web3.0

web3.0

How to operate Binance leverage trading in 2025? How many times the maximum leverage is supported?

How to operate Binance leverage trading in 2025? How many times the maximum leverage is supported?

How to operate Binance leverage trading in 2025? How many times the maximum leverage is supported?

The maximum leverage multiple supported by Binance is 125 times. The steps to conduct leveraged trading at Binance include: 1. Register and log in to the account, 2. Recharge funds, 3. Select a trading pair, 4. Set a leverage multiple, 5. Place an order, 6. Monitor and manage positions.

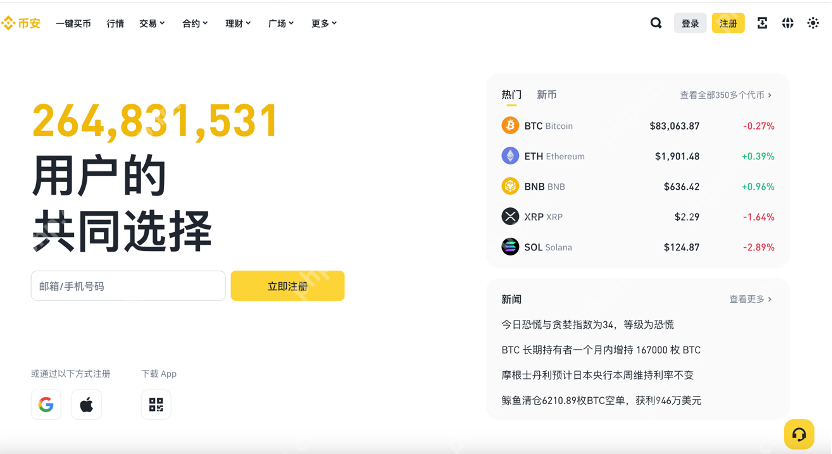

As the world's leading cryptocurrency exchange, Binance's leveraged trading function provides users with the opportunity to amplify investment returns. This article will provide a detailed introduction to how to conduct leveraged trading on the Binance platform in 2025 and the highest leverage multiple it supports.

What is leveraged trading?

Leveraged trading refers to a trading method that increases the scale of transactions by borrowing funds to amplify potential returns and risks. On the Binance platform, users can use leverage to conduct long or short trading in order to make profits from market volatility.

The basic process of Binance leverage trading

To conduct leveraged trading on Binance, users need to follow the following steps:

- Register and log in to the Binance account : First, the user needs to register an account on the Binance official website and complete the identity verification (KYC) process.

- Recharge funds : After logging in, the user needs to recharge enough cryptocurrency or fiat currency into the account to use for margin for leveraged trading.

- Select a leveraged trading pair : In Binance's trading page, users can select the trading pairs they want to trade leveraged. For example, BTC/USDT, ETH/USDT, etc.

- Set leverage multiple : Users can choose the appropriate leverage multiple based on their risk preferences and trading strategies. The leverage multiples supported by Binance will be described in detail in the next section.

- Order trading : After selecting a leverage multiple, users can choose to open long (buy) or short (sell), and set the take-profit and stop-loss prices.

- Monitor and manage positions : After trading, users need to pay close attention to the market conditions and adjust or close positions in time to manage risks.

The highest leverage multiple supported by Binance

As of 2025, Binance supports the highest leverage multiple of 125 times . However, the specific leverage multiple will vary according to the trading pair. For example, BTC/USDT pairs may support 125x leverage, while some small currency pairs may only support lower leverage multiples, such as 20x or 50x. When users choose leverage multiples, they need to make choices based on their own risk tolerance and trading strategies.

How to choose the right leverage multiple?

Choosing the right leverage multiple is a key step in leveraged trading. Here are some suggestions:

- Assess risk tolerance : High leverage means high risk, and users need to choose a leverage multiple based on their risk tolerance. If the risk tolerance is low, it is recommended to choose a lower leverage multiple.

