What is the future of DIA coins? How to buy? DIA Coin Price Forecast 2025-2030

Table of contents

What is DIA currency?

DIA Coin Price Forecast 2025-2030

DIA(DIA) price forecast by 2030

DIA price forecast for 2025

DIA price forecast for 2026

DIA price forecast for 2027

DIA price forecast for 2028

DIA price forecast for 2029

DIA price forecast for 2030

How to buy DIA coins?

What problems does DIA aim to solve?

How does DIA solve these problems?

DIA Token Economics

Who is the founder of DIA Coin?

What are the advantages and disadvantages of DIA?

DIA's future prospects

FAQs for DIA Coin

DIA token unlock date

What is the current price of DIA?

What is the market value of DIA?

What is the circulation supply of DIA?

What is the highest point in DIA?

What is the historical low point of DIA?

What is DIA's 24-hour trading volume?

Summarize

Dia (DIA), or decentralized information assets, is an open source oracle platform designed to help market participants acquire, provide and share reliable data. The project builds an ecosystem that aims to bring data from all available sources into its blockchain and is available for use by everyone. For historical data, information will be accessible for free, but in order for new data to appear on the platform, Dia users need to participate in the staking.

DIA tokens are native tokens of the DIA platform, a open source multi-chain data and oracle platform for Web3. It enables the community to manage the platform and is used to fund data requests, staking, platform development and access to real-time data flows.

So, what is the future of DIA coins? How to buy DIA coins? The following will explain DIA coins in detail.

What is DIA currency?

DIA is a native token of the DIA ecosystem for the following purposes:

Governance: DIA token holders have the right to participate in voting, affect the governance issues of the platform, and have an impact on the development and direction of DIA.

Data Collection: DIA tokens can be used as a reward for specific data needs.

Staking: Users can stake DIA tokens to obtain rewards and contribute to network security.

Participation incentives: DIA tokens are used to incentivize data providers and users to participate in the DIA ecosystem.

DIA Coin Price Forecast 2025-2030

From now until 2030, DIA is expected to reach $1.09. The potential yield on buying DIA at the current price of $0.6334 is 74.00%, and the all-time high for DIA is $5.73. DIA has been 27.08% in the past 24 hours and 53.92% in the past 7 days.

| Current Price | Total Market Value (USD) | Circulation volume | Maximum supply |

|---|---|---|---|

| $0.6334 | 74.68M | 119.67M DIA | 200.00M DIA |

DIA(DIA) price forecast by 2030

| years | lowest | Highest | average | Rise and fall |

|---|---|---|---|---|

| 2025 | $0.475 | $0.874 | $0.6334 | 1.00% |

| 2026 | $0.6029 | $0.8215 | $0.7537 | 20.00% |

| 2027 | $0.6852 | $0.9294 | $0.7876 | 26.00% |

| 2028 | $0.4893 | $1.06 | $0.8585 | 37.00% |

| 2029 | $0.9327 | $1.22 | $0.9615 | 54.00% |

| 2030 | $0.8294 | $1.39 | $1.09 | 74.00% |

| 2031 | $0.7838 | $1.39 | $1.24 | 99.00% |

| 2032 | $1.04 | $1.64 | $1.31 | 111.00% |

| 2033 | $1.39 | $1.78 | $1.48 | 137.00% |

| 2034 | $0.8813 | $1.68 | $1.63 | 161.00% |

| 2035 | $1.19 | $1.90 | $1.65 | 165.00% |

DIA price forecast for 2025

In 2025, the average price of DIA is expected to be $0.6334, the highest price is $0.874, and the lowest price is $0.475. Buy DIA at the current price of $0.6334 and you have the potential to earn a 1.00% yield in 2025.

DIA price forecast for 2026

Based on past trends and models, the highest price of DIA is expected to be $0.8215 and the lowest price is $0.6029 in 2026. So, buying DIA at the current price of $0.6334, your potential rate of return is 20.00% based on the average price of $0.7537 in 2026.

DIA price forecast for 2027

In 2027, most DIAs are expected to hover around $0.7876, with a minimum price of $0.6852 and a maximum price of $0.9294. Based on this forecast, if you buy at the current market price of $0.6334, your potential rate of return is 26.00%.

DIA price forecast for 2028

According to historical data, in 2028, the highest price of DIA is expected to be $1.06 and the lowest price is $0.4893. So if you buy DIA at the current price of $0.6334, your potential rate of return is 37.00% based on the average price of $0.8585 in 2028.

