web3.0

web3.0

What is AgriDex? Introduction to Team, Achievements, Token Economics and Token Allocation

What is AgriDex? Introduction to Team, Achievements, Token Economics and Token Allocation

What is AgriDex? Introduction to Team, Achievements, Token Economics and Token Allocation

AgriDex: Solana blockchain platform for innovating agricultural trade

This newsletter explores in-depth how Solana-based AgriDex platform introduces a $2.7 trillion agricultural industry into the blockchain world. The Solana ecosystem needs to go beyond the short-term boom of meme coins, and AgriDex is working on it.

What is AgriDex?

Global agriculture is facing technological changes, and efficiency improvement is crucial. However, high capital costs, inconsistent food quality standards, complex trade routes and fraud risks hinder development. AgriDex aims to solve these challenges through decentralized markets.

Core advantages of AgriDex:

- Combat food fraud: Use blockchain technology to improve food traceability and reduce the risk of fraud.

- Enhanced traceability: Transparently record product source, quality and sustainability information.

- Promote fair access: Create a fairer trade environment for producers and improve profit margins.

- Reduce settlement costs: Through blockchain technology, the settlement costs are reduced to less than 0.5%, and the settlement time is shortened to a few seconds.

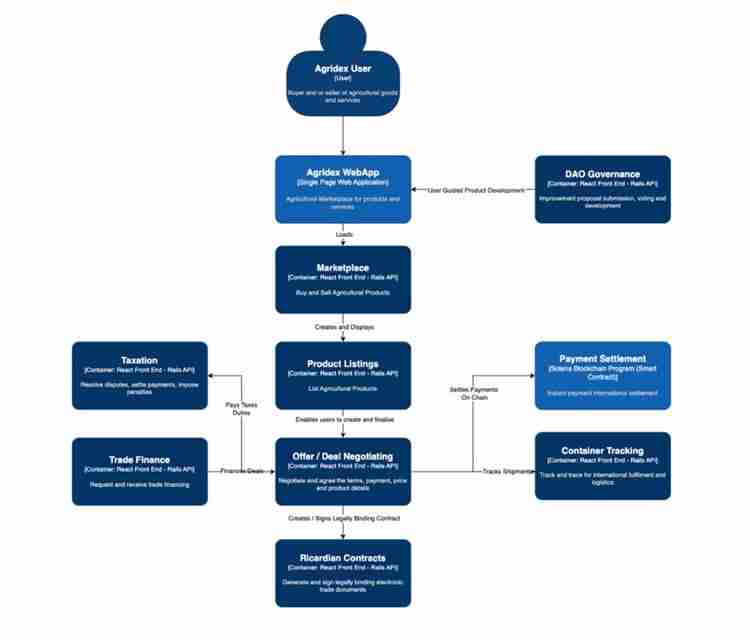

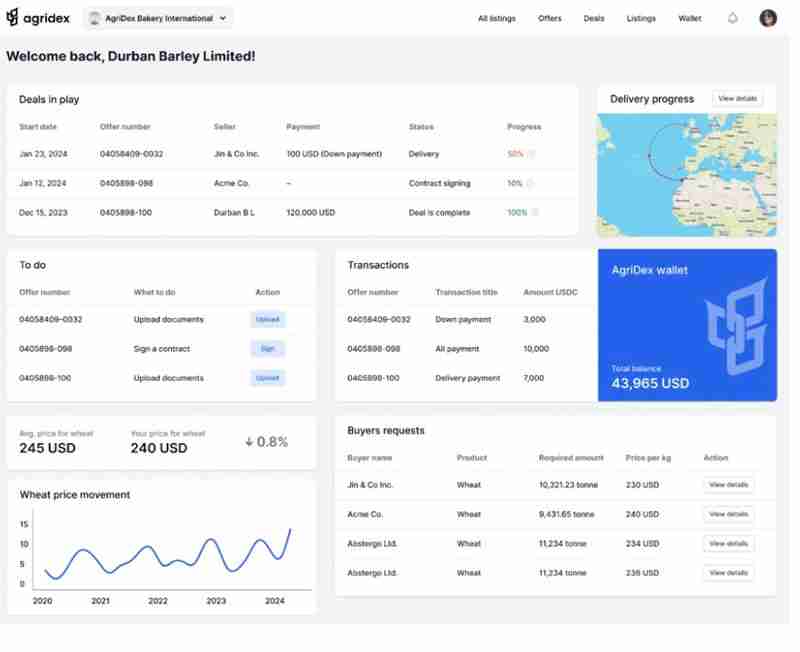

AgriDex provides an inclusive market that supports transparent transactions, simplified KYB processes, multi-currency settlement, smart contracts, and visualization of sustainability certification.

