What is an OCO order?

One Cancels the Other (OCO) allows you to place two orders at the same time. It combines a limit order and a stop-limit order, but only one of them can be executed.

In other words, as long as one of the limit orders is partially or fully executed and the stop-profit and stop-loss orders are triggered, the other order will be automatically canceled. Please note that canceling one order will also cancel the other.

When trading on the Binance exchange, you can use 2-for-1 orders as a basic form of trading automation. This feature gives you the option to place two limit orders at the same time, helping to take profits and minimize potential losses.How to use the two-choice order?

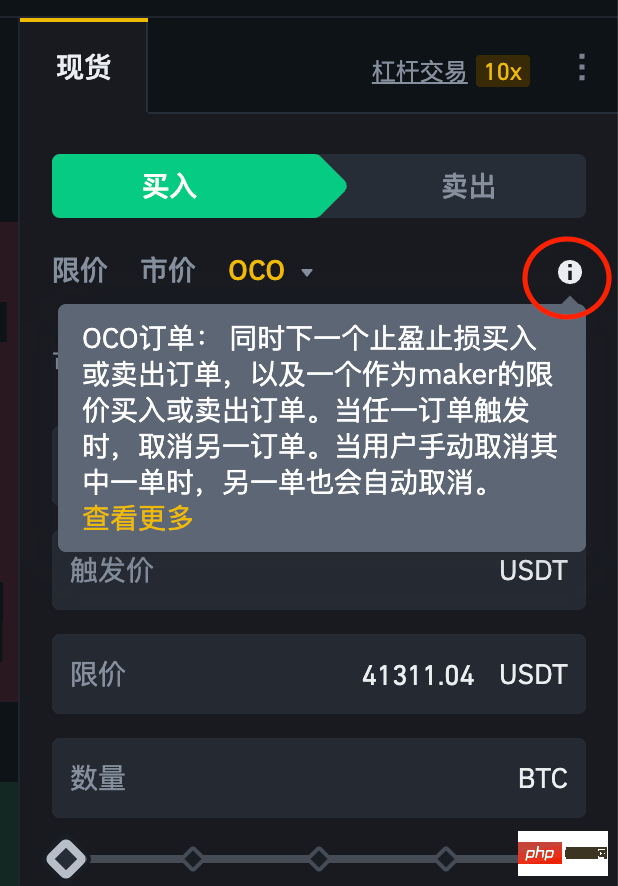

After logging into your Binance account, go to the basic trading interface and find the trading area shown in the image below. Click "Stop Limit Order" to open the drop-down menu and select "OCO".

On Binance, OCO orders can be placed as a pair of buy or sell orders. You can find more information about OCO orders by clicking on the exclamation point icon.

After selecting the "Choose one of two orders" option, a new trading interface will be loaded, as shown in the figure below. This interface allows you to set limit orders and stop-limit orders at the same time.

Limit Order

- Price: The price of your limit order. This order will appear in the order book.

Stop Limit Order

- Stop Loss: The price that triggers your stop limit order (e.g. 0.0024950 BTC). Limit Price: The actual price of your limit order after the stop is triggered (e.g. 0.0024900 BTC)

- Amount: The size of the order (e.g. 5 Binance Coin (BNB)).

- Transaction volume: The total value of the order.

After placing a two-choice order, you can scroll down to view the details of both orders in the "Open Orders" section.

For example, let’s say you just bought 5BNB at 0.0026837 BTC because you believe the price is near a major support zone and may rise higher.In this case, you can use the 2-for-1 order feature to place a take-profit order at 0.0030 BTC and a stop-limit order at 0.0024900 BTC.

If your prediction is accurate and the price rises to 0.0030 BTC or higher, your sell order will be executed and the stop limit order will be automatically canceled.

On the other hand, if your prediction is wrong and the price drops to 0.0024950 BTC, your stop limit order will be triggered. This may reduce your losses in case the price falls further.

