Technology peripherals

Technology peripherals

AI

AI

AI cores are selling out! NVIDIA announces epic financial report, stock price surges 30%

AI cores are selling out! NVIDIA announces epic financial report, stock price surges 30%

AI cores are selling out! NVIDIA announces epic financial report, stock price surges 30%

This wave of AI craze has made Nvidia, the world’s leader in AI computing power, laugh like crazy!

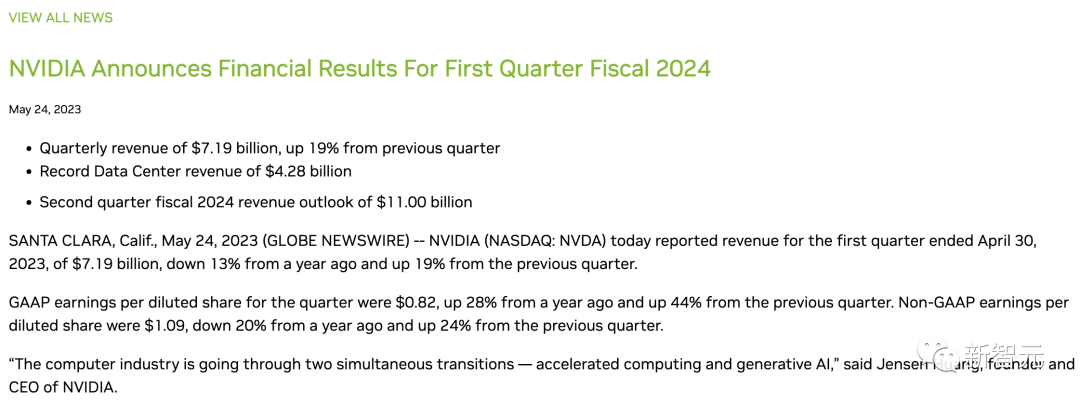

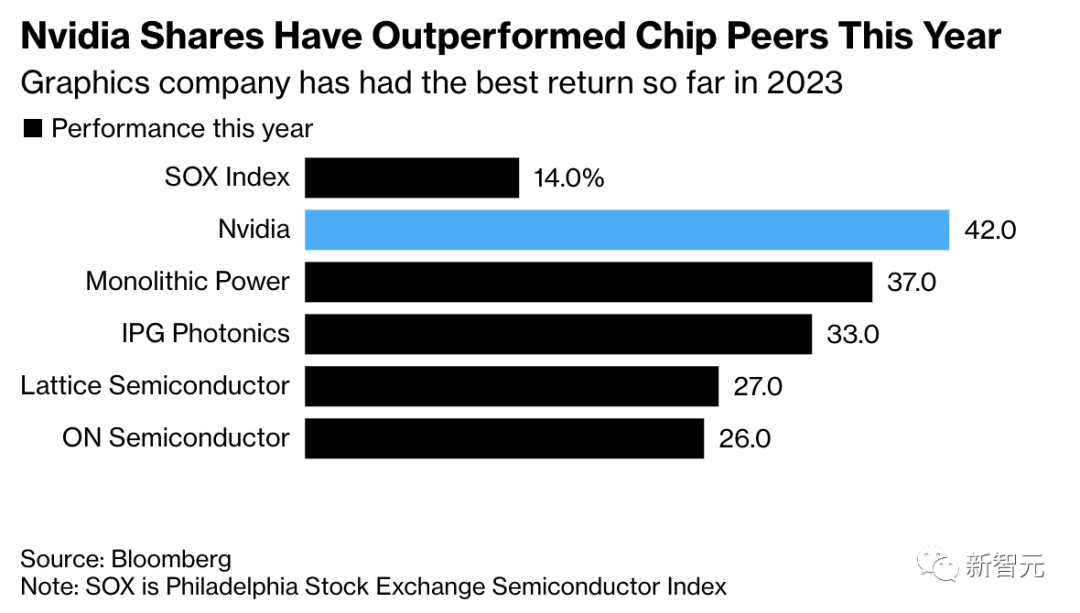

Last night, after Nvidia announced its first quarter financial report for 2024, it was like riding on a rocket, with its stock price soaring 30% to a record high.