DIA price forecast for 2029

In 2029, the lowest price for DIA is expected to be $0.9327 and the highest price is $1.22. With an average price of $0.9615, if you buy at a market price of $0.6334, your potential rate of return in 2029 is 54.00%.

DIA price forecast for 2030

Based on market sentiment in previous years, DIA is expected to fluctuate between $0.8294 and $1.39, with an average price of $1.09 in 2030. If you buy DIA at the current price of $0.6334 and HODL until 2030, your potential rate of return is 74.00%.

How to buy DIA coins?

1. If you have not downloaded or registered the Binance app, you can refer to this tutorial .

2. After registration is completed, open the Binance app (official download) and click the search box above [Quotation];

3. Enter [DIA], and the drop-down will display spot BERA/USDT, and click [DIA/USDT].

4. Click [Buy]

5. Select [Limit Price Order] - Purchase [Price] - Purchase [Quantity] - [Trade Quantity]. After setting it, click [Buy DIA].

What problems does DIA aim to solve?

The project aims to address problems in the collection and use of data in the DeFi field, including:

Data centralization: Many DeFi applications currently rely on centralized data sources, which potentially have reliability and security risks.

Lack of transparency and verification: The source and quality of data are often opaque, which makes users face difficulties in evaluating and trusting this information.

High cost and slow processing time: Data collection and processing are often costly and time-consuming, especially for complex data types.

How does DIA solve these problems?

Decentralized Data Network: DIA has established a decentralized network where data providers and users can interact directly. This helps increase transparency and reduces the risk of concentration.

Community Assessment and Verification: DIA encourages community participation in assessing and verifying data quality. In this way, the data on the DIA network will be more rigorously verified.

Open Data Standards: DIA develops open data standards that enable DeFi applications to easily integrate and use data from DIA networks.

DIA Token: DIA tokens are used to incentivize members to participate in the network, including providing data, evaluating data and using DIA services.

DIA Token Economics

Basic information about DIA:

- Name: Dia

- Transaction Name: DIA

- Type: Functional Token

- Platform: Ethereum

- Contract: 0x84ca8bc7997272c7cfb4d0cd3d55cd942b3c9419

- Total supply: 200,000,000 DIA

DIA Token Allocation:

- Reserve Fund: 45.7%

- Bond Curve Allocation: 15%

- Ecosystem: 12.5%

- Team: 12%

- Supporters: 9.8%

- Private equity: 5%

Who is the founder of DIA Coin?

DIA was founded by a group of experts, with three main characters most prominent:

Paul Claudius:

He is the official representative of DIA and plays an important role in business operations. Claudius has work experience in a variety of fields, from nutrition to finance, bringing a multi-faceted perspective and extensive connections to DIA.

Mihai Weber:

Co-founder and head of the DIA Association. With a broad background in economics and finance, as well as experience working in multiple banks, Weber is one of the main architects of the project.

Samuel Brack:

Responsible for DIA's technology. With a master's degree and a PhD in Computer Science, Brack plays an important role in the development and upgrading of the project's technology platform.

What are the advantages and disadvantages of DIA?

advantage:

- Decentralized features: DIA is not controlled by a single entity, ensuring data transparency and reliability.

- Community Contribution: DIA encourages communities to participate in the provision, management and evaluation of data to create diverse and rich sources of information.

- Scalability: DIA can retrieve a variety of decentralized data to meet the diverse needs of DeFi applications.

- Transparency: All activities on the DIA platform are documented on the blockchain, ensuring transparency and verifiability.

- Security: DIA uses advanced security mechanisms to protect data and prevent attacks.

- Wide application potential: DIA can be applied in many different fields, not limited to DeFi.

shortcoming:

- Complexity: DIA is a rather complex system that requires users to have a certain amount of blockchain and DeFi knowledge to use it effectively.

- Security Risk: Despite the use of advanced security mechanisms, there is still a risk of being attacked and exploiting security vulnerabilities.

- Stability: DIA is a relatively new project, and the stability of the platform has not been verified for a long time.

- Competition: DIA must compete with many other rivals in the oracle field, which may affect the development of the project.

- Laws and regulations: There are still many unclear laws and regulations on the use of digital assets and DeFi applications, which may cause difficulties in the development of DIA.

DIA's future prospects

DIA has the potential to become one of the top oracle platforms in the DeFi space. As DeFi continues to develop, the demand for reliable data will increase. With its outstanding advantages, DIA will play an important role in meeting this need.

