web3.0

web3.0

Behind the SOL price plunge: Encryption crisis under the interweaving of multiple difficulties

Behind the SOL price plunge: Encryption crisis under the interweaving of multiple difficulties

Behind the SOL price plunge: Encryption crisis under the interweaving of multiple difficulties

Solana (SOL) price plummeted: from $295 to $181, encrypting the crisis in the cold winter

In early 2025, Solana (SOL) briefly hit a high of $295, but just one month later, it plummeted to $181 on February 17, a drop of nearly 40%. This is not only a fluctuation in numbers, but also indicates that SOL is facing severe challenges in the future development. Why did SOL, once regarded as a strong competitor to Ethereum, face such a dilemma?

The aftermath of FTX bankruptcy and the sharp drop in market confidence

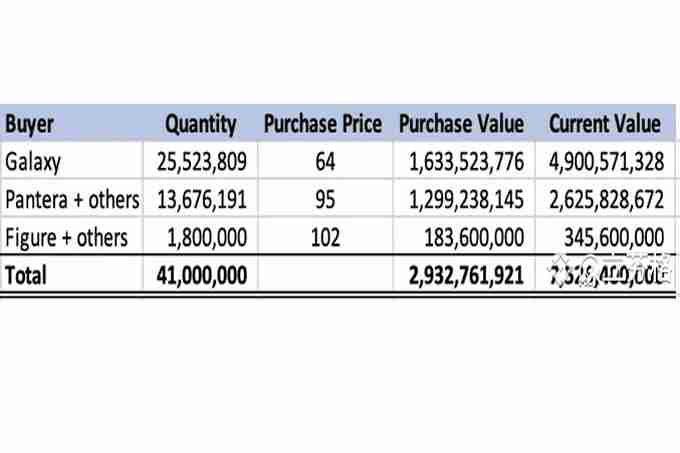

The impact of FTX bankruptcy liquidation cannot be ignored. On March 1, the 11.2 million SOLs auctioned by FTX are about to be unlocked, worth up to US$2.06 billion, accounting for 2.29% of the total SOL circulation. Previously, many institutions purchased a large number of SOLs at low prices, and now they are facing huge profits. Once sold, it will put huge pressure on the market. Solana's current trading volume and on-chain activity continue to be sluggish, and the lack of sufficient buying support further exacerbates the price decline. At the same time, the expected destruction mechanism has failed due to the decline in on-chain activity, which cannot effectively alleviate the pressure of selling.

The Meme coin craze has receded and the double blow to the LIBRA incident

The previous Meme coin fanaticism has driven up trading volume and prices on Solana, but the outbreak of the LIBRA incident has brought a heavy blow. In this incident, the team behind the scenes accurately ditched the investment and arbitrage, causing a large amount of retail investors to lose, triggering a crisis of trust in the Solana ecosystem, and questioning its project operation and profit distribution mechanism. Since then, Solana's on-chain liquidity and DEX trading volume have shrunk sharply, and the market has reassessed its long-term value.

On-chain data, technical aspects and regulatory pressures work together

On-chain data clearly reflects Solana's recession. After the Meme bubble burst, Jupiter trading volume plummeted from a peak of $1.9 billion on January 19 to $282 million in mid-February, a drop of more than 85%. The overall transaction volume on-chain of Solana's main network has also dropped significantly. At the same time, the rise of the Ethereum Layer2 ecosystem has weakened Solana's transaction fee advantages, and its technological advantages are no longer accelerator of price declines.

In terms of technical indicators, the SOL daily chart shows a downward trend, MACD dead cross, RSI is below 40 for a long time, and market sentiment is extremely pessimistic. On-chain position data shows that long-term holders are accelerating their positions reductions, and the growth rate of new addresses is slowing down. In addition, after the LIBRA incident, Solana may face stricter regulatory scrutiny, and its risks will be further increased in the context of stricter supervision of the crypto market.