Prior to this, its stock price had risen 109% in 2023.

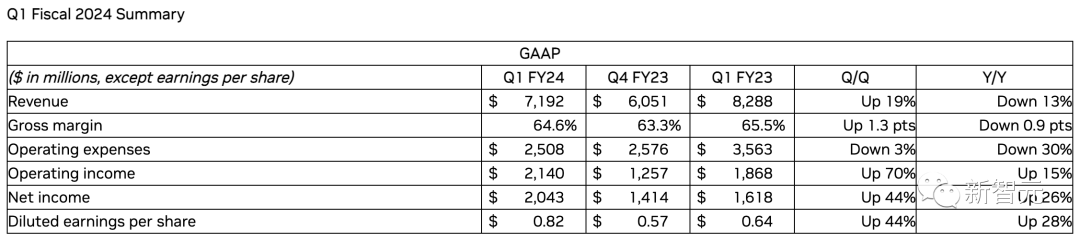

Financial report shows that Nvidia’s Q1 quarter revenue was US$7.19 billion, an increase of 19% from the previous quarter, far exceeding expectations by 10%. Net profit in the first quarter was US$2.713 billion.

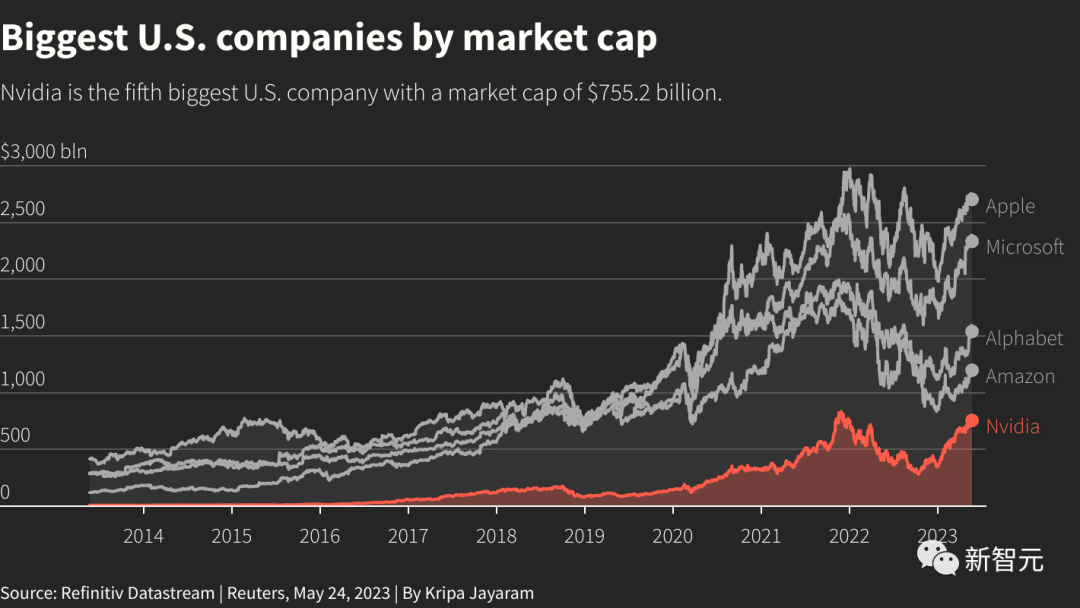

Founded in 1993, NVIDIA’s market value exceeds US$755.2 billion, ranking fifth in the world, far surpassing Meta , Tesla.

Nvidia’s success is because in this AI large model competition, it controls the “vital gate” of computing power. ”.

Lao Huang can proudly announce: "The whole world is buying our chips."

