web3.0

web3.0

11 charts explaining the crypto market in May: Spot ETF approval helped multiple Ethereum indicators hit record highs

11 charts explaining the crypto market in May: Spot ETF approval helped multiple Ethereum indicators hit record highs

11 charts explaining the crypto market in May: Spot ETF approval helped multiple Ethereum indicators hit record highs

Compiled by: Jordan, PANews

In May, most indicators of the cryptocurrency market fell. This article will use 11 pictures to interpret the crypto market conditions in the past month.

1. In May, the adjusted total on-chain transaction volume of Bitcoin and Ethereum fell by 4.4% to US$390 billion. Among them, the adjusted on-chain transaction volume of Bitcoin fell by 4.7%, and that of Ethereum fell by 4.7%. The transaction volume on the FangChain fell by 3.9%.

#2. After adjustment in May, the transaction volume on the stablecoin chain fell by 20.5% to US$879 billion; the supply of issued stablecoins increased, and the increase It was 0.5%, rising to US$141.9 billion. The market share of the US dollar stable currency USDT increased to 78.8%, while the market share of USDC dropped slightly to 17.1%.

3. Bitcoin miners’ income dropped to $963 million in May, a drop of 46%. Additionally, Ethereum staking revenue increased by 4.1% to $267 million.

#4. In May, the Ethereum network destroyed a total of 26,747 ETH, worth US$91.7 million. Data shows that since the implementation of EIP-1559 in early August 2021, Ethereum has destroyed a total of approximately 4.3 million ETH, worth approximately US$12.1 billion.

5. In May, the transaction volume of the NFT market on the Ethereum chain dropped sharply again, with a drop of 27.8%, further falling to approximately US$344 million.

6. The spot trading volume of compliance centralized exchanges (CEX) fell in May, falling by 22.5% to $68.9 billion.

7. The spot market share rankings of major cryptocurrency exchanges in May are as follows: Binance was 79.4% (an increase from April) and Coinbase was 10.1% , Kraken is 3.4%, and LMAX Digital is 1.8%.

8. In terms of crypto futures, the increase in open interest in Bitcoin futures in May reached 12.9%; thanks to the approval of the spot Ethereum ETF by US regulators , Ethereum futures open interest increased by 52%, hitting a record high; in terms of futures trading volume, Bitcoin futures trading volume fell by 21% in May to $1.26 trillion, and Ethereum futures trading volume increased by 0.2%.

