AI For Product Classification: Can Machines Master Tax Law?

Product classification, often involving complex codes like "HS 8471.30" from systems such as the Harmonized System (HS), is crucial for international trade and domestic sales. These codes ensure correct tax application, impacting every invoice and tax return. However, the process is prone to errors with significant consequences.

The High Stakes of Misclassification

Incorrect product classification isn't a minor oversight; it's a systemic issue. A single mistake can propagate through invoicing, accounting, and tax filing systems, often only detected by a tax auditor—resulting in substantial penalties, financial inaccuracies, and reputational harm. The potential for retroactive corrections and fines makes accurate classification paramount.

AI: A New Approach to Classification

Historically, manual classification by tax professionals was slow and error-prone. Now, AI offers a solution. AI systems analyze vast datasets—including descriptions, specifications, and images—to suggest accurate tax classifications. Hybrid systems combining text and image analysis prove especially effective in resolving ambiguities. AI's ability to learn from historical data promises increased accuracy and efficiency.

AI's Limitations in the Nuances of Tax Law

Despite its potential, AI faces challenges. Many products fall into gray areas requiring subjective judgment. For example, classifying smartwatches as communication devices or wristwatches depends on their primary function. Similarly, multifunction printers present classification dilemmas.

International variations in tax laws further complicate matters. The "Subway" bread case in Ireland and the UK's Mega Marshmallow VAT dispute illustrate how cultural factors and legal interpretation significantly influence classification. These cases highlight the inherent subjectivity in tax law, a challenge for AI's purely data-driven approach. Research confirms that while AI shows promise, zero-shot classification struggles with ambiguous categories.

The Enduring Need for Human Expertise

While AI automates routine tasks, human expertise remains crucial. AI can classify a chair, but determining the tax classification of a massage chair requires understanding its design, intended use, and relevant case law. AI can assist, but human judgment and legal interpretation are irreplaceable. The analogy of AI as a navigation system during a storm holds true: technology helps, but human experience guides crucial decisions. Recent research suggests integrating AI with external knowledge sources, such as knowledge graphs, to improve accuracy.

Collaboration: The Future of Product Classification

The future lies in collaboration between AI and humans. AI handles the volume of data, while human experts focus on complex cases requiring legal interpretation and nuanced judgment. Simplifying and standardizing tax classification systems could further reduce reliance on complex AI solutions. Before deploying increasingly sophisticated AI, we should consider simplifying the underlying tax structures themselves. A less complicated system would minimize the need for technological workarounds.

The above is the detailed content of AI For Product Classification: Can Machines Master Tax Law?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1657

1657

14

14

1415

1415

52

52

1309

1309

25

25

1257

1257

29

29

1230

1230

24

24

Getting Started With Meta Llama 3.2 - Analytics Vidhya

Apr 11, 2025 pm 12:04 PM

Getting Started With Meta Llama 3.2 - Analytics Vidhya

Apr 11, 2025 pm 12:04 PM

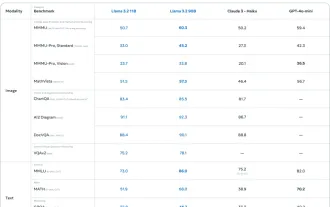

Meta's Llama 3.2: A Leap Forward in Multimodal and Mobile AI Meta recently unveiled Llama 3.2, a significant advancement in AI featuring powerful vision capabilities and lightweight text models optimized for mobile devices. Building on the success o

10 Generative AI Coding Extensions in VS Code You Must Explore

Apr 13, 2025 am 01:14 AM

10 Generative AI Coding Extensions in VS Code You Must Explore

Apr 13, 2025 am 01:14 AM

Hey there, Coding ninja! What coding-related tasks do you have planned for the day? Before you dive further into this blog, I want you to think about all your coding-related woes—better list those down. Done? – Let’

AV Bytes: Meta's Llama 3.2, Google's Gemini 1.5, and More

Apr 11, 2025 pm 12:01 PM

AV Bytes: Meta's Llama 3.2, Google's Gemini 1.5, and More

Apr 11, 2025 pm 12:01 PM

This week's AI landscape: A whirlwind of advancements, ethical considerations, and regulatory debates. Major players like OpenAI, Google, Meta, and Microsoft have unleashed a torrent of updates, from groundbreaking new models to crucial shifts in le

Selling AI Strategy To Employees: Shopify CEO's Manifesto

Apr 10, 2025 am 11:19 AM

Selling AI Strategy To Employees: Shopify CEO's Manifesto

Apr 10, 2025 am 11:19 AM

Shopify CEO Tobi Lütke's recent memo boldly declares AI proficiency a fundamental expectation for every employee, marking a significant cultural shift within the company. This isn't a fleeting trend; it's a new operational paradigm integrated into p

A Comprehensive Guide to Vision Language Models (VLMs)

Apr 12, 2025 am 11:58 AM

A Comprehensive Guide to Vision Language Models (VLMs)

Apr 12, 2025 am 11:58 AM

Introduction Imagine walking through an art gallery, surrounded by vivid paintings and sculptures. Now, what if you could ask each piece a question and get a meaningful answer? You might ask, “What story are you telling?

GPT-4o vs OpenAI o1: Is the New OpenAI Model Worth the Hype?

Apr 13, 2025 am 10:18 AM

GPT-4o vs OpenAI o1: Is the New OpenAI Model Worth the Hype?

Apr 13, 2025 am 10:18 AM

Introduction OpenAI has released its new model based on the much-anticipated “strawberry” architecture. This innovative model, known as o1, enhances reasoning capabilities, allowing it to think through problems mor

How to Add a Column in SQL? - Analytics Vidhya

Apr 17, 2025 am 11:43 AM

How to Add a Column in SQL? - Analytics Vidhya

Apr 17, 2025 am 11:43 AM

SQL's ALTER TABLE Statement: Dynamically Adding Columns to Your Database In data management, SQL's adaptability is crucial. Need to adjust your database structure on the fly? The ALTER TABLE statement is your solution. This guide details adding colu

Newest Annual Compilation Of The Best Prompt Engineering Techniques

Apr 10, 2025 am 11:22 AM

Newest Annual Compilation Of The Best Prompt Engineering Techniques

Apr 10, 2025 am 11:22 AM

For those of you who might be new to my column, I broadly explore the latest advances in AI across the board, including topics such as embodied AI, AI reasoning, high-tech breakthroughs in AI, prompt engineering, training of AI, fielding of AI, AI re