web3.0

web3.0

Bitcoin Price Rockets Higher This Week as Jerome Powell Announces the 'Time Has Come' for Interest Rate Cuts

Bitcoin Price Rockets Higher This Week as Jerome Powell Announces the 'Time Has Come' for Interest Rate Cuts

Bitcoin Price Rockets Higher This Week as Jerome Powell Announces the 'Time Has Come' for Interest Rate Cuts

Subscribe now to Forbes' CryptoAsset & Blockchain Advisor and "uncover blockchain blockbusters poised for 1000% plus gains" in the aftermath of bitcoin's halving earthquake!

Bitcoin has rocketed higher this week after Federal Reserve chair Jerome Powell dramatically announced the ‘time has come’ for interest rate cuts (though some are more focused on a China bazooka).

The bitcoin price has surged to over $64,000 per bitcoin, climbing sharply from lows of under $50,000 earlier this month as U.S. dollar collapse fears suddenly reemerge.

Now, as Donald Trump’s sons plot a radical plan to ‘shake up’ the world of banking and finance, a widely-respected analyst has predicted this week could be one of ‘the most important’ in years for tech stocks and the closely correlated bitcoin and crypto market.

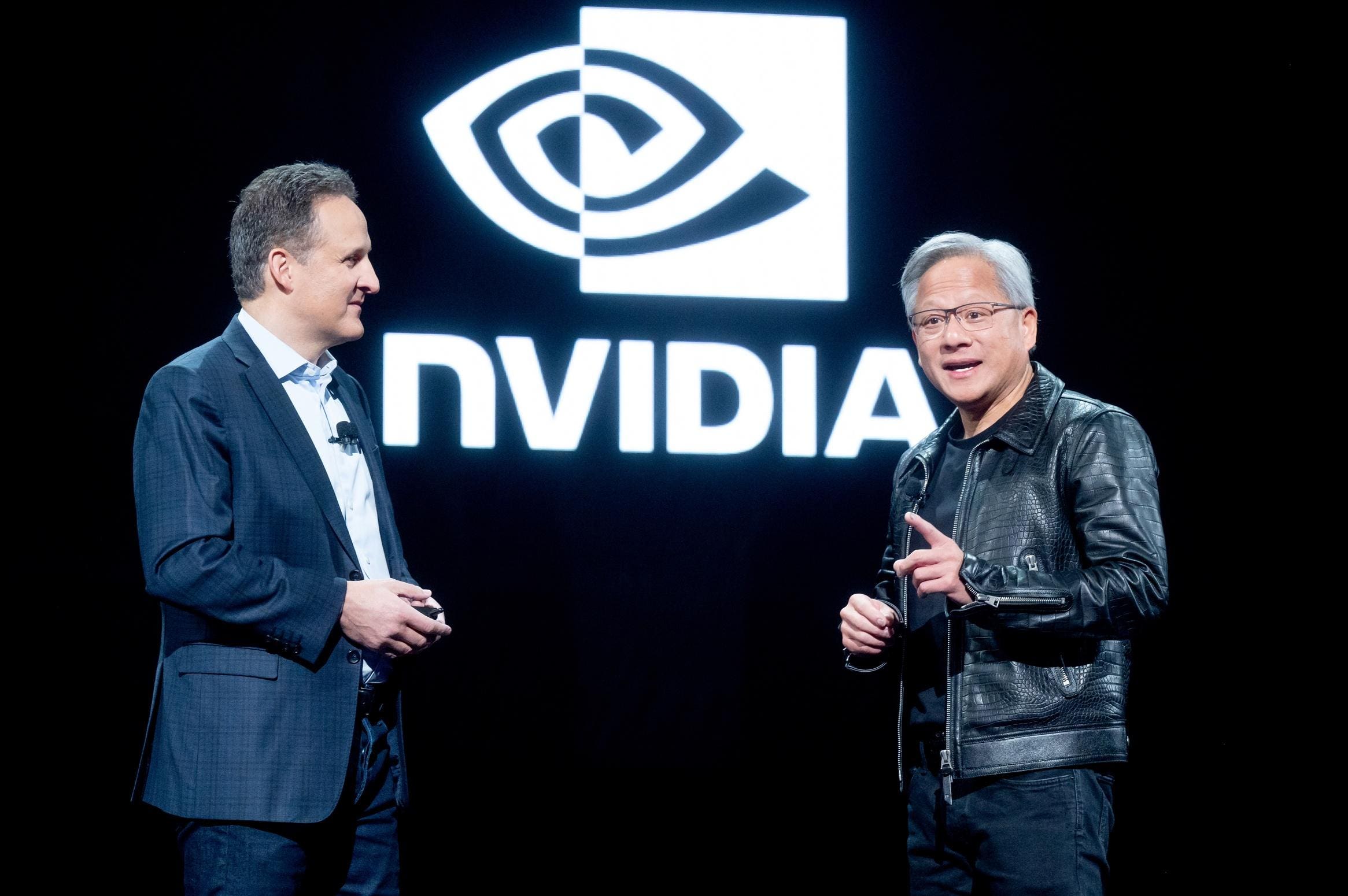

Nvidia chief executive Jensen Huang, right, is poised to deliver ‘the most important tech earnings ... [+] in years’ next week, potentially sparking bitcoin and crypto price chaos.

‘We believe the most important week for the stock market this year and potentially in years for the Street will be next week as the godfather of AI [chief executive] Jensen [Huang] and Nvidia have earnings on deck,’ Wedbush Securities tech analyst Dan Ives wrote in a note to clients seen by Fortune.

Ives expects Nvidia, which has seen its stock rocket to make it the world’s second most valuable company behind iPhone maker Apple over the last year, will post a ‘mic drop’ second quarter on Wednesday as it solidifies its position as ‘the only game in town’ for companies looking to buy artificial intelligence chips and GPUs.

Technology stocks more broadly could be boosted by a robust reassurance from Nvidia that the AI-led boom this year isn’t overdone.

‘The stage is set for tech stocks to move higher,’ Ives added, predicting ‘another masterpiece quarter’ from Nvidia, with analyst consensus of earnings per share of $0.64 on $28.67 billion in revenue for the second quarter, according to estimates compiled by Factset.

Ives believes the market better resembles ‘a 1995 (almost 1996) start of the internet moment and not a 1999 tech bubble-like moment,’ as Nvidia’s chips, hotly in demand at the world’s biggest technology companies to train generative AI models, are the ‘new oil and gold in this world.’

