Technology peripherals

Technology peripherals

AI

AI

Spend 61 billion US dollars! Chip giant Broadcom acquires VMware to achieve a 'fusion' of software and hardware

Spend 61 billion US dollars! Chip giant Broadcom acquires VMware to achieve a 'fusion' of software and hardware

Spend 61 billion US dollars! Chip giant Broadcom acquires VMware to achieve a 'fusion' of software and hardware

Today, chip industry giant Broadcom officially announced that it will acquire VMware for US$61 billion!

The purchase price values VMware at $142.50 per share, which is similar to the closing price on May 20, the last trading day before news of the acquisition was first reported. A premium of 44%. In addition, Broadcom will assume VMware's $8 billion in net debt.

Upon completion of the transaction, Broadcom Software Group will rebrand and operate as VMware, bringing Broadcom's existing infrastructure and security software solutions as part of the expanded VMware portfolio.

The merger of Broadcom and VMware would be one of the largest acquisitions in the history of the technology industry. Previously, Dell acquired EMC for $67 billion in 2015. Earlier this year, Microsoft acquired gaming giant Activision Blizzard for $68.7 billion.

This time Broadcom’s handwriting is almost the same. As a hardware giant in the semiconductor industry, Broadcom’s current chip business involves almost all aspects of daily computing. The company makes chips that are at the heart of storage and wired networking equipment. Broadcom is also a major player in the wireless industry, making Wi-Fi and Bluetooth chips used in PCs and mobile devices.

In the automotive industry, Broadcom’s chips occupy an important position in infotainment, autonomous driving and battery management systems. It also has a broad portfolio of enterprise hardware and software products, the latter of which is why this deal is critical to Broadcom's future growth.

VMware was founded in 1998 and focuses on virtualization software and cloud computing.

VMware's virtual machine software supports all major desktop operating systems (Windows, Linux, macOS) and also provides enterprise software solutions for server hardware platforms. In 2004, VMware was acquired by storage technology giant EMC. VMware was acquired by Dell in 2015 as part of the Dell-EMC deal. A year ago, Dell spun off VMware and once again operated as an independent company.

Broadcom President and CEO Chen Fuyang said, "VMware is a pioneer in the field of enterprise software, and this acquisition will better integrate our semiconductor and infrastructure software businesses with Combining the enterprise software business. As a leading infrastructure technology company, our goal is to re-invent the products and services we can provide our customers."

"We look forward to VMware's talented team joining Broadcom to further cultivate shared capabilities. "For the past 24 years, VMware has been reshaping the IT landscape and helping customers become digital enterprises." said Raghu Raghuram, CEO of VMware. The combination of assets and talented team with Broadcom’s existing enterprise software portfolio will result in a preeminent enterprise software player.”

Broadcom expects the transaction with VMware to be completed in fiscal 2023.

Chip giant cross-border "buy, buy, buy", can it be a win-win situation?

Currently, Broadcom and VMware have almost no business overlap. Broadcom mainly makes 5G and data center hardware, while VMware mainly develops cloud and virtualization software. Analysts believe that Broadcom is looking to expand its business beyond traditional chips, especially amid the current chip shortage.

The acquisition of VMware can provide opportunities in enterprise software. In addition, this transaction can also help Broadcom compete with cloud computing companies such as Amazon and Microsoft, and provide Broadcom with a better hybrid and multi-cloud operation strategy. "In Broadcom's view, the risk of market fluctuations in the chip field is too great," said Dan Morgan, a trust investment manager at financial services company Synovus. "One of the best ways to solve this problem is to shift to a stable, high-cash flow business." Enterprise The software market is that kind of business.

Broadcom has made several large-scale acquisitions in recent years, including acquiring CA Technologies for US$18.9 billion in 2018 and acquiring security company Symantec for US$10.7 billion in 2019, all in an effort to open up more diversification beyond hardware. business line.