Note: The above information is for reference only and is not investment advice. You should do a good job of researching before making investment decisions.

FAQs for DIA Coin

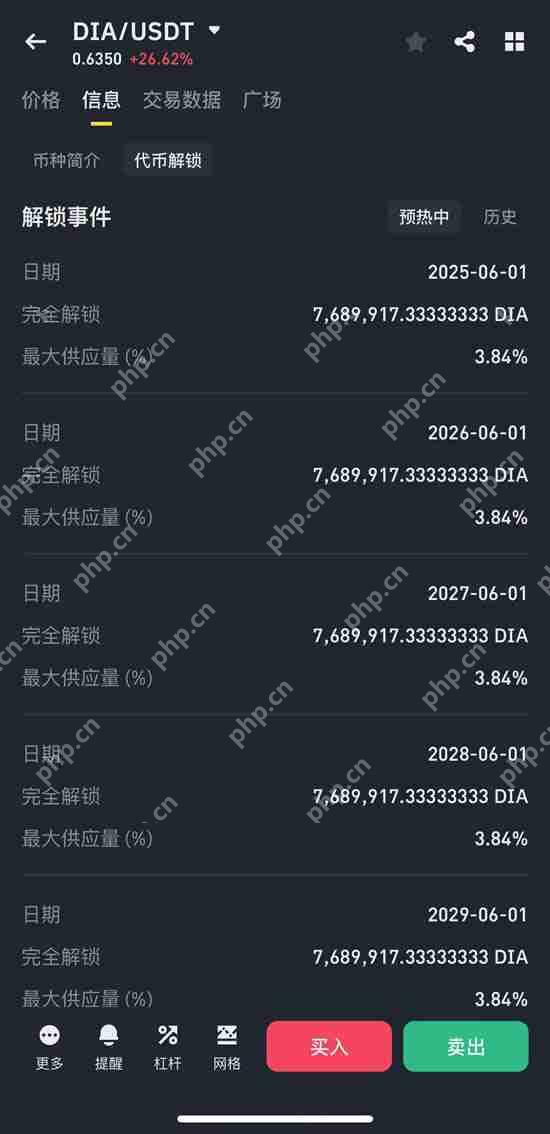

DIA token unlock date

What is the current price of DIA?

DIA (DIA) is currently priced at $0.629393

What is the market value of DIA?

DIA (DIA) has a current market capitalization of $75.32M.

What is the circulation supply of DIA?

DIA (DIA) Current circulation supply is 119.68M.

What is the highest point in DIA?

DIA (DIA) has an all-time high of $5.794451.

What is the historical low point of DIA?

DIA (DIA) has an all-time low of $0.210367.

What is DIA's 24-hour trading volume?

DIA (DIA) 24-hour trading volume is $28.43M.

Summarize

With the continuous improvement and expansion of the ecosystem, DIA Coin is expected to become one of the leading oracles and play an important role in the development of DeFi. However, investors need to carefully consider the risks inherent in cryptocurrency markets before making decisions.

The above is the detailed content of What is the future of DIA coins? How to buy? DIA Coin Price Forecast 2025-2030. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1677

1677

14

14

1430

1430

52

52

1333

1333

25

25

1278

1278

29

29

1257

1257

24

24

How to apply for Huobi Huobi API interface_Detailed explanation of Huobi Huobi API interface application process

May 15, 2025 pm 03:54 PM

How to apply for Huobi Huobi API interface_Detailed explanation of Huobi Huobi API interface application process

May 15, 2025 pm 03:54 PM

Applying for the Huobi API interface requires six steps: 1. Register a Huobi account and select "Global Station"; 2. Complete real-name authentication (L1/L2/L3); 3. Log in and enter the API management page; 4. Create an API key, fill in basic information and select permissions; 5. Generate and save Access Key and Secret Key; 6. Integrate API to the application, pay attention to security matters and change the key regularly.

Share the top ten correct address rankings of currency exchanges in 2025

May 15, 2025 pm 03:36 PM

Share the top ten correct address rankings of currency exchanges in 2025

May 15, 2025 pm 03:36 PM

In the 2025 currency exchange rankings, the top ten exchanges attracted much attention for their security, liquidity, user experience and innovation.

What is encryption jump start (blockchain jump start)?

May 15, 2025 pm 04:24 PM

What is encryption jump start (blockchain jump start)?