The bitcoin price and wider crypto market could be set to ride Nvidia’s coattails if it beats expectations—or plunge if it disappoints.

Bitcoin, often touted as digital gold, remains far more closely correlated to the stock market—and specifically technology stocks—than gold, which has hit an all-time high this month.

In June, a bitcoin price downturn that saw $500 billion wiped from the combined crypto market in just over a month, foreshadowed a brief stock market correction.

‘Since July, we’ve seen the correlation between bitcoin and equities turn negative, suggesting that bitcoin might not follow traditional markets during downturns. If this trend holds, a recession could boost crypto prices as investors look for alternative stores of value,’ Andrea Barbon, a professor of finance at the University of St. Gallen and crypto expert, said in emailed comments.

‘That said, the bitcoin-equity relationship has been volatile, so any change in the broader economic landscape could quickly shake things up.’

Federal Reserve chair Jerome Powell this week primed the market for a September interest rate cut, saying during a speech at the Jackson Hole, Wyoming, meeting of central bankers that ‘the upside risks to inflation have diminished, and the downside risks to employment have increased.’

However, Barbon thinks former U.S. president Donald Trump’s embrace of bitcoin and crypto means the bitcoin price is now more closely aligned to the U.S. November presidential election than to tech stocks like Nvidia.

‘While bitcoin has often been viewed as a hedge against economic turmoil, its future performance could hinge on the upcoming U.S. elections. So far, Donald Trump has been more supportive of crypto, and a return to the White House could bring regulatory shifts that favor digital assets,’ Barbon said.

The above is the detailed content of Bitcoin Price Rockets Higher This Week as Jerome Powell Announces the 'Time Has Come' for Interest Rate Cuts. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1663

1663

14

14

1420

1420

52

52

1313

1313

25

25

1266

1266

29

29

1237

1237

24

24

Just-In: MicroStrategy To Raise $1.75B Through Private Offering To Buy More Bitcoin

Nov 19, 2024 am 10:02 AM

Just-In: MicroStrategy To Raise $1.75B Through Private Offering To Buy More Bitcoin

Nov 19, 2024 am 10:02 AM

American business intelligence and software firm MicroStrategy Inc. has announced plans to offer the public up to $1.75 billion of its Convertible Senior Notes.

