web3.0

web3.0

Michael Saylor analysis: The reason why Bitcoin has not broken the new high is that the market is entering the chip rotation period

Michael Saylor analysis: The reason why Bitcoin has not broken the new high is that the market is entering the chip rotation period

Michael Saylor analysis: The reason why Bitcoin has not broken the new high is that the market is entering the chip rotation period

Why has Bitcoin prices not continued to rise, even reaching $150,000? Regarding this issue, Michael Saylor, founder of micro-strategy, pointed out in an interview with Natalie Brunell that the core reason is that the market is undergoing a key "rotation".

He explained that this means that short-term holders who are "less investing" in Bitcoin are taking profits at a high level, while new funds led by institutions are steadily entering the market through diversified pipelines such as Bitcoin spot ETFs, which is reshaping the market structure.

Chip rotation: short-term holder exit and long-term institutional layout

Saylor further explained this "rotation" phenomenon and said that a considerable amount of Bitcoin currently stays in the hands of non-long-term investors such as governments, lawyers and bankruptcy trustees for specific reasons. Most of these holders do not have the "ten-year investor mentality" and therefore tend to see it as a "good exit point for obtaining liquidity" when the price of Bitcoin rises significantly.

However, at the same time, a brand new group of investors, such as institutions entering the market through Bitcoin spot ETFs and companies that include Bitcoin in corporate reserves, are actively absorbing these released Bitcoins.

Perhaps behind Bitcoin’s recent rise of $100,000 is the direct reflection of this chip rotation effect.

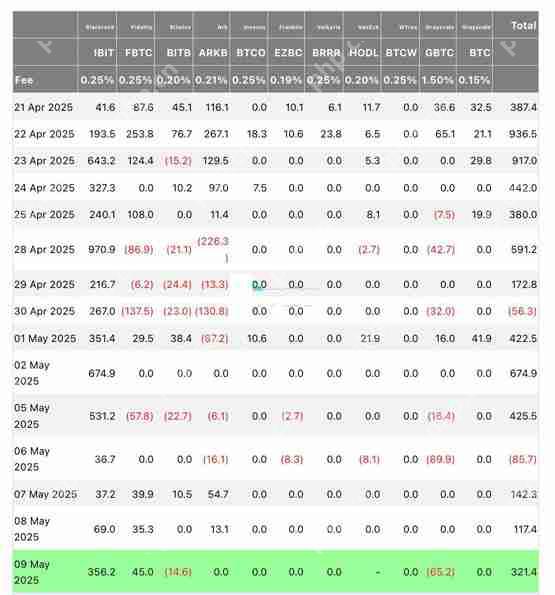

According to Farside data, in the past five trading days, Bitcoin spot ETFs have had a net inflow of US$920 million, with BlackRock's IBIT playing the main driving force.

This rotation clearly shows that the long-term layout of institutional investors is gradually replacing the short-term behavior of early giant whales, miners and retail traders, helping to reduce market volatility and support Bitcoin’s price.

Change in government positions and wave of Bitcoin institutionalization

It is worth noting that Michael Saylor expressed "surprising" at the positive change in Bitcoin's attitudes in just a few months since President Trump took office on January 20 this year. Related examples include signing an executive order to establish a strategic Bitcoin reserve for holding confiscated assets.

This change indirectly confirms the significant increase in Bitcoin acceptance at the government and institutions.

According to data from Saylor Tracker, before the deadline, MicroStrategist itself held 555,450 bitcoins, currently worth about US$57.78 billion. Its overall holding cost has achieved a floating profit of more than 50% compared to the average purchase price of US$68,569, which also provides a strong footnote to Saylor's optimistic position.

Looking ahead, although short-term volatility is inevitable, Bitcoin’s institutionalization trend is leading it into a new stage.

After confessing the wrong judgment yesterday, the founder of CryptoQuant also pointed out that it is time to abandon the traditional cyclical theory. The key to affecting Bitcoin's current trend is no longer the selling pressure of giant whale, but the new liquidity from institutions and ETFs.

Under such structural changes, Bitcoin’s long-term value and potential are worth investors’ rethinking and paying attention.

The above is the detailed content of Michael Saylor analysis: The reason why Bitcoin has not broken the new high is that the market is entering the chip rotation period. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1676

1676

14

14

1429

1429

52

52

1333

1333

25

25

1278

1278

29

29

1257

1257

24

24

Nine cryptocurrencies worth buying for short-term gains

May 14, 2025 pm 09:54 PM

Nine cryptocurrencies worth buying for short-term gains

May 14, 2025 pm 09:54 PM

How to choose cryptocurrency for short-term trading in catalog? Best Cryptocurrency List of Short-term Trading Bitcoin Avalanche Solana Dogecoin Polygon World Coin Chainlink How do emerging companies choose cryptocurrencies for short-term trading? Short-term trading refers to buying cryptocurrencies and holding them for a period of time, ranging from minutes to days. This method has a bright future, but it also has risks and takes a long time because you need to continue to pay attention to the market. But that's not all; when choosing the right cryptocurrency asset, you should also pay attention to the following points: Volatility: One of the main indicators of short-term trading success is the value of highly volatile cryptocurrencies; the higher the value, the greater the price volatility, thus creating more