May 15, 2025 pm 04:24 PM

What is encryption jump? How is encryption rush to take shape? How to avoid encryption jumping? The crypto field is a rush to make profits by unconfirmed transactions, leveraging the transparency of blockchain. Learn how traders, bots, and validators manipulate transaction sorting, their impact on decentralized finance, and possible ways to protect transactions. Below, the editor of Script Home will give you a detailed introduction to encryption and rush forward! What is the rush to the encryption field? Taking the lead has long been a problem in the financial market. It originated in the traditional financial field, and refers to brokers or insiders using privileged information to trade before clients. Such behavior is considered immoral and illegal, and the regulator will investigate and punish it.

htx official login portal registration htx exchange Huobi novices registration tutorial 2025 latest version

May 15, 2025 pm 04:36 PM

htx official login portal registration htx exchange Huobi novices registration tutorial 2025 latest version

May 15, 2025 pm 04:36 PM

As one of the world's leading digital asset trading platforms, HTX Exchange has attracted a large number of users with its secure, convenient and efficient trading services. With the advent of 2025, HTX Exchange continues to optimize and update its registration process to ensure that users can experience digital asset trading more smoothly. This article will introduce the registration process of the official HTX login portal in detail and provide the latest registration tutorial for beginners to help you get started quickly.

Sky Labs Posts $5 million in First-Quarter Loss

May 15, 2025 pm 01:21 PM

Sky Labs Posts $5 million in First-Quarter Loss

May 15, 2025 pm 01:21 PM

The loss was a clear shift compared to the previous quarter, when Sky (formerly known as Makerdao) made $31 million in profits. According to a report by Steakhouse Financial, the DefiSavings protocol Sky reported that interest payments to token holders have more than doubled, losing $5 million. By comparison, profits in the previous quarter were $31 million. The reason for the 102% increase in interest payments was the decision to incentivize the use of existing DAIs by the New Sky Stable Stock (USDS) using the agreement. “The sky savings rate remained at a height of 12.5% relative to the rest of other markets, driving a large inflow. As we started to reduce the rate in February to 4.

Coin) Stocks soared nearly 24% as it became the first crypto exchange for the S&P 500

May 15, 2025 pm 01:54 PM

Coin) Stocks soared nearly 24% as it became the first crypto exchange for the S&P 500

May 15, 2025 pm 01:54 PM

Coinbase (Coin) shares soared nearly 24% on Tuesday as Wall Street cheered on the first and only crypto exchange in the S&P 500, a major milestone for the company and a breakthrough for the industry at the crossroads of regulators. The move brought Coinbase's share price to its highest point since early February, and the SEC withdrew its allegations against Coinbase only months after a fierce lawsuit with the SEC. “Coinbase’s inclusion in the S&P 500 was a critical moment, marking a full-scale shift in the company after it was threatened by the SEC lawsuit (later revoked by the SEC). This inclusion makes Coinbase an S&

What are the income stablecoins? 20 types of income stablecoins

May 15, 2025 pm 06:06 PM

What are the income stablecoins? 20 types of income stablecoins

May 15, 2025 pm 06:06 PM

If users want to pursue profit maximization, they can maximize the value of the stablecoin through profit-based stablecoins. Earnings stablecoins are assets that generate returns through DeFi activities, derivatives strategies or RWA investments. Currently, this type of stablecoins accounts for 6% of the market value of the US$240 billion stablecoins. As demand grows, JPMorgan believes that the proportion of 50% is not out of reach. Income stablecoins are minted by depositing collateral into an agreement. The deposited funds are used to invest in the income strategy, and the income is shared by the holder. It's like a traditional bank lending out the funds deposited and sharing interest with depositors, except that the interest rate of the income stablecoin is higher

Ranking of the top ten cryptocurrency exchanges Apps Ranking of the top ten cryptocurrency exchanges

May 15, 2025 pm 06:27 PM

Ranking of the top ten cryptocurrency exchanges Apps Ranking of the top ten cryptocurrency exchanges

May 15, 2025 pm 06:27 PM

The top ten cryptocurrency exchanges are: 1. Binance, 2. OKX, 3. Huobi, 4. Coinbase, 5. Kraken, 6. Bittrex, 7. Bitfinex, 8. KuCoin, 9. Gemini, 10. Bybit, these exchanges are highly regarded for their high trading volume, diverse trading products, user-friendly interfaces and strict security measures.