Glauber Contessoto Predicts Parabolic Rise for Ethereum ETH/USD, Targeting $15,000 This Cycle

Nov 20, 2024 am 10:08 AM

Glauber Contessoto Predicts Parabolic Rise for Ethereum ETH/USD, Targeting $15,000 This Cycle

Nov 20, 2024 am 10:08 AM

Glauber Contessoto, also known as "Dogecoin millionaire," expressed bullish sentiments on Ethereum ETH/USD, predicting a parabolic rise for the second-largest cryptocurrency.

Don't Miss the Opportunity to Invest in Top 5 New Crypto Coins for 100X Gains

Nov 17, 2024 am 01:30 AM

Don't Miss the Opportunity to Invest in Top 5 New Crypto Coins for 100X Gains

Nov 17, 2024 am 01:30 AM

Here is the list of the top five new cryptocurrencies to invest in before they skyrocket. These newly launched projects possess massive gains

Digital cryptocurrency app trading software top10 (the latest ranking of 2025)

Mar 17, 2025 pm 05:12 PM

Digital cryptocurrency app trading software top10 (the latest ranking of 2025)

Mar 17, 2025 pm 05:12 PM

This article lists the top ten digital virtual currency exchange platforms, and ranks and introduces OKX, Binance, Gate.io, Huobi Global, Kraken, Coinbase, KuCoin, Crypto.com, Bitfinex and Bitstamp, analyzing the advantages and characteristics of each platform, such as OKX's powerful trading volume and user-friendly interface, Binance's huge user base and high liquidity, Gate.io's rich currency selection and low transaction fees, etc. When choosing a transaction, factors such as security, fees, currency selection, user interface, liquidity, and customer support are considered. The article emphasizes that investment should be cautious and recommends that users should be based on their own needs.

Robinhood Crypto gets rid of SEC investigation! OKX's company pays $84 million in settlement

Mar 04, 2025 am 09:15 AM

Robinhood Crypto gets rid of SEC investigation! OKX's company pays $84 million in settlement

Mar 04, 2025 am 09:15 AM

Signs of a change in US cryptocurrency regulatory policy: Robinhood and OKX case analysis Recently, US regulators' regulatory attitudes towards the cryptocurrency field have undergone subtle changes. Robinhood Crypto (RHC) successfully escaped from the Securities and Exchange Commission (SEC) investigation, while OKX's subsidiary AuxCayes FinTechCo. Ltd. reached a settlement with the U.S. Department of Justice (DOJ) to pay a $84 million fine. Together, these two incidents reveal dynamic adjustments in the US cryptocurrency regulation and the efforts of companies to actively adapt to the compliance environment. RobinhoodCrypto wins: SEC terminates investigation 2025 2

MicroStrategy Announces Proposed Private Offering of $1.75B of Convertible Senior Notes.

Nov 19, 2024 am 09:54 AM

MicroStrategy Announces Proposed Private Offering of $1.75B of Convertible Senior Notes.

Nov 19, 2024 am 09:54 AM

MicroStrategy intends to use the net proceeds to acquire additional Bitcoin and for general corporate purposes. The offering will be available to institutional investors and certain non-US buyers.

Bitkey Introduces Inheritance Feature for Bitcoin Self-Custody

Nov 19, 2024 am 03:32 AM

Bitkey Introduces Inheritance Feature for Bitcoin Self-Custody

Nov 19, 2024 am 03:32 AM

Bitcoin is increasingly seen as a multi-generational asset, and the need for secure and user-friendly solutions to ensure its legacy is more important

Crypto Bitlord: The Man Who Mastered the Art of Influence in the Ever-Changing World of Cryptocurrency

Nov 16, 2024 am 04:34 AM

Crypto Bitlord: The Man Who Mastered the Art of Influence in the Ever-Changing World of Cryptocurrency

Nov 16, 2024 am 04:34 AM

Particularly in the world of meme coins, Bitlord—known for his honest attitude, keen insights, and open demeanor—has created a distinct niche for himself