Moreover, Broadcom has been looking for larger transactions. The company attempted to acquire fellow chip giant Qualcomm in 2018, but was blocked by then-President Trump on national security grounds. Broadcom faces significant regulatory hurdles in acquiring Qualcomm because they are both chip companies. Nvidia faced similar challenges before when it acquired Arm, and was eventually forced to give up because it failed to pass regulatory approval.

"Now this deal is completely different. Entering the software field is a major strategic change for Broadcom." Some analysts predict that the merger of the two companies is expected to drive down the prices of cloud computing and 5G. The entry of more and stronger players in this field will promote the growth of the business and will reduce the prices over a period of time.

“This transaction is pro-competitive, not anti-competitive,” said Marty Wolf, managing partner of Martinwolf. In recent years, more and more hardware giants have opened up new bases in the software industry, from IBM to Cisco to Nvidia. The most direct way to open up bases across businesses is acquisition.

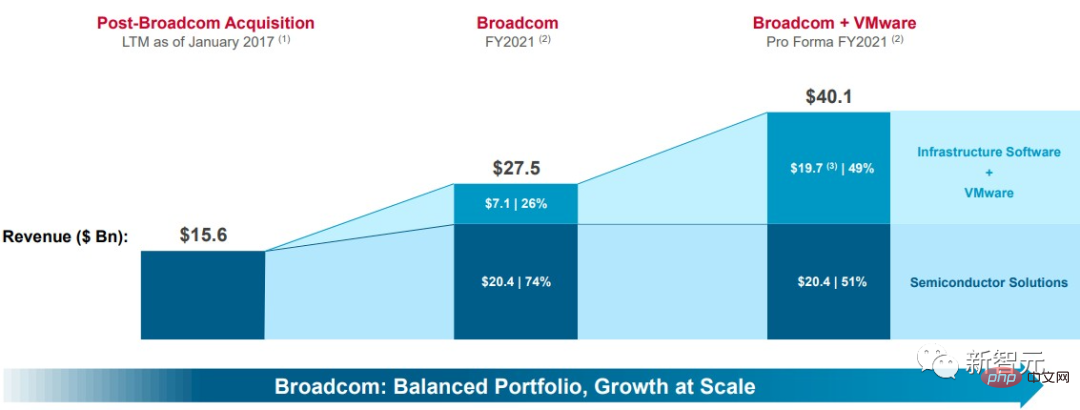

In the acquisition information document presented to investors by Broadcom, a comparison of the revenue of the software and hardware departments since January 2017 is given . In January 2017, after Avago completed its acquisition of Broadcom and Avago changed its name to Broadcom again, revenue for the 12 months of that year was US$15.6 billion.

As of the end of fiscal 2021, which ended in October, Broadcom has nearly doubled in size, with sales of chips, circuit boards and now systems reaching $20.4 billion. The company's Symantec and CA software businesses have sales of $7.1 billion, but their profit margins are much higher than those of the hardware unit, with operating margins as high as 70%.

After the acquisition of VMware, Broadcom's software revenue is expected to nearly triple to $19.7 billion, which is expected to be equivalent to the revenue of the semiconductor hardware division. Currently, Symantec, currently owned by Broadcom, has overlapping businesses with VMware in the field of network security.

However, even if the acquisition is completed, the field of network security is still a competitive field, and this transaction may not change the competitive situation. Forrester senior analyst Naveen Chhabra believes that the cooperation between VMware and Symantec will not change. Obviously, he is not very optimistic that this acquisition can achieve Broadcom's ideal vision.

First of all, it’s easier said than done. Furthermore, Broadcom's past acquisition strategies did not show much innovation, and were basically simple additions.

For the acquired VMware, whether it can be a "win-win" this time may also be an undecided outcome. Although the current growth of VMware product business is relatively stable, what about after the acquisition? The core of VMware's business is enterprise software subscription business, and the most important thing is "sustainable stability." But being acquired now is to some extent an "unstable change." The uncertainty caused by this instability may affect VMware's long-term customers.