AgriDex's core features include: real-time transaction tracking, flexible payment terms, and support for all international trade terms (Incoterms). AgriDex creates value for investors, farmers and governments through NFT tokenization of agricultural commodities.

Team and Achievements

AgriDex has received more than $6 million in financing, and its team members have expertise in finance, agriculture, law and technology.

AGRI Token Economics

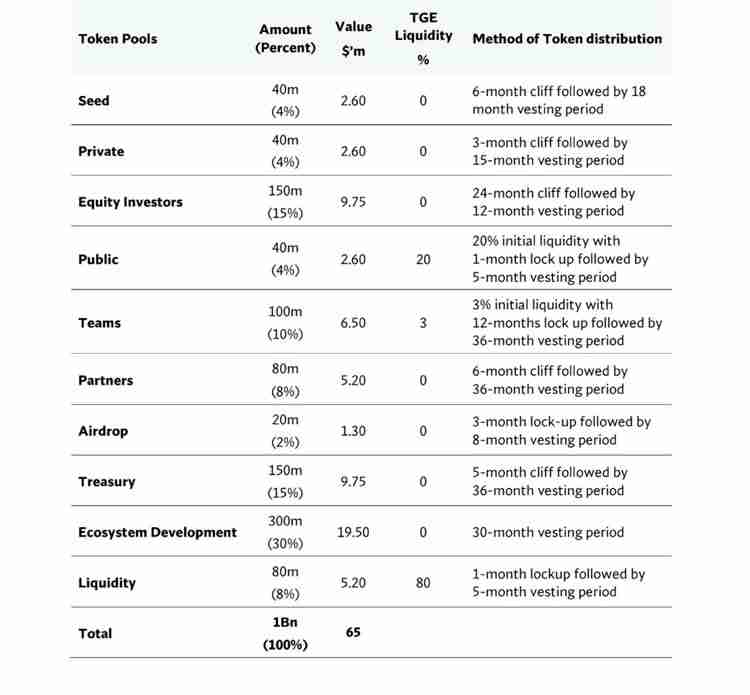

AGRI Token is AgriDex's governance token, and its uses include: governance voting, profit repurchase and reallocation. Token holders can participate in DAO governance and determine the utility of tokens, such as: market insight subscriptions, liquidity pool rewards, impact agricultural funds, on-demand data services, and environmental and social reward programs.

Token allocation

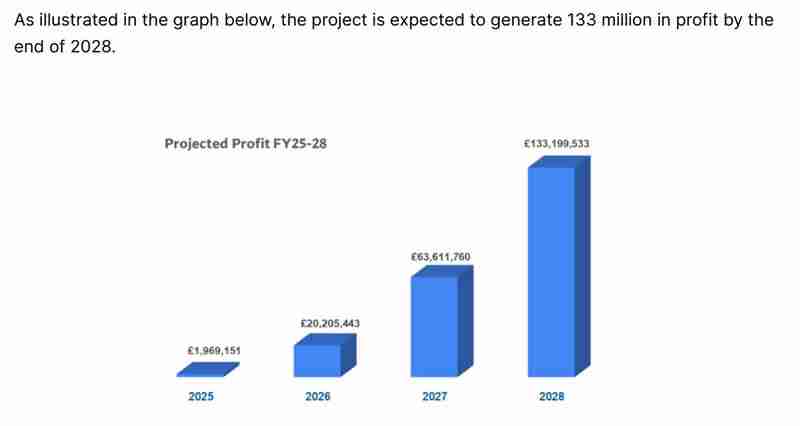

Total supply is 75 million AGRI tokens with an initial price of USD 0.065. Token allocation does not include public offerings.

Summary

AgriDex leverages Solana's strengths to expand the narrative of real-world assets (RWA) into the agricultural sector, aiming to revolutionize global agricultural trade, improve efficiency, and promote sustainable development.

The above is the detailed content of What is AgriDex? Introduction to Team, Achievements, Token Economics and Token Allocation. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

When choosing a digital currency trading platform suitable for beginners, you need to consider security, ease of use, educational resources and cost transparency: 1. Priority is given to platforms that provide cold storage, two-factor verification and asset insurance; 2. Apps with a simple interface and clear operation are more suitable for beginners; 3. The platform should provide learning tools such as tutorials and market analysis; 4. Pay attention to hidden costs such as transaction fees and cash withdrawal fees.