After ChatGPT, NVIDIA submitted its first paper

Technology giants such as Microsoft and Google Silicon Valley are fiercely competing in the AI competition, and the demand for using GPUs to train AI is bound to grow rapidly.

As the demand for computing power surges, Nvidia’s GPUs have almost become the only “hard currency.”

In Nvidia’s financial report, the most eye-catching result is the “data center business.”

This time, Nvidia’s data center business revenue surged to $4.28 billion, which was $3.9 billion higher than expected , setting a new record.

"The computer industry is undergoing two transformations at the same time - accelerating computing and generating artificial intelligence," Huang said in the financial report.

The surge in data center revenue is mainly due to the growing demand for generative AI and large language models using Hopper and Ampere architecture GPUs.

At the same time, the strong performance of data center revenue is further evidence that AI chips are important for cloud providers and other companies running large numbers of servers. Speaking up is becoming more and more important.

It is worth mentioning that Nvidia’s future is limitless.

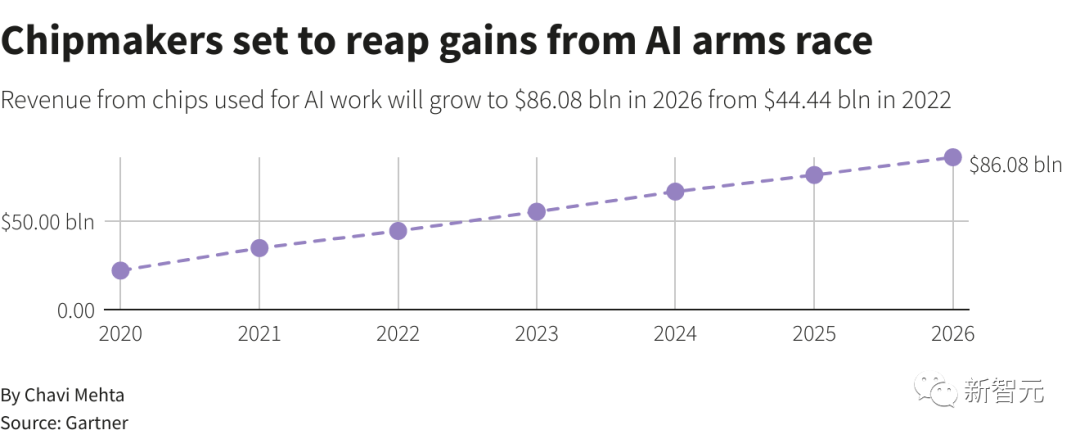

Gartner predicts that by 2026, the share of professional chips such as GPUs used in data centers is expected to rise by more than 15% from less than 3% in 2020.

While it’s difficult to pinpoint exactly how much of Nvidia’s revenue AI accounts for today, as Big tech companies are racing to develop similar AI applications, and artificial intelligence has the potential to grow exponentially.

Huang Renxun once said:

ChatGPT allows technology giant leaders to see the unlimited power of AI. But now, it's mostly a general-purpose software. Only by improving services and products tailored to a company's own needs can its true value be realized.

In addition to the data center, although the core business of gaming was hit by the economic downturn, revenue fell to only a double-digit US$2.24 billion, but it was significantly higher than market expectations, exceeding 13%.

Separately, Nvidia’s automotive division, which includes chips and software that develops self-driving cars, grew 114% year over year but is still small, with less than $300 million in revenue.

NVIDIA seizes GPU market dominance

New Street Research claims that NVIDIA occupies 95% of the graphics processor market share.

Investors are piling into Nvidia, betting that demand for artificial intelligence systems like ChatGPT will drive up orders for the company’s products, making it once again the world’s most valuable chipmaker.