These people may regard VMware's separation from Dell as a rare opportunity, an opportunity for "barrier-free growth." Now that there is an additional boss, it is not as "barrier-free" as before. However, everything has two sides, and some analysts believe that Broadcom’s huge size will help VMware better compete in the field of cloud computing.

“If VMware’s software can create synergy with Broadcom’s hardware, the result will be very powerful.” He said. As of now, Broadcom’s market value is US$224.82 billion.

VMware’s market capitalization is US$52.36 billion, an increase of nearly 30% from US$40.3 billion at the close of trading last Friday.

##

##

The above is the detailed content of Spend 61 billion US dollars! Chip giant Broadcom acquires VMware to achieve a 'fusion' of software and hardware. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

NVIDIA is not the only beneficiary, AI training also benefits memory chip manufacturers

May 31, 2023 pm 05:16 PM

NVIDIA is not the only beneficiary, AI training also benefits memory chip manufacturers

May 31, 2023 pm 05:16 PM

According to news on May 30, although the memory chip market is sluggish, there is a huge demand for artificial intelligence, which will benefit companies such as Samsung and SK Hynix. On May 24, Nvidia released its financial report, and the company’s market value surged by US$207 billion in two days. Previously, the semiconductor industry had been in a downturn, and this financial report forecast gave people great confidence and hope. If the field of artificial intelligence takes off, traditional technology giants like Microsoft and start-ups such as OpenAI will seek help from companies such as Samsung and SK Hynix. Machine learning requires memory chips to process large amounts of data, analyze video, audio and text, and simulate human creativity. In fact, AI companies may be buying more DRAM chips than ever before. Memory chip demand

Is the 1nm chip made in China or the United States?

Nov 06, 2023 pm 01:30 PM

Is the 1nm chip made in China or the United States?

Nov 06, 2023 pm 01:30 PM

It is not certain who made the 1nm chip. From a research and development perspective, the 1nm chip was jointly developed by Taiwan, China and the United States. From a mass production perspective, this technology is not yet fully realized. The main person in charge of this research is Dr. Zhu Jiadi of MIT, who is a Chinese scientist. Dr. Zhu Jiadi said that the research is still in its early stages and is still a long way from mass production.

First in China: Changxin Memory launches LPDDR5 DRAM memory chip

Nov 28, 2023 pm 09:29 PM

First in China: Changxin Memory launches LPDDR5 DRAM memory chip

Nov 28, 2023 pm 09:29 PM

News from this site on November 28. According to the official website of Changxin Memory, Changxin Memory has launched the latest LPDDR5DRAM memory chip. It is the first domestic brand to launch independently developed and produced LPDDR5 products, achieving a breakthrough in the domestic market and also making Changxin Storage's product layout in the mobile terminal market is more diversified. This website noticed that Changxin Memory LPDDR5 series products include 12Gb LPDDR5 particles, POP packaged 12GBLPDDR5 chips and DSC packaged 6GBLPDDR5 chips. The 12GBLPDDR5 chip has been verified on models of mainstream domestic mobile phone manufacturers such as Xiaomi and Transsion. LPDDR5 is a product launched by Changxin Storage for the mid-to-high-end mobile device market.

NVIDIA releases ChatGPT dedicated GPU, increasing inference speed by 10 times

May 13, 2023 pm 11:04 PM

NVIDIA releases ChatGPT dedicated GPU, increasing inference speed by 10 times

May 13, 2023 pm 11:04 PM

Once upon a time, artificial intelligence entered a decades-long bottleneck due to insufficient computing power, and GPU ignited deep learning. In the ChatGPT era, AI once again faces the problem of insufficient computing power due to large models. Is there any way NVIDIA can do this time? On March 22, the GTC conference was officially held. At the just-conducted Keynote, NVIDIA CEO Jen-Hsun Huang moved out the chips prepared for ChatGPT. "Accelerating computing is not easy. In 2012, the computer vision model AlexNet used GeForceGTX580 and could process 262 PetaFLOPS per second. This model triggered an explosion in AI technology," Huang said. "Ten years later, Tr

