web3.0

web3.0

Covalent (CQT): Build a new on-chain protocol revenue system and commit to financial transparency

Covalent (CQT): Build a new on-chain protocol revenue system and commit to financial transparency

Covalent (CQT): Build a new on-chain protocol revenue system and commit to financial transparency

In the vibrant world of blockchain and decentralized technology, Covalent Network (CQT) is reshaping the on-chain economic system through its innovative protocol revenue model. Unlike traditional financial systems, this feature brings unparalleled accessibility, eliminating intermediaries and giving the community direct access to granular blockchain data.

Covalent’s value accumulation mechanism

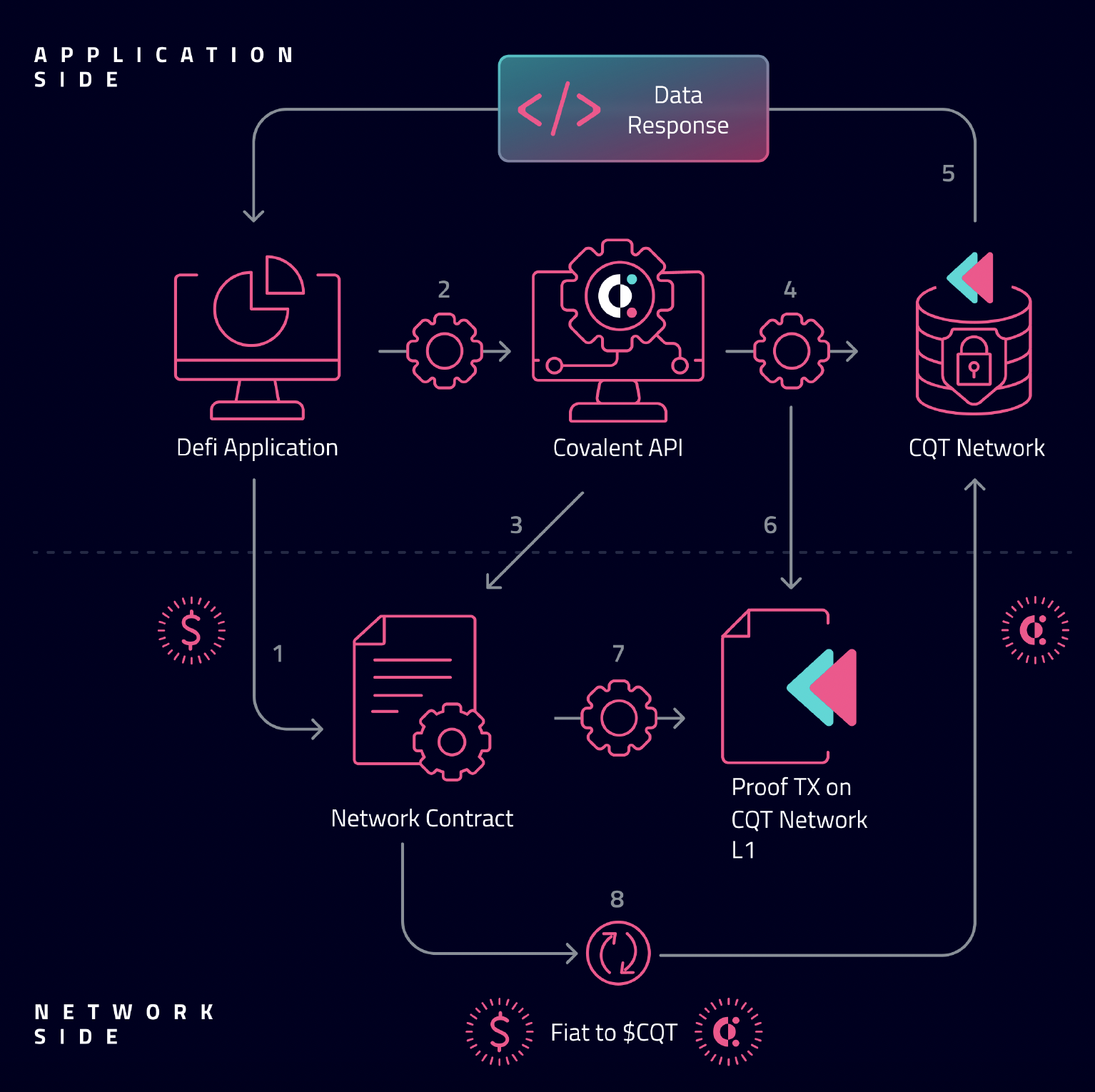

At the core level, Covalent Network (CQT) plays a dual role. It is both a decentralized physical infrastructure and a middleware project. Promote the connection between the supply and demand sides of data on the chain. Analogous to well-known platforms such as Uber, Covalent connects query operators (supply side) with applications (demand side) and differentiates itself from traditional financial structures by extracting revenue at a certain rate as a way to accumulate protocol revenue. Come on.

For the foreseeable future, Covalent Network (CQT) will rely entirely on the Ethereum network and exclusively use $ETH tokens for network fees. Through its Ethereum Wayback Machine (EWM), an innovative solution designed to secure access to historical blockchain data, Covalent Network (CQT) ensures decentralization and avoids dependence on centralized entities. This strategic move not only solidifies the integration of the Covalent Network (CQT) system, but also actively strengthens Covalent Network (CQT)’s commitment to the Ethereum ecosystem by cultivating a symbiotic relationship, not only for the Covalent Network (CQT) system as a whole improvement, and is also expected to promote the broader development of the Ethereum network.

How does it work?

Covalent Network (CQT) uses $CQT as the governance and staking token. Operators participate in network operations by pledging tokens, and their work shares will be distributed according to their pledge ratio, while the income generated by demand parties entering the network through the protocol will be distributed to operators through a new profit sharing mechanism.

The main value accumulation mechanism process is as follows:

- The application directly queries the blockchain data API by interacting with the smart contract on the chain, and pays with stable currency.

- Pricing for APIs is determined by the carrier network.

- Stablecoins are converted to $CQT through the market buyback mechanism.

- $CQT is staked by the network operator as a security guarantee of its honest behavior.