- Understand market volatility : Different cryptocurrencies have different market volatility, and currencies with high volatility are suitable for using lower leverage multiples to reduce risks.

- Develop a trading strategy : Choose a leverage multiple based on your trading strategy. For example, if it is a short-term trading, a higher leverage multiple may be chosen to amplify returns.

Risk management in leveraged trading

Although leveraged trading has potentially high returns, it is also accompanied by high risks. Therefore, when users conduct leveraged trading, they must do a good job of risk management:

- Setting take-profit and stop loss : When placing an order, the user should set the take-profit and stop loss prices to control potential losses.

- Diversified investment : Do not invest all your funds into a trading pair, but diversify investment to reduce overall risk.

- Use Quarantine Margin : Binance supports full position and Quarantine Margin mode, and it is recommended that novice users use Quarantine Margin mode to avoid the loss of one trading pair affecting other trading pairs.

Fees for leveraged trading

When Binance conducts leverage transactions, users need to pay a certain fee. These costs include:

- Transaction Fee : Each transaction will incur transaction fees, and Binance's transaction fee rate varies according to the user's transaction volume and BNB holdings.

- Financing fee : When holding a leveraged position, the user needs to pay the financing fee. The calculation method and rate of financing fees will change according to market conditions.

How to view details of leveraged trading on Binance Platform?

Users can view the details of leveraged transactions on the Binance platform to better manage their transactions. The following are the specific steps:

- Log in to the Binance Account : First, the user needs to log in to his or her Binance Account.

- Enter the leveraged trading page : In the main page of Binance, click "Leveraged Trading" to enter the corresponding trading page.

- View position information : In the leverage trading page, users can view the current position information, including leverage multiples, margin, profit and loss situation, etc.

- View transaction history : Users can also view past transaction history to analyze their trading performance and adjust strategies.

Frequently Asked Questions

Q1: Does Binance leveraged trading support all currencies?

A1: Not all currencies support leveraged trading. Binance will choose a currency that supports leveraged trading based on market liquidity and user needs. Users can view specific supported trading pairs in Binance's leveraged trading page.

Q2: How is the margin for leveraged trading calculated?

A2: The margin for leveraged trading is calculated based on the leverage multiple and the transaction amount. For example, if the user chooses 10x leverage to trade at 1000 USDT, the margin will be 100 USDT (1000 USDT/10). Specific margin calculation formulas can be found in Binance's Help Center.

Q3: If there is a loss in leveraged trading, will Binance force closing the position?

A3: Yes, if the user's position loss reaches a certain level, Binance will trigger a forced liquidation mechanism to prevent the user's losses from further expanding. The specific trigger conditions for forced closing can be found in Binance's trading rules.

Q4: How safe is the funds in Binance leveraged trading?

A4: Binance has taken a variety of security measures to protect the security of users' funds, including separation of hot and cold storage, multi-signature technology, and regular security audits. When leveraged trading, users can also further protect their account security by setting a strong password and enabling two-factor authentication.

The above is the detailed content of How to operate Binance leverage trading in 2025? How many times the maximum leverage is supported?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1664

1664

14

14

1421

1421

52

52

1315

1315

25

25

1266

1266

29

29

1239

1239

24

24

Which exchanges support meme currency trading

May 08, 2025 pm 06:00 PM

Which exchanges support meme currency trading

May 08, 2025 pm 06:00 PM

Exchanges such as Binance, Coinbase, KuCoin, OKEx and Uniswap support a variety of meme currency transactions, such as DOGE, SHIB, FLOKI and BABYDOGE. Users can choose the appropriate platform according to their needs.

Ranking of the top ten digital currency quantitative trading apps, the latest list of digital currency exchanges

May 08, 2025 pm 06:03 PM

Ranking of the top ten digital currency quantitative trading apps, the latest list of digital currency exchanges

May 08, 2025 pm 06:03 PM

Ranking of the top ten digital currency quantitative trading apps: 1. Binance, 2. OKX, 3. Huobi, 4. Coinbase, 5. Kraken, 6. Bitfinex, 7. Bittrex, 8. Poloniex, 9. Gemini, 10. KuCoin, these platforms provide high security and good user experience, and the steps to use include downloading and installing, registering an account, enabling two-step verification, and depositing and trading.

