Technical Analysis Teaching Guide: Judge Price Behavior through K-line

Catalog

-

Introduction

-

(I) Learning Path

-

(II) Key elements of type trading

-

1. Interpretation of K-line price behavior

-

(I) Basic concepts

-

(II) Analysis Tool

-

2. Analysis of K-line price behavior: weighing pros and cons

-

- Advantages

-

- Disadvantages

-

3. K-line pattern interpretation skills

-

- K-line strength and weakness determination

-

- Strong Trend Identification

-

- Research and judgment of reversal signal

-

4. The driving force of price fluctuations: Trend analysis

-

- Trend definition

-

- Trendline drawing and application

-

- Coping strategies after the trend line breaks

-

- Summary of trend analysis

-

5. K-line support and pressure levels

-

- Key Price Identification

-

- Test and conversion of support pressure levels

-

Conclusion

Introduction

Traditional type analysis, also known as traditional chart analysis, is a technical analysis method based on K-line price behavior. By summarizing specific price patterns and subsequent trends in historical markets, identifying specific patterns, so as to quickly screen trading opportunities and predict market trends. This article avoids using too many professional terms and strives to help readers establish a technical analysis system based on basic principles.

(I) Learning Path

-

Price Analysis: K-line strength → trend → support pressure → pattern;

-

Model analysis:Model introduction →Identification and entry strategy →Model trading strengthening.

(II) Key elements of type trading

-

Strict risk control and a stable mentality are the cornerstones of success.

-

Remember that the pattern comes from the price. You should first understand the "price", then summarize the "form", and finally deduce the "trend".

-

The shape and effectiveness of different time zones are different. It is necessary to combine the price range and trend of the large-level level, and judge the entry opportunity and profit-loss ratio at a small level.

-

Consensus is crucial, and the effect of superposition of morphology or combination of multiple technical indicators is better than that of a single morphology. Maybe you still find it difficult to fully understand the points mentioned in the article, but please remember them and experience them carefully in the future.

1. Interpretation of K-line price behavior

Price behavior is the core of traditional pattern analysis, but it is not the only focus of this article. The following outlines the concepts, tools and advantages and disadvantages of price behavior analysis.

(I) Basic concepts

Price Action Analysis (PA) is a technical analysis method that directly observes changes in market prices and trading volume to predict future trends. Price fluctuations are derived from the behavior of market participants, which are reflected through price patterns and trading volume.

(II) Analysis Tool

-

K-line (Candlesticks): Each K-line reflects the opening price, closing price, highest price and lowest price over a period of time. By observing the K-line arrangement, we can judge the strength and pattern of the trend over a period of time.

-

Trendline: A line connecting the high or low points of the price to identify the convergence, expansion or oscillation of the price, as well as the relative strength of the high and low trends.

-

Support & Resistance: Support is the position where the price is supported when it falls, and pressure is the position where the price is blocked when it rises. Interpret the market by observing the price strength when these prices are touched or broken through.

-

Patterns: The focus of this article is to combine the above tools to identify specific price patterns to predict future trends. Common forms and applications will be introduced later.

2. Analysis of K-line price behavior: weighing pros and cons

1. Advantages

- Easy to get started: no complex theoretical foundation is required, just start from the K-line and price, and choose a strong direction to intervene according to strength and weakness.

- High reliability: Price behavior is based on the collective choice of market participants and capital, and capital advantagers often dominate the trend.

- High expected returns: Understand the market start position and follow the trend of capital advantage, and the expected returns (Expected Value, EV) are higher.

2. Disadvantages

- Main manipulation: The main force also understands the trend principle and may use manipulation of stop loss to establish a price advantage.

- Difficult to master: a single analysis method may lead to slow judgment, require accumulating a lot of experience, and use multiple filtering methods to deal with market traps.

3. K-line pattern interpretation skills

1. K-line strength and weakness determination

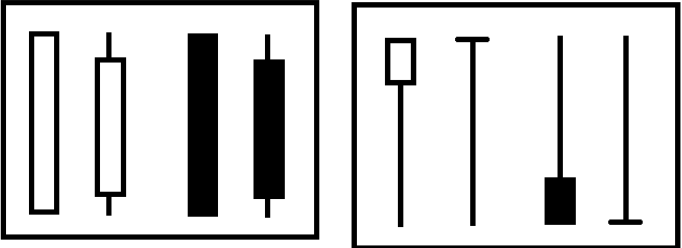

K-line consists of the opening price, the highest price, the lowest price and the closing price. The closing price is higher than the opening price and is the positive line (white), and vice versa. The part of the highest and lowest price exceeding the opening and closing price is a shadow line, and the part between the opening and closing price is an entity. Each K-line contains price and fluctuation information for this period.