It should be noted that in this example, the stop price is 0.0024950 (trigger price) and the limit price is 0.0024900 (the transaction price of the order). This means that your stop limit order will trigger the moment the price reaches 0.0024950. The price of the triggered limit order is 0.0024900. In other words, if BNB/BTC falls to 0.0024950 or lower, the system will still place a limit order for you at a price of 0.0024900, but because the price is lower than 0.0024900, your order may not be executed.

The 2-for-1 order type is a simple-to-use yet powerful tool that allows you and other Binance users to trade in a safer and more flexible way. This particular type of order is very beneficial for locking in profits, limiting risk, and even for entering and exiting positions. But before using 2-for-1 orders, you should still have a good understanding of limit orders and stop-limit orders.The above is the detailed content of What is an OCO order?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

What currency does Ripple (XRP currency) belong to? Detailed tutorial for beginners

Apr 28, 2025 pm 07:57 PM

What currency does Ripple (XRP currency) belong to? Detailed tutorial for beginners

Apr 28, 2025 pm 07:57 PM

Created by Ripple, Ripple is used for cross-border payments, which are fast and low-cost and suitable for small transaction payments. After registering a wallet and exchange, purchase and storage can be made.

Which of the top ten currency trading platforms in the world are the latest version of the top ten currency trading platforms

Apr 28, 2025 pm 08:09 PM

Which of the top ten currency trading platforms in the world are the latest version of the top ten currency trading platforms

Apr 28, 2025 pm 08:09 PM

The top ten cryptocurrency trading platforms in the world include Binance, OKX, Gate.io, Coinbase, Kraken, Huobi Global, Bitfinex, Bittrex, KuCoin and Poloniex, all of which provide a variety of trading methods and powerful security measures.

What are the top currency trading platforms? The top 10 latest virtual currency exchanges

Apr 28, 2025 pm 08:06 PM

What are the top currency trading platforms? The top 10 latest virtual currency exchanges

Apr 28, 2025 pm 08:06 PM

Currently ranked among the top ten virtual currency exchanges: 1. Binance, 2. OKX, 3. Gate.io, 4. Coin library, 5. Siren, 6. Huobi Global Station, 7. Bybit, 8. Kucoin, 9. Bitcoin, 10. bit stamp.

Top 10 virtual currency app rankings Recommended by the top ten virtual currency app trading platforms in 2025

Apr 28, 2025 pm 04:12 PM

Top 10 virtual currency app rankings Recommended by the top ten virtual currency app trading platforms in 2025

Apr 28, 2025 pm 04:12 PM

Top 10 virtual currency app rankings: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. Bitfinex, 8. KuCoin, 9. Bitstamp, 10. Gemini, these exchanges are known for their efficient trading systems, rich trading pairs and multiple security measures to meet the needs of different users.

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

The top ten digital currency exchanges such as Binance, OKX, gate.io have improved their systems, efficient diversified transactions and strict security measures.

How much is Bitcoin worth

Apr 28, 2025 pm 07:42 PM

How much is Bitcoin worth

Apr 28, 2025 pm 07:42 PM

Bitcoin’s price ranges from $20,000 to $30,000. 1. Bitcoin’s price has fluctuated dramatically since 2009, reaching nearly $20,000 in 2017 and nearly $60,000 in 2021. 2. Prices are affected by factors such as market demand, supply, and macroeconomic environment. 3. Get real-time prices through exchanges, mobile apps and websites. 4. Bitcoin price is highly volatile, driven by market sentiment and external factors. 5. It has a certain relationship with traditional financial markets and is affected by global stock markets, the strength of the US dollar, etc. 6. The long-term trend is bullish, but risks need to be assessed with caution.

Binance official website entrance Binance official latest entrance 2025

Apr 28, 2025 pm 07:54 PM

Binance official website entrance Binance official latest entrance 2025

Apr 28, 2025 pm 07:54 PM

Visit Binance official website and check HTTPS and green lock logos to avoid phishing websites, and official applications can also be accessed safely.

Bitcoin price today

Apr 28, 2025 pm 07:39 PM

Bitcoin price today

Apr 28, 2025 pm 07:39 PM

Bitcoin’s price fluctuations today are affected by many factors such as macroeconomics, policies, and market sentiment. Investors need to pay attention to technical and fundamental analysis to make informed decisions.