TOP10 futures trading platforms: Perpetual contracts and options trading

May 08, 2025 pm 07:12 PM

TOP10 futures trading platforms: Perpetual contracts and options trading

May 08, 2025 pm 07:12 PM

In the cryptocurrency market, futures trading platforms play an important role, especially in perpetual contracts and options trading. Here are the top ten highly respected futures trading platforms in the market, and provide detailed introduction to their characteristics and advantages in perpetual contract and option trading.

Strategy for making money with zero foundation: 5 types of altcoins that must be stocked in 2025, make sure to make 50 times more profitable!

May 08, 2025 pm 08:30 PM

Strategy for making money with zero foundation: 5 types of altcoins that must be stocked in 2025, make sure to make 50 times more profitable!

May 08, 2025 pm 08:30 PM

In cryptocurrency markets, altcoins are often seen by investors as potentially high-return assets. Although there are many altcoins on the market, not all altcoins can bring the expected benefits. This article will provide a detailed guide for investors with zero foundation, introducing the 5 altcoins worth hoarding in 2025, and explaining how to achieve the goal of making a 50x steady profit through these investments.

Top 10 cryptocurrency app exchanges 2025 reliable currency trading platform app inventory points

May 08, 2025 pm 10:21 PM

Top 10 cryptocurrency app exchanges 2025 reliable currency trading platform app inventory points

May 08, 2025 pm 10:21 PM

The top ten cryptocurrency exchange apps are: 1. Binance, 2. OKX, 3. Huobi, 4. Coinbase, 5. Kraken, 6. Bybit, 7. KuCoin, 8. Gemini, 9. Bitstamp, 10. Crypto.com. Each platform has its own unique advantages and features, and users can conduct cryptocurrency transactions by downloading apps, registering and completing verification, depositing, selecting transaction pairs and confirming transactions.

Top 10 cryptocurrency platforms in the world that support multi-chain transactions are authoritatively released in 2025

May 08, 2025 pm 07:15 PM

Top 10 cryptocurrency platforms in the world that support multi-chain transactions are authoritatively released in 2025

May 08, 2025 pm 07:15 PM

According to the latest evaluations and industry trends from authoritative institutions in 2025, the following are the top ten cryptocurrency platforms in the world that support multi-chain transactions, combining transaction volume, technological innovation, compliance and user reputation comprehensive analysis:

The TOP5 of the safest exchanges in 2025: Black U's guide to avoid pits, the rule of 100% of funds to save lives

May 08, 2025 pm 08:27 PM

The TOP5 of the safest exchanges in 2025: Black U's guide to avoid pits, the rule of 100% of funds to save lives

May 08, 2025 pm 08:27 PM

In the field of cryptocurrency trading, the security of exchanges has always been the focus of users. In 2025, after years of development and evolution, some exchanges stand out with their outstanding security measures and user experience. This article will introduce the five most secure exchanges in 2025 and provide practical guides on how to avoid Black U (hacker attacks users) to ensure your funds are 100% secure.

Guide to 'picking money' in the 2025 currency circle: Learn to leverage in contracts in 5 minutes and earn 100,000 a day!

May 08, 2025 pm 08:39 PM

Guide to 'picking money' in the 2025 currency circle: Learn to leverage in contracts in 5 minutes and earn 100,000 a day!

May 08, 2025 pm 08:39 PM

Contract leveraged trading is a common trading method in the currency circle, which allows traders to trade larger amounts with less funds. By using leverage, traders can amplify their profit potential, but also increase risks. Leverage is usually expressed in multiples, for example, 10 times leverage means that you can trade 10 Bitcoin contracts with margin of 1 Bitcoin.