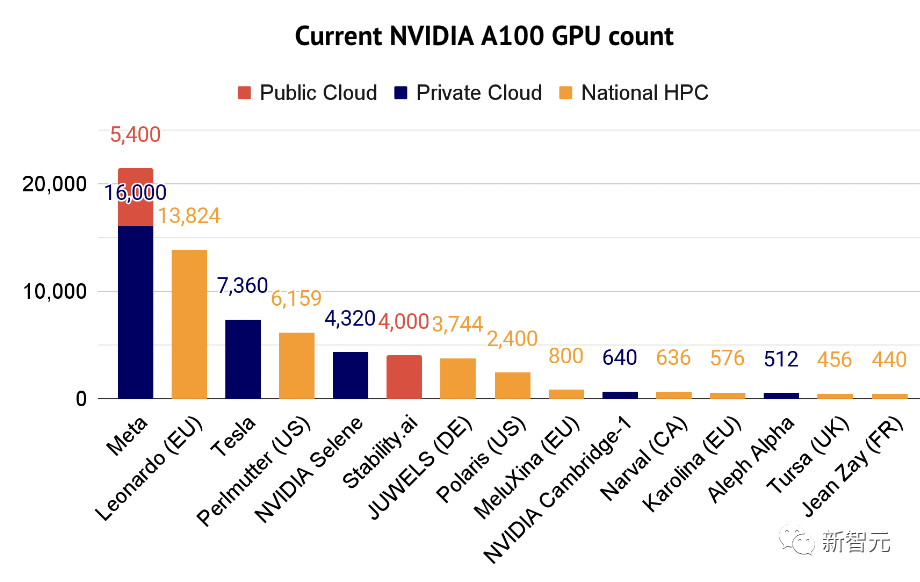

For a long time, whether it is the top ChatGPT, or Bard, Stable Diffusion and other models, the people behind it are An Nvidia A100 chip, worth about $10,000, provides the computing power.

The NVIDIA A100 can perform many simple calculations simultaneously, which is very important for training and using neural network models.

The technology behind the A100 was originally used to render complex 3D graphics in games. Now, the goal is to handle machine learning tasks and run in data centers.

Investor Nathan Benaich said that A100 has now become the "main workhorse" of artificial intelligence professionals. His report also lists some of the companies using the A100 supercomputer.

Machine learning tasks can consume an entire computer's processing power, sometimes for hours or days.

This means that companies with a best-selling AI product often need to buy more GPUs to cope with peak access periods, or to improve their models.

Many data centers also use a system containing eight A100 graphics processors - the Nvidia DGX A100, which costs up to $200,000 for a single system.

In addition to the A100, the successor H100 launched by Nvidia in 2022 has become a popular star.