- Earned $CQT are allocated to operators based on work completed.

- Operators sell a portion of the $CQT earned to pay for operating expenses, which again flows back into the ecosystem’s economy.

Convert demand into token value driver

It is worth noting that the demand side in Covalent Network (CQT) prices demand in US dollars or fiat currencies, ensuring Predictability of consumer bills under a variety of circumstances. Covalent Network (CQT) uses USD as the basis for collecting revenue, which is converted into $CQT (Covalent’s native token) through regular market purchases. $CQT is then distributed to validators as a network utility token, flowing back into the ecosystem and sustaining the operation of the network.

Covalent Network (CQT) provides fair compensation for those who actively participate in network operations, while the value accumulation of traditional models often favors passive stakeholders with limited or no direct participation in ecological construction. Obviously, Covalent Network (CQT) is fundamentally different from traditional economic models.

Q&A

Q: What is the difference between the decentralized model of Covalent Network (CQT) and the centralized model?

A: In the centralized model, passive token holders do not need to actively participate to benefit. The difference between Covalent and the centralized model is that its decentralized structure ensures that token holders are based on They are rewarded for their active contributions such as staking or running a validator node. This emphasizes active participation and establishes a fair and incentivized distribution model to ensure that the system operates efficiently in a decentralized manner.

Q: What is unique about Covalent Network (CQT) in terms of instant protocol revenue accumulation?

A: The more API calls made in the network, the more revenue is generated. By leveraging token incentives, costs will be reduced for users and long-term data availability will be transformed into a public benefit.

Q: Can you explain the current revenue accumulation method of Covalent Network (CQT) and the expected changes?

A: Currently, revenue accrual involves two steps: the demand side pays the protocol in USD as an API consumer, and converts it into $CQT tokens and distributes them to validators. As more validators join, our long-term goal is to build a more straightforward process that reduces reliance on centralized methods and builds larger decentralized systems over time.

About Covalent Network (CQT)

Covalent (CQT) focuses on blockchain data availability and supports millions of users to build a new economy. Since its establishment, Covalent has continued to help developers and analysts It provides comprehensive and real-time data on more than 200 chains.