The following is only a few more obvious examples, and actual judgments need to be combined with subsequent trends and overall trends.

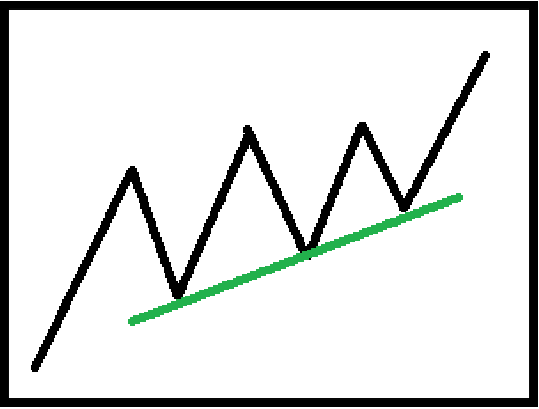

2. Recognition of strong trends

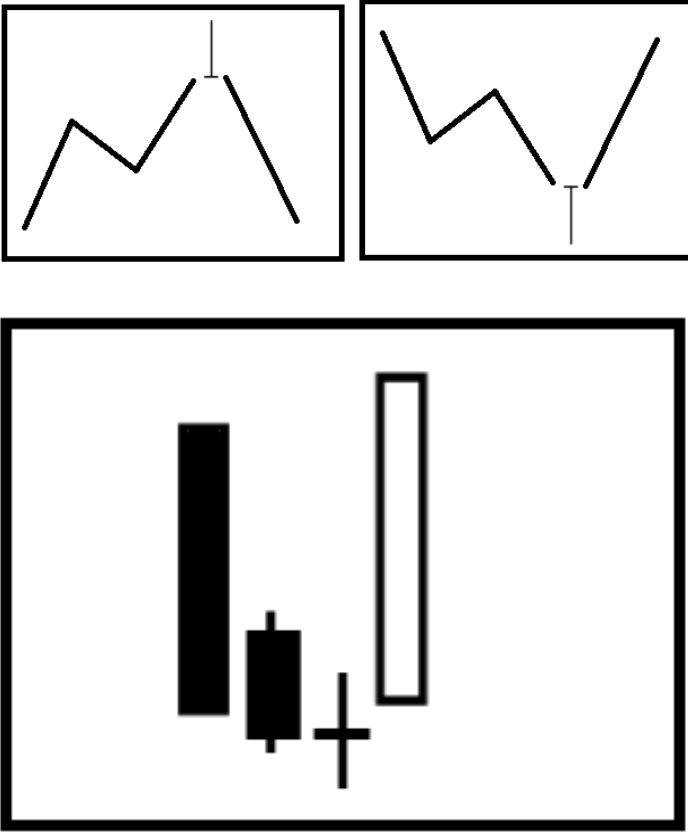

Strong K-lines are usually full, or full of solid and have very short shadows (above), or have strong closing characteristics, such as long lower shadows in upward trends and long upper shadows in downward trends (above).

3. Reversal signal

The long upper shadow appears in the band high point (above), the long lower shadow appears in the band low point (above), or the obvious pherophytic pattern appears (stop after the decline and is completely covered by a stronger K-line, as shown in the figure below), etc., which may be a reversal signal.

4. The driving force of price fluctuations: Trend analysis

1. Trend definition

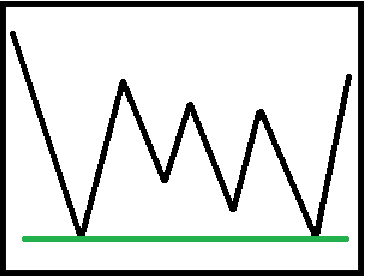

Trend refers to the direction of prices over a period of time, determined by the competition of supply and demand forces, and can be divided into upward, downward or horizontal trends.

Attack trend: Prices continue to rise, usually dominated by the buyer.

Downward trend: Prices continue to fall, usually dominated by the seller.

Horizontal Trend: Prices are maintained within a specific range, usually caused by the balance of long and short forces.