The latest updates to the oldest virtual currency rankings

Apr 22, 2025 am 07:18 AM

The latest updates to the oldest virtual currency rankings

Apr 22, 2025 am 07:18 AM

The ranking of virtual currencies’ “oldest” is as follows: 1. Bitcoin (BTC), issued on January 3, 2009, is the first decentralized digital currency. 2. Litecoin (LTC), released on October 7, 2011, is known as the "lightweight version of Bitcoin". 3. Ripple (XRP), issued in 2011, is designed for cross-border payments. 4. Dogecoin (DOGE), issued on December 6, 2013, is a "meme coin" based on the Litecoin code. 5. Ethereum (ETH), released on July 30, 2015, is the first platform to support smart contracts. 6. Tether (USDT), issued in 2014, is the first stablecoin to be anchored to the US dollar 1:1. 7. ADA,

Meme Coin Exchange Ranking Meme Coin Main Exchange Top 10 Spots

Apr 22, 2025 am 09:57 AM

Meme Coin Exchange Ranking Meme Coin Main Exchange Top 10 Spots

Apr 22, 2025 am 09:57 AM

The most suitable platforms for trading Meme coins include: 1. Binance, the world's largest, with high liquidity and low handling fees; 2. OkX, an efficient trading engine, supporting a variety of Meme coins; 3. XBIT, decentralized, supporting cross-chain trading; 4. Redim (Solana DEX), low cost, combined with Serum order book; 5. PancakeSwap (BSC DEX), low transaction fees and fast speed; 6. Orca (Solana DEX), user experience optimization; 7. Coinbase, high security, suitable for beginners; 8. Huobi, well-known in Asia, rich trading pairs; 9. DEXRabbit, intelligent

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

Cryptocurrency data platforms suitable for beginners include CoinMarketCap and non-small trumpet. 1. CoinMarketCap provides global real-time price, market value, and trading volume rankings for novice and basic analysis needs. 2. The non-small quotation provides a Chinese-friendly interface, suitable for Chinese users to quickly screen low-risk potential projects.

A list of special services for major virtual currency trading platforms

Apr 22, 2025 am 08:09 AM

A list of special services for major virtual currency trading platforms

Apr 22, 2025 am 08:09 AM

Institutional investors should choose compliant platforms such as Coinbase Pro and Genesis Trading, focusing on cold storage ratios and audit transparency; retail investors should choose large platforms such as Binance and Huobi, focusing on user experience and security; users in compliance-sensitive areas can conduct fiat currency trading through Circle Trade and Huobi Global, and mainland Chinese users need to go through compliant over-the-counter channels.

Top 10 latest releases of virtual currency trading platforms for bulk transactions

Apr 22, 2025 am 08:18 AM

Top 10 latest releases of virtual currency trading platforms for bulk transactions

Apr 22, 2025 am 08:18 AM

The following factors should be considered when choosing a bulk trading platform: 1. Liquidity: Priority is given to platforms with an average daily trading volume of more than US$5 billion. 2. Compliance: Check whether the platform holds licenses such as FinCEN in the United States, MiCA in the European Union. 3. Security: Cold wallet storage ratio and insurance mechanism are key indicators. 4. Service capability: Whether to provide exclusive account managers and customized transaction tools.

Summary of the top ten Apple version download portals for digital currency exchange apps

Apr 22, 2025 am 09:27 AM

Summary of the top ten Apple version download portals for digital currency exchange apps

Apr 22, 2025 am 09:27 AM

Provides a variety of complex trading tools and market analysis. It covers more than 100 countries, has an average daily derivative trading volume of over US$30 billion, supports more than 300 trading pairs and 200 times leverage, has strong technical strength, a huge global user base, provides professional trading platforms, secure storage solutions and rich trading pairs.

Can two exchanges convert coins to each other? Can two exchanges convert coins to each other?

Apr 22, 2025 am 08:57 AM

Can two exchanges convert coins to each other? Can two exchanges convert coins to each other?

Apr 22, 2025 am 08:57 AM

Can. The two exchanges can transfer coins to each other as long as they support the same currency and network. The steps include: 1. Obtain the collection address, 2. Initiate a withdrawal request, 3. Wait for confirmation. Notes: 1. Select the correct transfer network, 2. Check the address carefully, 3. Understand the handling fee, 4. Pay attention to the account time, 5. Confirm that the exchange supports this currency, 6. Pay attention to the minimum withdrawal amount.