The above is the detailed content of Covalent (CQT): Build a new on-chain protocol revenue system and commit to financial transparency. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

The top ten digital virtual currency apps are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

Meme Coin Exchange Ranking Meme Coin Main Exchange Top 10 Spots

Apr 22, 2025 am 09:57 AM

Meme Coin Exchange Ranking Meme Coin Main Exchange Top 10 Spots

Apr 22, 2025 am 09:57 AM

The most suitable platforms for trading Meme coins include: 1. Binance, the world's largest, with high liquidity and low handling fees; 2. OkX, an efficient trading engine, supporting a variety of Meme coins; 3. XBIT, decentralized, supporting cross-chain trading; 4. Redim (Solana DEX), low cost, combined with Serum order book; 5. PancakeSwap (BSC DEX), low transaction fees and fast speed; 6. Orca (Solana DEX), user experience optimization; 7. Coinbase, high security, suitable for beginners; 8. Huobi, well-known in Asia, rich trading pairs; 9. DEXRabbit, intelligent

Top 10 digital currency exchanges Top 10 digital currency app exchanges

Apr 22, 2025 pm 03:15 PM

Top 10 digital currency exchanges Top 10 digital currency app exchanges

Apr 22, 2025 pm 03:15 PM

The top ten digital currency exchanges are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

What is on-chain transaction? What are the global transactions?

Apr 22, 2025 am 10:06 AM

What is on-chain transaction? What are the global transactions?

Apr 22, 2025 am 10:06 AM

EU MiCA compliance certification, covering 50 fiat currency channels, cold storage ratio 95%, and zero security incident records. The US SEC licensed platform has convenient direct purchase of fiat currency, a ratio of 98% cold storage, institutional-level liquidity, supports large-scale OTC and custom orders, and multi-level clearing protection.

Top 10 digital virtual currency trading app rankings Top 10 digital currency exchange rankings in 2025

Apr 22, 2025 pm 02:45 PM

Top 10 digital virtual currency trading app rankings Top 10 digital currency exchange rankings in 2025

Apr 22, 2025 pm 02:45 PM

The top ten digital currency exchanges are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

What are the top ten virtual currency trading apps? Recommended on the top ten digital currency exchange platforms

Apr 22, 2025 pm 01:12 PM

What are the top ten virtual currency trading apps? Recommended on the top ten digital currency exchange platforms

Apr 22, 2025 pm 01:12 PM

The top ten secure digital currency exchanges in 2025 are: 1. Binance, 2. OKX, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. Bitfinex, 8. KuCoin, 9. Bybit, 10. Bitstamp. These platforms adopt multi-level security measures, including separation of hot and cold wallets, multi-signature technology, and a 24/7 monitoring system to ensure the safety of user funds.

What are the stablecoins? How to trade stablecoins?

Apr 22, 2025 am 10:12 AM

What are the stablecoins? How to trade stablecoins?

Apr 22, 2025 am 10:12 AM

Common stablecoins are: 1. Tether, issued by Tether, pegged to the US dollar, widely used but transparency has been questioned; 2. US dollar, issued by Circle and Coinbase, with high transparency and favored by institutions; 3. DAI, issued by MakerDAO, decentralized, and popular in the DeFi field; 4. Binance Dollar (BUSD), cooperated by Binance and Paxos, and performed excellent in transactions and payments; 5. TrustTo

Ranking of mixed stablecoin exchanges Top 10 recommended global mixed stablecoin trading platforms

Apr 22, 2025 am 10:00 AM

Ranking of mixed stablecoin exchanges Top 10 recommended global mixed stablecoin trading platforms

Apr 22, 2025 am 10:00 AM

The world-renowned hybrid stablecoin trading platforms include: 1. Binance: the world's largest, supports a variety of stablecoins, comprehensive trading tools, and strong security measures. 2. OKX: It is a world-leading, efficient trading engine, and provides products such as multi-chain non-custodial wallets. 3. Bitget: Innovative order transactions, complete security agreements, and advantages in transaction handling fees. 4. Coinbase: The US platform, known for its compliance and security, is suitable for beginners and professional traders. 5. Huobi: well-known in Asia, strong technical strength, and compliant operations. 6. Kraken: Has a long history, good safety record, and strict compliance. 7. Bitfinex: a global platform, high liquidity, suitable for