Technology peripherals

Technology peripherals

AI

AI

AI will change the core logic of investment, will the 60/40 stock and bond strategy become obsolete?

AI will change the core logic of investment, will the 60/40 stock and bond strategy become obsolete?

AI will change the core logic of investment, will the 60/40 stock and bond strategy become obsolete?

Morgan Stanley points out that the rise of artificial intelligence has the potential to change some investors’ core investment principles: 60/40 investment portfolio

This investing strategy — allocating 60% of a portfolio to stocks and 40% to bonds — has been touted as the foundation of investing since the 1950s, but over the past few years it has come under scrutiny. There are more and more doubts. Now, another driver of the debate is growing: artificial intelligence.

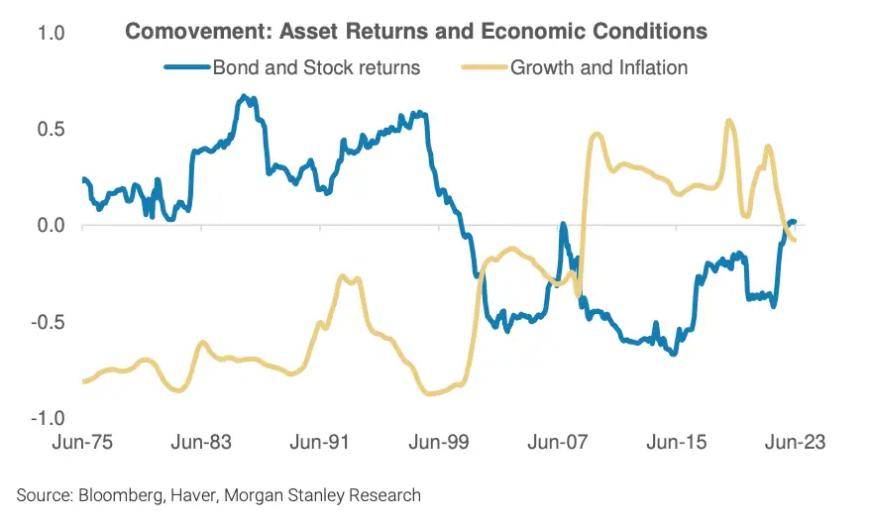

That’s because the technology could boost productivity so much that the correlations between economic growth and inflation, and between stocks and bonds, could reverse.

Morgan Stanley analysts wrote: "Technological diffusion acts like a supply shock, boosting growth in the short term and often lowering inflation at the same time."

As a result, previous assumptions about how to diversify risk may no longer apply, as the AI boom will deliver healthy returns for both stocks and bonds - breaking the traditional negative correlation between the two.

This undermines a key part of the 60/40 strategy. "In other words, bonds - as has been the case this year - will no longer be the good diversifiers they have been for the past 30 years," the analysts wrote.

Analysts at Morgan Stanley further explained that the traditional negative correlation between stocks and bonds has been reversed, a situation that also occurred during the Internet bubble in the 1990s. The explosive growth of information and communication technology has accelerated capital investment, reduced operating costs for enterprises, and increased wealth, leading to higher consumption levels

“Similar to information and communication technologies, artificial intelligence, especially generative artificial intelligence, has the potential to broadly improve productivity across industries.”

After the recent "U.S. debt crisis", the debate about the 60/40 portfolio has become increasingly fierce. This comes after the Federal Reserve sharply raised interest rates to curb rising inflation. Therefore, the 60/40 portfolio did not achieve amazing returns

BlackRock said that in the new era of high interest rates, the 60/40 investment portfolio is no longer applicable and investors now need to be more "flexible" and "meticulous." At the same time, Vanguard Group expects the strategy to bring high returns next year

Morgan Stanley said that the impact of generative artificial intelligence is only one of many factors that may affect asset correlation and has a certain impact on economic growth and inflation

The strategists said, "But if we do see this happen, we think it could mean that long-term portfolios will tilt more towards stocks than bonds, as fixed income becomes a less reliable diversifier. Investment tools. We think investors may be looking for new portfolio diversification tools,"

We may also see a further acceleration in asset allocators investing money into private credit. In theory, private credit is less correlated with listed equities and fixed income. They added

Source: Financial Associated Press

The above is the detailed content of AI will change the core logic of investment, will the 60/40 stock and bond strategy become obsolete?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1663

1663

14

14

1419

1419

52

52

1313

1313

25

25

1264

1264

29

29

1237

1237

24

24

Which of the top ten currency trading platforms in the world are among the top ten currency trading platforms in 2025

Apr 28, 2025 pm 08:12 PM

Which of the top ten currency trading platforms in the world are among the top ten currency trading platforms in 2025

Apr 28, 2025 pm 08:12 PM

The top ten cryptocurrency exchanges in the world in 2025 include Binance, OKX, Gate.io, Coinbase, Kraken, Huobi, Bitfinex, KuCoin, Bittrex and Poloniex, all of which are known for their high trading volume and security.