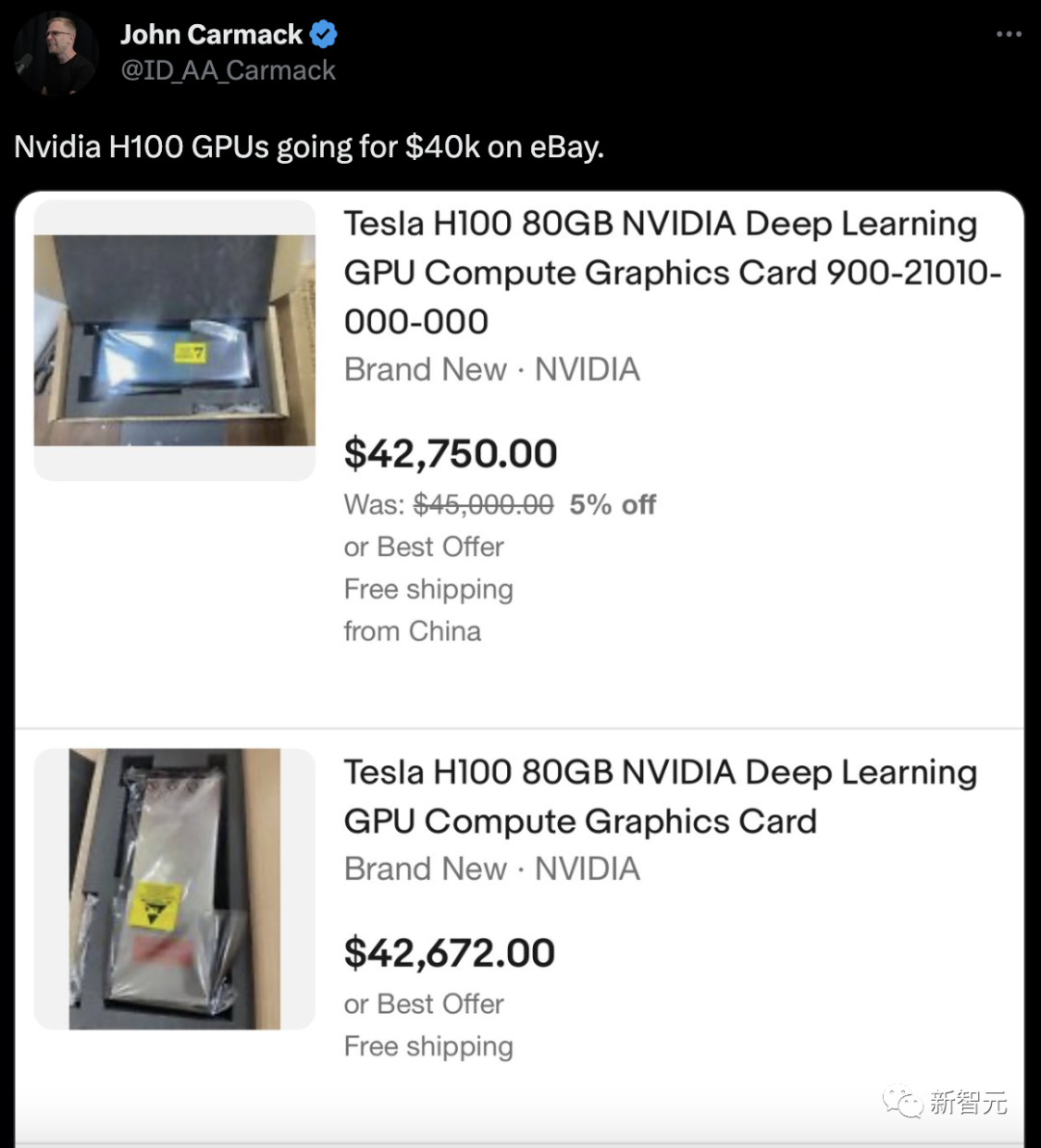

Some time ago, John Carmack said on Twitter that the price of Nvidia’s AI flagship chip H100 was being sold to US$40,000 in multiple stores.

It can be seen that as the ChatGPT chatbot developed by OpenAI becomes popular around the world, A100 and H100 GPUs are quickly becoming hot commodities. In the past, this product was sold for US$36,000.

In China, due to restrictions, Nvidia’s customized A800 and H800 chips have become China’s “special editions.” Some domestic cloud manufacturers have quickly followed suit and are also using NVIDIA's new GPUs.

Intel has "Moore's Law". Huang Renxun has previously proposed "Huang's Law" and said that GPUs will drive AI performance to double year by year.

Now, the rapid development of artificial intelligence by Microsoft, OpenAI, and Google has given the best proof.

NVIDIA’s way to break through is the way to win through technology and R&D.

The above is the detailed content of AI cores are selling out! NVIDIA announces epic financial report, stock price surges 30%. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Top 10 latest releases of virtual currency trading platforms for bulk transactions

Apr 22, 2025 am 08:18 AM

Top 10 latest releases of virtual currency trading platforms for bulk transactions

Apr 22, 2025 am 08:18 AM

The following factors should be considered when choosing a bulk trading platform: 1. Liquidity: Priority is given to platforms with an average daily trading volume of more than US$5 billion. 2. Compliance: Check whether the platform holds licenses such as FinCEN in the United States, MiCA in the European Union. 3. Security: Cold wallet storage ratio and insurance mechanism are key indicators. 4. Service capability: Whether to provide exclusive account managers and customized transaction tools.