At present, SOL price continues to fall, falling below $140, the technical pattern further weakens, and may continue to fluctuate and adjust in the short term, and the bottom has not yet appeared. Solana urgently needs to find new growth momentum and rebuild market confidence, otherwise future development will face huge challenges.

The above is the detailed content of Behind the SOL price plunge: Encryption crisis under the interweaving of multiple difficulties. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

The top ten digital virtual currency apps are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

When choosing a digital currency trading platform suitable for beginners, you need to consider security, ease of use, educational resources and cost transparency: 1. Priority is given to platforms that provide cold storage, two-factor verification and asset insurance; 2. Apps with a simple interface and clear operation are more suitable for beginners; 3. The platform should provide learning tools such as tutorials and market analysis; 4. Pay attention to hidden costs such as transaction fees and cash withdrawal fees.

Meme Coin Exchange Ranking Meme Coin Main Exchange Top 10 Spots

Apr 22, 2025 am 09:57 AM

Meme Coin Exchange Ranking Meme Coin Main Exchange Top 10 Spots

Apr 22, 2025 am 09:57 AM

The most suitable platforms for trading Meme coins include: 1. Binance, the world's largest, with high liquidity and low handling fees; 2. OkX, an efficient trading engine, supporting a variety of Meme coins; 3. XBIT, decentralized, supporting cross-chain trading; 4. Redim (Solana DEX), low cost, combined with Serum order book; 5. PancakeSwap (BSC DEX), low transaction fees and fast speed; 6. Orca (Solana DEX), user experience optimization; 7. Coinbase, high security, suitable for beginners; 8. Huobi, well-known in Asia, rich trading pairs; 9. DEXRabbit, intelligent

Top 10 latest releases of virtual currency trading platforms for bulk transactions

Apr 22, 2025 am 08:18 AM

Top 10 latest releases of virtual currency trading platforms for bulk transactions

Apr 22, 2025 am 08:18 AM

The following factors should be considered when choosing a bulk trading platform: 1. Liquidity: Priority is given to platforms with an average daily trading volume of more than US$5 billion. 2. Compliance: Check whether the platform holds licenses such as FinCEN in the United States, MiCA in the European Union. 3. Security: Cold wallet storage ratio and insurance mechanism are key indicators. 4. Service capability: Whether to provide exclusive account managers and customized transaction tools.

Top 10 digital currency exchanges Top 10 digital currency app exchanges

Apr 22, 2025 pm 03:15 PM

Top 10 digital currency exchanges Top 10 digital currency app exchanges

Apr 22, 2025 pm 03:15 PM

The top ten digital currency exchanges are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

What is on-chain transaction? What are the global transactions?

Apr 22, 2025 am 10:06 AM

What is on-chain transaction? What are the global transactions?

Apr 22, 2025 am 10:06 AM

EU MiCA compliance certification, covering 50 fiat currency channels, cold storage ratio 95%, and zero security incident records. The US SEC licensed platform has convenient direct purchase of fiat currency, a ratio of 98% cold storage, institutional-level liquidity, supports large-scale OTC and custom orders, and multi-level clearing protection.

Ranking of the top ten free virtual currency app exchanges. Recommended digital currency trading platform rankings in 2025

Apr 22, 2025 pm 02:36 PM

Ranking of the top ten free virtual currency app exchanges. Recommended digital currency trading platform rankings in 2025

Apr 22, 2025 pm 02:36 PM

The top ten free viewing software apps recommended include: 1. OKX, 2. Binance, 3. gate.io, 4. Huobi, 5. Coinbase, 6. KuCoin, 7. Kraken, 8. Bitfinex, 9. Bybit, 10. Bitstamp. These apps provide real-time market trends, technical analysis and price reminders to help users monitor market dynamics in real time and make informed investment decisions.

Top 10 digital virtual currency trading app rankings Top 10 digital currency exchange rankings in 2025

Apr 22, 2025 pm 02:45 PM

Top 10 digital virtual currency trading app rankings Top 10 digital currency exchange rankings in 2025

Apr 22, 2025 pm 02:45 PM

The top ten digital currency exchanges are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.