web3.0

web3.0

A stable risk aversion strategy in the downward market, a comparative study on high interest earning products on four major exchanges

A stable risk aversion strategy in the downward market, a comparative study on high interest earning products on four major exchanges

A stable risk aversion strategy in the downward market, a comparative study on high interest earning products on four major exchanges

Bybit's huge theft case triggered a crisis of trust in the crypto market, and many mainstream exchanges have increased the annualized interest rates of wealth management products to stabilize user confidence. At the same time, the cryptocurrency market continued to decline, and CoinGlass data showed that the entire network contract was liquidated by nearly US$1.15 billion on February 25. Faced with violent fluctuations, a stable risk aversion strategy is particularly important, and high-yield financial products have become the choice of many investors. Especially for users who hold mainstream currencies or stablecoins, it is wise to obtain stable returns to hedge risks while retaining funds to wait for the market to rebound.

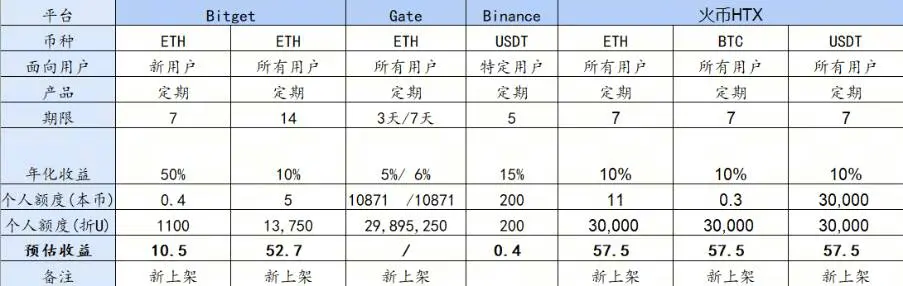

Binance, Huobi HTX, Bitget and Gate have recently launched new financial and currency-making products. This article will compare and analyze these products.

Comparison of income of financial products

The 7-day regular products launched by Huobi HTX have an annualized interest rate of up to 10%, and each product provides an equivalent subscription amount of USDT of 30,000. Subscription for one of these products at full amount will result in USDT returns of 57.5 when maturity is achieved, which is outstanding in terms of yield and practicality. In addition, Huobi HTX is the only exchange that provides high-interest BTC financial products, with stronger product diversity.

Bitget's 14-day regular ETH product annualized interest rate also reached 10%, but the quota is only 5 ETH; its 7-day regular ETH product annualized interest rate is as high as 50%, but only for new users, the quota is only 0.4 ETH, and the estimated return is only 10.5 USDT.

Gate mainly focuses on ETH products. The annualized interest rates for 3-day and 7-day regular products are 5% and 6% respectively. Although there is no limit, the interest rates are slightly lower than those of Huobi HTX and Bitget.

Binance has launched a limited-time event for current products of USDT, ETH and SOL, but the interest rate for ETH current products is only 2.1%, which is relatively weak in competitiveness. USDT current products have a large interest rate hike, but they still lack advantages compared with other exchanges.

Comparison of current products for stablecoin

In addition to the above-mentioned currency-making products, the yield of USDT current products is also an important indicator for measuring exchange financial management business. Bitget and Huobi HTX's USDT current products performed close, with Bitget's annualized interest rate reaching 12.9% in the lower amount ladder (500 USDT); Huobi HTX's annualized interest rate is higher (1,000 USDT), with an annualized interest rate of 10%. Gate's annualized interest rate for USDT current products is close to 4%, and an additional 10% annualized reward can be obtained within USDT.

In other stablecoins, Binance's FDUSD and Bitget's USDC are also competitive; Huobi HTX's 20% annualized income subsidy for the decentralized stablecoin USDD is also worth paying attention to.

Disclaimer: This article is for reference only and does not constitute any investment advice.

The above is the detailed content of A stable risk aversion strategy in the downward market, a comparative study on high interest earning products on four major exchanges. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

What currency does Ripple (XRP currency) belong to? Detailed tutorial for beginners

Apr 28, 2025 pm 07:57 PM

What currency does Ripple (XRP currency) belong to? Detailed tutorial for beginners

Apr 28, 2025 pm 07:57 PM

Created by Ripple, Ripple is used for cross-border payments, which are fast and low-cost and suitable for small transaction payments. After registering a wallet and exchange, purchase and storage can be made.