Summary of the top ten Apple version download portals for digital currency exchange apps

Apr 22, 2025 am 09:27 AM

Summary of the top ten Apple version download portals for digital currency exchange apps

Apr 22, 2025 am 09:27 AM

Provides a variety of complex trading tools and market analysis. It covers more than 100 countries, has an average daily derivative trading volume of over US$30 billion, supports more than 300 trading pairs and 200 times leverage, has strong technical strength, a huge global user base, provides professional trading platforms, secure storage solutions and rich trading pairs.

What are the top ten virtual currency trading apps? Recommended on the top ten digital currency exchange platforms

Apr 22, 2025 pm 01:12 PM

What are the top ten virtual currency trading apps? Recommended on the top ten digital currency exchange platforms

Apr 22, 2025 pm 01:12 PM

The top ten secure digital currency exchanges in 2025 are: 1. Binance, 2. OKX, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. Bitfinex, 8. KuCoin, 9. Bybit, 10. Bitstamp. These platforms adopt multi-level security measures, including separation of hot and cold wallets, multi-signature technology, and a 24/7 monitoring system to ensure the safety of user funds.

What are the stablecoins? How to trade stablecoins?

Apr 22, 2025 am 10:12 AM

What are the stablecoins? How to trade stablecoins?

Apr 22, 2025 am 10:12 AM

Common stablecoins are: 1. Tether, issued by Tether, pegged to the US dollar, widely used but transparency has been questioned; 2. US dollar, issued by Circle and Coinbase, with high transparency and favored by institutions; 3. DAI, issued by MakerDAO, decentralized, and popular in the DeFi field; 4. Binance Dollar (BUSD), cooperated by Binance and Paxos, and performed excellent in transactions and payments; 5. TrustTo

How many stablecoin exchanges are there now? How many types of stablecoins are there?

Apr 22, 2025 am 10:09 AM

How many stablecoin exchanges are there now? How many types of stablecoins are there?

Apr 22, 2025 am 10:09 AM

As of 2025, the number of stablecoin exchanges is about 1,000. 1. Stable coins supported by fiat currencies include USDT, USDC, etc. 2. Cryptocurrency-backed stablecoins such as DAI and sUSD. 3. Algorithm stablecoins such as TerraUSD. 4. There are also hybrid stablecoins.

What are the next thousand-fold coins in 2025?

Apr 24, 2025 pm 01:45 PM

What are the next thousand-fold coins in 2025?

Apr 24, 2025 pm 01:45 PM

As of April 2025, seven cryptocurrency projects are considered to have significant growth potential: 1. Filecoin (FIL) achieves rapid development through distributed storage networks; 2. Aptos (APT) attracts DApp developers with high-performance Layer 1 public chains; 3. Polygon (MATIC) improves Ethereum network performance; 4. Chainlink (LINK) serves as a decentralized oracle network to meet smart contract needs; 5. Avalanche (AVAX) trades quickly and

Which of the top ten transactions in the currency circle? The latest currency circle app recommendations

Apr 24, 2025 am 11:57 AM

Which of the top ten transactions in the currency circle? The latest currency circle app recommendations

Apr 24, 2025 am 11:57 AM

Choosing a reliable exchange is crucial. The top ten exchanges such as Binance, OKX, and Gate.io have their own characteristics. New apps such as CoinGecko and Crypto.com are also worth paying attention to.

What is DLC currency? What is the prospect of DLC currency

Apr 24, 2025 pm 12:03 PM

What is DLC currency? What is the prospect of DLC currency

Apr 24, 2025 pm 12:03 PM

DLC coins are blockchain-based cryptocurrencies that aim to provide an efficient and secure trading platform, support smart contracts and cross-chain technologies, and are suitable for the financial and payment fields.