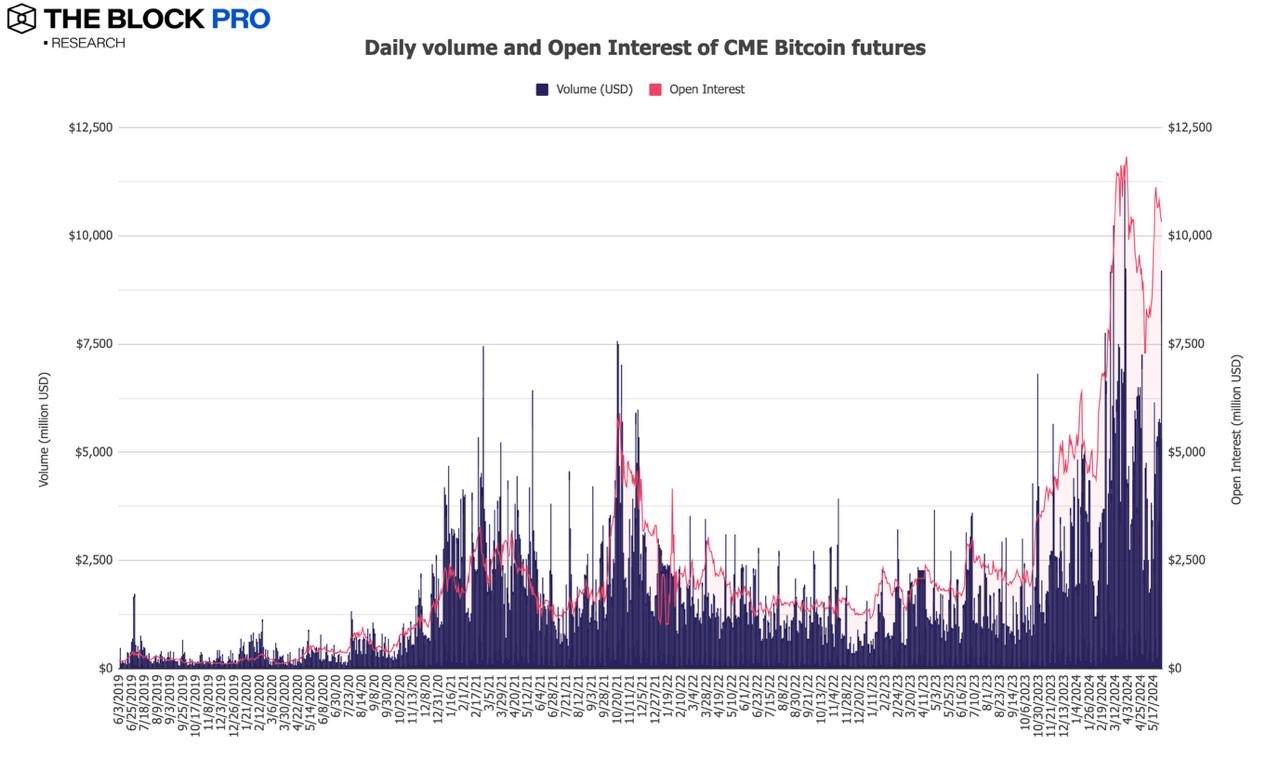

9. In May, CME Group’s open interest in Bitcoin futures increased by 15.9% to US$10.3 billion, and the daily avg volume decreased. 9%, down to approximately $4.35 billion.

10. In May, the average monthly trading volume of Ethereum futures decreased to US$692 billion, a slight increase of 0.2%.

11. In terms of cryptocurrency options, the open interest of Bitcoin options rebounded in May, with an increase of 30.5%, and the open interest of Ethereum also increased, with an increase of 41.4%. %. In addition, in terms of Bitcoin and Ethereum options trading volume, Bitcoin options trading volume reached US$46.8 billion, a decrease of 1.2%; Ethereum options trading volume reached a new high of US$31.4 billion, an increase of 19.2%, setting a record high.

The above is the detailed content of 11 charts explaining the crypto market in May: Spot ETF approval helped multiple Ethereum indicators hit record highs. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1673

1673

14

14

1429

1429

52

52

1333

1333

25

25

1278

1278

29

29

1257

1257

24

24

Metaplanet Expands Its Bitcoin Treasury Holdings by Another 319 BTC

Apr 15, 2025 am 11:20 AM

Metaplanet Expands Its Bitcoin Treasury Holdings by Another 319 BTC

Apr 15, 2025 am 11:20 AM

In an announcement made earlier today, Japanese firm Metaplanet revealed it has acquired another 319 Bitcoin (BTC), pushing its total corporate holdings beyond 4,500 BTC.

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)

Apr 18, 2025 am 11:24 AM

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)

Apr 18, 2025 am 11:24 AM

Bitwise, a leading digital asset manager, has announced the listing of four of its crypto Exchange-Traded Products (ETPs) on the London Stock Exchange (LSE).

As Binance Coin (BNB) Gains Momentum Toward a $1,000 Breakout, New Altcoin RCO Finance (RCOF) Is Stirring Conversations

Apr 15, 2025 am 09:50 AM

As Binance Coin (BNB) Gains Momentum Toward a $1,000 Breakout, New Altcoin RCO Finance (RCOF) Is Stirring Conversations

Apr 15, 2025 am 09:50 AM

As Binance Coin (BNB) gains momentum toward a $1,000 breakout

Central banks across the world are ramping up their gold purchases

Apr 15, 2025 am 11:00 AM

Central banks across the world are ramping up their gold purchases

Apr 15, 2025 am 11:00 AM

According to a report by The Kobeissi Letter on X, mentioning data from IMS IFS and the Global Gold Council, nations accumulated 24 tonnes of gold in February

Bitcoin (BTC) drifts upwards as the broader market adjusts favorably to trade-related news

Apr 15, 2025 am 11:14 AM

Bitcoin (BTC) drifts upwards as the broader market adjusts favorably to trade-related news

Apr 15, 2025 am 11:14 AM

The largest cryptocurrency was up 1.6% in the last 24 hours and is now trading just shy of $85,000. Ether (ETH), meanwhile, rose 2.7%

Movement Labs and the Movement Network Foundation have launched an independent investigation into recent market-making irregularities related to the MOVE token.

Apr 16, 2025 am 11:16 AM

Movement Labs and the Movement Network Foundation have launched an independent investigation into recent market-making irregularities related to the MOVE token.

Apr 16, 2025 am 11:16 AM

nt Labs and the Movement Network Foundation Launch Independent Investigation into MOVE Token Market-Making Irregularities

![A wave of capital is flowing out of Ethereum [ETH] and into Tron [TRX]](https://img.php.cn/upload/article/001/246/273/174477326297054.jpg?x-oss-process=image/resize,m_fill,h_207,w_330) A wave of capital is flowing out of Ethereum [ETH] and into Tron [TRX]

Apr 16, 2025 am 11:14 AM

A wave of capital is flowing out of Ethereum [ETH] and into Tron [TRX]

Apr 16, 2025 am 11:14 AM

With $1.52 billion in stablecoins migrating to Tron, investors appear to be favoring lower-cost chains and diversifying beyond traditional USD-backed assets.

The Pi Network token price has increased by more than 14% over the past week.

Apr 16, 2025 am 11:22 AM

The Pi Network token price has increased by more than 14% over the past week.

Apr 16, 2025 am 11:22 AM

As of press time, Pi is trading at $0.6711 after its integration with Chainlink on April 12th. The announcement caused a surge in the price of Pi