It is reported that TSMC's advanced packaging customers are chasing orders significantly, and monthly production capacity is planned to increase by 120% next year

Nov 13, 2023 pm 12:29 PM

It is reported that TSMC's advanced packaging customers are chasing orders significantly, and monthly production capacity is planned to increase by 120% next year

Nov 13, 2023 pm 12:29 PM

News from this site on November 13, according to Taiwan Economic Daily, TSMC’s CoWoS advanced packaging demand is about to explode. In addition to NVIDIA, which has confirmed expanded orders in October, heavyweight customers such as Apple, AMD, Broadcom, and Marvell have also recently pursued orders significantly. According to reports, TSMC is working hard to accelerate the expansion of CoWoS advanced packaging production capacity to meet the needs of the above-mentioned five major customers. Next year's monthly production capacity is expected to increase by about 20% from the original target to 35,000 pieces. Analysts said that TSMC's five major customers have placed large orders, which shows that artificial intelligence applications have become widely popular, and major manufacturers are interested in artificial intelligence chips. The demand has increased significantly. Inquiries on this site found that the current CoWoS advanced packaging technology is mainly divided into three types - CoWos-S

It is reported that Realtek 5GbE wired network card chip RTL8126-CG has stability issues and will be postponed to next year

Aug 25, 2023 am 11:53 AM

It is reported that Realtek 5GbE wired network card chip RTL8126-CG has stability issues and will be postponed to next year

Aug 25, 2023 am 11:53 AM

According to news from this site on August 24, most technology manufacturers displayed some new or upcoming new products at Gamescom. For example, ASRock showed its "half-generation" updated version of the Z790 motherboard. These new motherboards use The RTL8125-BG chip is used instead of the RTL8126-CG used in the prototype at the Computex show in June. According to Dutch media Tweakers, a number of motherboard manufacturers participating in Gamescom revealed that although Realtek's 5GbE wired network card chip RTL8126-CG is cheaper, it will not be installed on motherboards launched this fall due to stability issues. Realtek is said to be fixing this type of issue, but they won't be able to fix it before the new motherboards come out this fall

Is Nvidia's era of dominance over? ChatGPT sets off a chip war between Google and Microsoft, and Amazon also joins the game

May 22, 2023 pm 10:55 PM

Is Nvidia's era of dominance over? ChatGPT sets off a chip war between Google and Microsoft, and Amazon also joins the game

May 22, 2023 pm 10:55 PM

After ChatGPT became popular, the AI war between the two giants Google and Microsoft has burned into a new field-server chips. Today, AI and cloud computing have become battlegrounds, and chips have also become the key to reducing costs and winning business customers. Originally, major companies such as Amazon, Microsoft, and Google were all famous for their software, but now they are spending billions of dollars on chip development and production. The AI chip ChatGPT developed by major technology giants has exploded in popularity, and major manufacturers have launched a chip competition. According to reports from foreign media The Information and other sources, these three major manufacturers have now launched or plan to release 8 server and AI chips for internal product development. , cloud server rental or both. "if you

Sources say NVIDIA is developing China-specific versions of AI chips HGX H20, L20 PCle and L2 PCle

Nov 09, 2023 pm 03:33 PM

Sources say NVIDIA is developing China-specific versions of AI chips HGX H20, L20 PCle and L2 PCle

Nov 09, 2023 pm 03:33 PM

The latest news shows that according to reports from the Science and Technology Innovation Board Daily and Blue Whale Finance, industry chain sources revealed that NVIDIA has developed the latest version of AI chips suitable for the Chinese market, including HGXH20, L20PCle and L2PCle. As of now, NVIDIA has not commented. People familiar with the matter said that these three chips are all based on improvements from NVIDIA H100. NVIDIA is expected to announce them as soon as November 16, and domestic manufacturers will get samples as soon as these days. After checking public information, we learned that NVIDIAH100TensorCoreGPU adopts the new Hopper architecture, which is based on TSMC N4 process and integrates 80 billion transistors. Compared with the previous generation product, it can provide multi-expert (MoE)