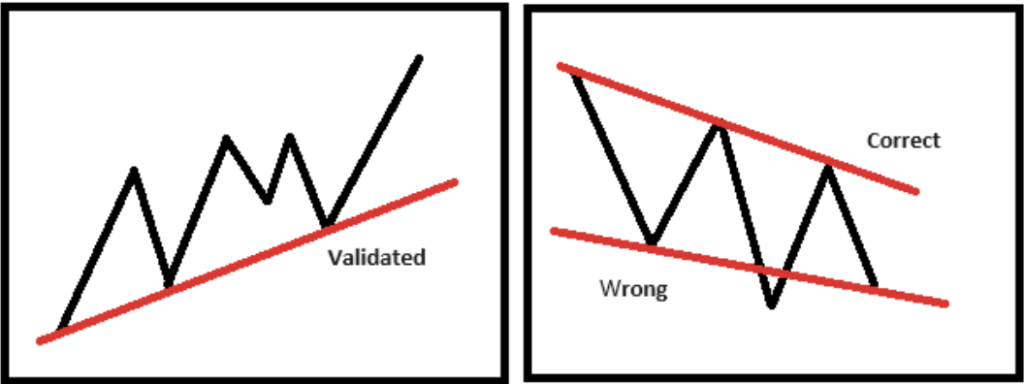

2. Trend line drawing and application

Trend lines connect price highs or lows to judge trends. An effective trend line must pass at least three points. The higher the level, the more effective it is, and try to cover the complete price changes.

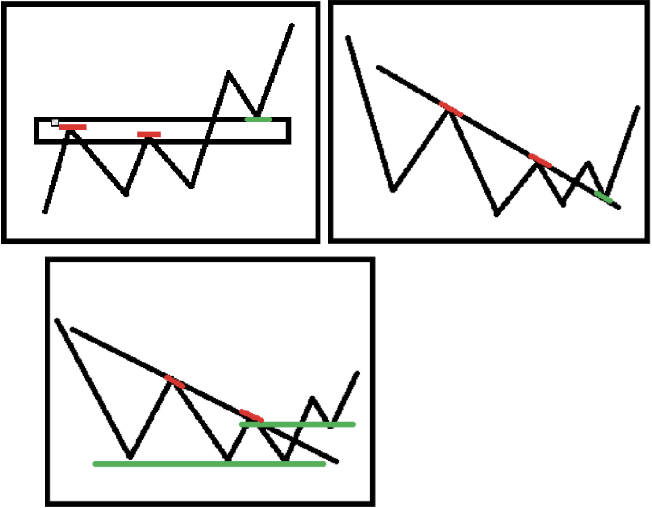

3. Coping strategies after the trend line breaks

- Retracement after breakthrough: It is necessary to combine the judgment of the strength and weakness of the K-line and follow-up trend to determine whether it is a false breakthrough or a trend reversal.

- Entity Breakthrough: It is usually regarded as a trend line failure or a trend level/amplitude expansion. It is necessary to operate with caution and consider reducing positions or moving stop loss.

4. Summary of trend analysis

All analytical tools and methods are designed to assist in identifying trends and trading. Different trends may exist at different levels, and small trends are part of the big trend. It is recommended to follow the trend at large level, find the same trend at small level to trade, and be cautious when trading against the trend.

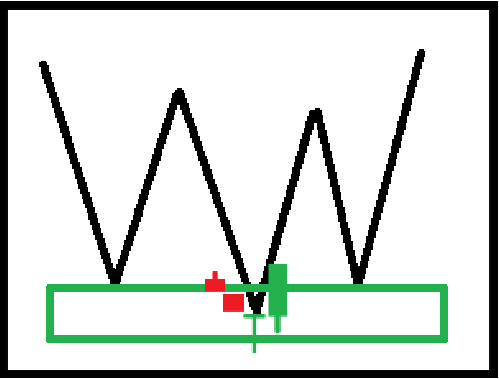

5. K-line support and pressure levels

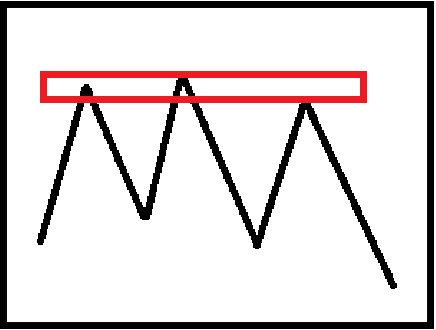

Support and pressure levels are positions that touch and are blocked or reversed during an upward or decline in a price increase or decrease. It's not an exact price, but a range. When selecting the support pressure level, we should pay attention to consensus and effectiveness:

1. Key price identification

- Constant high/equal low point

- Supply and Demand Range

- Trendline

- Large-level closing price/opening price

- Price integer level

- The top/bottom of the long K-line with explosive volume is more than that of

2. Test and conversion of support pressure levels

The support pressure level can be confirmed through multiple tests. Support pressure level swap means that the support level becomes a pressure level after it is broken, or the pressure level becomes a support level after it is broken.

Conclusion

Price Action Analysis is a technical analysis method based on price changes. Market price fluctuations are derived from the behavior of market participants, which are reflected in price patterns and trading volume. Its advantage is that it is easy to get started, but it requires accumulation of experience and the use of multiple methods to deal with market risks.

