Technology peripherals

Technology peripherals

AI

AI

Nvidia, which sells graphics cards, is gone! Nvidia has monopolized the AI industry

Nvidia, which sells graphics cards, is gone! Nvidia has monopolized the AI industry

Nvidia, which sells graphics cards, is gone! Nvidia has monopolized the AI industry

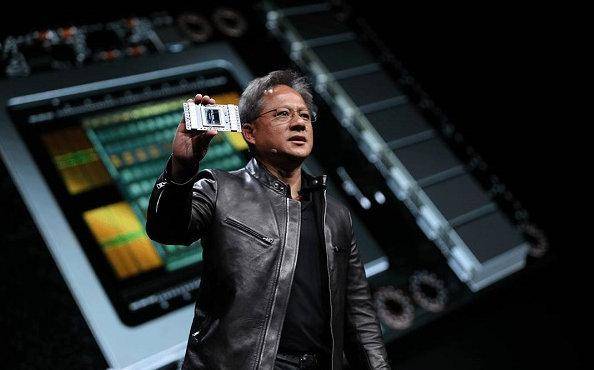

From games to artificial intelligence, from cloud computing to ChatGPT and AI data large models that became popular at the end of last year. Whenever the wind shifts, the pigs in the sky take turns flying, but Huang Renxun can always leave his own figure among them. Jen-Hsun Huang is the CEO of the famous American semiconductor company NVIDA. Huang Jen-Hsun believes that we are in the iPhone era of AI, which means that AI will change the world just like the iPhone changed the mobile phone industry.

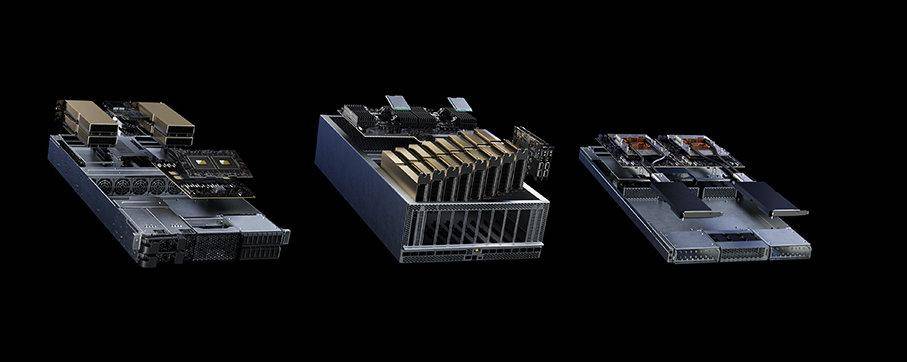

NVIDIA GPU professional computing cards are expected to replace CPUs and become the main computing power support for future computers and supercomputers. NVIDIA cooperates with many world-renowned companies, including cloud service providers such as Alibaba Cloud and Azure, to provide a variety of software and hardware solutions. Only by using NVIDIA products can enterprises deploy AI models better and more easily.

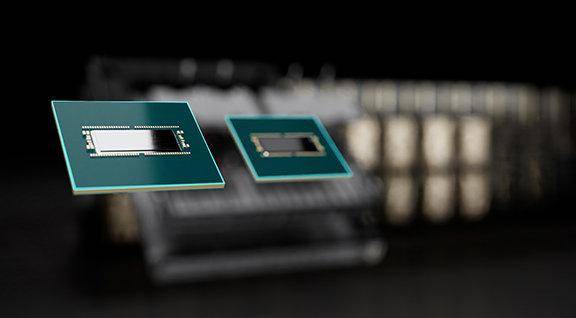

Without computing power, no matter how good the model is, it cannot run. If you want to play with AI, you need at least a thousand Nvidia A100 or H100 computing cards. The market price of an A100 is 150,000 yuan, but the cost is less than 9,000 yuan. This shows how profitable Nvidia’s computing cards are, and their ability to attract money is terrifying. On May 30, Nvidia's market value reached US$1.02 trillion, while Intel's market value was only US$123.5 billion, with eight Intels worth only one Nvidia.

The first quarter financial report for fiscal year 2024 was announced by NVIDIA on May 23 (the fiscal year is different from the natural year). The company's revenue reached US$7.192 billion, exceeding analysts' average forecast of US$6.52 billion, and net profit was US$2.713 billion. On the day the financial report was released, NVIDIA's stock price soared 24.63% like a rocket, an increase equivalent to the market value of AMD. Today's achievements are all due to NVIDIA's long-term technology research and development and product layout in high-performance computing and data centers.

According to financial report data, Nvidia’s data center business revenue in the first quarter was US$4.28 billion, accounting for more than half of the total revenue, a year-on-year increase of 14% and a month-on-month increase of 18%. It is worth noting that although the revenue of the automotive business was only US$296 million, its year-on-year growth rate was as high as 114%, which is a very rapid growth rate. In September last year, Nvidia released the latest generation of autonomous driving chip Thor. To the author's surprise, the computing power reached 2000TOPS. Manufacturers can use all computing power for autonomous driving functions, or allocate part of the computing power to in-vehicle AI and entertainment functions, while the other part is used for assisted driving.

This sentence can be rewritten as: If you want to know whether the automotive business has the ability to become a pillar, the key is to understand the performance of Thor's self-driving chips and never underestimate its potential. NVIDIA hopes that all the computing power required for a series of functions such as assisted driving, automatic parking, and smart cockpits of future cars will be supplied by one chip. Providing car manufacturers with universal software and hardware solutions for all scenarios and building an autonomous driving platform can be more profitable than selling graphics cards.