How much is Bitcoin worth

Apr 28, 2025 pm 07:42 PM

How much is Bitcoin worth

Apr 28, 2025 pm 07:42 PM

Bitcoin’s price ranges from $20,000 to $30,000. 1. Bitcoin’s price has fluctuated dramatically since 2009, reaching nearly $20,000 in 2017 and nearly $60,000 in 2021. 2. Prices are affected by factors such as market demand, supply, and macroeconomic environment. 3. Get real-time prices through exchanges, mobile apps and websites. 4. Bitcoin price is highly volatile, driven by market sentiment and external factors. 5. It has a certain relationship with traditional financial markets and is affected by global stock markets, the strength of the US dollar, etc. 6. The long-term trend is bullish, but risks need to be assessed with caution.

Which of the top ten currency trading platforms in the world are the latest version of the top ten currency trading platforms

Apr 28, 2025 pm 08:09 PM

Which of the top ten currency trading platforms in the world are the latest version of the top ten currency trading platforms

Apr 28, 2025 pm 08:09 PM

The top ten cryptocurrency trading platforms in the world include Binance, OKX, Gate.io, Coinbase, Kraken, Huobi Global, Bitfinex, Bittrex, KuCoin and Poloniex, all of which provide a variety of trading methods and powerful security measures.

Decryption Gate.io Strategy Upgrade: How to Redefine Crypto Asset Management in MeMebox 2.0?

Apr 28, 2025 pm 03:33 PM

Decryption Gate.io Strategy Upgrade: How to Redefine Crypto Asset Management in MeMebox 2.0?

Apr 28, 2025 pm 03:33 PM

MeMebox 2.0 redefines crypto asset management through innovative architecture and performance breakthroughs. 1) It solves three major pain points: asset silos, income decay and paradox of security and convenience. 2) Through intelligent asset hubs, dynamic risk management and return enhancement engines, cross-chain transfer speed, average yield rate and security incident response speed are improved. 3) Provide users with asset visualization, policy automation and governance integration, realizing user value reconstruction. 4) Through ecological collaboration and compliance innovation, the overall effectiveness of the platform has been enhanced. 5) In the future, smart contract insurance pools, forecast market integration and AI-driven asset allocation will be launched to continue to lead the development of the industry.

What are the top currency trading platforms? The top 10 latest virtual currency exchanges

Apr 28, 2025 pm 08:06 PM

What are the top currency trading platforms? The top 10 latest virtual currency exchanges

Apr 28, 2025 pm 08:06 PM

Currently ranked among the top ten virtual currency exchanges: 1. Binance, 2. OKX, 3. Gate.io, 4. Coin library, 5. Siren, 6. Huobi Global Station, 7. Bybit, 8. Kucoin, 9. Bitcoin, 10. bit stamp.

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

The top ten digital currency exchanges such as Binance, OKX, gate.io have improved their systems, efficient diversified transactions and strict security measures.

How to use the chrono library in C?

Apr 28, 2025 pm 10:18 PM

How to use the chrono library in C?

Apr 28, 2025 pm 10:18 PM

Using the chrono library in C can allow you to control time and time intervals more accurately. Let's explore the charm of this library. C's chrono library is part of the standard library, which provides a modern way to deal with time and time intervals. For programmers who have suffered from time.h and ctime, chrono is undoubtedly a boon. It not only improves the readability and maintainability of the code, but also provides higher accuracy and flexibility. Let's start with the basics. The chrono library mainly includes the following key components: std::chrono::system_clock: represents the system clock, used to obtain the current time. std::chron

How to handle high DPI display in C?

Apr 28, 2025 pm 09:57 PM

How to handle high DPI display in C?

Apr 28, 2025 pm 09:57 PM

Handling high DPI display in C can be achieved through the following steps: 1) Understand DPI and scaling, use the operating system API to obtain DPI information and adjust the graphics output; 2) Handle cross-platform compatibility, use cross-platform graphics libraries such as SDL or Qt; 3) Perform performance optimization, improve performance through cache, hardware acceleration, and dynamic adjustment of the details level; 4) Solve common problems, such as blurred text and interface elements are too small, and solve by correctly applying DPI scaling.