The above is the detailed content of Technical Analysis Teaching Guide: Judge Price Behavior through K-line. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1653

1653

14

14

1413

1413

52

52

1304

1304

25

25

1251

1251

29

29

1224

1224

24

24

How to measure thread performance in C?

Apr 28, 2025 pm 10:21 PM

How to measure thread performance in C?

Apr 28, 2025 pm 10:21 PM

Measuring thread performance in C can use the timing tools, performance analysis tools, and custom timers in the standard library. 1. Use the library to measure execution time. 2. Use gprof for performance analysis. The steps include adding the -pg option during compilation, running the program to generate a gmon.out file, and generating a performance report. 3. Use Valgrind's Callgrind module to perform more detailed analysis. The steps include running the program to generate the callgrind.out file and viewing the results using kcachegrind. 4. Custom timers can flexibly measure the execution time of a specific code segment. These methods help to fully understand thread performance and optimize code.

How to understand ABI compatibility in C?

Apr 28, 2025 pm 10:12 PM

How to understand ABI compatibility in C?

Apr 28, 2025 pm 10:12 PM

ABI compatibility in C refers to whether binary code generated by different compilers or versions can be compatible without recompilation. 1. Function calling conventions, 2. Name modification, 3. Virtual function table layout, 4. Structure and class layout are the main aspects involved.

How to use the chrono library in C?

Apr 28, 2025 pm 10:18 PM

How to use the chrono library in C?

Apr 28, 2025 pm 10:18 PM

Using the chrono library in C can allow you to control time and time intervals more accurately. Let's explore the charm of this library. C's chrono library is part of the standard library, which provides a modern way to deal with time and time intervals. For programmers who have suffered from time.h and ctime, chrono is undoubtedly a boon. It not only improves the readability and maintainability of the code, but also provides higher accuracy and flexibility. Let's start with the basics. The chrono library mainly includes the following key components: std::chrono::system_clock: represents the system clock, used to obtain the current time. std::chron

How to use string streams in C?

Apr 28, 2025 pm 09:12 PM

How to use string streams in C?

Apr 28, 2025 pm 09:12 PM

The main steps and precautions for using string streams in C are as follows: 1. Create an output string stream and convert data, such as converting integers into strings. 2. Apply to serialization of complex data structures, such as converting vector into strings. 3. Pay attention to performance issues and avoid frequent use of string streams when processing large amounts of data. You can consider using the append method of std::string. 4. Pay attention to memory management and avoid frequent creation and destruction of string stream objects. You can reuse or use std::stringstream.

How to optimize code

Apr 28, 2025 pm 10:27 PM

How to optimize code

Apr 28, 2025 pm 10:27 PM

C code optimization can be achieved through the following strategies: 1. Manually manage memory for optimization use; 2. Write code that complies with compiler optimization rules; 3. Select appropriate algorithms and data structures; 4. Use inline functions to reduce call overhead; 5. Apply template metaprogramming to optimize at compile time; 6. Avoid unnecessary copying, use moving semantics and reference parameters; 7. Use const correctly to help compiler optimization; 8. Select appropriate data structures, such as std::vector.

How to understand DMA operations in C?

Apr 28, 2025 pm 10:09 PM

How to understand DMA operations in C?

Apr 28, 2025 pm 10:09 PM

DMA in C refers to DirectMemoryAccess, a direct memory access technology, allowing hardware devices to directly transmit data to memory without CPU intervention. 1) DMA operation is highly dependent on hardware devices and drivers, and the implementation method varies from system to system. 2) Direct access to memory may bring security risks, and the correctness and security of the code must be ensured. 3) DMA can improve performance, but improper use may lead to degradation of system performance. Through practice and learning, we can master the skills of using DMA and maximize its effectiveness in scenarios such as high-speed data transmission and real-time signal processing.

How to uninstall MySQL and clean residual files

Apr 29, 2025 pm 04:03 PM

How to uninstall MySQL and clean residual files

Apr 29, 2025 pm 04:03 PM

To safely and thoroughly uninstall MySQL and clean all residual files, follow the following steps: 1. Stop MySQL service; 2. Uninstall MySQL packages; 3. Clean configuration files and data directories; 4. Verify that the uninstallation is thorough.

How to use MySQL functions for data processing and calculation

Apr 29, 2025 pm 04:21 PM

How to use MySQL functions for data processing and calculation

Apr 29, 2025 pm 04:21 PM

MySQL functions can be used for data processing and calculation. 1. Basic usage includes string processing, date calculation and mathematical operations. 2. Advanced usage involves combining multiple functions to implement complex operations. 3. Performance optimization requires avoiding the use of functions in the WHERE clause and using GROUPBY and temporary tables.