If the current competition in the AI field is like a gold rush, then NVIDIA is a businessman specializing in "shovels". The difference is that all companies can only buy NVIDIA's "shovel" because NVIDIA monopolizes the entire industry. The hardware, software deployment solutions and development platforms provided by NVIDIA are enough to influence the development of the AI industry. To a certain extent, Nvidia has built an ecological barrier to prevent AMD from penetrating. With the emergence of huge artificial intelligence market demand, graphics card manufacturers have emerged one after another, including Chinese brands, but if they want to catch up with Nvidia, they still need to make exponential efforts.

The above is the detailed content of Nvidia, which sells graphics cards, is gone! Nvidia has monopolized the AI industry. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1662

1662

14

14

1418

1418

52

52

1311

1311

25

25

1261

1261

29

29

1234

1234

24

24

How much is Bitcoin worth

Apr 28, 2025 pm 07:42 PM

How much is Bitcoin worth

Apr 28, 2025 pm 07:42 PM

Bitcoin’s price ranges from $20,000 to $30,000. 1. Bitcoin’s price has fluctuated dramatically since 2009, reaching nearly $20,000 in 2017 and nearly $60,000 in 2021. 2. Prices are affected by factors such as market demand, supply, and macroeconomic environment. 3. Get real-time prices through exchanges, mobile apps and websites. 4. Bitcoin price is highly volatile, driven by market sentiment and external factors. 5. It has a certain relationship with traditional financial markets and is affected by global stock markets, the strength of the US dollar, etc. 6. The long-term trend is bullish, but risks need to be assessed with caution.

Which of the top ten currency trading platforms in the world are among the top ten currency trading platforms in 2025

Apr 28, 2025 pm 08:12 PM

Which of the top ten currency trading platforms in the world are among the top ten currency trading platforms in 2025

Apr 28, 2025 pm 08:12 PM

The top ten cryptocurrency exchanges in the world in 2025 include Binance, OKX, Gate.io, Coinbase, Kraken, Huobi, Bitfinex, KuCoin, Bittrex and Poloniex, all of which are known for their high trading volume and security.

What are the top currency trading platforms? The top 10 latest virtual currency exchanges

Apr 28, 2025 pm 08:06 PM

What are the top currency trading platforms? The top 10 latest virtual currency exchanges

Apr 28, 2025 pm 08:06 PM

Currently ranked among the top ten virtual currency exchanges: 1. Binance, 2. OKX, 3. Gate.io, 4. Coin library, 5. Siren, 6. Huobi Global Station, 7. Bybit, 8. Kucoin, 9. Bitcoin, 10. bit stamp.

Decryption Gate.io Strategy Upgrade: How to Redefine Crypto Asset Management in MeMebox 2.0?

Apr 28, 2025 pm 03:33 PM

Decryption Gate.io Strategy Upgrade: How to Redefine Crypto Asset Management in MeMebox 2.0?

Apr 28, 2025 pm 03:33 PM

MeMebox 2.0 redefines crypto asset management through innovative architecture and performance breakthroughs. 1) It solves three major pain points: asset silos, income decay and paradox of security and convenience. 2) Through intelligent asset hubs, dynamic risk management and return enhancement engines, cross-chain transfer speed, average yield rate and security incident response speed are improved. 3) Provide users with asset visualization, policy automation and governance integration, realizing user value reconstruction. 4) Through ecological collaboration and compliance innovation, the overall effectiveness of the platform has been enhanced. 5) In the future, smart contract insurance pools, forecast market integration and AI-driven asset allocation will be launched to continue to lead the development of the industry.

Which of the top ten currency trading platforms in the world are the latest version of the top ten currency trading platforms

Apr 28, 2025 pm 08:09 PM

Which of the top ten currency trading platforms in the world are the latest version of the top ten currency trading platforms

Apr 28, 2025 pm 08:09 PM

The top ten cryptocurrency trading platforms in the world include Binance, OKX, Gate.io, Coinbase, Kraken, Huobi Global, Bitfinex, Bittrex, KuCoin and Poloniex, all of which provide a variety of trading methods and powerful security measures.

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

The top ten digital currency exchanges such as Binance, OKX, gate.io have improved their systems, efficient diversified transactions and strict security measures.

Recommended reliable digital currency trading platforms. Top 10 digital currency exchanges in the world. 2025

Apr 28, 2025 pm 04:30 PM

Recommended reliable digital currency trading platforms. Top 10 digital currency exchanges in the world. 2025

Apr 28, 2025 pm 04:30 PM

Recommended reliable digital currency trading platforms: 1. OKX, 2. Binance, 3. Coinbase, 4. Kraken, 5. Huobi, 6. KuCoin, 7. Bitfinex, 8. Gemini, 9. Bitstamp, 10. Poloniex, these platforms are known for their security, user experience and diverse functions, suitable for users at different levels of digital currency transactions

Bitcoin price today

Apr 28, 2025 pm 07:39 PM

Bitcoin price today

Apr 28, 2025 pm 07:39 PM

Bitcoin’s price fluctuations today are affected by many factors such as macroeconomics, policies, and market sentiment. Investors need to pay attention to technical and fundamental analysis to make informed decisions.