Which of the top ten currency trading platforms in the world are the latest version of the top ten currency trading platforms

Apr 28, 2025 pm 08:09 PM

Which of the top ten currency trading platforms in the world are the latest version of the top ten currency trading platforms

Apr 28, 2025 pm 08:09 PM

The top ten cryptocurrency trading platforms in the world include Binance, OKX, Gate.io, Coinbase, Kraken, Huobi Global, Bitfinex, Bittrex, KuCoin and Poloniex, all of which provide a variety of trading methods and powerful security measures.

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

The top ten digital currency exchanges such as Binance, OKX, gate.io have improved their systems, efficient diversified transactions and strict security measures.

What are the top currency trading platforms? The top 10 latest virtual currency exchanges

Apr 28, 2025 pm 08:06 PM

What are the top currency trading platforms? The top 10 latest virtual currency exchanges

Apr 28, 2025 pm 08:06 PM

Currently ranked among the top ten virtual currency exchanges: 1. Binance, 2. OKX, 3. Gate.io, 4. Coin library, 5. Siren, 6. Huobi Global Station, 7. Bybit, 8. Kucoin, 9. Bitcoin, 10. bit stamp.

Which of the top ten currency trading platforms in the world are among the top ten currency trading platforms in 2025

Apr 28, 2025 pm 08:12 PM

Which of the top ten currency trading platforms in the world are among the top ten currency trading platforms in 2025

Apr 28, 2025 pm 08:12 PM

The top ten cryptocurrency exchanges in the world in 2025 include Binance, OKX, Gate.io, Coinbase, Kraken, Huobi, Bitfinex, KuCoin, Bittrex and Poloniex, all of which are known for their high trading volume and security.

What kind of software is a digital currency app? Top 10 Apps for Digital Currencies in the World

Apr 30, 2025 pm 07:06 PM

What kind of software is a digital currency app? Top 10 Apps for Digital Currencies in the World

Apr 30, 2025 pm 07:06 PM

With the popularization and development of digital currency, more and more people are beginning to pay attention to and use digital currency apps. These applications provide users with a convenient way to manage and trade digital assets. So, what kind of software is a digital currency app? Let us have an in-depth understanding and take stock of the top ten digital currency apps in the world.

Quantitative Exchange Ranking 2025 Top 10 Recommendations for Digital Currency Quantitative Trading APPs

Apr 30, 2025 pm 07:24 PM

Quantitative Exchange Ranking 2025 Top 10 Recommendations for Digital Currency Quantitative Trading APPs

Apr 30, 2025 pm 07:24 PM

The built-in quantization tools on the exchange include: 1. Binance: Provides Binance Futures quantitative module, low handling fees, and supports AI-assisted transactions. 2. OKX (Ouyi): Supports multi-account management and intelligent order routing, and provides institutional-level risk control. The independent quantitative strategy platforms include: 3. 3Commas: drag-and-drop strategy generator, suitable for multi-platform hedging arbitrage. 4. Quadency: Professional-level algorithm strategy library, supporting customized risk thresholds. 5. Pionex: Built-in 16 preset strategy, low transaction fee. Vertical domain tools include: 6. Cryptohopper: cloud-based quantitative platform, supporting 150 technical indicators. 7. Bitsgap:

Top 10 Virtual Digital Currency Exchanges Ranking List The latest list of Top 10 Virtual Currency Exchanges

Apr 30, 2025 am 10:21 AM

Top 10 Virtual Digital Currency Exchanges Ranking List The latest list of Top 10 Virtual Currency Exchanges

Apr 30, 2025 am 10:21 AM

Top 10 virtual digital currency exchanges rankings: 1. OKX, 2. Binance, 3. Coinbase. 1. OKX ranks first with its powerful features and user-friendly interface, supporting a variety of transactions and staking services. 2. Binance ranks second with its huge user base and rich trading pairs, providing a variety of trading and IEO services. 3. Coinbase ranks third with its user-friendly interface and powerful security measures, supporting a variety of mainstream virtual currency transactions.