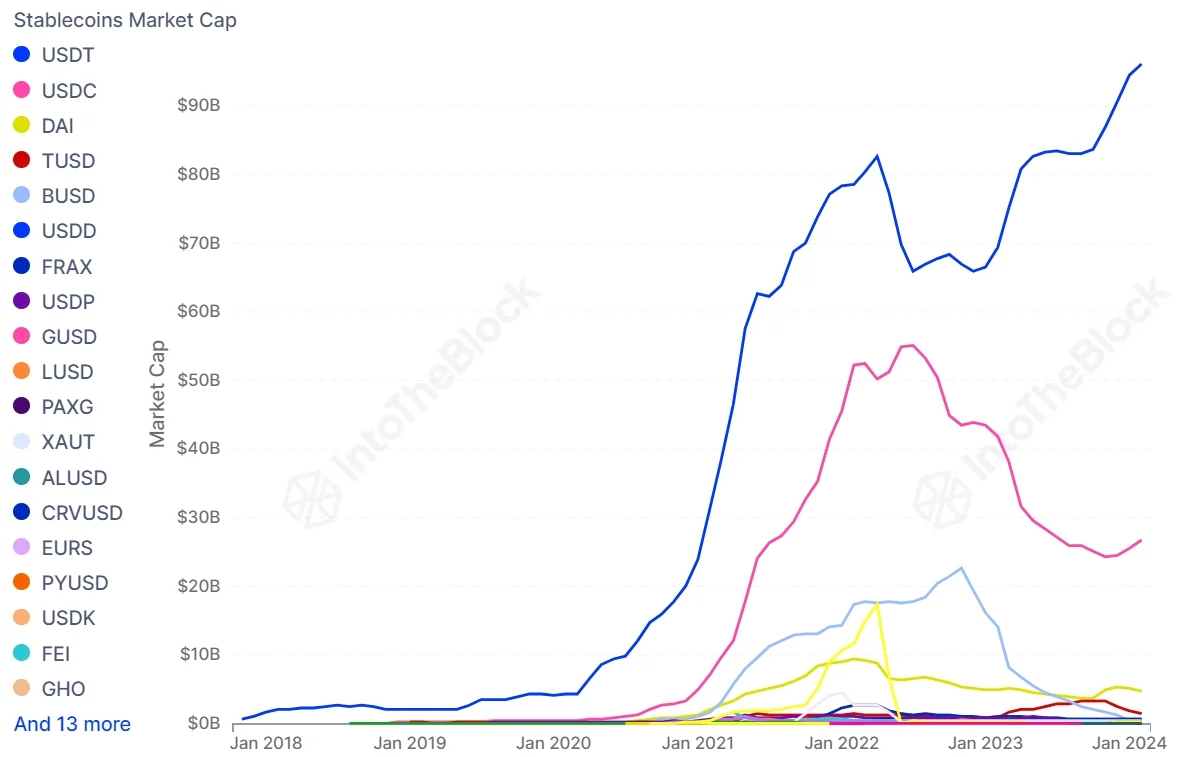

Trend Observation 2: USDT market value hits new high

In addition, IntoTheBlock data shows that USDT has written a major new milestone. The market value has now climbed to 96 billion US dollars, setting a record high. IntoTheBlock also It is pointed out that the market value of stablecoins is rising strongly, with an increase of more than 9 billion US dollars since October 2023. The continued upward trend further enhances the possibility of a bull market cycle.

Market value of stablecoin

The above is the detailed content of Bitcoin continues to fluctuate at $43,000! Take stock of 2 signs of a bull market outbreak. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1659

1659

14

14

1415

1415

52

52

1309

1309

25

25

1257

1257

29

29

1231

1231

24

24

How much is Bitcoin worth

Apr 28, 2025 pm 07:42 PM

How much is Bitcoin worth

Apr 28, 2025 pm 07:42 PM

Bitcoin’s price ranges from $20,000 to $30,000. 1. Bitcoin’s price has fluctuated dramatically since 2009, reaching nearly $20,000 in 2017 and nearly $60,000 in 2021. 2. Prices are affected by factors such as market demand, supply, and macroeconomic environment. 3. Get real-time prices through exchanges, mobile apps and websites. 4. Bitcoin price is highly volatile, driven by market sentiment and external factors. 5. It has a certain relationship with traditional financial markets and is affected by global stock markets, the strength of the US dollar, etc. 6. The long-term trend is bullish, but risks need to be assessed with caution.

Free viewing market software websites What are the top ten free viewing market software websites

Apr 24, 2025 pm 02:21 PM

Free viewing market software websites What are the top ten free viewing market software websites

Apr 24, 2025 pm 02:21 PM

Top 10 free-to-view market software websites are recommended: 1. Binance, 2. OkX, 3. Sesame Open Door (KuCoin), 4. CoinMarketCap, 5. CoinGecko, 6. TradingView, 7. Investing.com, 8. Yahoo Finance, 9. Glassnode Studio, 10. LunarCrush, these websites provide real-time data, technical analysis tools and market information to help you make informed investment decisions.

What currency does Ripple (XRP currency) belong to? Detailed tutorial for beginners

Apr 28, 2025 pm 07:57 PM

What currency does Ripple (XRP currency) belong to? Detailed tutorial for beginners

Apr 28, 2025 pm 07:57 PM

Created by Ripple, Ripple is used for cross-border payments, which are fast and low-cost and suitable for small transaction payments. After registering a wallet and exchange, purchase and storage can be made.

Sesame Open Door Official Website Entrance Sesame Open Door Official Latest Entrance 2025

Apr 28, 2025 pm 07:51 PM

Sesame Open Door Official Website Entrance Sesame Open Door Official Latest Entrance 2025

Apr 28, 2025 pm 07:51 PM

Sesame Open Door is a platform that focuses on cryptocurrency trading. Users can obtain portals through official websites or social media to ensure that the authenticity of SSL certificates and website content is verified during access.

Binance official website entrance Binance official latest entrance 2025

Apr 28, 2025 pm 07:54 PM

Binance official website entrance Binance official latest entrance 2025

Apr 28, 2025 pm 07:54 PM

Visit Binance official website and check HTTPS and green lock logos to avoid phishing websites, and official applications can also be accessed safely.

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

The top ten digital currency exchanges such as Binance, OKX, gate.io have improved their systems, efficient diversified transactions and strict security measures.

What are the top currency trading platforms? The top 10 latest virtual currency exchanges

Apr 28, 2025 pm 08:06 PM

What are the top currency trading platforms? The top 10 latest virtual currency exchanges

Apr 28, 2025 pm 08:06 PM

Currently ranked among the top ten virtual currency exchanges: 1. Binance, 2. OKX, 3. Gate.io, 4. Coin library, 5. Siren, 6. Huobi Global Station, 7. Bybit, 8. Kucoin, 9. Bitcoin, 10. bit stamp.

Top 10 Currency Exchange Trading Platform Ranking Top 10 Currency Exchange App Recommended in 2025

Apr 28, 2025 pm 12:18 PM

Top 10 Currency Exchange Trading Platform Ranking Top 10 Currency Exchange App Recommended in 2025

Apr 28, 2025 pm 12:18 PM

Ranking of the top ten currency trading platforms: 1. Binance, 2. OKX, 3. Gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bittrex, 10. Poloniex, these exchanges provide registration, verification, deposit, withdrawal and trading functions, which are suitable for traders of different levels.