One article to clarify the role of stablecoins during economic fluctuations

May 14, 2025 pm 09:15 PM

One article to clarify the role of stablecoins during economic fluctuations

May 14, 2025 pm 09:15 PM

You don't need to be an economist to feel the economic turmoil. Prices fall, job stability declines, and everyone seems to be anxious about their financial future. What is a stablecoin? Stablecoins are like life jackets in the crypto world: a digital currency designed to keep its value stable, often linked to stable assets such as the US dollar or gold. Unlike cryptocurrencies with severe price fluctuations such as Bitcoin or Ethereum, stablecoins pursue stability. When an economic storm strikes, investors will naturally seek stability, and stablecoins just provide this safe-haven asset – free from volatility. Why stablecoins thrive when economic instability is

The best currency trading platform recommended by the top ten currency exchange platforms

May 14, 2025 pm 09:36 PM

The best currency trading platform recommended by the top ten currency exchange platforms

May 14, 2025 pm 09:36 PM

Best currency trading platform: 1. Binance is the world's largest exchange, providing diversified financial products. 2. Ouyi is known for its powerful derivative trading functions. 3.Gate.io provides a wide range of currency options. 4. Huobi is famous for its stable system and diverse financial products. All platforms support fiat currency transactions, have a user-friendly interface, and provide mobile applications and multiple payment methods.

Introduction to Cryptocurrency Investment: What are currency standard contracts and U standard contracts? How to use it?

May 14, 2025 pm 09:42 PM

Introduction to Cryptocurrency Investment: What are currency standard contracts and U standard contracts? How to use it?

May 14, 2025 pm 09:42 PM

With the rapid development of the digital currency market, cryptocurrency derivatives trading has attracted increasing attention from investors. Among many trading tools, contract trading has become a trading method favored by many investors due to its leveraged trading characteristics and high risk and high returns. However, for beginners, the concepts of coin-prime contracts and U-prime contracts are often confusing. This article will analyze the characteristics, differences and their application in cryptocurrency investment in detail. What is a currency standard contract? A currency standard contract is a derivative contract that uses cryptocurrencies as margin and settlement currency. In this model, investors use Bitcoin or other cryptocurrencies as collateral to trade

In this article, learn about the future and role of the Ethereum Foundation! But some communities have quarrelled

May 14, 2025 pm 10:00 PM

In this article, learn about the future and role of the Ethereum Foundation! But some communities have quarrelled

May 14, 2025 pm 10:00 PM

Ethereum faces major community distrust this year. At the end of last year, it triggered the angrily criticized by Ethereum Foundation (EF) as if it was useless, which triggered the foundation to be reorganized in the first two months. Recently, it also frequently posted articles on the official website and community communities that have not been updated for a long time, showing its desire for community reconstruction. Ethereum co-founder Vitalik also posted a statement today (29) to supplement the mission of the Ethereum Foundation (EF). He believes that EF should make efforts for the use of Ethereum and decentralized promotion, but it has caused dissatisfaction among the community. V God Post Aya Miyagotchi, the new president of the Ethereum Foundation, recently uploaded new ones on the Ethereum official website and community

Bitget announces VOXEL transaction rollback! The user will be compensated for the loss

May 14, 2025 pm 10:45 PM

Bitget announces VOXEL transaction rollback! The user will be compensated for the loss

May 14, 2025 pm 10:45 PM

Cryptocurrency exchange Bitget recently announced that it will roll back transactions during this period due to abnormal trading fluctuations in the VOXEL contract market and propose compensation plans. However, the use of the statement "user manipulates the market" in the official announcement has caused doubts about its improper handling of public relations, fearing that this will lead to further expansion of the crisis. The abnormal trading of BitgetVOXEL tokens has caused internal market making concerns between 8:00 and 8:30 am yesterday Beijing time, an abnormal trading event of VOXEL tokens broke out on the Bitget Exchange. The trading volume during this period even exceeded Bitcoin for a time, causing the market to question the transparency of its internal operations. After the incident occurred due to the violent fluctuation of VOXEL token prices, the community began to question the possibility of Bitget

Tesla announced its first quarter financial report: Revenue fails to meet standards! But still no Bitcoin was sold

May 14, 2025 pm 10:03 PM

Tesla announced its first quarter financial report: Revenue fails to meet standards! But still no Bitcoin was sold

May 14, 2025 pm 10:03 PM

Electric car giant Tesla released its first-quarter earnings report, with performance not meeting market expectations and revenue slightly lower than analysts' forecasts. It is worth noting, however, that Tesla still holds about $1 billion worth of Bitcoin, indicating that the company did not cash out by selling Bitcoin last quarter. According to Tesla's financial report as of March 31, the company's holdings are worth $951 million, down from $1.076 billion at the end of last year. According to external analysis, this is mainly due to the fluctuations in the price of Bitcoin, rather than the actual trading operations that Tesla has conducted. According to BitcoinTreasuries, Tesla currently holds 11,509 bitcoins on its balance sheet. Blockchain data platform A

Good News Micro Strategy spent another $550 million to buy Bitcoin! The total holding volume exceeded 538,000

May 14, 2025 pm 09:39 PM

Good News Micro Strategy spent another $550 million to buy Bitcoin! The total holding volume exceeded 538,000

May 14, 2025 pm 09:39 PM

Bitcoin big player "Strategy" (formerly MicroStrategy) has made a big investment again. The company purchased 6,556 bitcoins between April 14 and 20 for $555.8 million, with an average cost of $84,785 per coin, according to filings with the Securities and Exchange Commission on Monday. These funds come entirely from stock capital increase. Strategy successfully raised $555.5 million for Bitcoin purchases through two ongoing stock issuance plans, selling 1.76 million common shares (MSTR) and more than 91,000 preferred shares (STRK) in the week. The two stock issuance plans were launched in October 2024 and March 2025, respectively.